VIPsight - 2nd Edition 2023 <click here>

VIPsight - News

April 2023

Allianz SE: Ignoring a Technical Dilemma

Since BaFin has taken its tasks seriously, even supposedly top names are no longer immune to criticism. The restrained communication about a current event shows the force with which this realization hit Allianz.

Since BaFin has taken its tasks seriously, even supposedly top names are no longer immune to criticism. The restrained communication about a current event shows the force with which this realization hit Allianz.

more - VIPsight - 2nd Edition 2023 <click here>

brave new world

ThyssenKrupp was not really an opponent; Cevian got into the ring - and soon realised that manual mistakes made the commitment turn blood red and stay that way. Siemens was beyond the reach of activists, as spin-offs came faster than concretely "demanded". Daimler's march back to Mercedes was completely in the interests of the managers. And the honourable as well as arrogant Bayer people (who are they? What are their names?) were just the logical target of all activists; they came, they went, they came back and even Thomas Henrik Shrager, Managing Director of Tweedy Browne demanded what is still demanded today: divide and spill. Who doesn't remember Shrager's appearance at THAT Bayer AGM where political (bee) activists climbed the balustrade behind the supervisory board....

ThyssenKrupp was not really an opponent; Cevian got into the ring - and soon realised that manual mistakes made the commitment turn blood red and stay that way. Siemens was beyond the reach of activists, as spin-offs came faster than concretely "demanded". Daimler's march back to Mercedes was completely in the interests of the managers. And the honourable as well as arrogant Bayer people (who are they? What are their names?) were just the logical target of all activists; they came, they went, they came back and even Thomas Henrik Shrager, Managing Director of Tweedy Browne demanded what is still demanded today: divide and spill. Who doesn't remember Shrager's appearance at THAT Bayer AGM where political (bee) activists climbed the balustrade behind the supervisory board....

more - VIPsight - 2nd Edition 2023 <click here>

Deutsche Börse AG: Sitting between the Chairs can be uncomfortable

Clearstream Banking S.A., Luxembourg, a subsidiary of Deutsche Börse AG, informed that a US court awarded judgment to creditors of Iran who had brought a lawsuit seeking turnover of approximately 1.7 billion USD that are attributed to the Iranian central bank (Bank Markazi) and held in custody at Clearstream in Luxembourg in a client account. Clearstream is considering appealing the decision.

Clearstream Banking S.A., Luxembourg, a subsidiary of Deutsche Börse AG, informed that a US court awarded judgment to creditors of Iran who had brought a lawsuit seeking turnover of approximately 1.7 billion USD that are attributed to the Iranian central bank (Bank Markazi) and held in custody at Clearstream in Luxembourg in a client account. Clearstream is considering appealing the decision.

more - VIPsight - 2nd Edition 2023 <click here>

TUI AG: Close, but just taken the Curve

In mid-April, the TUI share came under a little pressure. This was due to an unexpected oversupply of shares.

In mid-April, the TUI share came under a little pressure. This was due to an unexpected oversupply of shares.

In March 2023, the company announced the launch of a capital increase with subscription rights. The gross proceeds of the issue of approx. 1.8 billion EUR shall be used for repayment of WSF state aid and a significant reduction of the KfW credit lines to strengthen its balance sheet.

more - VIPsight - 2nd Edition 2023 <click here>

March 2023

BERKSHIRE HATHAWAY INC.

To the Shareholders of Berkshire Hathaway Inc.:

Charlie Munger, my long-time partner, and I have the job of managing the savings of a great number of individuals. We are grateful for their enduring trust, a relationship that often spans much of their adult lifetime. It is those dedicated savers that are forefront in my mind as I write this letter.

Charlie Munger, my long-time partner, and I have the job of managing the savings of a great number of individuals. We are grateful for their enduring trust, a relationship that often spans much of their adult lifetime. It is those dedicated savers that are forefront in my mind as I write this letter.

A common belief is that people choose to save when young, expecting thereby to maintain their living standards after retirement. Any assets that remain at death, this theory says, will usually be left to their families or, possibly, to friends and philanthropy.

Our experience has differed. We believe Berkshire’s individual holders largely to be of the once-a-saver, always-a-saver variety. Though these people live well, they eventually dispense most of their funds to philanthropic organizations. These, in turn, redistribute the funds by expenditures intended to improve the lives of a great many people who are unrelated to the original benefactor. Sometimes, the results have been spectacular.

The disposition of money unmasks humans. Charlie and I watch with pleasure the vast flow of Berkshire-generated funds to public needs and, alongside, the infrequency with which our shareholders opt for look-at-me assets and dynasty-building.

BERKSHIRE HATHAWAY INC. - 2022 ANNUAL REPORT (PDF) <click here>

The Power of Capitalism

Dear CEO,

Each year I make it a priority to write to you on behalf of BlackRock’s clients, who are shareholders in your company. The majority of our clients are investing to finance retirement. Their time horizons can span decades.

The financial security we seek to help our clients achieve is not created overnight. It is a long-term endeavor, and we take a long-term approach. That is why, for the past decade, I have written to you, as CEOs and Chairs of the companies our clients are invested in. I write these letters as a fiduciary for our clients who entrust us to manage their assets – to highlight the themes that I believe are vital to driving durable long-term returns and to helping them reach their goals.

When my partners and I founded BlackRock as a startup 34 years ago, I had no experience running a company. Over the past three decades, I’ve had the opportunity to talk with countless CEOs and to learn what distinguishes truly great companies. Time and again, what they all share is that they have a clear sense of purpose; consistent values; and, crucially, they recognize the importance of engaging with and delivering for their key stakeholders. This is the foundation of stakeholder capitalism.

more - https://www.blackrock.com/corporate/investor-relations/larry-fink-ceo-letter

January 2023

Deutsche Börse AG: Testing the Limits

Good relationships with the supervisory authorities are particularly important for financial institutions. After all, financial institutions cannot operate without official approval. What is more, good standing with the regulators is important for the customers´ trust in the solidity of their business?

Good relationships with the supervisory authorities are particularly important for financial institutions. After all, financial institutions cannot operate without official approval. What is more, good standing with the regulators is important for the customers´ trust in the solidity of their business?

more - VIPsight - 1st Edition 2023 <click here>

ADLER Group S.A.: Will this Bird ever fly again?

If you put it euphemistically, ADLER Group faces special challenges. Already the known corporate governance problems would be enough to overthrow the average market participant. However, the short-term securing of the company´s financing is much more important. Here, the bondholders are in the foreground.

If you put it euphemistically, ADLER Group faces special challenges. Already the known corporate governance problems would be enough to overthrow the average market participant. However, the short-term securing of the company´s financing is much more important. Here, the bondholders are in the foreground.

more - VIPsight - 1st Edition 2023 <click here>

BAYER AG: Advances in Damage Control open up new Perspectives for Shareholders

The takeover of Monsanto by BAYER can confidently be classified as one of the biggest money burns in the German capital market. With this acquisition, BAYER bought reputation and legal risks, a business model with an operationally weakening business, and limited strategic perspectives in the agricultural business.

The takeover of Monsanto by BAYER can confidently be classified as one of the biggest money burns in the German capital market. With this acquisition, BAYER bought reputation and legal risks, a business model with an operationally weakening business, and limited strategic perspectives in the agricultural business.

more - VIPsight - 1st Edition 2023 <click here>

August 2022

Dear CEO,

Each year I make it a priority to write to you on behalf of BlackRock’s clients, who are shareholders in your company. The majority of our clients are investing to finance retirement. Their time horizons can span decades.

The financial security we seek to help our clients achieve is not created overnight. It is a long-term endeavor, and we take a long-term approach. That is why ... - ... I know this firsthand. In this polarized world, CEOs will invariably have one set of stakeholders demanding that we do one thing, while another set of stakeholders demand that we do just the opposite.

That is why it is more important than ever that your company and its management be guided by its purpose. If you stay true to your company's purpose and focus on the long term, while adapting to this new world around us, you will deliver durable returns for shareholders and help realize the power of capitalism for all.

March 2021

WHO WAS ABLE TO LEND NON-ISSUED/ NOT EXISTING SHADOW SHARES ?

Custodian settlement is ... marvellous - may i vote my lended shares?

GameStop Corp. Short Interstest as % of Free Float

Volkswagen chart <ordinary> October 2008

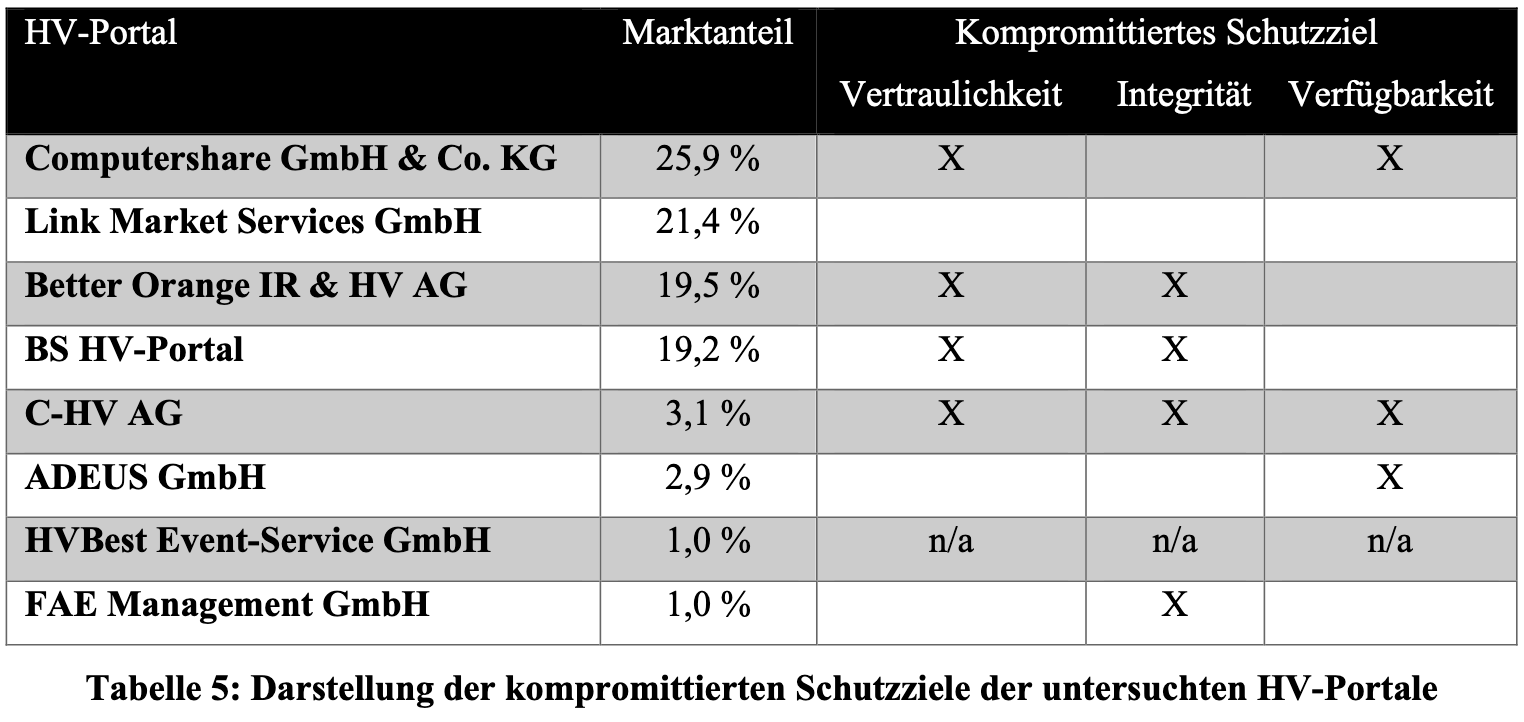

Virtuelle Hauptversammlungen (2020): Ein sicherer Ersatz für Präsenzveranstaltungen?

How to Break Virtual Shareholder Meetings

Prof. Dr.-Ing. Andreas Mayer, Hochschule Heilbronn

<click here> complete version (PDF) deutsch

<click here> complete version (PDF) english - page 98 (114) to 112 (128)

17. Deutscher IT-Sicherheitskongress des BSI

https://www.bsi.bund.de/EN/Home/

December 2019

Proxinvest publishes its twentieth third report: “Annual General Meetings and shareholder activism – 2019 season”

(Hans-Martin Buhlmann and Jose Ignacio Sanchez Galan after VIP remarks in 2019 Iberdrola AGM)

Restrained General meetings

While the “Place de Paris” (i.e stakeholders on the French listed market) wonders about the potential framework regarding shareholder activism, Proxinvest’s report on General Meetings displays that in fact General Meetings of French companies remain very controlled. In point of fact, 57.6% of voting rights exercised in the 315 General Meetings analyzed by Proxinvest were in the hands of reference shareholders (36% in the CAC 40), explaining why only 0.64% of resolutions were not adopted.