Welcome to VIPsight Africa - South Africa

|

|

| Terry Booysen |

13 October 2022

THIS ARTICLE – AND GOOD GOVERNANCE – COULD SOON BECOME OUTLAWED

By Terrance Booysen and peer reviewed by Dave Loxton (Schindlers Attorneys: Partner)

In the context of the proposed changes set out in the Protection of Constitutional Democracy against Terrorist and Related Activities Amendment Bill (“POCDATARA Bill”) currently before parliament, if it is passed in its current form, this indeed may become the “final straw that breaks the camel’s back”, and all aspirations of holding the South African government to account for poor or no governance may come to an end.

Given the wide definitions of “terrorism” and “terrorist activities” contained in the Bill, any person or organisation that criticises or challenges the government in respect of their legislation, policies or dubious activities -- such as landing a private chartered jet at Waterkloof Air Force Base or citizens paying for senior government official’s utilities bills -- may conceivably find themselves on the wrong side of the law. Indeed, governance reporting itself may also become problematic for government organisations and their leadership. This is so as governance reporting mechanisms and systems highlight the real facts in order to improve the organisation’s governance at strategic and operational levels.

Government institutions, and even those organisations contracting with such institutions, might well be disinclined to expose poor governance if that might land them in a criminal court facing hefty fines and jail time. Sad as it may be, non-profit organisations such as OUTA, Afriforum, Corruption Watch, Dear SA, Business Leadership SA and many similar watchdog organisations -- which have been instrumental in exposing crime and corruption, especially within the South African government sectors -- will essentially be exposed to a high risk of fear and intimidation, through criminal prosecutions for alleged terrorism. Donors and sponsors of these organisations will most likely withdraw their funding for fear of reprisal, which includes massive fines and/or lengthy prison sentences to those who directly and/or indirectly criticize or pass adverse comments about the government, should these criticisms and comments be found to be terrorist activities.

Social media platforms -- which in South Africa and other countries -- have played a pivotal role in creating national awareness of a great deal of important and critical issues, might also be under threat. Freedom of expression as we know it in our Constitution and hard-won democracy, may also be muzzled as a result of the impending changes contained in the POCDATARA Bill.

What is most surprising is the absence of dissent from the legal profession, governance professionals, academics, religious leaders and indeed the human rights champions in South Africa. It is as though they are all in a deep slumber, and as the watchdogs continue to gradually lose their bite, these draconian laws continue to instil fear amongst those who understand the likely consequences of this Bill being passed in its current form. Expectedly, if all the watchdogs have not understood their imminent threat of being silenced (extinguished) once and for all, then how will ordinary citizens even know that the looming deadline to dissent upon their civil liberties -- as contained in the SA Constitution – which will be substantially eroded, ends on 18 October 2022. To this end, at the time of writing this article, less than 20,000 concerned citizens have commented and voiced their disapproval of the changes contained in the POCDATARA Bill on the Dear SA website. Whilst there may be other non-profits similar to Dear SA creating a platform for concerned citizens to object to these draconian changes against critics of a corrupt government, the numbers are alarmingly minuscule. Should the legislators ignore the objections, there will no doubt be constitutional challenges, but more importantly, those who are vacillating about leaving, and who can afford to do so, might well view this legislation as just one more step towards a failed state which will make their decision that much easier.

History has taught the world many lessons. The utilitarian philosopher John Stuart Mill, who delivered an 1867 inaugural address at the University of St. Andrews once said, “Let not any one pacify his conscience by the delusion that he can do no harm if he takes no part, and forms no opinion. Bad men need nothing more to compass their ends, than that good men should look on and do nothing. He is not a good man who, without a protest, allows wrong to be committed in his name, and with the means which he helps to supply, because he will not trouble himself to use his mind on the subject.”

Should we do nothing more than watch these proposed changes as set out in the draft bill being implemented, we must appreciate that in the future we might not be able to speak out against any poor governance imposed by the government, and if anybody is bold enough to do so, there is every chance they will be accused of being a terrorist.

23 April 2022

MEASURING THE ORGANISATION’S GOVERNANCE EFFORTS

By Terrance Booysen and peer reviewed by Jene’ Palmer CA(SA)

For many years corporate governance has been a sensitive topic for many boardrooms. In reality, despite the writing of the various codes of corporate governance, the business and state environments remain littered with examples of failed governance.

Given that the South African business landscape still finds itself in deep trouble, one may argue that the introduction of the latest King IV™ Report on Corporate Governance for South Africa 2016 and its outcomes-based reporting has still not had the desired impact in driving governance change.

With South African business confidence indexes at an all-time low over the last three decades, the county’s poor levels of governance have contributed toward multiple country downgrades, loss of foreign investment and the highest recorded levels of unemployment since World War II.

The enforceability of governance codes

Essentially the various reports on Corporate Governance for South Africa (King Codes) have only been recognized by the larger South African corporates and government organisations. Whilst the reports have changed dramatically over the last two decades, moving from a shareholder-centric to a stakeholder inclusive model, the recommendations for better governance found within the King Codes are exactly that; they are only recommendations and therefore not every company may feel it necessary to adopt or subscribe to them.

Whilst the King Codes have also been cited in South African case law, including a few other international jurisdictions, where boards have been found wanting in respect of not properly fulfilling their fiduciary obligations, at best, judges can only make reference to the recommended practices found with these codes. Exactly the same challenge applies to any othergovernancecode produced anywhere else in the world, for example the UK Code for Governance (2018) and the German Corporate Governance Code (2019). None of these codes provide clear guidance on how to measure whether the application of these codes is leading to good governance within the organisation concerned. This makes it very difficult for a court of law to impose effective sanctions on an organisation or a director for practicing poor governance. Any sanctions which are imposed are largely subjective and the consequences attached to poor governance vary quite considerably from one judgment to the next. It is therefore not surprising that many regulatory bodies are also not more proactive in driving (and enforcing) good governance practices across all sectors and industries.

International standards and benchmarking

The introduction of ISO 37000 in the last quarter of 2021 presents an opportunity to change the landscape. Whilst ISO 37000 is very similar to the governance codes in that it also provides for “principles and key aspects of practices to guide governing bodies (boards) and governing groups on how to meet their responsibilities”, its differentiator is that it is written to serve as a universal standard which will allow key stakeholders to more accurately measure and compare governance performance across all geographies and forms of business.

With ISO 37000 there are also some significant departures from a governance code such as:

1. Many governance codes are country-specific and have regional application whereas an international standard is applied as a ‘universal language’ irrespective of where the organisation is established or does business. It is broadly recognized and measured using the same requirements for compliance and certification across all businesses.

2. A governance code is mostly aspirational, and whilst many organisations may work towards the improvement of their governance practices, the ‘act of improving the organisation’s governance’ remains largely subjective in nature. An international standard, however, identifies specific areas that must be assessed and measured by an independently approved and qualified assurance provider in order to obtain formal certification. In addition, for the organisation to retain its certification, the continued proper application of the standard must be regularly re-assessed and confirmed.

Following a governance code or being ISO compliant?

It is essential not to confuse a governance code -- such as King IV™ -- with ISO 37000. Each ‘instrument’ fulfils a very specific purpose within not only the organisation itself, but its key stakeholders too.

Given that governance by its very nature is a complex topic, with myriad nuances, it is important to understand the practical benefits of using a widely accepted international standard which can be used as a common platform for all organisations (regardless of their type, size, location, structure or purpose) to guide and measure the application of good governance making use of comparable reporting indicators. That being said, organisations must also be cognizant of their respective jurisdictional regulatory and compliance obligations such as the JSE Listing Requirements which specify compliance with King IV™.

Many leading organisations subscribe to the renowned ISO standards such as ISO 27000 and ISO 14000 and there is no doubt that the independent assessment process involved in obtaining and retaining an ISO certification provides an additional level of comfort and assurance to key stakeholders, including investors and regulators. It is therefore likely that certified early adopters of ISO 37000 will be significantly differentiated from their peers. In this regard, the increasing pressure being placed by stakeholders on organisations to proactively and positively impact global sustainable development is also likely to fast track the implementation of ISO 37000. In addition, the adoption of ISO 37000 may also help multi-jurisdictional organisations to simplify the interpretation of different governance codes and apply a common standard of governance across geographies.

Boards will therefore need to carefully consider what makes sense in their business and organisational environment as they strive to ensure that their organisations implement robust governance frameworks which are strategically aligned to their purpose, vision and mission and which offer them a competitive advantage.

New meaning to governance

Although still in its infancy, ISO 37000 has established new benchmarks for assessing governance frameworks across the world. It has sparked vigorous debates and uncomfortable questions about measuring, auditing and comparing one organisation’s GRC (governance, risk and compliance) inputs and outcomes to another, including assessing their aligned values, profitability and long-term goals.

In South Africa it is mandatory for JSE-listed companies to apply King IV™, however, one wonders how these current requirements may change as the benefits of adopting an international standard become more firmly entrenched? On the other hand, one also has to consider whether the introduction of ISO 37000 will really help in setting the stage for smaller and non-listed companies to willingly subscribe to the principles of ISO 37000 as the governance playing fields are leveled?

For many reasons, external stakeholders, in particular, are looking for an easy way to assess an organisation’s governance status. In the face of mounting of pressure, organisations are going to have to consider how they actively demonstrate (as opposed to simply communicate) their GRC status. The old adage of “what’s not measured is not managed” rings true for board members as calls for accountability strengthen. Future boardroom discussions will have to include an objective and quantifiable review of the organisation’s actual GRC status (in every area of the business) compared to internationally benchmarked best practice or at the very least, to that of its peers.

18 November 2021

USING THE CORPORATE GOVERNANCE FRAMEWORK® IN TIMES OF GREAT UNCERTAINTY

By Terrance Booysen and peer reviewed by Jene’ Palmer CA(SA)

Whilst most corporations across the world have had to make drastic changes to their business operations as a result of the Covid19 pandemic, many business leaders believe that the disruptions caused by the pandemic have inadvertently introduced more advantages than disadvantages. However, are the odds actually stacked against the organisation?

Besides the obvious health risks and workplace social distancing requirements, research conducted by McKinsey & Company in February 2021 (The Future Of Work After COVID-19) estimate that more than 100 million employees in the eight countries surveyed will probably switch occupations by 2030. Moreover, that a hybrid remote work-from-home (WFH) model is likely to continue well beyond the pandemic, with 20%-25% of employees in advanced economies working from home 3-5 days a week, and about 10% doing the same in emerging economies.

In the same research, new trends suggest that the concentration of jobs in the world’s largest cities and in traditional offices, are reversing. With greater numbers of employees choosing to work from home, the geography of work -- including office vacancy rates -- has seen significant changes across major cities since 2020. For instance, San Francisco has seen office vacancies dropping by as much as 91%, Edinburgh 45%, London 32% and Berlin 27%.

With such dramatic changes to the traditional workplace, it is necessary for organisations to consider whether their existing risk management policies and procedures are still appropriate. The new ‘unstructured’ work environment is likely to introduce new strategic and operational risks onto boardroom agendas. To exacerbate this perturbing situation, the multiple economic pressures may now lead stressed employees to commit fraud or other commercial crime and this is sure to show marked increases across the world in the months ahead. Notwithstanding a 17% reduction amongst South African companies who have experienced economic crime -- as reported in PwC’s 2020 Global Economic Crime and Fraud Survey -- South Africa’s rate of reported economic crime (currently at 60%) continues to remain significantly higher than the global average of 47%. In these uncertain times, we are reminded of the great Nobel Prize winner – Marie Currie (1867-1934) – who said, "Nothing in life is to be feared, it is only to be understood. Now is the time to understand more, so that we may fear less." Given the profound work-life altering changes we are experiencing, accompanied by the critical need to reduce economic crime, now is the time -- more than ever -- for a more scientific and analytical approach to the manner in which we understand, manage, measure and compare the governance practices within and across organisations.

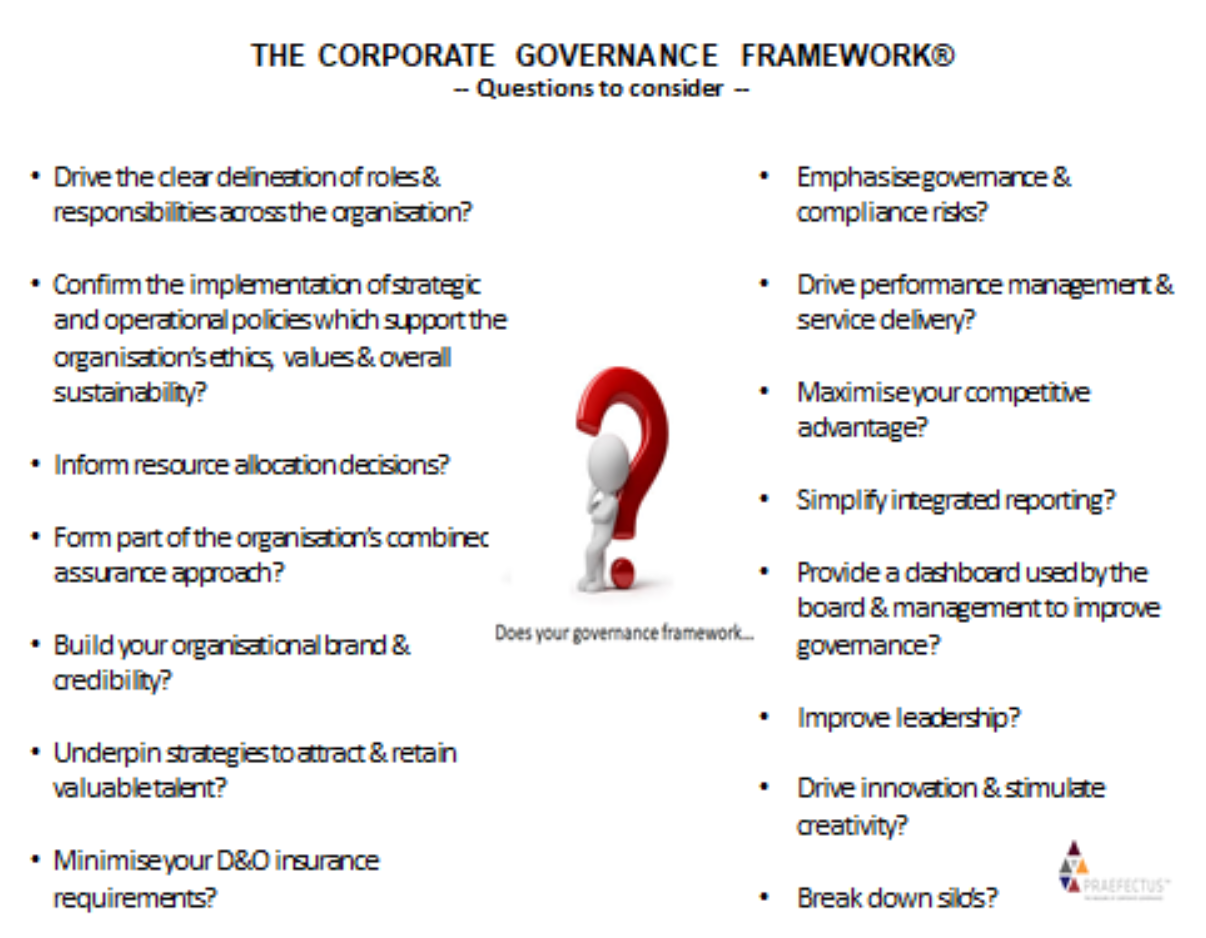

As the world, and indeed South Africa, marks the International Fraud Awareness Week (14-20 November 2021), it is imperative for organisations to adopt a comprehensive Corporate Governance Framework® which provides the board of directors with greater oversight over the strategic and operational functions of the organisation. By clearly depicting the strategic and operational areas within the organisation -- and indeed its supply chain -- where governance, risk and compliance ('GRC’) vulnerabilities exist, the board is provided with early warning signs of impending trouble.

Boards can no longer afford to play “catch-up”. The effective deployment of a Corporate Governance Framework® enables the organisation to inter alia; proactively analyse GRC trends; identify areas of business which require further investigation or independent assurance reviews; highlight policies which are outdated or not in place; rapidly determine business processes which are not delivering value; investigate conflicting information or messages; and promote cohesiveness and common purpose amongst the management team itself as well as between the management team and the board. These outcomes can be used by the board and management to not only initiate further action, but also make decisions about the importance and urgency of reallocating resources to mitigate risks on a case-by-case basis.

The advances of the Fourth Industrial Revolution (4IR) have enabled (and compelled) organisations to rapidly deploy smarter technology solutions and review their business processes to optimize their value creation activities. The Corporate Governance Framework® is a useful assessment tool which assists boards and management to sustainably improve the way in which they govern the organisation and complements the organisation’s existing business and risk management systems by integrating their critical outputs. In this way the Corporate Governance Framework® strengthens the organisation’s combined assurance processes and helps to protect the interests of the organisation.

Notably, PwC’s 2020 Global Economic Crime and Fraud Survey reported that South African companies have seen an increase (from 15% in 2016 to 34% in 2020) in instances of senior management perpetrating fraud. The Corporate Governance Framework® recognises the interdependencies of different areas of the business and as such, assists in identifying possible areas of collusion and override.

Boards of directors inherently have to deal with the changing dynamics of risk which is a fundamental part of their boardroom duties. To borrow some of Marie Currie’s sharp thinking of fear; the pandemic may have struck some fear, and even raised concern within the organisation’s leadership vis-à-vis their unpreparedness in these volatile times. However, this is certainly no time for panic -- nor fear -- especially considering the many challenges we may still face ahead. The board, together with the organisation’s executives, will need to become even more agile and embrace the challenge of governing these new unprecedented risks arising from Covid19 and its impact on business. Objective and reliable information about the state of governance within the business will be essential in ensuring that boards and management can tackle this “new norm”.

SOURCE REFERENCES:

- The future of work after COVID-19 (2021) https://www.mckinsey.com/~/media/mckinsey/featured%20insights/future%20of%20organizations/the%20future%20of%20work%20after%20covid%2019/the-future-of-work-after-covid-19-executive-summary-vf.pdf?shouldIndex=false

- Global Economic Crime and Fraud Survey 2020 https://www.pwc.co.za/en/assets/pdf/global-economic-crime-survey-2020.pdf

2 August 2021

THE PUBLIC AND ORGANISATIONAL STAKEHOLDERS – ARE THEY THE SAME?

By DrIrma Meyer and peer reviewed by TerranceBooysen

When does anymember of the publicbecome a stakeholderof an organisation? How would an organisation know when such a publicmember -- or group of members -- has become a stakeholder?Adding to this important line of thinking, who deserves more attention:publicmembers/groupsor the organisation’s traditional stakeholders? Is there a difference between publicand organisational stakeholders andif so, what is it?

“If you work for and eventually lead a company, understand that companies have multiple stakeholders including employees, customers, business partners and the communities within which they operate.”

Don Tapscott, Co-Founder and Executive Chairmanof the Blockchain Research Institute

Clearly organisations and public relations practitioners also battle with these questionsand distinctions. Some organisationshave astakeholder relations department andapublic relations department,or a well-staffed public relations department, as well as an individual responsible for stakeholder relations.

Such organisationsarguably viewpublic relations and stakeholder relations as two distinctly different functions, aimed at different outcomes. This being the case, they obviously also make a distinction between publicsand stakeholders. However, when questioned, individualsin these organisationsresponsible for stakeholder relations,find it difficult to articulate the difference between their roles and those of the public relationspractitioners. This confusing and seeminglycomplicatedmatter of semantics couldbe resolved if organisationsaccept that there no longer is a distinctionbetween the publicand stakeholdersand start to embracean all-inclusive stakeholder approach.

Edward Freeman introduced the stakeholder approach to corporate management in 1984 when he suggested that organisations should move away from being shareholder-centric to becomingstakeholder-centric. He defined a stakeholder as “any group or individual who can affect or is affected by the achievement of the organisation’s objectives” (Freeman, 1984:46) and despite many proliferations, Freeman’s definition is still regarded as the standard definition in the literature. However, considering the challenges we are currently facingsuch as the climate crisis and pandemics, one should probably change the definition slightly to “any group, individual [or thing] who[that]can affect or is affected by the achievement of the organisation’s objectives”, thus making provisionfor the flora and fauna in this definition.

Freeman’s introduction of the stakeholder concept coincided with Ferguson’s view that relationships should be the main focus of communication management and not the organisation, publicor the actual communication process (Ferguson 1984:16).It is concerning that, despite Ferguson’s insight, the uptake of the stakeholder concept and stakeholder theory in the public relations domain has beenslow. Numerous stakeholdertheoryapproaches and stakeholder identificationstrategies followed Freeman’s seminal stakeholder concept, but only a few of these emanated from communication science theorists. A possible explanation of this phenomenonis the birth of Grunig and Grunig’s excellence public relationstheory approximately at the same time as Freeman’s stakeholder concept. Despite shortcomings, critique and advanced developments, the excellence theory has remained a dominant and founding theory in public relations, overshadowing stakeholder concepts and theories.

What is equallyconcerning is the apparent ignorance amongst public relations practitioners ofthe significant inclusion of the stakeholder concept in the King III Report on Corporate Governance which came into effect on 01 March 2010. For the first time, it dedicated an entire chapter to stakeholder relationships, outlining six principles for governing stakeholder relationships.

The subsequent King IVReport on Corporate Governance™(2016) retained thisfocus on stakeholder relations. The stakeholder concept, albeit in aconfusing and uncertain manner, is slowly surfacing in some public relations areas. At least one South African university now offers a stakeholder relationship management module and a number of organisations have established a stakeholder relationship department orappointedan individual responsible for stakeholder relationships. None, however, has been so brave toreplacethe terminologypublic relationswith stakeholder relations.The terms publicsand stakeholdersare often used interchangeably. Theorists argue thatthe termstakeholderis found in business literature and used by organisations’ management, whereas publics relationsemanate from the public relations literature and is used by publicrelations practitioners(Rawlins, 2006:1). Some argue that organisations choose their stakeholders, but that “publicsarise on their own and choose the organisation for attention” (Grunig &Repper,1992:128), while others believe that publicsare formed when certain stakeholdergroups recognise an issue and organise themselves to deal with it (Steyn & Puth, 2000:199 –200)

However, in ourexperience in dealing with and training them, public relations practitionersfavour stakeholdersover publics. They may also refer to the receivers, readers and listeners of their media messages as audiences, but very seldom do they use publics.

Perhaps it is time to end the debate on publicsversus stakeholdersand accept that a stakeholder is anything, group or individual who can affect or is affected by the achievement of the organisation’s objectives, purpose and/or mission.

Given the current volatility experienced as a result of the COVID-19 pandemic, where new stakeholders have been introduced to the business supply chainor known, but previously neglected stakeholders have become very important, executives are quick to agree that organisations now have to operatein a so-called “new-normal” mode. Very few, however, have defined “new-normal” succinctly yet, and structures, processes and policies still reflect a pre-COVID-19 mind-set. To paraphrase freely from Albert Einstein –we cannot solve our new problems with the same old thinking we used when we created them. Organisations now need to start thinking laterally and creatively about the future and how to engage with all their stakeholders.

To this end, organisations should be brave and rename organisational public relationsfunctions tostakeholder relations.A stakeholder relations organisational department could, for instance, comprise of several divisions, such as employee relations, media relations, investor relations, community relations, government relations and consumer relations. Given the importance and role stakeholders fulfil within an organisation, the significance of stakeholder engagement within an organisation’s governance framework, is therefore not surprising. Indeed, it cannot be emphasised enough just how important it is to maintain proper, relevant and two-waycommunication with the organisation’s stakeholders, moreover,maintaining a high ethical standard with them at all times.

Perhaps a simple name change is all that is needed to understand that legal compliance is only a small part of corporate governance,and that effective governance has a touchpoint with all areasin the organisation and with all stakeholders, whether they are latent (unaware), active or activists. One can onlyhope thatsuch aname change would elevate the public relations function from apublicity-seeking, propaganda function, which it sadly still often is,to a communication discipline strivingto establish solid relationships with all the organisation’s stakeholders through honest two-way conversations.

21 July 2021

WHAT DOES THE FUTURE OF SOUTH AFRICA LOOK LIKE IF LEADERS REFUSE TO BE HELD ACCOUNTABLE?

By Terrance Booysen and peer reviewed by Jené Palmer CA(SA)

During the years of President Jacob Zuma’s leadership, the country experienced many great governance challenges which played out in the courts and the public domain. The Public Protector at the time -- Ms. Thuli Madonsela -- appeared to be winning the battle against corruption, notwithstanding the great odds that she was facing.

One may also recall how little support was found in the National Prosecuting Authority, with Adv. Shaun Abrahams at its helm and the Special Investigations Unit (SIU) with very little to offer in the battle so desperately needed to beat this scourge which both then and today erodes the moral fibre of our society, including the economic engine that is expected to sustain the country.

“Leaders inspire accountability through their ability to accept responsibility before they place blame.”

Courtney Lynch

Founding Partner Lead Star, N.Y. Times Bestselling Author

With President Zuma being forced to step down, there was renewed hope found in President Cyril Ramaphosa’s appointment; his “new dawn” promises thrilled both the worn-out citizens, including the business sector and many investors. It appeared that the worst of times was in the rear-view mirror, and for a period of time conditions in South Africa seemed to improve. However, our optimism appears to have been short-lived with many promises to hold people accountable for their actions being broken or simply ignored.

Sadly, with President Ramaphosa now in the position for almost three years, many South Africans believe that the conditions in South Africa have in fact deteriorated. Questions are being asked about the internal leadership battles within the ruling party, deep rooted and widespread corruption particularly in the public sector, poor policy decision making by government, abysmal governance and poor economic growth.

Given the extent of SA’s dire circumstances, where the global rating agencies have downgraded the country’s sovereign rating well into “junk status” -- and the IMF themselves increasingly more concerned about South Africa’s growing debt ratios to our GDP -- it is hardly surprising that many anxious citizens and investors have turned their attention and focus to other destinations that offer better conditions which are more conducive to safer living and diverse working and investment opportunities. Whilst there are countless references to the shocking crime and declining business statistics that continue to plague South Africa, which is referenced by many market commentators including the Auditor-General each year, surely the simple truth must be exposed where the relevant people are held to account?

After billions of Rands have been wasted on dysfunctional state-owned companies in South Africa, how is it possible that the respective leaders – including their boards of directors – have not yet been brought to book? When their actions, both individually and or collectively, have proven to be reckless, why have these people not been prosecuted and declared delinquent?

In almost every case, organisations without a governance framework, for example SAA, SABC, Eskom, Denel, SA Post Office, Transnet and PRASA, have any consistent form of determining who exactly is to be held accountable when matters go astray. This is very convenient and whilst the status quo continues, three dead certain consequences are inevitable:

- boards of directors, including their executive management will continue getting away with poor leadership, unacceptable business behaviour and sub-standard organisational performance;

- SA taxpayers, who are already a dwindling base of tax revenue, will be expected to continue to subsidise the malaise of poor leadership within the government business structures, and

- failed governance will inevitably lead to dysfunction which can take on many forms, including the ultimate ‘death’ of an organisation.

It is without any doubt that South Africa’s future survival and sustainably depends upon exemplary leadership, ethical people, robust governance frameworks and a stakeholder community that demands accountability of people in leadership positions or those charged with governance.

Anything short of this will not end well!

12 November 2020

DIRECTORS’ SENTIMENT INDEX ™ REPORT: 5TH EDITION – CGF’s observations from a governance perspective

By Glen Talbot (CA) SA and Terrance Booysen and peer reviewed by Jene’ Palmer CA(SA)

A review of the Institute of Directors in South Africa (‘IoDSA’)’s recently released report for 2020 raises some interesting observations from a governance perspective. It should be noted that the study was concluded prior to the nation-wide lockdown and national state of disaster due to the Corona virus (‘Covid-19’) pandemic. It is likely that the sentiments expressed by respondents may have been significantly more pessimistic had the study been concluded in the second half of 2020.

The findings of the report illustrate the views of 454 South African directors and track the changes in business sentiment over the past 5 years across various categories, comprising Economic, Business, Governance and Directorship factors.

The Governance category, although ranked highest of the 4 categories, shows a steady downward trend from a score of 3.6 in 2014 to 3.3 in 2020, out of a possible maximum score of 5. Responses to the question in the Governance sector: “What do you consider to be the three main governance challenges currently facing your business?” included a variety of responses by some of the respondents which is provided in the table below.

| QUESTION: “What do you consider to be the three main governance challenges currently facing your business?” | |

| RESPONSE |

CGF’s RESPONSE |

| None. My business is not challenged by any governance factors |

It is interesting to note that 34% of respondents indicated that their business is not challenged by any governance factors. Based on CGF’s interactions with directors over recent years, a response of this nature may be a case of “you don’t know what you don’t know”. When organisations have been asked by CGF what their organisation’s governance framework entails, many would offer their organogram, board charter, delegation of authority or company secretary’s job description as a response. From these responses it is clear that these organisations do not have a thorough understanding of the GRC status for every area of their business. As such, the Board of Directors (and therefore the organisation) will be unnecessarily exposed to unforeseen and unanticipated risks. A well implemented Corporate Governance Framework® can assist the Board in ensuring that the organisation has identified and is mitigating important “governance factors” well beyond the afore-mentioned documents. |

| Lack of sustainable thinking |

Visionary leaders appreciate the importance of the Corporate Governance Framework® in nurturing organisational sustainability by driving values-based decision-making to “play the long game”. The framework helps to break down siloed thinking and promotes decisionmaking which is aligned to the organisation’s corporate vision. It is important to ensure that the organisation’s Corporate Governance Framework® addresses sustainability issues and highlights the effective and efficient deployment of all resources, as contemplated under the 6 capitals model, on a balanced and coordinated basis. In this way, integrated thinking is promoted such that the longer term impact of the organisation’s actions can be carefully considered and monitored. |

| Too cumbersome and time consuming | Too many organisations (and indeed directors) view governance as just an additional layer of bureaucracy, not truly appreciating that governance speaks to the way in which an organisation is directed and controlled. The Corporate Governance Framework® is a useful management tool which supports strategic value by strengthening performance and optimising the governance of the organisation’s people and processes. The objective is to improve efficiencies and productivity in the long term interests of the legitimate stakeholders. |

| Lack of understanding (King IV™) | The Corporate Governance Framework® should be aligned to the legislation, rules, policies and codes of best practice applicable and relevant to the organisation. As such, it provides a meaningful and practical understanding of how and where the organisation either meets or falls short of the applicable local and/or international GRC prescripts, including the requirements of King IV™ as may be necessary. |

| Unethical behaviour (bribery and corruption) |

The implementation of a Corporate Governance Framework® strengthens the organisation’s combined assurance approach in that it introduces thirty-two lines of defence supported (or not) by organisational evidence. The segregation of duties in performing governance assessments in the framework while recognising the inter-connectivity between different areas of the business further underpins the usefulness of this tool in driving transparent and ethical behaviour. Moreover, ethics as an organisational discipline lies at the heart of the Corporate Governance Framework®. As such, the framework assists business leaders (management and the board) in assessing whether a rules-based mentality permeates the organisation or whether a culture of accountability and “speaking up” is being inculcated within the organisation. |

| Lack of understanding the overall benefits |

Based on interactions with directors over the years, CGF can attest to this response highlighted by the survey. Against the backdrop of a complex and evolving business environment, the implementation of a Corporate Governance Framework® enables boards to become more purposeful and agile in their decision-making while better appreciating the risks facing the organisation. Moreover, a real-time GRC dashboard provided by a Corporate Governance Framework® promotes a common understanding of the organisation’s GRC maturity and assists in prioritising areas for improvement. |

| Too costly or the perception of being too costly |

This response begs the question: can the organisation afford the cost of failed governance? The evidence and dire outcomes of failed governance processes are very evident in the South African public and private sectors. The cost of such failed governance is yet to be determined. CGF would argue that the benefits of implementing and maintaining a Corporate Governance Framework® far outweigh the costs. The implementation of a Corporate Governance Framework® drives organisational resilience by supporting evidence-based decision-making to drive accelerated strategy implementation. The business intelligence gained from performing the governance assessments required by the framework leads to a more engaged workforce, integrated thinking, increased productivity and quicker execution. The return on investment is evident. |

As a recognised thought leader and governance solutions provider in South Africa, CGF has reviewed these questions and their related responses from the perspective of having implemented a Corporate Governance Framework® for various organisations.

The above highlighted outcomes of the IOD’s Directors’ Sentiments Index, underline CGF’s concerns about the general lack of understanding of governance and the critical role it plays in ensuring that an organisation is able to sustainably and responsibly deliver on its strategic mandate.

The board’s ability to direct and control an organisation can be simplified by implementing a Corporate Governance Framework®. In this way, the board will truly understand that good governance is a business enabler, rather than a business inhibitor.

26 August 2020

INVIGORATINGTHE INTERNAL AUDIT PROFESSION THROUGH ROBUST GOVERNANCE AND CONTROLS

By Jene’ Palmer CA(SA)(CGF Lead Independent Consultant)and peer reviewed by Terrance M. Booysen

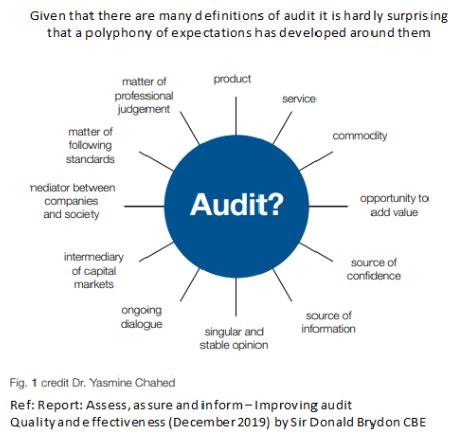

The recent public censure and financial penalties imposed by the JSE Limited on Tongaat Hulett Ltd and EOHLtd for non-compliance with the JSE Listing Requirements, again brings the effectiveness of the internal audit profession (and indeed external audit) into question. Is internal audit adding value?

The question is relevant to both the public and private sector where examples of financial misstatement and the circumvention of internal procurement policies and procedures are increasingly being uncovered. In these circumstances, questions need to be asked about the future role and stakeholder expectations of internal audit.

While most organisations’ internal governance instruments (e.g. the internal audit charter) are aligned to the requirements of King IV™ and clearly outline that the CAE(Chief Audit Executive)should be independent of management and should report directly to the Audit Committee, in reality, the role of internal audit is often diluted by an ineffective Audit Committee and/or by a controlling CEOor CFO. The situation is compounded by the complexities of an increasingly digital business environment which demands a better understanding of the organisation’s strategic intent and risk appetite to enable internal audit to be relevant and effective. The typical reactive risk-basedapproach to internal audit will need to evolve into a more proactiveapproach which embraces the business’s strategic drivers and the conditions which give rise to business volatility.

While continuous audits will go a long way towards assessing the consistent implementation of internal controls, the CAE and members of internal audit will necessarily also need a broader, more practical understanding of how the organisation deploys technology to achieve its strategic objectives. This knowledge is critical in ensuring that internal audit processes are properly scoped and are relevant. A superficial and mainly theoretical knowledge of industry best practice applicable to the different areas of the business will not add value in assessing the financial and non-financial controls. The Audit Committee should consider the extent to which the internal audit function may need to be outsourced to multiple service providers who are experts in their field, so as to achieve the desired level of comfort that internal controls are being appropriately applied across the business.

“The purpose of an audit is to help establish and maintain deserved confidence in a company, in its directors and in the information for which they have responsibility to report, including the financial statements.”Sir Donald Brydon (CBE)December 2019

In addition, the Audit Committee (and indeed the CAE) should ensure that the internal audit plan is sufficiently comprehensive to proactively address all areas of the business over time. The Corporate Governance Framework® plays an important role in prioritising areas for internal audit and highlighting the levels of governance, risk and compliance (GRC) maturity associated with each area. Indeed, the governance framework presents an opportunity to strengthen the second and third lines of defense andto improve the quality and integrity of the organisation’s integrated reports. The mandating of XBRL reporting and the requirement for meaningful sustainability reporting should also inform the scope of the organisation’s internal audit plan.

Against this backdrop, the roleand valueof the internal audit function should evolve to a combination of watchdog and strategic advisor in the areas of GRC. As such, internal audit will need to get more involved in the organisation’s strategic planning and risk management processes –while at the same time remaining independent. Not an easy feat! However, this approach is necessary given that internal audit is increasingly expected to act in the public’s interest across a broad range of matters and make a demonstrable impact on the organisation’s credibility and long-term sustainability.

28 July 2020

SURVIVING DISRUPTIONS IN BUSINESS CALLS FOR MORE AGILE BOARDS AND A ROBUST GOVERNANCE FRAMEWORK

By Terrance M. Booysen

After a few months of Covid-19 lockdown in South Africa, there is no doubt that somehow all the rules seem to have changed for civil society, and indeed also for the world of business at large. Businesses across the world have had to quickly adapt to their respective Covid-19 regulations with South Africa having become known as a country with some of the strictest Covid-19 regulations in place in an attempt to flatten the Covid-19 curve, and save lives.

Even prior to the Covid-19 pandemic, the ease of doing business in South Africa was already under great pressure. According to the World Bank’s annual ratings, South Africa’s ranking had deteriorated from 82nd position amongst 190 economies to 84th position in 2019. The Covid-19 saga has clearly made matters far worse for businesses to survive in South Africa, hence requiring greater board agility to weather and beat the socio-economic tsunami we are now facing.

Considering the impact Covid-19 has had upon most businesses, boards of directors have again been reminded of the critical importance of having an appropriate and responsive back-up plan in order to sustain the massive business disruptions caused by unexpected risks. Unsurprisingly, a number of organisations have been caught short and this begs the question regarding the board’s full understanding of its own business resilience in such turbulent times.

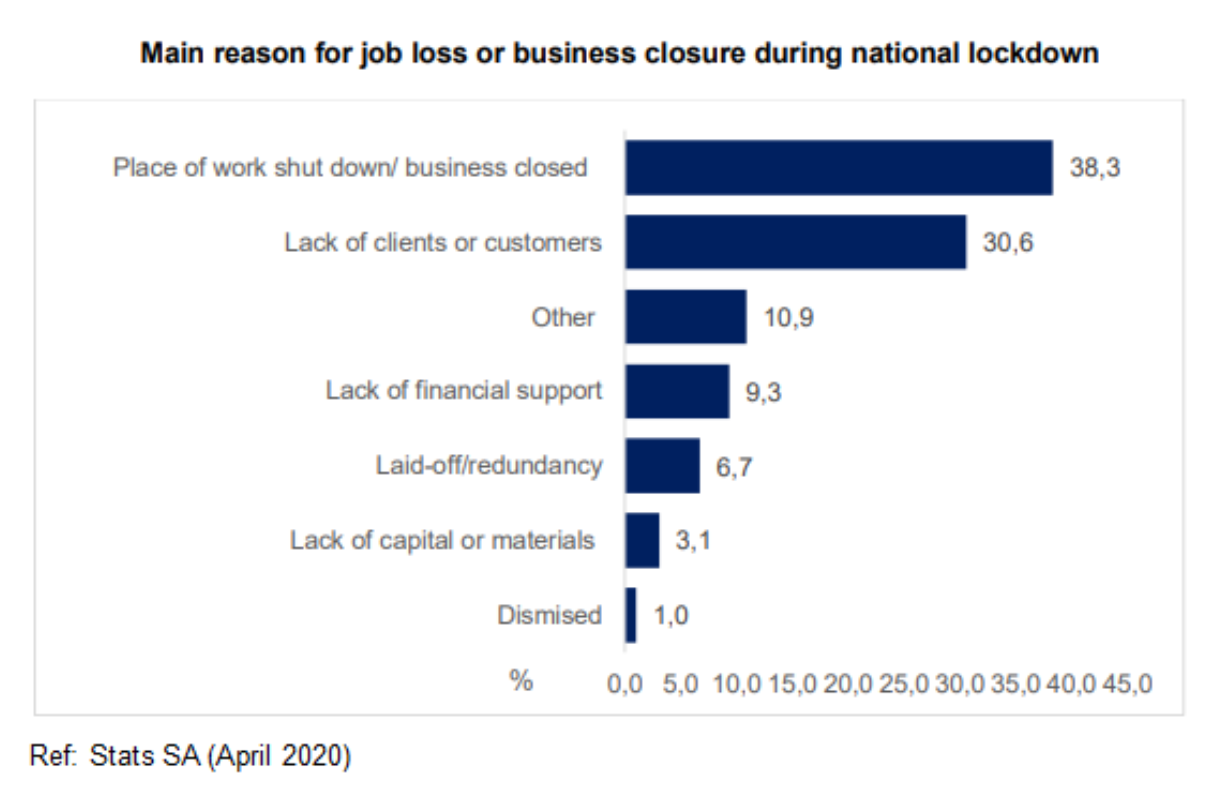

According to a recent series of surveys conducted by Stats SA (April 2020), nine out of ten (90%) businesses surveyed (2,182 businesses) reported reduced turnover; thirty-six percent (36%) indicated they were retrenching employees in the short term as a measure to cope with Covid-19 and twentyfive percent (25%) indicated they were decreasing their working hours. Approximately one out of ten businesses (10%) indicated that they had ceased business permanently and the industries with the highest percentage of organisations permanently closing their doors include construction (14%); community, social and personal services (12%); and agriculture, hunting, forestry and fishing (12%). Thirty percent (30%) indicated they could survive less than a month without any turnover, whilst 55% of the surveyed organisations indicated that they could survive between 1 and 3 months. Only seven percent (7%) indicated that they could survive for a period longer than three (3) months. With the hindsight of a number of recent wide-scale business disruptions caused by either natural or human activated disasters such as 9-11, and given the experiences gained from these past events, most medium and large sized businesses should have been able to not only foresee a risk such as Covid-19, but they should also have been able to rapidly absorb the shock and bounce back in a very short space of time.

With the hindsight of a number of recent wide-scale business disruptions caused by either natural or human activated disasters such as 9-11, and given the experiences gained from these past events, most medium and large sized businesses should have been able to not only foresee a risk such as Covid-19, but they should also have been able to rapidly absorb the shock and bounce back in a very short space of time.

The reality is that most South African organisations have not been able to resume a ‘business as usual’ approach and this has been further complicated by massive government intervention which may indeed be doing more harm than good.

By closing down the sale of various nonessential products or services, or restricting trade in one way or another, it fundamentally unsettles the business supply chain and creates other unintended problems that could cause terrible long-term social and economic damage. In addition to these matters, since Covid-19 does not appear to be going away anytime soon, organisations are realising that their business operating environment will rapidly need to become ‘contactless’. In this regard, the challenges of dealing with Covid-19 go well beyond the wearing of face-masks and the routine of measuring people’s temperatures. Covid-19 regulations are forcing organisations, amongst other entities, to accommodate increased virtual interactions with their employees, customers and suppliers. This entails re-modelling previously physical ‘touch’ and ‘space’ zones to provide for spatial distancing between people, as well as the tracking and monitoring of their daily movements in certain circumstances. Expectedly, this has great bearing upon the entire organisation and the outcomes (impact) will be evident in the organisation’s governance framework. Considering these ‘new’ business challenges, one may question just how knowledgeable and prepared boards are to deal with the Covid-19 impacts that affect many of their strategic and operational activities. Do boards have the ingenuity and means to understand the primary and secondary risk implications, not least also the impact Covid-19 will have upon the organisation’s resilience? A robust governance framework will facilitate a common understanding amongst board members of the governance, risk and compliance (GRC) challenges facing the organisation and will highlight those business areas which require immediate and/or critical attention. Rudimentary governance instruments implemented to act as a substitute for a governance framework will not be useful in assisting the board to prioritise the allocation of scarce resources to achieve their strategic objectives and ultimately ensure organisational sustainability.

Considering these ‘new’ business challenges, one may question just how knowledgeable and prepared boards are to deal with the Covid-19 impacts that affect many of their strategic and operational activities. Do boards have the ingenuity and means to understand the primary and secondary risk implications, not least also the impact Covid-19 will have upon the organisation’s resilience? A robust governance framework will facilitate a common understanding amongst board members of the governance, risk and compliance (GRC) challenges facing the organisation and will highlight those business areas which require immediate and/or critical attention. Rudimentary governance instruments implemented to act as a substitute for a governance framework will not be useful in assisting the board to prioritise the allocation of scarce resources to achieve their strategic objectives and ultimately ensure organisational sustainability.

It’s true, these are most uncertain and unprecedented times we now live in, and more than ever before, boards will increasingly be required to truly understand their businesses and operations if they are to prove their strategic worth.

The implementation of a Corporate Governance Framework® will enhance the speed and quality of decision-making by boards by ensuring a more holistic understanding of the interdependencies within the business, including a proper perspective of the organisation’s GRC challenges. Covid-19 has certainly changed the rules of business and boards will need to ensure that their organisations can adapt accordingly.

18 April 2020

COVID-19: ADDRESSING DEBILITATING RISKS REQUIRES A ROBUST GOVERNANCE FRAMEWORK

By Terrance M. Booysen and peer reviewed by Jene’ Palmer CA(SA) (CGF Lead Independent Consultant)

The times we are currently living in are unprecedented. Covid-19 has once again highlighted the reasons why governance -- good governance -- is a critical function in a democratic country.

The President of South Africa made what most people believe to be a good strategic call on the national Corona virus lock-down, including the implementation of the relevant regulations intended to protect the citizens of South Africa from contracting the disease. So far, it would appear that this strategy is working and that South Africa is using the time to prepare the national health system to cope with an imminent exponential influx of patients.

In arriving at the decisions to lockdown the country -- and then later to extend this lockdown -- President Ramaphosa no doubt consulted (and continues to consult) widely with his team of advisors to ensure that the extent of the problem and its likely impact is thoroughly understood and continues to be monitored so that action plans can be adapted as required to address the changing circumstances.

Covid-19 has caught many an organisation and its leadership by surprise. Many businesses had to invoke their business continuity plans (BCPs) to ensure that at the very least their workforce could work remotely. Those organisations which were prepared were able to make the ‘switch’ within hours and at the most within two days. Others took much longer to get up and running with some finding that their plans were either outdated or were not properly tested nor constructed, resulting in additional costs and possibly reputational damage. For the most part however, the majority of businesses in South Africa are suddenly faced by a complete loss of revenue while still having to maintain the same cost structure. It has become evident that many business strategies did not provide for alternative routes to market or consider scenarios where products/solutions would have to be adapted to suit an arguably permanently changed business landscape. These are only a few of the Covid-19 consequences which are being faced by businesses.

Whilst the above scenarios may be resonating with some boards of directors and their executive teams, no doubt many readers would respond by saying that Covid-19 could not have been predicted; and this may be true in respect of the disease itself. However, CGF believes that those organisations which had implemented a Corporate Governance Framework® prior to the national lockdown would have been better prepared to manage their way through these types of ‘unknown’ risks.

Since the lockdown, CGF has hosted a series of virtual breakfast meetings, with practical discussions and demonstrations showing how a digitised Corporate Governance Framework® assists boards of directors in ensuring that every area of their business (including business continuity management and strategic planning) is being regularly assessed with regards to their governance, risk and compliance (GRC) maturity levels. The objective is to drive informed and timeous decision-making at a board and at a management level to safeguard the organisation’s interests, success and sustainability.

A brief overview of the conclusions of these virtual breakfast meetings is outlined below:

1. A governance framework

- The Corporate Governance Framework® drives a common view and understanding of the organisation’s governance structures and processes with a view to improving the timing and quality of decision-making.

- In addition -- in its simplest of form -- it gives a high level view (on a simple red, amber, green (‘RAG’ methodology basis) of the extent to which all the components of governance are being efficiently and effectively monitored, managed and controlled.

2. Timing

- The timing of decisions is critical. Acting proactively, reactively or sluggishly usually distinguishes those organisations that succeed from those that fail. Never has this been more true than in today’s lockdown environment. Many businesses are currently faced with restructuring decisions; the trick will be to know when to start executing these decisions to ensure business continuity. The Corporate Governance Framework® will assist in identifying those areas of the business which require more immediate decision-making.

3. Reliable information

- Acting upon non-verified information, or unreliable sources of information is in itself a recipe for disaster. Equally dangerous, is acting when certain key information is weak, or missing. It’s critical for leaders to understand the necessary and relevant information at the right time and place. The Corporate Governance Framework® through its governance assessments can assist the board and management in addressing one of its biggest challenges: acknowledging what is not known and / or understood, and then trying to appropriately fill these knowledge deficiencies.

4. Evidence

- The burden of proof cannot be over-emphasised. Hard facts and evidence need to be presented and commonly understood. The Corporate Governance Framework® requires evidence to support any GRC assessments and helps to ensure that decision-makers are better equipped to vary their decisions and instructions in line with the organisation’s risk appetite and risk tolerance levels. Having your evidence readily available shortens the time for decision-making, especially during a crisis.

5. Co-ordinated approach and communication

- The Corporate Governance Framework® helps eliminate ‘siloed-thinking’ and enables a greater cohesion between functions, departments, divisions and geographic regions. A better understanding of the ‘big picture’ and how every area of the business is inter-related, helps to instil an innovative culture and is particularly valuable when the business is faced with the need to drive a sudden change in strategy or achieve improved efficiencies and altered cost structures.

- Bridging the communication gap between management and the board also holds immeasurable benefits for the organisation in ensuring that decision-making is authorised, transparent, supported and coordinated both during ‘normal’ trading circumstances and times of crisis.

6. Roles, responsibilities and competencies

- Every board will agree that everyone in the organisation must understand their role and responsibilities that need to be executed to successfully and sustainably achieve the organisation’s mandate.

- Although many businesses implement a job-grading system and would claim that their job descriptions are well documented and implemented, the governance assessments (performed through the Corporate Governance Framework®) often identify gaps between the existing skills and qualifications base and the desired skills and qualifications base required to meet the organisation’s strategy and implement its operating plans in accordance with the organisation’s policies, procedures, performance agreements and ultimately best practice. Having a good (prior) understanding of the organisation’s strengths and weaknesses in this regard will facilitate the implementation of risk mitigating initiatives.

7. Transparency and ethics

- Inconsistent, ill-conceived and uncoordinated decision-making undermines trust in the organisation and its leaders.

- Ethics lies at the heart of the Corporate Governance Framework®. Instilling a values-based approach to management helps to empower employees to make decisions which they believe are in the best interests of the organisation and it builds a culture of accountability. Against this backdrop it becomes easier for the board and management to implement change while remaining within their risk appetite and risk tolerance parameters.

- The governance framework dashboard not only helps to prioritise resource allocation, but also serves to underpin transparency and drive performance. These values become even more critical during times of crisis when stakeholders are looking for reassurance that the business will be able to manage the risks (known and unknown) and continue to be sustainable.

8. Impact of the governance framework on the organisation

- Correctly implemented, the Corporate Governance Framework® facilitates informed and timeous decision-making which makes the business more agile and resilient in respect of risks. In these current times, being able to respond quickly to changing market conditions is a strategic differentiator.

9. Benefits for the board

- A strong board comprises different personalities with varying skills and experience backgrounds. The Corporate Governance Framework® enables the chairman of the board to positively harness the strength of such diversity to create value for the organisation by adopting a disciplined approach to performance management.

- In addition, the non-executive board members have improved up-to-date access to information about the organisation, particularly as regards the organisation’s GRC status.

- The implementation of the governance framework drives accountability. As such, it becomes a good tool to measure the extent to which executives and non-executives are adhering to their fiduciary duties and acting in the best interests of the organisation.

10. Sustainability

- The behaviour and actions taken by leaders, in the best and worst of times, is what determines the final outcome of an organisation’s success and sustainability. With a thorough GRC overview, leaders are better equipped to make informed decisions, and implement meaningful actions to mitigate and or reduce the effects of any risks that may harm, or even render the organisation unsustainable.

26 January 2020

SELECTING THE WRONG DIRECTORS FOR THE SOE AND SOC BOARDS HAS BEEN DISASTROUS

By Terrance M. Booysen and peer reviewed by Jene’ Palmer CA(SA) (CGF Lead Independent Consultant)

As most South Africans eagerly awaited some reprieve from a year of constant and negative bombardment, be this over matters such as a massively contracted economy, rising unemployment, state capture, rising corruption and the threat of expropriation of property without compensation, many had hoped to return from their annual vacation rested, and hopeful to hear some positive news. This did not happen.

Besides the imminent threat of being downgraded to junk-status by Moody’s Rating Agency and in spite of the National Treasury and our central bank’s optimism of expanding our GDP by 1.2% this year, both the World Bank and the International Monetary Fund have pegged our economic growth below 1%!

Let’s not forget about all the promises from the Eskom board in early December 2019, saying that South Africans would not experience any load shedding during the festive period. These promises did not last long, and way before most employees arrived back at work in January 2020, their holidays had been marred by further blackouts.

Then there’s the SAA business rescue saga; the SA government finally allowed business sense to prevail when it was agreed that SAA would be placed into business rescue, subject to the strict provisions of the Companies Act and the appointment of an independent business rescue practitioner. However, there appears to be a strong belief that the national airline must be saved, whatever the costs and in spite of the findings and recommendations (which are still to be finalised) of the practitioner. Was the business rescue decision just another smoke-screen to tick the good governance box? The bizarre decisions being taken by the boards of directors such as Eskom and SAA (and these are just two examples) fail to take cognisance of the bigger picture which should be about placing the organisation’s interests -- and therefore the broader interests of South Africa -- first. It is patently obvious that directors are not performing their fiduciary duties in the manner prescribed under various legal prescripts, nor following governance codes such as King IV™.

Clearly, something is wrong, in fact seriously wrong!

But the latest set of events following the ANC’s Lekgotla last weekend seems to suggest that both President Cyril Ramaphosa and the ANC’s NEC seem to have understood the critical importance of placing the correct, and most appropriate people on the boards of state-owned companies (‘SOC’) and other state-owned entities (‘SOE’). In total, there are about 700 state-owned companies and entities. Many of these organisations have reported dismal financial performance and have dysfunctional boards, the most notable of these include Eskom, SAA, Transnet, Denel, PRASA, NECSA, SABC and Landbank.

As we are now well on our way into the new year, with the President’s #SONA2020 and Minister Tito Mboweni’s Budget Speech being just a few weeks away, one wonders if President Ramaphosa’s vows which he expressed shortly after last weekend’s Lekgotla -- to stop haphazard cadre deployment within the SOE/SOC boards -- will have any positive bearing upon the pending Moodys announcement, including the SA Business Confidence Index, not least also on new foreign direct investment?

In order to “build a capable state”, President Ramaphosa is calling for boards to be comprised of credible individuals, who have the correct qualifications to occupy such positions. This call, seemingly, has the backing of the NEC. The President is quoted as saying “the ANC will become more stringent in the selection process of all public representatives including setting qualification criteria for comrades who should be put on ANC lists.”

Undoubtedly, such a move which if backed by proper oversight, bodes well if it is implemented correctly. Its national deployment should see much improved organisational performance, and indeed improved governance of the respective organisations, as well as a much-needed branding refurbishment for South Africa. As is the case within the private sector, the principles of applying good and proper governance frameworks which are effective and efficient, remain the same irrespective of the nature and / or the size of the organisation.

As an organisation that specialises in corporate governance, we agree with the President’s sentiment that “a capable state starts with the people who work in it. Officials and managers must possess the right financial and technical skills” and most importantly, these people must unequivocally lead organisations ethically, using appropriate governance measures to direct and control their organisations in a sustainable manner. We stand firmly with the President, when he announced the state’s commitment “to end the practice of poorly qualified individuals being parachuted into positions of authority through political patronage.”

The past practices of appointing incompetent individuals to serve as directors in many of the state-owned companies and entities has over the last two decades, not only resulted in dysfunctional boards, but in many instances, it has also resulted in a toxic relationship between the board and the shareholder (Minister/s), as well as within the board membership itself. Against this backdrop, it is not surprising to see premature board retirements, which are often cited under the auspices of ‘ill-health’ or ‘career advancements’.

Hope springs -- once again -- for the promise of a “new dawn” for South Africa.

8 October 2019

NEW APPOINTMENT: STEPHEN SIMMONDS ADDS FURTHER GOVERNANCE GRAVITAS TO THE CGF STABLE

Stephen (‘Steve’) Simmonds has been a familiar face and friend of CGF for a number of years, and our association started in early 2015 when he and some of his work colleagues from Metrix Software Solutions attended governance training hosted by CGF. And so a few years later, we are delighted to welcome Steve as the newest member to join our team of Lead Independent Consultants.

Stephen (‘Steve’) Simmonds has been a familiar face and friend of CGF for a number of years, and our association started in early 2015 when he and some of his work colleagues from Metrix Software Solutions attended governance training hosted by CGF. And so a few years later, we are delighted to welcome Steve as the newest member to join our team of Lead Independent Consultants.

Steve has an impressive background. He is originally from the United Kingdom where he started his career and tertiary training at the National Gas Turbine Establishment, this being the central site for developing and testing gas turbines and jet engines such as those used on the Concorde, Harrier and Tornado in collaboration with the world-famous Royal Aircraft Establishment in Farnborough.

After emigrating to South Africa in 1975, he was employed in the engineering and quality assurance profession for almost two decades. Hereafter, Steve entered the management consulting profession, where he assisted numerous organisations with the implementation of ISO Management Systems in the Quality, Environmental, Health & Safety, Food Safety and Automotive disciplines.

Steve then joined Metrix Software Solutions in 2008 and was responsible for managing the implementation of Governance, Risk and Compliance (‘GRC’) software projects at clients, including management systems design and development. As a subject matter expert, he also guided software project implementation teams to ensure the content of the GRC software was accurate and fit for purpose according to client requirements.

Steve is also highly knowledgeable in the disciplines of Business Continuity Management (BCM), information security, risk management, governance and ethics -- amongst other governance elements -- all of which form part of the renowned digital Corporate Governance Framework® which is used to assess, measure and validate an organisation’s real-time GRC status.

As an authority in Systems Integration (‘SI’), Steve is well positioned to assist our clients map and integrate their numerous, and often complex GRC instruments, into the organisation’s governance framework whist at the same time ensuring the respective business processes and procedures are effective and efficient. Indeed, Steve’s deep business experience of SI bodes well to ensure duplicative operations are highlighted and rectified in order to optimise business efficiencies. To pursue his passion for integrated governance systems, Steve left Metrix Software Solutions in July 2017 and returned to the consulting profession as an Integrated Management Systems specialist, prior to being appointed as a Lead Consultant at CGF in October 2019.

Steve forms part of CGF’s extended team of GRC professionals, who are seasoned business leaders and who have had the opportunity to work closely with various boards. Together, our experienced consultants are able to assist CGF’s clients to extract significant value from a properly implemented and structured Corporate Governance Framework®, which has equal applicability to public, private and non-profit organisations. Our team can assist the organisation in attesting to its compliance with the various levels of combined assurance as well as in augmenting the requisite lines of defence within the organisation’s governance framework.

Steve is a Certified Business Continuity Management Practitioner through the BCI UK, Management Systems Lead Auditor, Qualified Learning Assessor, Coach, Guide, Moderator, Assessment Designer and Developer, a former National President and Director of the South African Society for Quality and former Director of the South African Quality Institute. Professionally he is a member of the Institute of Consultants SA.

17 July 2019

NEW APPOINTMENT: CGF’s GOVERNANCE SERVICES STRENGTHENED WITH APPOINTMENT OF TRAVERS CAPE (CA(SA), MBA)

CGF is delighted to welcome Travers Cape as a Lead Independent Consultant to our company. Travers has acquired a wealth of experience in senior financial management positions and fulfilled various strategic roles within multinational and local businesses.

Being adept at analysing facts, figures and similar detail, Travers will support our clients in the application and verification of their combined assurance processes, including the associated functions that are linked in their annual integrated reports.

The integrated report is a fundamental governance instrument used for keeping an organisation’s stakeholders properly informed of its many enterprise activities, including the organisation’s commitment to the protection of the environment, good corporate citizenship and value creation.

The Integrated Report is one of only a few organisational documents which is required to be made publicly available to stakeholders at large. As such, it is widely used by stakeholders to assess the performance and future sustainability of an organisation. It is therefore imperative that this report be transparent and accurate in its disclosure of information. Regrettably, there are too many instances where this critical governance feedback mechanism is compiled from a solely marketing perspective and is often “disconnected” from the actual strategic, governance and risk management realities experienced by the business. The fact of the matter is that only the financial statement section of the Integrated Report is actually subjected to external audit; the quality and adequacy of the rest of the information contained in the report is dependent on the board’s willingness to transparently present all the matters which are relevant and which will enable stakeholders to hold the board accountable for their actions (or lack thereof).

In the listed environment, the Integrated Report may be scrutinized by the company’s corporate sponsor for compliance with the disclosure requirements recommended by the King Report on Governance for South Africa 2016. However, this review does not extend to the verification and validation of any ESG information disclosed in this report.

The Tongaat Hullett governance debacle serves as the latest reminder of the effects and consequences of poor governance. Stakeholders play a pivotal role in the success and even in determining the legitimacy of modern business organisations. They are therefore entitled to know exactly how these organisations affect their lives, both at a personal and environmental level. As such, stakeholders are increasingly demanding more, relevant and meaningful information that can withstand external scrutiny.

To ensure a sustainable relationship with its material stakeholders, organisations have a moral obligation to ensure that their reporting (both internal and external) is accurate and complete so that it can facilitate informed decision-making.

It is imperative that:

- key stakeholders have an accurate understanding of the overall governance activities within an organisation, including the ethical principles of its leadership;

- timely, transparent and complete reporting is provided to the public at large, which is independently verified and made available via easily accessible platforms such as the organisation’s website; and

- the Integrated Report clearly demonstrates how the organisation’s activities are integrated so as to deliver value to the stakeholders, including outlining the ESG risks and opportunities facing the business.

With numerous corporate governance failures occurring in South Africa over the past few years, boards must pay more attention to the contents of the Integrated Report. The organisation’s lines of defense must be secure and the various levels of assurance must have been properly implemented and tested so that the board can confidently approve the information contained in this important stakeholder communication mechanism.

CGF’s team of experienced governance, risk and compliance (‘GRC’) professionals will assist clients in mapping and reporting all of the organisation’s key governance elements found within its Corporate Governance Framework®. A properly defined and implemented governance framework will have a profound impact on the organisation’s governance activities and reporting processes. Expectedly, the work emanating from this team of GRC professionals changes the traditional perspective and behaviour of the board, as well as internal and external audit.

5 June 2019

GETTING BOARD APPOINTMENTS WRONG WITH DEVASTATING CONSEQUENCES FOR THE ORGANISATION

By Terrance M. Booysen and peer reviewed by Jene’ Palmer CA(SA) (CGF Lead Independent Consultant)

The recent resignations of the CEOs of Eskom and South African Airways have again focussed the spotlight on board performance and effectiveness. Inevitably, the critical question arises: why are these CEOs really leaving?

In considering the answer to this question one must include a review of the board’s composition and the extent to which the overall ‘health’ of the board may have influenced any decision to leave or not leave the organisation.

Board composition

Typically, on incorporation of an organisation, the appointment of the first directors comprises the shareholder’s ‘inner circle’ of family, friends or other associates who have the risk appetite and experience to assist the shareholder in building their vision for a prosperous and sustainable organisation. At this early stage of the organisation’s development, the board’s composition is not necessarily based on the skills and competencies actually required to implement a longer term strategy for the organisation. This is a classic dilemma faced by a number of organisations which is further reinforced when the founding member (director) of the organisation ardently believes that they cannot outlive their time and usefulness in the organisation which they started. Often, the founding director refuse to make way for younger or more energetic thinking that is required to grow the organisation further.

It is quite rare for start-up organisations who establish boards to formalise the board appointment, let alone compile a board skills matrix that identifies the skills, knowledge, experience and capabilities required of the board members to ensure they are able to successfully steer the organisation through both its current and future challenges. In these cases, narrow-mindedness, including a lack of new, innovative and strategic thinking, often contributes to stifled business growth.

Board mapping

Before delving into the issue of the skills by an organisation’s board over time, it is imperative to assess whether a candidate director is conflicted, not only in respect of their financial interests, but also their competing interests.

The principle task that underpins board mapping is understanding which other board positions the candidate director may have previously occupied (or continues to occupy) and which may result in competing interests or conflicts that would affect the individual’s appointment and performance on the organisation’s board.

An exercise of this nature should theoretically easily report all the board positions currently (and historically) held by the candidate director. However, the reality is that many regulatory systems which are used to record director appointments and removals are mired by bureaucracy, or worse, are outdated and therefore early warning alerts are not always available to unsuspecting boards.

In addition to a direct conflict of interest which may arise from being appointed as a director for a competitor, boards must also be alert to situations where a candidate director may have previously served in an executive capacity only. In these scenarios, regulatory systems cannot be relied upon to detect these potential conflictive circumstances.