Welcome to VIPsight Europe - France

|

|

| Pierre-Henri Leroy |

7 December 2022

Opération Glass Lewis & Proxinvest

Glass Lewis annonce l’acquisition de la société française de conseil de vote Proxinvest, poursuivant ainsi le renforcement de sa présence en Europe dans le cadre de son expansion mondiale.

SAN FRANCISCO ET PARIS (1er décembre 2022) – Glass Lewis a le plaisir d’annoncer l’acquisition de la société française de conseil de vote Proxinvest, en date du 1er décembre 2022. Fondée en 1995, Proxinvest est la seule agence de conseil de vote française, offrant aux investisseurs une couverture des entreprises françaises et européennes. L’acquisition de Proxinvest marque une nouvelle étape du renforcement de la présence de Glass Lewis sur le marché européen après l’acquisition des clients de la société de conseil de vote espagnole Alembeeks. Elle permettra à Glass Lewis de mieux servir les marchés européens des investisseurs institutionnels et des entreprises.

SAN FRANCISCO ET PARIS (1er décembre 2022) – Glass Lewis a le plaisir d’annoncer l’acquisition de la société française de conseil de vote Proxinvest, en date du 1er décembre 2022. Fondée en 1995, Proxinvest est la seule agence de conseil de vote française, offrant aux investisseurs une couverture des entreprises françaises et européennes. L’acquisition de Proxinvest marque une nouvelle étape du renforcement de la présence de Glass Lewis sur le marché européen après l’acquisition des clients de la société de conseil de vote espagnole Alembeeks. Elle permettra à Glass Lewis de mieux servir les marchés européens des investisseurs institutionnels et des entreprises.

Les clients de Proxinvest bénéficieront de la gamme complète des produits et services de Glass Lewis, tels que les rapports de recherche Proxy Paper, la plateforme de vote Viewpoint ou encore la nouvelle plateforme SaaS Engagement Management Platform, outil unique pour permettre aux investisseurs de gérer leurs initiatives en matière d’ESG et d’engagement.

Alain Demarolle, Président du Conseil d’administration et Charles Pinel, Directeur Général de Proxinvest, ont déclaré : « Nous tenons en haute estime Glass Lewis, qui est déjà notre partenaire dans certains domaines. Nous savons que Glass Lewis protégera pleinement l’indépendance et la spécificité de notre recherche et toute l’équipe de Proxinvest partage notre enthousiasme pour cette nouvelle étape de notre développement».

La politique de vote de Proxinvest est élaborée à partir d’une analyse unique des spécificités et enjeux locaux. Glass Lewis s’engage à maintenir et développer cette politique, qui continuera à être offerte en français pour répondre aux attentes des clients de Proxinvest. Dans son histoire, Glass Lewis a réalisé avec succès plusieurs acquisitions d’acteurs locaux, telles que la société allemande IVOX, et a su démontrer sa capacité à servir au mieux leurs clients.

« Je suis ravi d’accueillir Proxinvest au sein de la grande famille de Glass Lewis» a déclaré Kevin Cameron, PDG de Glass Lewis. « Proxinvest est un leader dans le domaine de la recherche en matière de vote en France et ses clients s’étendent à travers l’Europe. L’entreprise est très respectée pour sa politique de vote, que nous continuerons à proposer en langue française pour répondre aux besoins du marché. Je suis particulièrement enthousiaste à l’idée d’offrir nos différentes solutions en constante expansion aux clients de Proxinvest, y compris notre toute dernière solution SaaS, l’Engagement Management Platform, qui permet aux investisseurs de gérer au mieux leurs initiatives ESG. »

Avec cette opération Proxinvest devient une filiale de Glass Lewis, demeurant basée à Paris et sans aucune interruption de la qualité du service de ses clients.

À propos de Glass Lewis :

Glass Lewis est le principal fournisseur de solutions indépendantes de gouvernance au niveau mondial. Nous permettons aux investisseurs institutionnels et aux sociétés cotées en bourse de prendre des décisions durables, basées sur la recherche et les données. Nous couvrons plus de 30 000 réunions chaque année, sur environ 100 marchés mondiaux. Nous comptons parmi nos clients la majorité des plus grands régimes de retraite, fonds communs de placement et gestionnaires d’actifs au monde, qui gèrent collectivement plus de 40 billions de dollars d’actifs. Nos solutions de base comprennent la recherche en matière de procuration Proxy Paper et la plateforme de gestion des votes par procuration Viewpoint. Plus d’informations sont disponibles sur www.glasslewis.com.

À propos de Proxinvest :

Fondée en 1995, Proxinvest est une société de conseil de vote pour les investisseurs. Proxinvest conseille en matière de politique d’engagement actionnarial et assiste les investisseurs dans l’exercice de leurs droits de vote lors des assemblées générales des sociétés cotées. Proxinvest propose également à ses clients des alertes et des analyses sur la gouvernance des entreprises. Proxinvest propose la couverture des principaux indices européens Stoxx (MSCI Europe, FTSE Eurofirst 300, Stoxx Europe 50) et de toutes les entreprises européennes sur demande. Proxinvest collecte depuis plus de 20 ans des données relatives à la gouvernance des sociétés cotées. www.proxinvest.com.

Konsolidierung der Proxy-Agenturen quasi abgeschlossen

Fast 3 Jahrzehnte war Governance sein Leben, nun ist Proxinvest an Glass Lewis verkauft. Mein alter Freund Pierre-Henri Leroy baute seine Proxy-Maschine in Paris seit 1995 und hat, wenn die Governance nicht stimmte, keinen Gegner gescheut. Viel haben wir zusammen gemacht, auch 2012 die Nicht-Entlastung bei der Deutsche Bank – wo sein Partner DSW (Deutsche Schutzvereinigung für Wertpapierbesitz) durch Klaus Nieding öffentlich abredewidrig zu votieren empfahl und vermutlich weisungswidrig auch so abgestimmt hatte.

Fast 3 Jahrzehnte war Governance sein Leben, nun ist Proxinvest an Glass Lewis verkauft. Mein alter Freund Pierre-Henri Leroy baute seine Proxy-Maschine in Paris seit 1995 und hat, wenn die Governance nicht stimmte, keinen Gegner gescheut. Viel haben wir zusammen gemacht, auch 2012 die Nicht-Entlastung bei der Deutsche Bank – wo sein Partner DSW (Deutsche Schutzvereinigung für Wertpapierbesitz) durch Klaus Nieding öffentlich abredewidrig zu votieren empfahl und vermutlich weisungswidrig auch so abgestimmt hatte.

Pierre baute an Europa – während der Stur. Und Drangzeit von ICGN (International Corporate Network) in maximaler Ausbreitung kurze Zeit bis Kanada und Australien – ab 2010 zusammen mit Familie Biedermann bei Ethos und dem Netzwerk European Corporate Governance Services. In der interkontinentalen Zeit auch Expert Corporate Governance Services.

Vergangenes Jahr kündigte es sich an, der CEO von Proxinvest Loic Dessaint wurde zum Chief Governance Officer. In Spanien schluckte Glass Lewis die IT-lastige Alembeeks. Gestern am 05. Dezember2022 dann die Meldung (nur in französisch) : Proxinvest goes Glass Lewis.

Die Partner in Madrid (Juan Prieto, Corporance), in Rom (frontis, Sergio Carbonara), die DSW in Düsseldorf und ein paar wechselnde in weiteren europäischen Kulturen sind nun für die amerikanische Proxy Agentur nicht mehr von Interesse. Die mit ergänzendem Geschäftsmodell wie Ethos und DSW werden das noch am ehesten überdauern. Man könnte auch sagen, Glass Lewis aus San Franzisko hat die Corona-Geschwächten zur rechten Zeit eingesammelt, das ISS (Institutional Shareholder Service) aus Rockville in Maryland war sich dafür zu fein oder zu behäbig. ... so galt es bis gestern, jetzt ist ISS die grosse Unabhängige zum Thema virtuelle Hauptversammlung eingeknickt – entweder wegen ihrer Emittenten-Umsätzen oder mit dem pflegerischen Druck der neuen Eigentümer : die Frankfurt’er Börse.

Note détaillant le calcul de la rémunération de Carlos Tavarès, CEO de Stellantis NV, au titre de 2021, selon Proxinvest et la méthodologie français

Introduction:

Stellantis NV étant une société de droit néerlandais, elle ne publie plus les tableaux de synthèse sur la rémunération des dirigeants recommandés par l’AFEP-MEDEF ou l’Autorité des marchés Financiers, contrairement aux autres sociétés cotées sur Euronext Paris qui sont domiciliées en France. La principale différence porte sur la valorisation des plans d’actions gratuites puisque les tableaux de synthèse des sociétés françaises comptabilisent la juste valeur à la date d’attribution des plans d’actions nouvellement attribués en 2021. Cette « juste valeur à la date d’attribution » ou « Fair value at grand date » en anglais est calculée selon les normes IFRS. Dès lors la rémunération totale selon les tableaux habituellement utilisés en France n’est pas de 19,1M€ tel que présenté par Stellantis en page 163 de son rapport annuel mais de 66,6M€.

Read more <click here>

27 January 2022

Covid-19 : mesures exceptionnelles en copropriété

N° 2022-1 / À jour au 25 janvier 2022

Ordonnance n° 2020-304 du 25.3.20 : JO du 26.3.20 / Ordonnance n° 2020-1400 du 18.11.20 : JO du 19.11.20 / Ordonnance n° 2021-142 du 10.2.21 : JO du 11.2.21 / Loi n° 2021-689 du 31.5.21 : JO du 1.6.21 / Loi n° 2022-46 du 22.1.22 : JO du 23.1.22

Le renouvellement automatique des mandats de syndic

(ord. du 25.3.20 : art. 22 / loi du 22.1.22 : art. 9)

Pour faire face aux difficultés matérielles de réunion des Assemblées générales (AG) des copropriétaires, la loi du 22 janvier 2022 prévoit que lorsque l’AG n’a pas pu ou ne peut pas se tenir, les contrats de syndics expirant entre le 1er janvier 2022 et le 15 février 2022 sont renouvelés dans les mêmes termes jusqu'à la prise d'effet du nouveau contrat du syndic désigné par la prochaine AG des copropriétaires, au plus tard le 15 avril 2022.

La rémunération forfaitaire du syndic est déterminée selon les termes du contrat qui expire ou a expiré, au prorata de la durée de son renouvellement.

Pour mémoire, le renouvellement automatique des mandats de syndic avait été également prévu :

- lorsqu’ils expiraient entre le 12 mars 2020 et le 23 juillet 2020 inclus et ce jusqu’à la tenue de la prochaine AG (ordonnance du 25.3.20, modifiée par celle du 20.5.20) ;

- lorsqu’ils expiraient entre le 29 octobre et le 31 décembre 2020 (ordonnance du 18.11.20), à condition que l’AG se soit tenue au plus tard le 31 janvier 2021. Et ce à moins que l’AG ait désigné avant le 19 novembre 2020 un syndic dont le contrat avait pris effet à compter du 29 octobre 2020.

Le renouvellement automatique des mandats de membres de conseils syndicaux

(ord. du 25.3.20 : art. 22-1 / loi du 22.1.22 : art. 9)

De la même manière que pour le contrat de syndic, le mandat des membres du conseil syndical expirant entre le 1er janvier et le 15 février 2022 est renouvelé jusqu’à la tenue de la prochaine AG des copropriétaires, au plus tard le 15 avril 2022 (loi du 22.1.22).

Pour mémoire, le renouvellement automatique des mandats des membres des conseils syndicaux est intervenu également lorsqu’ils expiraient :

- entre le 12 mars 2020 et le 23 juillet 2020 et ce jusqu’à la tenue de la prochaine AG (ordonnance du 25 mars 2020, modifiée par celle du 20 mai 2020) ;

- entre le 29 octobre 2020 et le 31 décembre 2020. Ce renouvellement s’opérait jusqu’à la prochaine AG (qui devait intervenir au plus tard le 31 janvier 2021, à moins que l'AG n’ait désigné les membres du conseil syndical avant le 19 novembre 2020).

Assemblée générale à distance

(ord. du 25.3.20 : art. 22-2 à 22-5 / loi du 22.1.22 : art. 9)

Dématérialisation

En principe, les copropriétaires peuvent participer à l’AG physiquement, au moyen d’un formulaire de vote par correspondance ou par visioconférence.

À titre dérogatoire, la loi du 22 janvier 2022 permet aux syndics d’organiser les AG entièrement à distance du 24 janvier 2022 au 31 juillet 2022.

Modalités d’organisation

En principe, la participation à l’AG par un moyen de communication électronique n’est possible que si les moyens et supports techniques le permettant ont été choisis par une précédente AG.

Dans le contexte de la crise sanitaire, le syndic peut décider, à titre dérogatoire, des moyens et supports techniques permettant à l'ensemble des copropriétaires de participer à l'AG par visioconférence, audioconférence ou tout autre moyen de communication électronique permettant leur identification, la transmission de leur voix, ainsi que la retransmission continue et simultanée des délibérations.

Ces moyens et supports techniques sont utilisés, pendant cette période particulière, jusqu'à ce que l'AG se prononce sur leur utilisation de manière habituelle.

Lorsque le recours à la visioconférence ou à un autre moyen de communication électronique est impossible pour des raisons techniques et matérielles, le syndic pourra prévoir, après avis du conseil syndical, que les décisions d’AG seront prises au seul moyen du vote par correspondance.

Lorsque l’AG est organisée intégralement par vote par correspondance, elle ne pourra donner lieu à rémunération complémentaire que si son organisation n’est pas prévue dans la rémunération forfaitaire du syndic.

Si l’AG est totalement dématérialisée, la convocation n’a pas à indiquer un lieu de réunion déterminé. Le président de séance (et le ou les scrutateurs, le cas échéant) dispose d’un délai de huit jours suivant la tenue de l’AG pour certifier l’exactitude de la feuille de présence et signer le procès-verbal.

Lorsque les décisions sont prises au seul moyen du vote par correspondance, les missions du président de séance sont assurées par :

- le président du conseil syndical ;

- à défaut, l'un de ses membres ;

- en leur absence, l'un des copropriétaires votant désigné par le syndic.

Cas particulier des assemblées générales déjà convoquées

Lorsque le syndic décide que l’AG ne se tiendra pas physiquement et qu’elle a déjà été convoquée, il en informe les copropriétaires au moins quinze jours avant la tenue de cette assemblée par tout moyen permettant d'établir avec certitude la date de la réception de cette information.

Si ce délai ne peut pas être respecté, le syndic peut reporter la tenue de l'AG et, le cas échéant, décider de l’organiser de manière dématérialisée. Il en informe les copropriétaires, au plus tard le jour prévu pour la tenue de cette assemblée, par tout moyen permettant d'établir avec certitude la date de la réception de cette information. Cette AG se tient dans un délai qui ne peut être inférieur à quinze jours à compter de la date initialement prévue.

Pour mémoire :

La possibilité pour les syndics de prévoir que les copropriétaires ne participent pas à l’AG par présence physique, initialement prévue du 12 mars 2020 jusqu’à un mois après la cessation de l’état d’urgence sanitaire (ordonnance du 25.3.20), a fait l’objet de plusieurs prolongations. Les AG ont ainsi pu être tenues entièrement à distance jusqu’au 30 septembre 2021.

Les AG convoquées entre le 29 octobre et le 4 décembre 2020 pouvaient, sur décision du syndic et sous conditions, être tenue au seul moyen du vote par correspondance.

Délégation de votes

À titre dérogatoire, une personne peut recevoir plus de trois délégations de vote si le total des voix dont elle dispose elle-même et de celles des copropriétaires lui ayant donné mandat n'excède pas 15 % (contre 10 % habituellement) des voix du syndicat des copropriétaires.

Pour mémoire :

Cette mesure était également applicable entre le 1er juin 2020 et le 30 septembre 2021 (ordonnance du 20.5.20 complétée par l’ordonnance du 18.11.20 et par la loi du 31.5.21).

19 December 2021

RAPPORT - DU HAUT COMITE DE GOUVERNEMENT D’ENTREPRISE

Selon l’article 27.2 du code Afep-Medef, le Haut Comité est « chargé du suivi de l’application du code de gouvernement d’entreprise pour les sociétés cotées qui s’y réfèrent et s’assure de l’application effective de la règle fondamentale de gouvernement d’entreprise qu’est le principe ′′appliquer ou expliquer′′ ».

La mission assignée par cet article au Haut Comité par le Code est double : assurer le suivi de son application et proposer à l’Afep et au Medef les évolutions qui lui paraîtraient nécessaires. La mission de suivi est apparue indispensable pour assurer la bonne application du principe « appliquer ou expliquer ». C’est là la particularité du droit souple que promeut le Haut Comité en application du code Afep-Medef. Il s’agit d’inciter sans contrainte afin que les entreprises adoptent des pratiques vertueuses qui correspondent à leurs besoins et spécificités. Sous cet aspect, les bonnes pratiques doivent se généraliser au-delà des normes obligatoires qu’il revient à la loi d’édicter pour la protection des actionnaires et des autres parties prenantes. Pour autant, la diversité des situations des entreprises interdit de considérer qu’en matière de gouvernance « one size fits all ». Encore faut-il alors, si on ne respecte pas les préceptes du code, que la qualité des explications justifie pleinement les choix auxquels les entreprises procèdent. Faute de cela, les comportements des entreprises ne pourraient être compris et acceptés par tous ceux qui sont concernés par leurs activités.

À ce titre, le Haut Comité procède aux interprétations et recommandations que nécessite l’application du Code. Il peut d’une part être saisi par les conseils d’administration ou de surveillance des sociétés s’y référant, d’autre part s’autosaisir afin d’appeler l’attention des sociétés sur les points du Code qu’elles n’appliquent pas sans explication suffisante. Il le fait chaque fois qu’un écart de conformité est porté à son attention, soit en prenant contact directement avec les dirigeants, soit de façon plus formelle en adressant des demandes écrites et circonstanciées aux conseils. Plus systématiquement, à l’issue de la « saison » de publication des documents d’enregistrement universels et de tenue des assemblées générales, le Haut Comité examine ces documents et adresse des demandes d’explication. Par ailleurs, la publication de son rapport annuel contribue à la réalisation des missions du Haut Comité. Les statistiques qu’il contient donnent une mesure de la progression des bonnes pratiques des grandes entreprises.

De même, la pratique, qui demeure mesurée, du « name and shame » a un effet incitatif. Conformément à la politique maintenant établie du Haut Comité, elle s’applique aux sociétés qui, malgré ses invitations, ont persisté à s’écarter des recommandations significatives du Code. Outre celles qui n’ont pas répondu à une lettre d’auto-saisine du Haut Comité, il s’agit des sociétés qui, sur saisine ou auto-saisine du Haut Comité, n’ont ni suivi l’avis du Haut Comité écartant les justifications fournies par la société, ni signalé dans leur rapport sur le gouvernement d’entreprise l'avis reçu du Haut Comité et les raisons pour lesquelles elles auraient décidé de ne pas s’y conformer, ni pris l’engagement de rectifier cette situation. Selon la situation, le Haut Comité rend public ses avis sur son site ou dans son rapport annuel.

Enfin, les commentaires thématiques contribuent à la réflexion sur les évolutions du cadre normatif dans un environnement en constante mutation.

Read more <click here>

RAPPORT - DU HAUT COMITE DE GOUVERNEMENT D’ENTREPRISE (PDF)

5 November 2021

Proxinvest longstanding call for governance reform at French company Lagardère SCA now implemented

Watchful of the respect of shareholders’ rights, Proxinvest had always regretted the protective governance regime (“Société en Commandite par Actions”) adopted by Lagardère because of the unequal treatment between shareholders, leading to excessive and costly managerial protectionism and an implied governance discount on the company’s value.

Following the engagement of some key shareholders supported by Proxinvest, Lagardère’ general meeting held on 30 June this year resulted in the adoption of new articles of association and a new governance structure that are more favourable to investors. Proxinvest then welcomed the ” significant governance improvements that have been long sought“: the new right of the board of directors to appoint and dismiss its executive officer, the end of the general partner’s veto right on amendments to the articles of association, a strategy now defined by the board of directors, a remuneration policy defined by the board of directors, the end of the special dividend for the general partner and the end of a costly related-party agreement with Lagardère Capital Management, the family holding of Arnaud Lagardère

These changes in the articles of association and governance have transformed Lagardère’ shareholder attractiveness. The basic rules of accountability towards shareholders have finally become fully applicable. The end of the management entrenchment mechanism has restored the mechanism of public offer Vivendi’s proposed takeover bid project for Lagardère thus reflects this return to the usual market rules and offers a substantial premium to Lagardère shareholders who would like to tender their shares.

Proxinvest is pleased to contribute to defending the values of good corporate governance and shareholder democracy for more than 25 years.

Proxinvest has been the only French voting advice agency, or “Proxy firm”, for 26 years, specialising in general meetings, corporate governance and shareholder engagement. Its strategic ambition is to become the reference player in Corporate Governance for investors in Europe.

11 September 2021

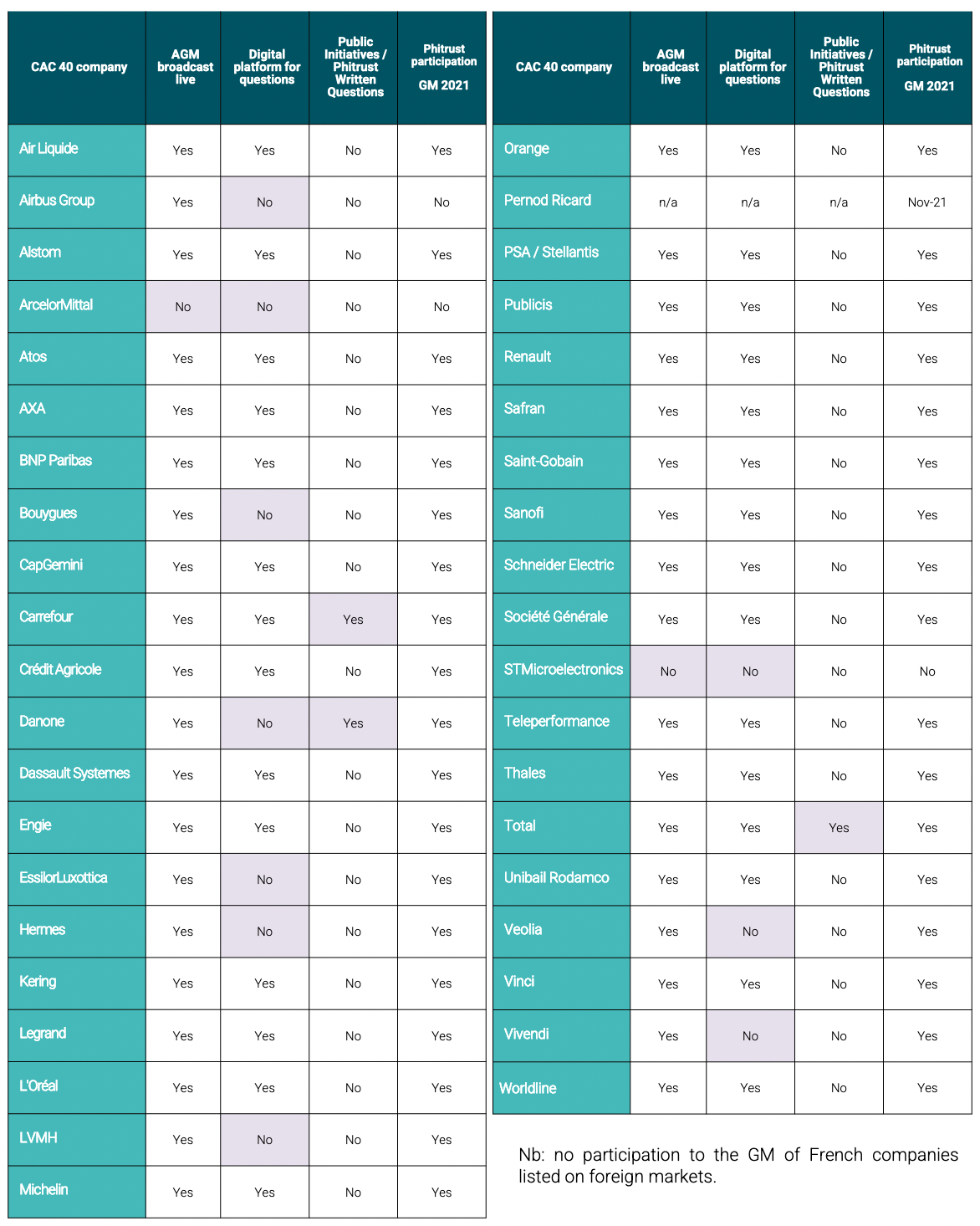

GENERAL MEETINGS 2021 - PHITRUST

INCREASINGLY COMMITTED SHAREHOLDERS, IN A CONTEXT WHERE "REMOTE" FORMATS ARE BECOMING PREVALENT, SOMETIMES TO THE DISADVANTAGE OF SHAREHOLDER DEMOCRACY.

Phitrust Active Investors France 2021 Voting and Engagement Report

The 2020 AGM season will remain in the minds of all shareholders. In more than 15 years, the context has evolved, awareness is growing particularly on the impact of the activity of companies on our environment, on their social responsibility, on their role in the city, and in a world where some of them have become actors as powerful as some states.

Laws and decrees have required them to publish extra-financial reports. Long-term investors have put pressure on them, aware that only companies that integrate these criteria will create value. Here too, the law has required major fund managers to report on the way they integrate ESG criteria and the impacts of their management. Shareholder engagement is now finally recognized as the most successful form of SRI by Novethic (July 2020).

But for both companies and investors, the law is not enough. It is intentionality that is at the heart of the matter. We’ve been in tough discussions with Total Group executives for more than 10 years. In recent months, after a demanding meeting, they have decided to propose to the shareholders that the environmental and social responsibility of directors be included in the articles of association. The intentionality of Total’s management team is at work here, and it is committed.

The same is true for asset managers. Here again, it is the intentionality of the investor – and shareholder – that is central. This is what we did again this year when we publicly asked companies in a position to pay dividends to devote part of their income to the creation of support funds for their ecosystem, which has been so weakened by the unprecedented crisis we are experiencing.

In this 2020 edition of its voting and engagement report, Phitrust proves once again this year the importance of the dialogue that the management company maintains with the leadership of major companies.

> Main themes of engagement carried out this year by our SICAV, stages of dialogue and public initiatives with Renault (governance) Vivendi (governance and remuneration), Total (environment), PSA-FCA (merger between equals – governance and conditions of the merger) – Engie (organization of governance) and Vinci (shareholder democracy).

> Lessons to be learned and points of vigilance for the future.

We are exercising our responsibility as shareholders. Particularly today when, in this deep crisis, we must be collectively constructive for the future.

<click here> complete version (PDF)

15 June 2021

DANONE, 2021 AGM – WHAT CONCLUSIONS?

by PHITRUST

Following the Danone’s recent governance crisis, five corporate shareholders, Phitrust, Mirova, Ircantec, CAVP and OFI AM, together holding more than 0.7% of the capital, have obtained the inclusion of an item on the agenda of the General Meeting of April 29 – in accordance with the current legal provisions. The objective was to allow each director to express his or her strategic vision for the Group, in particular by developing his or her personal contribution on environmental issues and his or her approach to the organization of a balanced governance.

The response given during the AGM of April 29, 2021 was made in different ways:

1/Implicitly, both by the Chairman (Gilles Schnepp) and the Lead Independant Director (Jean-Michel Severino), who both referred to the Board’s commitment to pursue the implemented strategy – in particular the Local First plan and the status of a mission-driven company – ,the ongoing recruitment of the Chief Executive Officer, and a review of the composition of the Board of Directors with the central idea of not increasing the number of Board members (14).

The recent governance crisis at Danone has highlighted both formal dysfunctions and fundamental disagreements within the company’s Board of Directors.

2/Explicitly, at our request, by:

> Cécile Cabanis (Vice-Chairman of the Board) – whose mandate was only renewed at 82% – who resumed the central principles of a mission-driven company, in line with the company’s culture and “raison d’être”,

> Serpil Timuray on environmental issues and the reduction of carbon impact,

> Michel Landel, who addressed the governance issues mentioned above.

We regret that Franck Riboud, former CEO of the Group, did not speak. We also regret that we were unable to question Pascal Lamy, Chairman of the Mission Committee, even though he stated that he had obtained assurances from the new Chairman both on the principles of this “mission” and on the continuation of its implementation in the Group’s operations.

The vast majority of the resolutions (23 out of 28) were adopted with scores above 90%, which seems to show that shareholders support the entire project presented by the Board of Directors.

Nevertheless, social or societal issues were not mentioned as such, which shows the priority today for the group to rebalance its growth, to return to a higher level of profitability and to find ways to face its own environmental challenges (notably the treatment of waste and residues generated by its products).

It is clear that past issues of dissension, or even dysfunction (lack of confidentiality) within the Board – which have been in contradiction with the principle of collegiality, often repeated during this Assembly – have been totally missing from the presentations of successive speakers.

It will be interesting and necessary to keep an eye on the results of the organization of the new governance, whether through the choice of the future Chief Executive Officer or through the recomposition of the Board of Directors.

15 June 2021

Suez -Veolia: Proxinvest continues its action for shareholders' rights

by Proxinvest

Proxinvest, the leading independent French and European proxy advisory agency, stresses again the paramount importance of shareholders' rights and proper functioning of the market in view of the latest developments in Veolia's public offer for Suez.

As early as September 2020, Proxinvest expressed its opposition to the creation of a Dutch foundation to Suez, outlining in particular the need for a prior consultation of the shareholders convened in the General Meeting. Proxinvest has therefore taken note with satisfaction of the position of the Autorité des Marchés Financiersdated April 2, 2021 underlining that the modifications made to this foundation undermine in particular the principles of transparency and market integrity.

Following the AMF position, several commentators have questioned the compatibility of the powers attributed to the board of directors of a company targeted by a takeover bid under the provisions of the "Florange Act" with the applicable stock market regulations. Proxinvest is ready to bring its contribution to this key debate for the Paris marketplace.

Finally, Proxinvest has received a request for information from the European Commission regarding the exercise of the voting rights attached to the Engie block at the next Suez general. Through its responseto this request as well as through its next actions until the Suez general meeting, Proxinvest will continue to ensure full compliance with shareholder’s rights.

27 February 2021

The Case of the Century – The French Administrative Court Issues a Groundbreaking Ruling on State Responsibility for Climate Change

by Gibson Dunn

In response to a claim brought by several environmental advocacy groups (the Associations), which sought to obtain the recognition of the French State’s failure to act in response to climate change, the Administrative Court of Paris (the Court) ruled, for the first time in French law, in a judgment of February 3, 2021, that such a liability action against the State was admissible, that the ecological damage alleged by the Associations was established and that the French State was partially responsible for it. The Court ordered a further investigation in order to determine the measures that it could enjoin the French State to adopt to repair the highlighted damage and prevent its aggravation.

I. Context of the ruling rendered by the Court

The Court’s ruling comes in the wake of several rulings by the Conseil d’Etat, the French highest Administrative Court, which reveal an intensification of control and compliance with the State’s obligations in environmental matters in general, and in connection with climate change in particular.

In a ruling of July 10, 2020, the Conseil d’Etat found that the Government had not taken the measures requested to reduce air pollution in 8 areas in France, as the judge had ordered in a decision of July 12, 2017. To compel it to do so, the Conseil d’Etat imposed a penalty payment of 10 million euros for each semester of delay, the highest amount ever imposed to force the State to enforce a judgement taken by the Administrative judge (CE, Ass., 10 July 2020, Les Amis de la Terre, no. 428409).

In a Grande Synthe ruling of November 19, 2020, the Conseil d’Etat ruled for the first time on a case concerning compliance with commitments to reduce greenhouse gas emissions. Indeed, the city of Grande-Synthe referred the matter to the Conseil d’Etat after the refusal of the Government to comply with its request for additional measures to be taken to meet the goals resulting from the Paris Agreement. The Conseil d’Etat first ruled that the request of the city, a coastal city particularly exposed to the effects of climate change, was admissible. On the merits, the Conseil d’Etat noted, firstly, that although France has committed to reducing its emissions by 40% by 2030, in recent years it has regularly exceeded the emission ceilings it had set itself and, secondly, that the decree of April 21, 2020 postponed most of the reduction efforts beyond 2020. According to the High Administrative Court, it is not necessary to wait until the 2030 deadline to exercise control over the State’s actions since the control of the trajectory that the State has set itself is relevant in ecological matters. Before ruling definitively on the request, the Conseil d’Etat asked the Government to justify, within three months, that its refusal to take additional measures is compatible with compliance with the reduction trajectory chosen to achieve the objectives set for 2030. If the justifications provided by the Government are not sufficient, the Conseil d’Etat may then grant the municipality’s request and cancel the refusal to take additional measures to comply with the planned trajectory to achieve the -40% target by 2030 (EC, November 19, 2020, Commune de Grande-Synthe et al., no. 427301), or even impose obligations on the French State. According to the information provided by representatives of the Conseil d’Etat, the decision could be taken before Summer 2021.

Moreover, in a ruling of January 29, 2021, the Versailles Administrative Court of Appeal referred a question to the Court of Justice of the European Union to determine whether the rules of the European Union law should be interpreted as opening up to individuals, in the event of a sufficiently serious breach by a European Union Member State of the obligations resulting therefrom, a right to obtain from the Member State in question compensation for damage affecting their health that has a direct and certain causal link with the deterioration of air quality (CAA Versailles, January 29, 2021, no. 18VE01431).

II. Reasoning steps followed by the Court

First, the Court ruled on the admissibility of the action for compensation for ecological damage brought by the Associations against the French State. In order to recognize the Associations’ status as victims, the Court had to acknowledge the existence of a fault, damage and a causal link between the fault and the damage.

First of all, it recalled that in application of article 1246 of the French Civil Code “Any person responsible for ecological damage is required to repair it”. Implicitly, the Court considered that this provision is applicable to the State. Article 1248 of the French Civil Code provides that “The action for compensation for ecological damage is open to any person having the capacity and interest to act, [such as] associations approved or created for at least five years at the date of the institution of proceedings which have as their purpose the protection of nature and the defense of the environment”. After having examined the purpose in the Associations’ by-laws, which mention the environment protection and sometimes explicitly the fight against climate change, the Court considered that their liability action was admissible.

Second, the Court had to rule on the existence of ecological damage, bearing in mind that such damage consists of “a non-negligible damage to the elements or functions of ecosystems or to the collective benefits derived by mankind from the environment” (Article 1247 of the French Civil Code). In this respect, it should be emphasized that the Conseil Constitutionnel considered that the legislature could validly exclude from the set-up compensation mechanism, the compensation for negligible damage to the elements, functions and collective benefits derived by mankind from the environment (Decision no. 2020-881 QPC of February 5, 2021). Consequently, it is up to the courts to determine, on a case-by-case basis, according to the facts of the case, what the notion of “non-negligible damage” covers.

In order to characterize the existence of non-negligible damage, the Court first relied on the work of the Intergovernmental Panel on Climate Change (IPCC), from which it concluded “that the constant increase in the average global temperature of the Earth, which has now reached 1°C compared to the pre-industrial era, is due mainly to greenhouse gas emissions [resulting from human activity]. This increase, responsible for a modification of the atmosphere and its ecological functions, has already caused, among other things, the accelerated melting of continental ice and permafrost and the warming of the oceans, resulting in an accelerating rise in sea level”.

It also drew on the work of the National Observatory on the Effects of Global Warming, a body attached to the Ministry of Ecological Transition and responsible in particular for describing, through a certain number of indicators, the state of the climate and its impacts on the entire national territory. The Court found that “in France, the increase in average temperature, which for the 2000-2009 decade amounts to 1.14°C compared to the 1960-1990 period, is causing an acceleration in the loss of glacier mass, particularly since 2003, the aggravation of coastal erosion, which affects a quarter of French coasts, and the risk of submersion, which poses serious threats to the biodiversity of glaciers and the coastline, is leading to an increase in extreme climatic phenomena, such as heat waves, droughts, forest fires, extreme rainfalls, floods and hurricanes, which are risks to which 62% of the French population is highly exposed, and is contributing to the increase in ozone pollution and the spread of insects that are vectors of infectious agents such as dengue fever or chikungunya”.

In light of all these elements, the Court considered that the ecological damage claimed by the Associations had to be considered as established.

Third, the Court had to identify the obligations of the States in responding to climate change in order to, in a second stage, rule on possible breaches in relation to these obligations.

The Court considered that it arose in particular from the provisions of the Paris Agreement of December 12, 2015, as well as from European and national standards relating to the reduction of greenhouse gas emissions, that the French State had committed to take effective action against climate change in order to limit its causes and mitigate its harmful consequences. From this perspective, the Court recalled that the French State had chosen to exercise “its regulatory power, in particular by conducting a public policy to reduce greenhouse gas emissions emitted from the national territory, by which it undertook to achieve, at specific and successive deadlines, a certain number of objectives in this area”.

The Court then examined compliance with the greenhouse gas emission reduction trajectories that the State had set itself in order to determine whether it had failed to meet its obligations. To do so, it relied in particular on the annual reports published in June 2019 and July 2020 by the High Council for the Climate, an independent body whose mission is to issue opinions and recommendations on the implementation of public policies and measures to reduce greenhouse gas emissions of France. In its two reports, the High Council for the Climate noted that “the actions of France are not yet commensurate with the challenges and objectives it has set itself” and noted the lack of substantial reduction in all the economic sectors concerned, particularly in transportation, agriculture, construction and industry sectors.

The Court concluded that the French State should be regarded as having failed to carry out the actions that it had itself recognized as likely to reduce greenhouse gas emissions. The guilty failure to meet its commitments was thus characterized, as was the causal link between that failure and the ecological damage previously identified. The Court therefore considered that part of that damage was attributable to the failure of the French State to act.

Fourth, the Court had to rule on the modalities of reparation of the ecological damage. Under the terms of the law, this was to be carried out primarily in kind. It is only in the event of impossibility or inadequacy of the reparation measures that the judge sentences the liable person to pay damages to the plaintiff, such damage being allocated to the reparation of the environment.

The Court considered that in the state of the investigation of the case, it was not in a position to determine the measures “that must be ordered to the State” to repair the observed damage or to prevent its future aggravation. He therefore prescribed a further two-month investigation in order to identify the measures in question.

Fifth, it sentenced the State to pay each of the Associations a symbolic sum of one euro as compensation for the moral prejudice it had caused them by not respecting the goals of reducing greenhouse gas emissions.

III. Follow-up to the Court’s ruling

The Court’s ruling, which sentences the State for not having implemented the necessary measures to achieve the greenhouse gas emission reduction targets, is a landmark decision in French law.

The second ruling that will be rendered following the two-month additional investigation ordered by the Court could constitute another historic decision if the Court were to enjoin the State - as the terms of the Ruling seem to imply - to implement a number of specific measures aimed at achieving the expected reduction targets, if necessary within a set timeframe. When this judgment comes into effect, possibly before the 2021 Summer, it will then be necessary to examine the impact of the measures that would thus be ordered on the economic sectors and companies likely to be affected.

At this stage of the proceedings, it is not possible to determine whether or not the French State will decide to appeal the ruling rendered by the Court to the Administrative Court of Appeal of Paris. If the latter were to uphold the ruling, the French State could then appeal to the Conseil d’Etat. A final decision on the issue at stake in this case could thus only be made in several years’ time.

The Court’s ruling could also have the immediate effect of modifying the provisions of the “Bill to combat climate change and strengthen resilience to its effects” which will be debated in the French Parliament from the end of March 2021. During the discussion, parliamentarians in favor of strengthening the provisions of this law could rely on the Court's ruling to motivate and justify their position.

16 February 2021

DANONE, LA SITUATION EST-ELLE SI CRITIQUEPOUR LES ACTIONNAIRES MINORITAIRES?

by PHITRUST -Denis Branche / Olivier de Guerre

Les investisseurs présentsdans la Sicav Phitrust Active Investors France, actionnaire de Danone depuis 2003,se sont réunispour faire le point sur la crise de gouvernance très médiatisée de Danone. Ils ont tenu à faire part de leur incompréhension face aux demandes expriméespubliquement par certains actionnaires et par les «fuites» faisant état dedissensions dans le Conseil d’administration.

Gouvernance: La séparation des fonctions n’est-elle qu’un prétexte?

1/ Historiquement,la société Danone a toujours privilégié la réunification des fonctions (PDG), couplée depuis plusieurs années avec la nomination du Directeur Général Déléguécomme administrateur.(1)

2/ Dans une société de droit français à Conseil d’administration, la décision de séparer ou de réunir les fonctions de Président et de Directeur général est prise par le Conseil. En 2017, le Conseil d’administration de Danone,présidé par Franck Riboud, a décidé de réunir à nouveau ces fonctions (séparées depuis 2014) pour les confier à Emmanuel Faber. Toute décision de changement de cette organisation revient donc au Conseild’administration, qui est le seul à même de décider de la séparation ou non des fonctions.

3/ Depuis 2003, Phitrust a insisté auprès de nombreux dirigeants d’entreprises du CAC 40, dont ceux de Danone, sur l’importance de séparer les fonctions de direction dans les grands groupespour des raisons d’équilibre et de répartition claire des pouvoirs. L’existence d’un Administrateur réfèrent chez Danone est néanmoins un facteur certain de contre-pouvoir. Ce rôle est d’autant plus fort que sa fonction etson rôle sont inscrits dans les statuts plutôt que dans le règlement intérieur. En 2020, Phitrust a renouvelé auprès du PDG de Danone la nécessité d’inscrire le rôle de l’administrateur référent dans les statuts lorsde la prochaine Assemblée générale.

4/ Tout membre du Conseil d’administration est tenu à la confidentialité des débats au sein du Conseil. Les informations distillées dans les médias sur des «dissensions» au sein du Conseil de Danone quant à la stratégie menée par son PDG ne peuvent qu’interpeller sur les causes et les objectifs de ces «fuites», qui de fait déstabilisent l’entreprise. Divulguer des lettres privées envoyées par des actionnaires au Conseil d’administration, alors que la direction générale est dans une période où elle ne peut s’exprimer pour y répondre, conforte cette idée d’une manœuvre déstabilisante.

Légitimité des décisions stratégiqueslargement approuvées jusqu’à ce jour en Assemblée Générale

1/ Le plan de transformation «Local First», évoqué publiquement depuis 2015, a été approuvé par le Conseil d’administration de Danone et annoncé le23 novembre 2020, soit il y a 3mois seulement. Il semble donc que les critiques formulées à l’égard de ce plan sont,soit sans fondement réel si ellessont émises par des actionnaires récents (ce plan n’ayant pasencore produit ses effets), soit sans légitimité si elles sont émises par des membres du Conseil qui ont «challengé» ce plan et l’ont adopté.

2/ Danone subit dans son activité «Eau» un ralentissement très fort liéà la crisesanitaire, qui ne remet pas en cause la pertinence de ce pôle à long terme mais pèse sur les résultats de la société aujourd’hui. Par ailleurs, le virage stratégique pris par Danone sous l’impulsion d’Emmanuel Faber (notamment avec l’acquisition de WhiteWave en 2017), même s’il n’est pas encore pleinement concrétisé dans les résultats de l’entreprise, se révèle être un axe de croissance durable. Cette stratégie a été validéepar le Conseil d’administration et l’ensembledes actionnaires en Assemblée générale.

Appuyer les stratégies de long terme est précisément ce que Phitrustmet en œuvre depuis 2003 avec les dirigeants des entreprises du CAC40. Cetterelationest fondée sur un dialogue long et parfois difficile. Actionnaire de Danone depuis 2003, Phitrust a toujours entretenu un dialogueet une écoute mutuelle constructive, même si cela a dû donner lieu à des dépôts de résolution en Assembléegénérale.

Etre actionnaire responsable,c’est accompagner la nécessaire transition environnementale et sociale des entreprises. Le groupe Danone asu procéder au cours de son histoire à des virages stratégiques importants,porteurs de croissance durable,et cetout en respectant les intérêts de l’ensemble de ses parties prenantes (et notamment ses salariés et actionnaires). La vision stratégique proposée par le Conseil d’administration de Danone,et validée par la très grande majorité des actionnaires,est pionnière depuis de très nombreuses années et vise à réconcilier l’entreprise avec les enjeux sociaux et environnementaux des territoires dans lesquels le groupe intervient.

L’AG 2021sera l’occasion de débattre avec sérénitéet plus de recul sur ces enjeux fondamentaux et surla vision à long terme qui les englobe. Aux actionnaires de valider ou non la vision présentée par son Président-Directeur général et le Conseil d’administration.

(1)16 février 2021*la séparation Président/Directeur général est mise en place pour faciliter la transmission avec la nomination d’un Directeur général appelé à devenir Président quand le prédécesseur part à la retraite.

22 December 2020

City Of Paris Is Fined 90,000 Euros For Naming Too Many Women To Senior Positions

The city of Paris has been fined 90,000 euros for an unusual infraction: It appointed too many women to senior positions in the government.

In 2018, 11 women and five men became senior officials. That meant 69% of the appointments were women — in violation of a rule that dictated at least 40% of government positions should go to people of each gender.

In remarks on Tuesday to the capital's governing body, Mayor Anne Hidalgo said she would deliver the check to the Ministry of Public Service herself — along with the women in her government.

"So there will be many of us," she said.

Since 2019, French law provides a waiver to the 40% rule if the new hires do not lead to an overall gender imbalance, Le Monde explains. That's the case for the city of Paris, according to the newspaper: Women still make up just 47% of senior executives on its government. And female city officials are paid 6% less than their male counterparts.

Since 2019, French law provides a waiver to the 40% rule if the new hires do not lead to an overall gender imbalance, Le Monde explains. That's the case for the city of Paris, according to the newspaper: Women still make up just 47% of senior executives on its government. And female city officials are paid 6% less than their male counterparts.

But the rule change comes too late to avoid the fine.

"It is paradoxical to blame us for appointments that make it possible to catch up on the backlog we had," Antoine Guillou, the mayor's deputy in charge of human resources, told Le Monde.

Hidalgo, a member of the Socialist party who was first elected mayor in 2014 and was reelected this year, says the aim is to resolve an existing imbalance toward men.

"Yes, we must promote women with determination and vigor, because the delay everywhere in France is still very great," she told the Paris Council. "So yes, to promote and one day achieve parity, we must speed up the tempo and ensure that in the nominations there are more women than men."

"Yes, we must promote women with determination and vigor, because the delay everywhere in France is still very great," she told the Paris Council. "So yes, to promote and one day achieve parity, we must speed up the tempo and ensure that in the nominations there are more women than men."

"In Paris, we are doing everything to make it a success, and I am very, very proud of a large team of women and men who carry together this fight for equality," Hidalgo added.

Amélie de Montchalin, France's Minister of Public Service, lamented the fine and called the provision "absurd."

"@Anne_Hidalgo, the cause of women deserves better!" Montchalin tweeted. "I want the fine paid by Paris for 2018 to finance concrete actions to promote women in the public service. I invite you to the ministry to raise them!"

14 September 2020

ENGAGEMENT ACTIONNARIAL - Les investisseurs responsables face aux dilemmes des AG 2020

Définition

"L’engagement actionnarial désigne le fait, pour un investisseur, de prendre position sur des enjeux Environnementaux, Sociaux et de Gouvernance (ESG) et d’exiger des entreprises visées qu’elles améliorent leurs pratiques dans la durée. Ces exigences sont formulées via une démarche struc-turée comprenant un dialogue direct avec l’entreprise et un suivi sur le long terme."Certains acteurs utilisent aussi le terme d’« actionnariat actif » (stewar-dship en anglais). L’objectif de l’engagement actionnarial est de sensibi-liser l’entreprise à des risques ESG pour lesquels ses actionnaires l’estiment insuffisamment préparée et à faire pression pour qu’elle modifie sa stratégie afin d’y faire face. Il répond à une logique d’escalade (voir graphique) qui s’adapte aux réactions des entreprises ciblées.

ENGAGEMENT ACTIONNARIAL - Les investisseurs responsables face aux dilemmes des AG 2020 (PDF)

24 June 2020

PROXINVEST NEW SHAREHOLDING AND GOVERNANCE

Pierre-Henri Leroy, Founder and Chairman of France’s leading proxy agency Proxinvest, has sold a controlling stake to Alain Demarolle.

For 25 years, Proxinvest has been the sole independent proxy firm in France promoting effective corporate governance practices & shareholder democracy in numerous situations such as Renault, Lagardère or Casino among many others. Proxinvest is also the managing partner of ECGS, the European corporate governance service network.

Alain Demarolle has a close to 30 years global track record including 20 years on financial markets and 10 years as a French senior Government official. An Inspecteur des finances he served in the French Treasury, from 2005 to 2007 as the Economic and Financial Advisor to the Prime Minister of France and then advised the French Minister of Finance Christine Lagarde on Sovereign Wealth Funds. He held various senior financial positions in New York & London, at Salomon Smith Barney, and also as a Partner with Bear Stearns (2002- 2005) and Eton Park International a global multi strategy fund (2007-2010). He also served as Chairman of LCH Clearnet SH (2014-2016).

According to Pierre-Henri Leroy: “I welcome Alain Demarolle as the new controlling shareholder of Proxinvest. More accountability & transparency is needed by all stakeholders to ensure the financing of the real economy and of the financial sector”.

Alain Demarolle added: “It’s an honour to follow Pierre-Henri Leroy at Proxinvest. In full respect of its independence & key principles, I will endeavour to further develop Proxinvest as a key player on the French and European markets”.

Alain Demarolle has been elected today as Chairman of the Board of Proxinvest. Also joining the Board are Sonia Criseo, Regional Head World Agency France at Euler Hermes, Jean-Philippe Hottinguer Chairman of the Supervisory Board at Banque Hottinguer and Pierre Mongin Senior Advisor of Greenhill and Co, former CEO of RATP and Deputy CEO of ENGIE. Olivier de Guerre, Chairman of Phitrust and Vincent Kaufmann, Managing Director of Ethos Service SA, remain Members of the Board.

Loïc Dessaint has been confirmed as Chief Executive Officer of Proxinvest and will continue to lead the Proxinvest team.

27 April 2020

TOTAL –PHITRUST: A FRUITFUL DIALOGUE ON ENVIRONMENTAL ISSUES IN VIEW OF THE AGM OF MAY 29th, 2020

For several years (in 2011 and 2016 in particular), Phitrust has conducted an active dialogue with Total’s executives on the environmental and social impact of the company's activities. Itsobjective this year was to obtain a formalization of this dialogue in respect with multilateral agreements (the Paris Agreement) and changes in French legislation (the Pacte Law).

By accepting a change that Phitrust requested, which will be proposed to the Shareholders' General Meeting of May 29, 2020 in the 14th resolution (amendment of the Article 14 in the legal status defining the powers of the Board of Directors), the Total’s Chairman and Chief Executive Officer andthe Board of Directors formalize their commitment to take into account major environmental and social issues.

Although the Pacte law amended the French Civil Code’sArticle 1833 ("the company is managed in its social interest, taking into consideration the social and environmental issues of its business"), it was important that:

1/ Total include environmental and social issues in itslegal status;

2/ the Board of Directors’powers be extended to the determination and implementation of the activity taking into consideration these social and environmental issues. This implies a de facto responsibility of all directors to take these issues into account.

Including environmental and social responsibility in the missions of the Board of Directors represents a major change:it goes beyond the sole issueof reporting, which, although necessary and important, can evolve over time in terms of indicators or objectives. Above all, this involves the groupto integratethe urgency of certain issues -particularly environmental ones -into its vision and strategic orientations.

We hope, however, that Total's management will take a further step in this direction by explicitly linking these issues to the objectives of the «Accord de Paris».

The process undertaken with TOTAL is one of several initiatives that are motivated by the same goal of improving the governance of the oil company.

With Phitrust Active Investors France mutual fund’s investors, we will pursue our demanding but confidentdialogue with Total’s managementand the implementation of our shareholder’ rights.In this way, we will keep on encouraging theTotal’s Board of Directors to address environmental and social issuesconcretely and at a steady pace.

18 April 2020

Phitrust’s resolution project at the Vivendi AGM

The shareholders of the mutual fund (Sicav) Phitrust Active Investors France have taken the decision to submit a resolution project at Vivendi’s Annual General Meeting on April 15th 2019.

Since 2015, Phitrust has insisted on Vivendi’s non-satisfactory governance. Today, the company’s governance is “reversed” and does not comply with the logic of having a separation of powers. This separation of management functions had been voted by shareholders at the AGM in 2005 with the creation of a Supervisory Board and a Management Board. Indeed, in a dual governance structure with a Supervisory Board and a Management Board, major shareholders should be represented at the Supervisory Board, and the Group’s operational management should be members of the Management Board. In fact, Vivendi’s current governance structure is the opposite of what good governance practices should be.

The Supervisory Board, appointed by shareholders, is chaired by Mr. Yannick Bolloré, who is also the Chairman and CEO of Havas Group, which is one of Vivendi’s subsidiaries. Therefore, Yannick Bolloré has the responsibility of “supervising” Vivendi’s Management Board to which he must himself report as the Executive Director of one of the most important subsidiaries.

Furthermore, two managing directors of the Group, Bolloré, Mr. Gilles Alix and Mr. Cédric de Bailliencourt, are both members of Vivendi’s Management Board, without having key experiences of the business specificities of Vivendi. It therefore seems complicated for Vivendi’s Supervisory Board to oversee the representatives of its major shareholder…

In general terms, concerning potential conflicts of interest that can be generated by business relationships between the companies Vivendi and Bolloré, it would be in an interest of good governance that the Supervisory Board of Vivendi appoints an independent Chairman.

Phitrust calls upon shareholders to join this resolution project asking for the anticipated end of Yannick Bolloré’s mandate as a member of the Supervisory Board at the Annual General Meeting on April 15th 2019.

[Impact Actionnarial] Projet de résolution de Phitrust à l’AG de Vivendi

Les actionnaires présents dans la Sicav Phitrust Active Investors France ont pris la décision de soumettre un projet de résolution à l’assemblée générale de Vivendi du 15 avril 2019.

Depuis 2015 notamment, Phitrust insiste sur l’organisation non satisfaisante de la gouvernance de Vivendi. La gouvernance de la société fonctionne aujourd’hui « à l’envers » et ne répond pas à la logique de séparation des pouvoirs, validée par les actionnaires à l’assemblée générale de 2005 avec la création d’un Conseil de surveillance et d’un Directoire. En effet, dans une structure de gouvernance duale à Conseil de surveillance et Directoire, la place des grands actionnaires est de siéger au Conseil de surveillance et la place des dirigeants opérationnels est d’être membre du Directoire. Vivendi pratique exactement l’inverse.

Le Conseil de Surveillance, nommé par les actionnaires, est ainsi présidé par Monsieur Yannick Bolloré, alors que ce dernier occupe aussi la fonction de Président-Directeur Général d’Havas, filiale de Vivendi. Ainsi Yannick Bolloré a-t-il la responsabilité de « surveiller » le Directoire de Vivendi auquel il doit lui-même rendre des comptes en tant que dirigeant d’une des plus importantes filiales.

Par ailleurs, deux dirigeants du groupe Bolloré, MM. Gilles Alix et Cédric de Bailliencourt, siègent en tant que membres du Directoire de Vivendi, sans expérience clé sur les métiers de Vivendi. Il semble délicat pour le Conseil de surveillance de Vivendi de contrôler des représentants de son actionnaire principal…

D’une manière générale, au regard des conflits d’intérêts potentiels que peuvent susciter les relations d’affaires entre les groupes Vivendi et Bolloré, il semblerait de bonne gouvernance que le Conseil de surveillance nomme un Président indépendant.

Phitrust invite donc les actionnaires à s’associer à son projet de résolution demandant à l’Assemblée générale du 15 avril 2019 la fin par anticipation du mandat de M. Yannick Bolloré comme membre du Conseil de Surveillance de Vivendi.

2 March 2020

Following the Carlos Ghosn case let us dismiss also the auditors of Renault & Nissan

The independent auditors are the pillars of the financial markets, for their job is to monitor the fairness and legality of the companies accounts and activities.

The independent auditors are the pillars of the financial markets, for their job is to monitor the fairness and legality of the companies accounts and activities.

Financial concentration created powerful multinational firms but also sometimes allowed for self-dealings and misbehaviors at the top. Independent auditors, because they offer also many others services to management, sometimes ignored or even covered-up these failures which endanger the profitability or even the survival of these groups.

The Renault-Nissan self-dealing case, illustrated by the Versailles video, and confirmed by recent press updates, was an extreme and unexpected case : Nissan turned against its former chairman and CEO for potentially criminal acts which the company auditor, the Japanese branch of EY, had, according to the Japanese press, known for long :

http://www.asahi.com/ajw/articles/AJ201811280050.html

While these already settled with the SEC for about 140 M$ mis-reporting, it appears appropriate to restore the accountability of auditors, as these audit firms are the only protection of the shareholders, employees and directors, but also consumers.This petition therefore calls for their eviction and the putting into play of their responsibility.

As stakeholders of Renault SA we hereby request the French State, the AMF, the Board of directors and the workers Council of Renault SA to consider the legal dismissal of the two acting auditing firms of Renault SA and Nissan Motors, EY and KPMG before the next general meeting of the Renault shareholders to be held on June 12 2019 in Paris.

RENAULT'S STAKEHOLDERS CALL

“For the protection of the Renault employees, clients, shareholders and Directors, and in line with articles L823-6 and L823-7 of the Code de commerce, we shareholder(s) of Renault SA, the owner of 43% of Nissan, h's employees, clients and shareholders we hereby request the French State as first shareholder of the company, the French Autorité des Marchés Financiers the Board of directors of the company to proceed as soon as possible with the court request for the dismissal under the "récusation" process of article L823-6 or under the "relèvement judiciaire" of article L823-7 of the two independent acting audit firms appointed by the Board and the shareholders of Renault, ERNST & YOUNG Audit ( EY) and KPMG Audit (KPMG),.“

EXPLANATION

The reason of this request is the likeliness of negligence as these auditors failed to control or detect that a number of the alleged transactions of the management of both Renault and Nissan groups were arranged with related parties while some remuneration items for the CEO were not disclosed to investors in breach of the auditors and the automotive companies disclosure obligations.

All the hereunder mentioned alleged transactions or remunerations should have been subject to the French legal public disclosures and/or to the French related party transactions approval proceedings, but were not. Most of them were known by the auditors, and many of them could have been suspected and prevented by appropriate actions allowing directors and shareholders of the companies to act.

Responsibility of the independent auditors of the Renault-Nissan Alliance group.

The major audit firms generally boost that their international network is a benefit for their multinational clients and for the shareholders of these companies. EY is the independent auditor of both Renault and Nissan Motors, a 43% Japanese subsidiary of Renault, and KPMG is joint-auditor at Renault.

On November 19, 2018, Nissan Motor Co., Ltd disclosed that the company’s Representative Director and Chairman Carlos Ghosn and Representative Director Greg Kelly had for years underreported compensation amounts in Tokyo Stock Exchange securities reports to reduce the disclosed amount of these compensations. Over the past decade, Nissan reported paying its president Carlos Ghosn ¥1 billion per year in compensation, but in truth, Nissan paid Mr. Ghosn an additional ¥1 billion per year in the form of deferred compensation, but failed to disclose these payments in the company’s publicly filed financial reports, and that as a result, Nissan underreported its CEO true pay over the decade by an estimated ¥10 billion.

Nissan Motor Co., Ltd. also disclosed on the same day other “significant acts of misconduct” by Ghosn, including personal use of company assets.

According to the Japanese Asahi Shimbun newspaper (see hereunder: REUTERS November 28, 2018 “Auditor had questioned Nissan on payments to Ghosn”) , the auditor of Nissan Motors, Ernst & Young ShinNihon, a member of the EY world network, indicated to have questioned several times since 2013 the Nissan management about different transactions including the purchase and renovation of luxury houses by a € 70 million cash rich Dutch subsidiary of Nissan Zi-A Capital BV, a shell company chaired by Carlos Ghosn until 2012. A home in Lebanon was purchased in 2012 for $9.5 million and renovated at a cost of $7.2 million.

EY ShinNihon had been auditor for Toshiba Corp. and Olympus Corp. during financial scandals at the two Japanese companies in recent years. EY as one of greatest audit firm in the world must be aware worldwide of the French rules concerning related party transactions.

Under the French article L 823-12 independent auditors should inform the general meeting of shareholders or the Board any irregularity or inaccuracy they have observed during their mission Under the article L 225-38 that “Any agreement that intervenes directly or by an interposed person between the company and one of its general Directors, one of its directors, one of its shareholders with a fraction of voting rights exceeding 10% (..) must be subject to the prior authorization of the board of Directors ” and must be included in a special listing signed by the auditors to be later approved by non-beneficiary shareholders at the annual general meeting.

This real-estate transaction was clearly never reported by the Nissan and Renault chairman Carlos Ghosn or his aides in the special report signed by EY for Renault directors and shareholders. EY knew it, “questioned Nissan’s management several times” but did nothing else either to stop these transactions or to proceed with le legal authorization proceedings.

A series of significant acts of misconduct reported by the press

It appeared since in the press that several other major transfers for the direct or indirect benefit of Carlos Ghosn have been undertaken through different subsidiaries or co-subsidiaries of Nissan Motors and/ or Renault SA.

1/ For the CEO himself, according to the press, the Japanese prosecution alleged:

- the transfer to Nissan of Foreign exchange contracts carrying 1.85 billion yen in unrealized losses from a personal investment contract then following a retransfer of the contract back to him in February 2009, the payment by Nissan Middle East, a Nissan subsidiary based in the United Arab Emirates, of 1.3 billion yen to a company owned by Khaled Juffali between 2009 and 2012.

- a $8.8 million payment made in 2018 by a 50-50 venture between Nissan Motor Co. and Mitsubishi Motors Corp., set up in 2017 in Amsterdam a special undisclosed transaction bonus,

- a payment $5 million to himself the Oman dealership, Suhail Bahwan Automobiles (SBA), from a 15 million transfer by a Nissan subsidiary called Nissan Middle East based in the United Arab Emirates from December 2015 to July 2018.

- the rental, purchase and/or renovation for his exclusive personal use of luxury housing including a house in Lebanon and apartments in Amsterdam, Paris, Tokyo and Rio de Janeiro for an estimated USD one million yearly charge.

- and the hiding of unreported differed pay amounts by Nissan of $43 million (5 billion yen) in compensation for 2010-2015 about 1 billion yen ($9 million) each year that he had arranged to receive later

2/ For his son Anthony Ghosn, the indirect benefits from the transfers to Suhail Bahwan Automobiles (SBA) of funds which, according to the Asahi Shimbun, in part ended up at GFI a Lebanese personal company which from 2015 to 2018, offered $27.5 million in financial assistance to a company Shogun set up in the United States

3/ For his sister Claudine Bichara de Oliveira the benefit of yearly substantial cash payments totaling $1.7 million from the Japanese automaker and the permanent residence in a Nissan beach front apartment in Rio de Janeiro.

4/ For friends and relatives : according to the press sixteen mostly Lebanese VIP friends with his sister were invited by Carlos Ghosn to the Rio carnival in February 2018 for total expenses exceeding USD 100 000. Besides, the French and Lebanese press had reported the occurrences the celebration of a personal anniversary in 2016 in the castle of Versailles, as recognized by Renault on February 7. 2019, and of a gala dinner on March 9 2014 for Carlos Ghosn 60 th. birthday for expenses of respectively € 50 000 euros and € 636 000 paid by the Renault group.

The Reuters agency reports (February 1st. 2019 “Renault-Nissan payments to political advisers draw scrutiny ”), several payments made by the Dutch joint venture company Renault-Nissan BV lacked transparency and are under scrutiny. “Spending on advisers appeared in RNBV accounts as a single line for consultants’ fees, which exceeded 20 million euros in 2015.”

Under French law, all of these transactions, when relating directly or indirectly to the Chairman and CEO of Renault, Carlos Ghosn, should have been first reported by the Chairman to the Board of Directors and carried by the Auditors in the special report on related party transactions signed each year by the representatives of EY and KPMG for a final approval vote by the general meeting of shareholders. It appears clearly that while EY as a group and KPMG have been aware of several of these transactions managed by Carlos Ghosn for his own direct and indirect benefit none of these were reported to the Directors nor to the shareholders of Renault. The independent auditors of Renault knew of it and, despite of substantial service fees, did not engage appropriate means.

ACCORDINGLY, THE UNDERSIGNED STAKEHOLDERS IN RENAULT SUBSCRIBE AND INVITE EMPLOYEES, CLIENTS AND SHAREHOLDERS TO SUBSCRIBE TO THE ABOVE CALL FOR THE RAPID RESIGNATION OR DISMISSAL OF THE AUDITORS EY AND KPMG.

Pierre-Henri Leroy

With special thanks for their support to Baudoin de Pimodan, Yves Thomazo, Loïc Dessaint, Loïc de la Cochetière, Nicolas Boucant.

May 2019

Reuters November 28. 2018

Nissan Motor Co.’s auditor had repeatedly questioned transactions at the heart of allegations of financial misconduct by former chief Carlos Ghosn but Nissan said they were proper, a person with direct knowledge of the matter said on Wednesday.

Ernst & Young ShinNihon LLC questioned Nissan's management several times, chiefly around 2013, about purchases of overseas luxury homes for Ghosn’s personal use and of stock-appreciation rights that were conferred on him.

But the Japanese automaker said the transactions and financial reporting were appropriate, the source told Reuters on condition of anonymity.

The revelation shows Nissan and its auditor were discussing the transactions, in apparent contrast with Nissan’s contention that the alleged misreporting of benefits for Ghosn was masterminded by Ghosn and a key lieutenant.

A spokesman for EY ShinNihon, the Japanese affiliate of global accounting firm Ernst & Young, said he could not comment on specific cases. A Nissan spokesman declined to comment.

Ghosn was arrested on Nov. 19 as he arrived in Japan. Prosecutors accuse him of falsifying Nissan’s annual reports to understate by about half his total compensation of some 10 billion yen ($90 million) over several years.

The high-profile former executive has denied the allegations, according to Japanese media. Ghosn remains in custody and is unable to speak publicly. He is represented by former prosecutor Motonari Otsuru, according to Japanese media.

Otsuru’s law firm declined to comment on Wednesday, and Otsuru has not responded to requests for comment.

Nissan has largely pinned the blame on Ghosn and Greg Kelly, a former representative director who was arrested along with Ghosn on the same allegations.

“As a result of the investigation, we are certain these two are the masterminds,” CEO Hiroto Saikawa told a news conference on Nov. 19, referring to Ghosn and Kelly. He declined to say whether others at Nissan were involved in the alleged wrongdoing. An internal investigation is ongoing, and Nissan says it is cooperating with prosecutors.

Nissan and Mitsubishi Motors Corp. have removed Ghosn as chairman in the wake of his arrest. The French member of the three-firm alliance, Renault SA, retains him as chairman and CEO.

EY ShinNihon questioned Nissan management about Zi-A Capital BV, asking whether the Dutch unit--which purchased the overseas homes for Ghosn's use--was conducting business in line with its stated aim as an investment company, said the source, who is not authorized to speak publicly on the matter.

The car maker said Zi-A was conducting its business appropriately, the source said. Japanese media have valued the transactions at more than 2 billion yen.

Similarly, the source said, the auditor asked whether the stock-appreciation rights--which are like stock options but pay out in cash if a share rises to a certain price--should be declared, but Nissan replied that was not necessary. Japanese media say the rights were worth some 4 billion yen.

EY ShinNihon had been auditor for Toshiba Corp. and Olympus Corp. during financial scandals at the two Japanese companies in recent years.

17 December 2019

PHITRUST HAS WRITTEN TO THE EXECUTIVES OF GROUPE PSA

CONCERNING THE 50/50 MERGER PROJECT WITH FCA GROUP

Phitrust has written to the Chairman of Groupe PSA concerning the proposed merger with Fiat Chrysler Automobiles (FCA Group), questioning the financial, as well as environmental, social and governance (ESG) aspects of the project, therefore questioning its implementation in the current state.

Phitrust has written to the Chairman of Groupe PSA concerning the proposed merger with Fiat Chrysler Automobiles (FCA Group), questioning the financial, as well as environmental, social and governance (ESG) aspects of the project, therefore questioning its implementation in the current state.

These questions are grouped around 3 major issues:

1. The parity initially proposed does not reflect the reality of the strengths and weaknesses of both groups. It was made on the basis of a 50/50 merger, erroneous by principle as a merger between equals does not exist. The parity of this merger is also unsatisfactory in its calculation, taking into account the relative value of the two groups with the intended asset disposals and distributions, as well as their situation in industrial (and social …) terms. Phitrust questions the level of readiness of both companies in order to face the challenges of the future European, as well as international environmental regulatory standards, and challenges in the automotive sector as a whole.

Phitrust requests that, in order to respect the balance between the parties, the merger parity or announced distributions be reviewed.

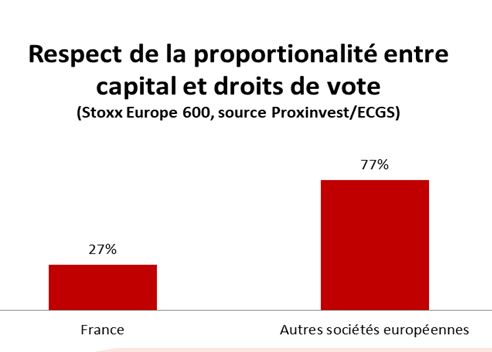

2. The proposed transfer of registered office in the Netherlands would in fact introduce a deterioration of shareholders’ rights and a decline in governance. This deterioration concerns, in particular, the end of the representation of employees on the Board of Directors, the maintenance of unequal voting rights, as well as other restrictions on minority shareholder’s rights (higher threshold for filing resolutions, stronger capital protections) in Dutch law.

Phitrust therefore requests that the head office of the future entity be located in France and subject to French law.

3. In case of refusal of the transaction by Groupe PSA shareholders in Extraordinary General Meeting (EGM), Phitrust expressly requests that the possible compensation for breach of contract, be simply canceled.

Since the announcement of this merger, Phitrust is surprised by the bad news leaked on the market. These news concern a lawsuit against FCA for corruption (which would be orchestrated by General Motors on the US market) and the risk of fines. In addition, tax penalties concerning the acquisition of Chrysler could affect FCA in Italy due to the significant amount of the fine.

All this reflects the image of a poorly prepared operation, carried out in a hurry (following the setback suffered by that envisaged with Renault), and which at this stage leaves far too many unresolved issues in order for this merger to be accepted in the state by Groupe PSA shareholders during the Extraordinary General Meeting dedicated to this project.

Phitrust hopes that the Groupe PSA executives will have heard these questions and will provide answers before presenting this major transaction to the shareholders’ vote at the General Meeting.

12 December 2019

Proxinvest publishes its twentieth third report: “Annual General Meetings and shareholder activism – 2019 season”

(Hans-Martin Buhlmann and Jose Ignacio Sanchez Galan after VIP remarks in 2019 Iberdrola AGM)

Restrained General meetings

While the “Place de Paris” (i.e stakeholders on the French listed market) wonders about the potential framework regarding shareholder activism, Proxinvest’s report on General Meetings displays that in fact General Meetings of French companies remain very controlled. In point of fact, 57.6% of voting rights exercised in the 315 General Meetings analyzed by Proxinvest were in the hands of reference shareholders (36% in the CAC 40), explaining why only 0.64% of resolutions were not adopted.

Only 42 resolutions were rejected, reaching its lowest level in six years. Once again this year, thanks to reference shareholders’ double voting rights, 17 resolutions were adopted when they would have been rejected without them.