VIPsight - January 2010

COMPANIES

New pay structures

The new Act on appropriateness of executive remuneration (VorstAG) is showing its effects. In mid-December carmaker Volkswagen announced that success-related pay would be basically changed, with top managers' pay oriented towards long-term objectives. In 2010 a long-term bonus is to be introduced, linked to strategic objectives. Pay is also to reflect how satisfied customers and employees are, something to be determined in representative surveys. Further components of pay are security of employment, market share and defined sales figures. Share options are to be completely abolished. The long-term bonus is to be calculated on the basis of the past four years, and paid out only if the group is in the black. As well as VW, State-supported Commerzbank has also introduced new pay rules. Executive pay is to be oriented towards long-term success, and if developments are poor can also be cut. Carmaker Daimler announced that its pay system was already in line with the Act. By stressing long-term elements of remuneration and the obligation on directors to hold company shares, the pay structure was oriented to sustainability objectives. At the AGM in April 2010, shareholders are to vote on the pay system for the first time. Siemens, ThyssenKrupp and BASF have similar plans.

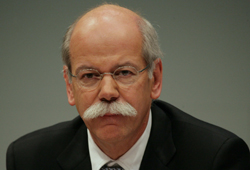

Is Zetsche tottering on the brink?

In mid-December the Daimler supervisory board decided that the contract of utility-vehicles director Andreas Rentschler would be renewed for three years. However, the body refrained from also renewing the contract of Daimler CEO Dieter Zetsche. Daimler commented on this non-renewal by saying that the CEO’s contract had still to run until 2010, so that the last year of his term of office had not yet started. However, lawyers say there is a legal possibility for early renewal, which is also laid down in the Corporate Governance Code. The deliberate non-utilization of this option might be a negative indication, says Oliver Maaß, capital-market expert of Munich law firm Heisse Kursawe Eversheds. As well as Zetsche’s renewal, the reappointment of technology director Thomas Weber is also still pending.

In mid-December the Daimler supervisory board decided that the contract of utility-vehicles director Andreas Rentschler would be renewed for three years. However, the body refrained from also renewing the contract of Daimler CEO Dieter Zetsche. Daimler commented on this non-renewal by saying that the CEO’s contract had still to run until 2010, so that the last year of his term of office had not yet started. However, lawyers say there is a legal possibility for early renewal, which is also laid down in the Corporate Governance Code. The deliberate non-utilization of this option might be a negative indication, says Oliver Maaß, capital-market expert of Munich law firm Heisse Kursawe Eversheds. As well as Zetsche’s renewal, the reappointment of technology director Thomas Weber is also still pending.

Changes on the supervisory board are emerging for the New Year. In early 2009 the Emirate of Abu Dhabi had come into the Stuttgart company through its investment company Aabar at 9%, or 2 billion euros. In mid-December the CEO of the investment company, Mohamed al-Husseiny, announced that he wished to come on to the supervisory board in October 2010. It remains open whether a new seat on the supervisory board will be created for the purpose, or whether a member of the capital side will have to vacate his seat.

No insider trading at EADS

In June 2006 it became clear that there would be considerable delays in the major project for the Airbus. The share price of aerospace company EADS fell once the extent of the total amount became known. Previously, both leading managers and the two major shareholders Lagardère and Daimler had got rid of EADS securities. Since then, the penal committee of French stock-exchange watchdogs AMF have been investigating those concerned for insider trading. In June this year an AMF employee had stated that ex EADS head Noel Forgeard, Airbus sales boss John Leahy, Airbus boss Andreas Sperl from Dresden and a further four managers, in office or having left, were punishable for insider trading. On 17 December French stock-exchange regulators have however now absolved all sixteen managers and shareholders accused of the charge of insider trading. EADS welcomed the AMF decision and said it was convinced that the parallel investigations by Paris public prosecutors would also be dropped.

Siemens comes to an agreement with D&O insurers

In December, conglomerate Siemens was able to reach a settlement with all its D&O insurers. Departing from the rule that insurers have to pay compensation only as from a fixed compensation amount, in the course of the agreement all the insurers agreed to participate in the damage that accrued to the group or its managers in the course of the bribery affair between 2004 and 2007. D&O (Directors' and Officers' Liability) insurance enables companies to ensure their managers and themselves against claims by third parties. Since in the course of the settlement Siemens had to pay 150 million euros, the AGM still has to agree to the deal. The insurers are keeping a back door open here: if a court finds that Siemens directors already knew before 1 October that they were in breach of their organizational and supervisory duties and then did not prevent the corruption, the insurers can withdraw from the settlement.

In December, conglomerate Siemens was able to reach a settlement with all its D&O insurers. Departing from the rule that insurers have to pay compensation only as from a fixed compensation amount, in the course of the agreement all the insurers agreed to participate in the damage that accrued to the group or its managers in the course of the bribery affair between 2004 and 2007. D&O (Directors' and Officers' Liability) insurance enables companies to ensure their managers and themselves against claims by third parties. Since in the course of the settlement Siemens had to pay 150 million euros, the AGM still has to agree to the deal. The insurers are keeping a back door open here: if a court finds that Siemens directors already knew before 1 October that they were in breach of their organizational and supervisory duties and then did not prevent the corruption, the insurers can withdraw from the settlement.

VW replaces VW in the Dax

In the course of an extraordinary change in the composition of the DAX, the ordinary shares of car maker Volkswagen (VW) left the top German share index on 23 December. Dispersed holdings had, after the announcement by the Emirate of Qatar that it had built its holding up to 17%, fallen under the minimum proportion of 10%, so the criteria for the share to remain in the index were no longer met. Porsche Holding and Porsche GmbH together hold over 53% of the ordinary shares, and Lower Saxony a further 20%. However, VW still continues to be listed in the DAX: instead of the ordinary shares, VW preference shares entered the first rank of the German stock exchange above competitor Heidelberg Cement. Volkswagen has announced a capital increase for the first half of 2010 in the preference shares. The next regular review of the DAX comes on 3 March 2010.

In the course of an extraordinary change in the composition of the DAX, the ordinary shares of car maker Volkswagen (VW) left the top German share index on 23 December. Dispersed holdings had, after the announcement by the Emirate of Qatar that it had built its holding up to 17%, fallen under the minimum proportion of 10%, so the criteria for the share to remain in the index were no longer met. Porsche Holding and Porsche GmbH together hold over 53% of the ordinary shares, and Lower Saxony a further 20%. However, VW still continues to be listed in the DAX: instead of the ordinary shares, VW preference shares entered the first rank of the German stock exchange above competitor Heidelberg Cement. Volkswagen has announced a capital increase for the first half of 2010 in the preference shares. The next regular review of the DAX comes on 3 March 2010.

VW sorts itself out

For some 1.7 billion euros, VW has bought 19.9% of the shares in Japanese carmaker Suzuki. Suzuki is to be incorporated into the group as its twelfth brand behind Porsche and MAN. As a counterpart, the Japanese are taking a holding of half the purchase price in VW. Shortly before, VW had already taken over some 50% of Stuttgart sports-car maker Porsche, with the objective of integrating it into the group by 2011 as its tenth brand. In the course of the merger with sports-car maker Porsche, carmaker Volkswagen may possibly be taking on a new appearance by 2011. Alongside the private-car sector, as soon as VW has built up its holding in utility-vehicle maker MAN to over 50%, a truck division is to be formed, from MAN and Scania. The VW supervisory board chair and family patriarch Ferdinand Piëch is also chair of the supervisory board at MAN, and is said to have contributed to the resignation of MAN CEO Håkan Samuelsson and CFO Karlheinz Hornung in December. Officially, the MAN bribery case was what sparked off the resignation. As the third pillar in the VW group, financial services could be built up, reported Wirtschaftswoche – however, without any confirmation by VW.

On 3 December 2009, VW shareholders had at an extraordinary general meeting agreed to a capital increase by 135 million in preference shares, to a value of some 8 billion euros, thus setting going the first step towards the takeover of the Porsche group by VW. Subsequently, VW was able in early December to take 49.9% of the Porsche shares, for 3.9 billion euros. In future, the owning families Porsche and Piëch will, according to Wirtschaftswoche, not, as previously assumed, hold 35 to 40%, but now only some 30% of the VW ordinary shares. Lower Saxony is said to hold 20% plus one share, and the Emirate of Qatar 20% minus one share.

MAN clears its table

Around six months after investigators had made raids on utility-vehicle maker MAN SE throughout Germany, the corruption scandal that relates to the years from 2002 through 2009, in which suspicious payments amounting to €51.6 million were shown, is more or less over for the firm. In early December the Munich regional court and public prosecutors found that the two MAN group divisions Utility Vehicles and Turbo each had to pay €75.3 million in fines, for a total of €150.6 million. The compliance structure in the Utility Vehicles division had been defective, and the infringement of the supervision obligation was a breach of administrative regulations, said the court in justifying the fine. Altogether, over a hundred people were accused of having been involved in bribery payments. However, investigations are still going on in relation to individuals possibly liable for fines. In the course of the internal investigations in 80 suspicious cases, 20 MAN employees and the whole management of utility sales around Peter Erichreineke had to go. The company is now looking into whether the fine imposed and the internal investigation cost amounting to 50 million euros can be got back from its former directors by way of compensation payments.

Blackrock heavily involved in the DAX

With the takeover of BGI, Blackrock has at a stroke become a major shareholder in several German companies. The British bank Barclays, heavily affected by the financial crisis, had sold the division in June this year to the US asset manager for some 13.5 billion dollars. Blackrock now holds 5.46% of Deutsche Börse, 5.45% of the Lufthansa shares, 5.4% of BASF, 4.93% of the shares in Adidas, 4.86% in Allianz, 4.58% in Munich Re, 4.8% in E.ON, 4.57% in RWE and 4.55% in MAN. Apart from this, the Americans have holdings in Dax companies K+S (3.24%), SAP (3.21%), Linde (3.23%) and Daimler (3.9%). In the next-lower index MDAX, Blackrock now even holds 10.07% of Gea Group, and 7.04% of the shares of HeidelbergCement. The company has further holdings in Sky Deutschland (3.26%), Bilfinger Berger (5.25%), Aurubis (5.56%), Klöckner & Co (5.61%) and Rhön-Klinikum (3.43%). Additionally, the Americans now have over 3.44% of TecDax company Solarworld.

Conti reschedules its debts

The automotive supplier, in debt for some €9.5 billion, has come to agreement with its 50 or so banks for a postponement of payments on its loan due in August 2010 for up to two years. Conti will – probably in January 2010 - raise its capital by around 1 billion euros. The banks will then make initially some 2.5 billion euros available.

The automotive supplier, in debt for some €9.5 billion, has come to agreement with its 50 or so banks for a postponement of payments on its loan due in August 2010 for up to two years. Conti will – probably in January 2010 - raise its capital by around 1 billion euros. The banks will then make initially some 2.5 billion euros available.

Salzgitter raises its stake in Aurubis

Salzgitter has raised its holding in Aurubis from 23.2% to 25.3%. As the leading European copper producer stated on 16 December, the steel firm held on 15 December 25.260% of the voting rights through its subsidiary Salzgitter Mannesmann. According to earlier statements, an increase up to 29.9% is conceivable.

Post sector receives exemption from turnover tax

Competition on the German postal market is in the view of the monopoly commission “miserable”. Deutsche Post will nonetheless continue in future to receive its controversial turnover-tax privilege for a part of its services. Additionally, however, competitors would also become entitled to turnover-tax exemption for letters and packages. This emerges from a decision by the Federal Cabinet on 15 December.

Competition on the German postal market is in the view of the monopoly commission “miserable”. Deutsche Post will nonetheless continue in future to receive its controversial turnover-tax privilege for a part of its services. Additionally, however, competitors would also become entitled to turnover-tax exemption for letters and packages. This emerges from a decision by the Federal Cabinet on 15 December.

BaFin criticizes Merck

Merck has to make disclosures, ordered by the Federal Financial Services Oversight Institution (BaFin), for errors in its annual accounts for 2008. The German Accounting Centre criticized the forecast report of the Darmstadt family firm as inadequate. The pharmaceuticals group had devoted only eleven lines to explaining that because of the “un-assessable” economic environment no quantitative or qualitative statements on trends were possible. The capital market had thus been deprived of “information of relevance to decisions” on future developments, said BaFin. Merck has lodged objections.