AGMagenda

|

Dec.26,2025 Grupo Radio CentroSAB de CV in Mexico (MX) |

|

Dec.26,2025 Yunnan Yuntianhua in (CN) |

|

Dec.26,2025 AisinoLtd in (CN) |

|

Dec.26,2025 New Hope Liuhe in Shandong (CN) |

|

Dec.26,2025 Alphax Food System in (JP) |

|

Dec.26,2025 Public Joint Stock Novorossiysk Commercial Sea Port in (RU) |

|

Dec.26,2025 Jilin Leading Technology Development in (CN) |

|

Dec.26,2025 Bank AlJazira in Riyadh (SA) |

|

Dec.26,2025 Guangxi Beisheng Pharmaceutical in (CN) |

|

Dec.26,2025 Hua Xia Bank in Beijing (CN) |

|

Dec.26,2025 Tianjin Tasly Pharmaceutical in (CN) |

|

Dec.26,2025 Suning Appliance in (CN) |

|

Dec.26,2025 Kangmei Pharmaceutical in (CN) |

|

Dec.26,2025 Huangshan Tourism Development in (CN) |

|

Dec.26,2025 Renhe Pharmacy in (CN) |

|

Dec.26,2025 Hainan Haiyao in (CN) |

|

Dec.26,2025 OPG Power Ventures |

|

Dec.26,2025 Southern Province Cement in (SA) |

|

Dec.26,2025 Credit du Maroc in (MA) |

|

Dec.26,2025 Nymox Pharmaceutical |

|

Dec.26,2025 Sunflower Sustainable Investments |

|

Dec.26,2025 Hisense Electric in (CN) |

|

Dec.26,2025 Zhongchu Development Stock in (CN) |

|

Dec.26,2025 Beijing Utour Intl Travel Svcs in Beijing (CN) |

|

Dec.26,2025 Sichuan Lutianhua Co in (CN) |

Search

VIPsight

|

Corporate Governance – portrayed in the individual cultural and legal framework, from the standpoint of equity capital. VIPsight is a dynamic photo archive, sorted by nations and dates, by and for those interested in CG from all over the world. VIPsight offers, every month:

|

Welcome to VIPsight Asia - India

|

|

|

|

| Naveen Kumar | Gunjan Bhardwaj | John M.Itty |

27 November 2017

The India Proxy Season 2017 came to an end on September 30, 2017

InGovern collated meeting details of 1,502 companies. These meetings included Annual General Meetings (AGMs), Extraordinary General Meetings (EGMs), Court Convened Meetings (CCMs) and Postal Ballots (PBs) and were held during the period of January 1, 2017 to September 30, 2017.

The full report, prepared by InGovern, can be downloaded from here: India Proxy Season 2017

Key insights of the proxy season are:

- Eight Indian companies faced shareholder activism in 2017

- Activism has shifted from individuals to funds

- Activism in 2017 was carried out through multiple fronts - meetings, courts and media

- Investors have been scrutinizing proposals more than ever

- 84 resolutions of Top-100 companies had more than 20% dissenting votes either by institutional or non-institutional shareholders, or promoters. This comprised nearly 10% of total resolutions proposed by these companies

- Auditors are being rotated more frequently than before

Listed below are some of the statistics of the Proxy Season 2017:

- A total of 10,972 resolutions were proposed by these 1,502 companies

- This included 9,889 resolutions through AGMs, 268 resolutions through EGMs, 60 resolutions through CCMs and 755 resolutions through PBs

- 8,291 resolutions were classified as ordinary resolutions while 2,681 were special resolutions

- 9,601 resolutions were proposed by the management while 1,371 resolutions were proposed by shareholders

- September was the busiest month with 5,811 resolutions being tabled at the meetings

- August (2,372 resolutions), July (1,521 resolutions) were the second and third most busiest months respectively

The report also contains sections on:

- A note on shareholder activism in India in 2017

- Proposals of Top-100 Companies that were dissented by a significant percentage of shareholders

- Regulatory updates in 2017

- Recommendations of Uday Kotak Committee on Corporate Governance

12 Februar 2015

Securities and Exchange Board of India Announces New Insider Trading Regulations

On January 15, 2015, the Securities and Exchange Board of India, the securities market regulator in India ("SEBI"), announced the Securities and Exchange Board of India (Prohibition of Insider Trading Regulations) 2015 ("2015 Regulations"). The 2015 Regulations replace the earlier regulations governing insider trading in India -- the Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations, 1992 ("1992 Regulations"). The 2015 Regulations will become effective on May 15, 2015, i.e., four months after their notification.

The 2015 Regulations seek to (a) address the inadequacies of the 1992 Regulations; (b) establish a legal structure which conforms to global best practices and the changes brought about by the Companies Act, 2013; and (c) consolidate the changes effected by circulars, notifications, amendments of enactments and judicial precedents concerning securities laws in India since 1992.

This Client Advisory highlights the key changes effected by the 2015 Regulations to the current insider trading regime, and various related key concepts, including "connected persons", "unpublished price sensitive information" ("UPSI") and "insider". The 2015 Regulations have also introduced certain new measures including a more comprehensive code of conduct and fair disclosure along with trading plans for lawful trading by insiders.

Key Highlights

The following are some of the key changes that have been implemented by the 2015 Regulations:

- Scope: While the 1992 Regulations were applicable to listed companies only, the 2015 Regulations apply to listed companies as well as companies that are proposed to be listed on a stock exchange. There is no clarity as to which companies would fall in the category of 'proposed to be listed', i.e., is it a company that has filed a draft red herring prospectus?

- Connected Person: The definition of "connected person" has been significantly widened. The term now includes, among others (a) immediate relatives; (b) persons associated with the company in a contractual, fiduciary or employment relationship; and (c) persons who are in frequent communication with the company's officers within the definition of a connected person. This widens the definition under the 1992 Regulations, which was solely based on positions and designations of persons in relation to the relevant company. The 2015 Regulations now raise a presumption that connected persons are in possession of UPSI unless they prove otherwise.

- Insider: The revised definition of connected persons has resulted in the related widening of the definition of an "insider". The 2015 Regulations specify that the definition of insider includes both (a) "connected persons" (by virtue of their relationship with the company) and (b) those who are in possession of UPSI (by virtue of mere possession of UPSI). However, the 2015 Regulations permit the person having possession or access to the UPSI to prove that he was not in such possession or that he has not traded while in possession of the UPSI.

- Generally Available Information: The 2015 Regulations now define "generally available information". This makes it easier to identify UPSI which is any information that is not generally available information. If the information is accessible to the public on a non-discriminatory platform, like a stock exchange website, it will be construed as generally available information.

- Unpublished Price Sensitive Information: UPSI now includes price sensitive information relating to the company or its securities that is not generally available. The 1992 Regulations did not include information relating to securities in the definition of UPSI. The 2015 Regulations now provide a definitive legal test to determine UPSI which is in harmony with the listing agreement, while specifying a platform for lawful disclosure, i.e., the stock exchange website. There is an explicit prohibition on the communication and procurement of UPSI, except for legitimate purposes, due performance of duties (for example, by employees of the company who are in possession of UPSI) and the discharge of legal obligations. Consequently, communication and procurement of UPSI has become a distinct offence, other than for expressly exempted purposes.

- Disclosure Requirements: The 2015 Regulations mandate that a person in possession of UPSI who intends to trade in securities discloses such UPSI two days prior to trading. This is to ensure that such information is made available to the public for an adequate period of time before trading. The 2015 Regulations permit a company to seek disclosures from connected persons regarding their ownership of the company's securities and trading of such securities to ensure compliance with the 2015 Regulations. The 2015 Regulations also require that companies formulate a code of fair disclosure that they should adhere to, based on certain objective principles stated in the 2015 Regulations.

- Derivative Trading: In order to conform to the Companies Act, 2013, key management personnel and directors have been prohibited from engaging in derivative trading of the securities of the company.

- Safeguards: The 2015 Regulations have established safeguards to protect legitimate business transactions. The 2015 Regulations include safeguard exclusions for communication and procurement of UPSI in pursuance of transactions relating to private investment in public equity, mergers and acquisitions and off-market promoter transactions, provided that the disclosure requirements (discussed above) are complied with. These exclusions also protect trades undertaken in the absence of leaked information, recognizing Chinese walls within a company. Further, trades pursuant to a trading plan (discussed below) do not constitute an offence under the 2015 Regulations. This is an important amendment; now a due diligence of a listed company will enable a prospective purchaser to have wider access to information without any risk of it being construed as an offence under the 2015 Regulations .

- Trading Plan: The 2015 Regulations have formally recognized the concept of trading plans in India. The 2015 Regulations permit trading by persons who may continuously be in possession of UPSI so that they are able to lawfully trade in securities in accordance with a pre-determined trading plan for a period of at least one year. Trading plans have to comply with the 2015 Regulations and are required to be approved by the designated compliance officer. The 2015 Regulations further restrict the trading plan from including trades that are to be made twenty days prior to the end of a financial period for which results are to be declared by the concerned company.

Gibson, Dunn & Crutcher LLP, 333 South Grand Avenue, Los Angeles, CA 90071

28 March 2013

Indian Depository Receipts: Two way Fungibility and its Implications

Naveen Kumar

An Indian Depository Receipts (IDR) is “an instrument denominated in Indian Rupees in the form of a depository receipt created by a Domestic Depository against the underlying equity of issuing company to enable foreign companies to raise funds from the Indian securities markets.”

The provisions for IDR are encapsulated in the Section 605 A of the Companies Act and Issue of Indian Depository Receipts Rules, 2004 (IDR Rules) of the securities regulator, Securities Exchange Board of India (SEBI). The instrument is further governed by “Issue of Capital and Disclosure Requirements “(ICDR Regulations, 2009) of SEBI and Reserve Bank of India (RBI).

Fungibility, in general financial terms, denotes interchange ability of any security class. Fungibility, in context of IDR means, ability of IDR to convert into underlying equity security and vice versa. In its circular (CIR/CFD/DIL/10/2012) dated August 28, 2012, SEBI in detail prescribed framework for one way fungibility, that is, conversion/ redemption of IDRs into underlying equity shares. It enabled the partial convertibility of IDR into shares up to 25 % percent of the initially issued IDRs in a given financial year. However, regulation does not allow holders of underlying equity shares to convert such equity share into an IDR. Redemption of an IDR into underlying equity shares was permissible subject to fulfilling certain conditions, such as, a minimum holding period of one year from the date of issue of IDRs and such IDR qualifying as an infrequently traded security on the stock exchange(s) in India.

The regulatory position has now being modified by SEBI to provide for limited two-way fungibility for IDRs, similar to the fungibility available in case of an American Depository Receipt (ADR) or Global Depository Receipt (GDR). SEBI in their circular (CIR/CFD/DIL/6/2013) dated March 1, 2013 provides a detailed framework for partial two way fungibility of IDRs, meaning that IDR can be converted into underlying equity security and vice versa within available headroom ( that is, difference between IDR originally issued and outstanding IDR further adjusted to underlying equity share).

Partial fungibility of IDR by foreign issuer is provided in following ways: converting IDRs into underlying shares; or converting IDRs into underlying shares and selling the underlying shares in the foreign market where the shares of the issuer are listed and providing the sale proceeds to the IDR holders; or both the above options may be provided to IDR holders. Option of fungibility at time of issuance of IDR cannot be changed without prior approval of the SEBI. However, fungibility of underlying equity share into IDRs will also be subject to securities regulations of that country, where foreign company is listed.

Partial two-way fungibility under the current regulation is allowed only after one year of issuance of the IDR. Regulation further requires, that fungibility shall be provided by foreign issuer on continuous basis, and headroom for conversion and significant transactions (for conversions/ reconversions) should also be disclosed on a continuous basis.

The endeavour of SEBI regulation on two fungibility is “to encourage more number of foreign companies to issue IDRs in the Indian market”, as envisaged in the last budget of the year 2012-13. Two way fungibility of IDRs’ have been considered as major constraints by foreign issuers for raising funds from Indian capital markets, thus limiting its attractiveness. Till date, since the issuance of IDR guidelines, IDRs have received by limited interest with only UK banking major Standard Chartered getting listed on Indian Stock exchanges in 2010, and issuing IDR.

Two way fungibility of IDR will allow true market price of IDR in relation its underlying equity share, as it will endow holders of IDRs or equity shares, the scope of arbitrage. It means that investors of the foreign company ( either, Indian investors holding IDRs or foreign investors holding equity shares in their home country) can convert shares into IDRs or vice versa, depending market movement of IDR or shares. This was not permissible earlier. Two way fungibility will realign the prices of IDRs and equity shares in capital markets of two countries, help investors of the company maximize their gains. However, only partial fungibility is permissible, as full capital account convertibility is not permissible and restrictions placed by Government and RBI to control the flux of foreign currency in the country.

IDRs only constitute a small portion of total equity shares. IDR listing, in their current form, as compared to equity securities would be low with infrequent trading and feeble trading volume. Due to this, currently IDRs are confronted with problem of low liquidity and volatile price due weak market breadth of IDRs. The regulation permitting two-way fungibility will increase market breadth of IDRs and definitely improve their liquidity. IDR are likely to attract more investors, and foreign issuers will able to attract all Indian investors to fully subscribe to depository receipts.

Cross border mergers and acquisitions will also be facilitated by the new guidelines of two fungibility of the SEBI. Merger of Indian company (Transferor Company) with foreign company (Transferee Company) and vice versa is permitted under section 234 of the Companies Bill, 2011. Two-way listing was listing was considered as major impediment to some cross border mergers. One of major cross border mergers like Bharti – MTN failed due to this. Dual fungibility in way allow dual listing, grant Indian shareholders to directly have shares of the foreign company, if it has been listed on Indian stock exchange and issued IDR for past one year. Two-way fungibility of ADR/GDR by SEBI in conjunction with RBI is already has been permitted. In acquisition deal, where foreign company acquires Indian company, Indian investors can have either shares of foreign company or equivalent cash. This will surely benefit investors and contribute to country’s foreign exchange account.

Two- way fungibility of IDRs, for sure, is step forward to increase the attractiveness capital markets and remove some barriers hindering the mergers and acquisition in Indian market. However, certain challenges still persist, such as automatic fungibility, security laws of foreign company (where it is listed) and limited current account convertibility. If these can be taken care of effectively (first keeping in view the country’s interest), it will allow Indian capital market to grow rapidly, and substantially rapid its pace of economic development.

5 July 2012

Shareholder Faciltated With E-voting by Securities Regulator

Naveen Kumar

India’s securities regulator, the Securities Exchange Board of India ( SEBI) has facilitated shareholders of the listed companies with E-voting system. The decision was taken by SEBI in its Board meeting held on 26th June 2012. It had made the electronic voting system mandatory for all listed companies — in respect of those businesses to be transacted through postal ballot — which would help shareholders participate in decision-making without being physically present in the meetings.

SEBI has decided to implement it in a phased manner. In its briefing, it said, “it would be mandated for top 500 listed companies on the BSE and NSE based on market capitalization”. The listed companies may choose any of the agency that providing e-voting platform.

The initiative on the part of SEBI, guided by directives of the Indian Government is long leap towards greater empowerment and involvement of shareholders in the decision making process of listed companies at Annual General Meeting (AGM). The move will certainly enlighten the passive institutional and retail shareholders of India, and make them an active participants of the corporate governance process.

27 April 2012

John M.Itty

Panel for Corporate Governanace in India

To improve Corporate Governance, the Ministry of Corporate Affairs; Government of India,has constituted a high-level committee comprising representatives from the corporate world, industry bodies and government departmenst. This committee will suggest a comprehensive policy framework to enable corporate governance of highrest quality in all classes of companies without impinging on their internal autonomy to order their affairs in their best judgment.

As per reports, the government i keen on bringing in major changes in corporate governance guidelines by including good practices such as tax compliance and asking companies to adopt it voluntarily.

30 January 2012

Naveen Kumar

Environmental, Social and Governance (ESG) Reporting: Attains a Mandatory Status in India

It is increasingly recognized that companies are accountable not only to the shareholders, but to all the stakeholders and to the society. Recognizing the need for same, Securities Exchange Board of India (SEBI), India’s securities regulator, on November 24, 2011 mandated listed companies to publish a Business Responsibility report. The report should be annexed to company’s annual report and elaborate its effort in the direction of environmental, social and governance.

Securities regulator effort augments the Ministry of Corporate Affairs (MCA) earlier initiative. MCA after much deliberation and discussion, on July 8, 2011 released “National Voluntary Guidelines on Social, Environmental and Economic Responsibilities of Business” . The business responsibility reports as mandated SEBI should include what issuers have done towards the 9 key principles given in the voluntary guidelines. SEBI, however, has adopted a cautious approach to mandate environmental, social and governance reporting in companies. It is mandated in phased manner, with its current applicability only to top 100 companies (based on the market capitalization). Slowly, all the companies will come under purview of publishing business responsibility report.

SEBI effort in congruence with MCA initiative is in right direction. MCA whereas took a initiative to implement ESG in through voluntary way, SEBI made it mandatory. Business activities are not performed in isolation, but they affect various stakeholders (like employees, its creditors and customers), environment and whole society. Business is sustainable only if does not harm environment and works for betterment of entire society. Investors, now not only look for financial disclosures, but other important non-financial (EGG) parameter disclosures. Companies have after this SEBI requirement have to adopt more focused approach towards environmental, social and governance (ESG). Companies adopting better standards may use this for their competitive advantage. But, only future will tell, to which extent companies adhere to it ( “ in form or in substance”) and regulators are able to enforce it.

28 January 2012

John M.Itty

Vodafone wins Rs.1,10,000 Million tax case in India

The Supreme Court of India on 20 January, set aside the demand of Indian tax authorities asking the Netherlands –based holding company-Vodafone to pay capital gains tax to the tune of over Rs.1,10,000 Million on a 2007 offshore transaction in the purchase of a Cayman Island –based minority shareholder in Hutch-Essar. The offshore transaction , which gave the Vodafone holding company a 67 per cent stake in Hutch-Essar , was a bonafide, structured foreign direct investment into India, held a three-judge Bench of the Court.

The subject matter was the transfer of a company incorporated in Cayman Islands. Consequently, Indian tax authorities had no territorial tax jurisdiction to tax the off-shore transaction; the Bench said. Vodafone International Holdings BV, a company resident for tax purposes in the Netherlands, acquired the entire share capital of CGP Investments (Holdings) Ltd. On 11 February 2007. Revenue authorities claimed that this would give the Netherlands-based company a 67 per cent controlling interest in Hutch-Essar, accompany resident for tax purposes in India. However, Vodafone disputed this saying that it only controlled a 67 per cent interest , but not controlling interest, in Hutchison Essar Ltd.

According to Vodofone, it was asked by the Income Tax department in October 2010, to pay Rs.1,12,170 million in capital gains tax . After Bombay High Court upheld the demand, the company filed an appeal in the Supreme Court; and the highest court in India, issued aa verdict in favour of the company.

29 November 2011

Naveen Kumar

Curbing and Monitoring Related Party Transactions: A Way Forward to Enhancing Corporate Governance Standard in India

Related party transaction are often very diverse, complex and generally involve transaction between firm and its related entity (like holding or subsidiary firm, promoters, controlling shareholders, key managerial persons, directors and their direct relative). It is symptomatic of serious concern of corporate transparency. Though, not all the related party transactions are detrimental, but may arouse potential conflict of interest. They are frequent cause of exploitation of firm assets by its management or its owners.

In India, existence of large number of related party transactions has long background and pertinently linked to existence of complex ownership structure in companies. Most of the companies in India have high ownership concentration, and largely part of family managed business groups, while state controlled firms also play an important role. Around, 60 percent of total firm that approximately account for 65 percent of market capitalization, belong family managed groups (Chakrabarti et. al, 2007). The promoters (the business groups – the principal owners) are largest and dominant controlling shareholders in India. The average promoters holding in BSE 500 companies for year 2009 was approximately 51.197 percent (according to CMIE database). Complexity of family group structure and interconnectedness among firs bequeaths of related party transactions inn India. The pyramiding and tunneling effects leads to opaqueness in ownership structures, and grants promoters (family groups) ownership rights much more than their voting rights. The high ownership concentration structure prevalent in India, minimizes the typical agency problems arising from separation of ownership and control. However, it raises distinct agency issues and cost due to potential conflict of interest arising between large shareholder and minority shareholders. The dominant shareholder may exploit firm resources for their private benefits, depriving minority shareholders of their equitable rights. In family managed firms, many of the transactions takes between controlling shareholder and firm that occur at arm’s-length distance and often that result in expropriation of shareholder wealth. Expropriation may come in several forms involving a series of self-dealing transactions through sale of goods and assets and services, loan from company on preferential basis, or through transfer of assets from one company to another (Johnson et al., 2000). Academic researchers have suggested that family managed business groups of India were able to tunnel significant for portion of wealth from companies through abusive related party transactions via non-operating part of profits (Bertrand et. al, 2002; Chakrabarti et. al, 2007).

In India, there exists a pervasive regulatory framework to deal with the issue of related party transactions. The Indian Companies Act 1956, inadvertly covers the aspect of related party transactions without explicitly referring trem. There are several sections in Companies Act, which intends to curb expropriation of firm resources through related party transactions. Section 297 - requires approval of contract by Board of Directors. Further, prior approval of Central Government is necessary for companies having paid up capital more the Rs 10 million. Section 299 requires disclosure of interest by directors in contract with company. Disclosure of nature of interest in contracts and arrangement to both is required. Section 300 disallows the director to participate in discussion and voting, when the board resolution is passed relating to any business in which he is interested. The scope of related party is whereas limited only to the directors in the Companies Act, a broader scope is engulfed in Indian Accounting Standards (AS 18) and Clause 49 of Listing agreement. AS 18 promulgated by Institute of Chartered Accountants of India (ICAI) is on the lines of International Accounting Standards 24 (IAS 24) is mandatory for all companies from 2004. Under AS 18, two parties construe to be related, “if at any time during the reporting period one party has the ability to control the other party or exercise significant influence over the other party in making financial and/or operating decisions”. Disclosure requirement under this standard require “name of the related party and nature of the related party relationship where control exists should be disclosed irrespective of whether or not there have been transactions between the related parties Clause 49 of Listed Agreement necessitates audit committee to review all related party transactions and disclosure by companies on materially significant related party transactions that may have potential conflict of interest. Further¸ Auditing and Assurance Standard 23 makes it necessary on part of auditor to identify and disclose the related party transaction in the financial statements. The aspect of related party transaction with tax implications is also covered in the Income Tax Act under Section 40 A (2).

In India, therefore, plethora of laws and regulations subsist to curtail the detrimental effects arising out of related party transactions. Promulgation of AS 18 is considered as significant step towards bring corporate transparency in dealings of family managed groups. However, in practices companies majority of which are family controlled, strive only to comply with inescapable stipulations of law and always endeavor to get better of existing ambiguities. Most companies venture to comply in form rather than in substance. Any discussion on related party transaction in India is incomplete, without mention of India’s largest accounting fraud at Satyam Computers Ltd (now, known as Mahindra Satyam). The fraud at Satyam extricated only because of failure of abusive related party transactions, where promoters wanted to siphon out fictions assets from Satyam ( a widely held firm) to their another firms Maytas Infrastructure and Maytas properties. The discussion further assume significance, considering the fact that it has been importunate and pertinent issue in number of high profile governance failure and frauds like Enron, WorldCom, Tyco and Paramalat. In case though related party transaction was not inherent cause of fraud, but certainly it was failure of different corporate governance mechanism in monitoring such transactions. The episode illustrates how transactions may adverse to perception of market integrity, (Times of India, 2010) , where investors lost approximately Rs 140 billion of wealth.

OECD recognizes related party transactions particularly, between controlling shareholders and firm ( known as “ abusive related party transactions) as one of the major challenge business landscape of Asian economies and major barrier to corporate transparency in markets like India ( OECD, 2009; Kar, 2010). As implicated by OECD ( OECD, 2009), the major challenge to curb and monitor related party transactions is not due to existence of legal regulatory framework but ineffective enforcement mechanism and lax board oversight. After case of Satyam, the situation has focused attention on improving corporate governance standard in India for dealing with abusive related party transactions effectively. Curbing and monitoring of related party transactions has come to forefront in corporate governance reforms of India. Policy makers and regulator are now aware of the risks arising out these related party transactions that may impede trust of investors , who are already in doldrums due to fear of economic recession. So in this regard, several efforts have made in Companies Bill, 2009 to deal with this issue with both ex-ante and ex-post mechanism. Ex-ante stipulations are aimed at detecting and controlling these transactions, by having stringent board oversight and shareholder approval mechanism, while confiscating unnecessary government intervention. These include

- Key Managerial Personnel and directors included under related party

- No central government approval required on related party transactions to reduce unnecessary time delays and more flexibility to companies

- Shareholders to approve all related party transactions in bigger companies, while board of directors to approve it in remaining companies

- Disclosure to be made in board of directors report, while Central Government has power to prescribe the format

- Audit committee provided more specific role and responsibilities in conjunction to related party transactions

- Interested parties from disallowed from voting in special resolution for prescribed related party transaction with aim to protect the rights of minority shareholders

Equally important, attempts have also been made in the Companies Bill, 2009 to address minority shareholder grievances through ex-post mechanisms. Stipulations will now allow shareholders to file Class Action Suits to obtain their legal right in case of abusive related party transactions from court. Special courts may set up quick readdress of minority shareholder grievances from such transactions. Further, emphasis has on strict enforcement of provisions of the Bill, by stringent financial penalties and legal disciplinary action, in case of non-compliance.

The two aspects related monitoring of related party transactions, considering the complex ownership of Indian companies is the role of independent auditors and independent directors. Not being related to management or controlling shareholders, independent directors are considered as efficacious mechanism for protecting minority shareholder rights through their role in Board and Audit Committee. Independent directors for the first time find statutory recognition in the legislative books via Companies Bill, 2009. Enough provisions are instigated in the Bill to ensure that their independence is not compromised and they actively monitor abusive related party transactions On the other hand, related party transactions are frequent and one of difficult type of transactions to trace from the audit point of view, considering the inherent opaqueness these transactions due to persistence of complex ownership structure. Independence of auditor and quality of audit performed by him assume significance in such context of monitoring and reporting related party transactions. The Bill endeavors to enhance auditor independence through auditor rotation. Further, an independent board may be set up in proposed law, which may look upon the issue of auditor independence and quality of audit performed by them timely intervals.

In conclusion, the legal reforms initiated after Satyam case through Companies Bill, 2009 are in right direction to limit the effect of the abusive related transactions involving promoter. As mentioned above, in latest effort through this Bill, policy makers and regulators endeavor to enhance corporate transparency and raise standards of corporate governance in India. Through different mechanisms, the issue of abusive related party has been addressed with sincere effort to protect minority shareholders rights. Every attempt is made to bring out more transparency thorough disclosures, engagement of minority shareholders in such transactions and aftermath re-addressal through court. External auditors and Board, particularly independent directors need to play a greater role with responsibility in monitoring such abusive transactions detrimental to shareholders and raising the bar of corporate governance in India. However, it remains to be seen, how these mechanism work actually in India, which has long history of enough laws with little compliance and fragile enforcement.

References and Further Readings:

1. Bertrand, M., Mehta P. and Mullainathan, S. (2002), “Ferreting out Tunneling: An Application to Indian Business Groups"; Editionly Journal of Economics, , 117(1), pp. 121-48.

2. Chakrabarti, R., Megginson, W.L. and Yadav, P.K. (2008), “Corporate Governance in India”, Journal of Applied Corporate Finance, 20 (1), pp.59–72

3. Clause 49 of Listing Agreement, available at : www.sebi.gov.in/circulars/2005/dil0105.html

4. Companies Act (1956) Acts of Parliament, 1956,

Available at: http://indiacode.nic.in/fullact1.asp?tfnm=195601.

5. Companies Bill (2009) Available at: http://www.mca.gov.in/Ministry/actsbills/pdf/Companies_Bill_2009_24Aug2009.pdf

6. Indian Accounting Standard ( AS)18, Available at : http://220.227.161.86/262accounting_standards_as18new.pdf

7. Johnson, S., LaPorta, R., Lopez-de-Silanes, F. and Shleifer, A. (2000) , “Tunneling,” American Economic Review,90, pp. 22-27

8. Kar, P. ( 2010), “Related Party Transactions and Effective Governance: How it works in practice in India” in OECD - Asia Roundtable on Corporate Governance, Fighting Abusive Related Party Transactions in Asia.

9. OECD ( 2009), Guide on Fighting Abusive Related Party Transactions in Asia, Corporate Governance Series, September 2009

10. Times of India (2010), “More Disclosures Must in Related Party Deals: SEBI” , available at :

Welcome to VIPsight Europe - Switzerland

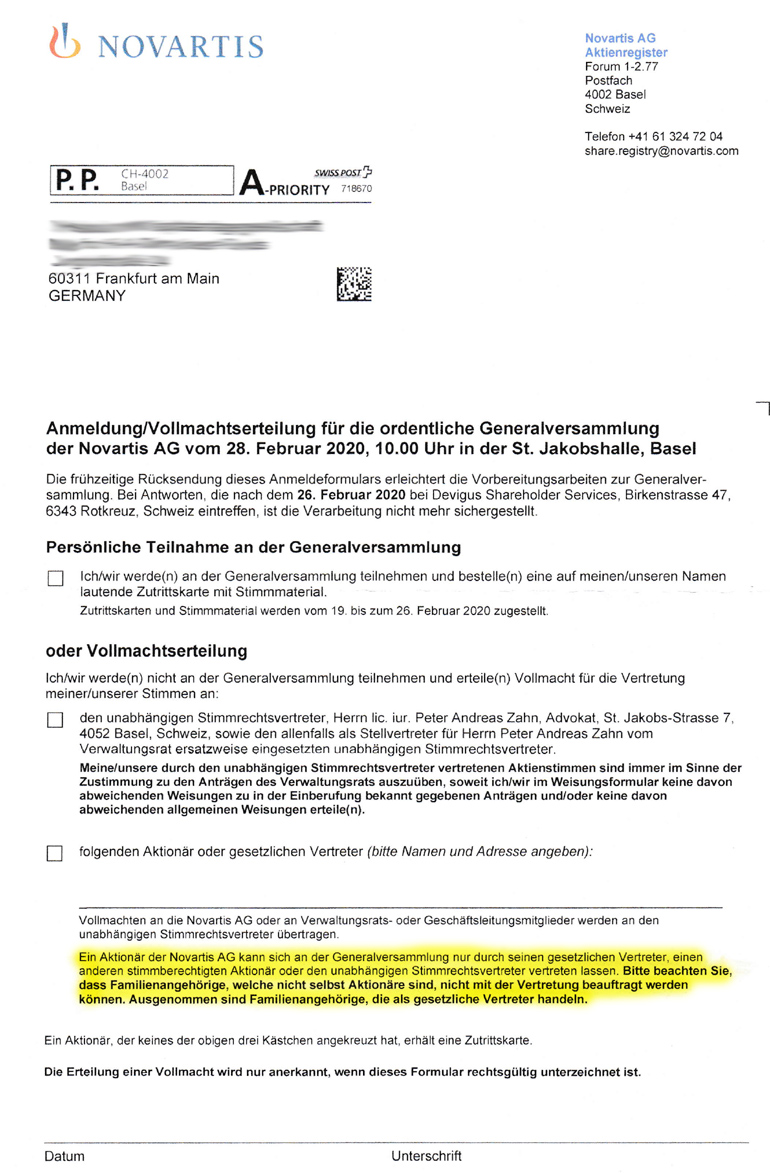

26 February 2020

Governance in Swiss translation?

6 July 2018

2018 - General meetings of spi companies stabilisation of remuneration

Since the entry into force of the Ordinance against excessive remuneration (the Minder initiative), the different votes on board and executive remuneration are the proposals most contested by the shareholders, which is reflected in a stabilisation of overall remuneration in SPI companies and a slight decrease in the largest listed companies.

During the first half of 2018, 187 annual general meetings and five extraordinary general meetings of companies included in the Swiss Performance Index took place. The average attendance rate of shareholders has remained stable for 4 years at 66% of the voting rights. Part of the absenteeism is explained by the low participation of mutual funds in general meetings. In contrast to other countries, mutual funds under Swiss law are not obliged to exercise their voting rights.

In total, more than 3,500 proposals were put to the vote in 2018 with an average approval rate of 96.6%. 27 proposals voted in companies with a controlling shareholder (holding at least one-third of the voting rights) would not have been approved had the sole vote of the other shareholders been taken into account.

Proposals relating to board and executive remuneration remain particularly contested. The advisory vote of the remuneration report received 87% approval on average, while more than 21% of the remuneration proposals received less than 80% affirmative votes.

Ethos' voting recommendations are published on its website and are based on its 2018 guidelines, which are also publicly available. During the 2018 proxy season, Ethos advised more than 200 Swiss institutional investors representing Swiss equities exceeding CHF 40 billion. Ethos recommended to approve 81.6% of the proposals (81.0% in 2017). In general, the items for which Ethos recommended to oppose were approved by 90.6% of the votes while those for which Ethos recommended approval vote were approved by 97.7%.

Remunerations decreasing in SMI companies

Average remuneration remained almost unchanged overall, but with strong variations depending on the size of the companies. In particular, the average 2017 remuneration of the CEOs of the SMI companies decreased by 7% to CHF 6.8 million while that of the CEOs of the following 27 companies (SMIM index) decreased by 8% to CHF 3.7 million.

A stabilisation of board and executive remuneration has now been observed over the last 3 years, which tends to confirm that the rights granted to shareholders in the area of remuneration since the Minder initiative was implemented make it possible to curb excesses. However, certain levels of remuneration remain too high and not always in line with the performance of companies. Thus, in accordance with its guidelines, Ethos recommended to oppose 35% of the binding votes on the remuneration of the board of directors and 33% of the binding votes on the remuneration of the executive management.

In particular, within the financial sector, the link between pay and performance is not demonstrated. The stability of the remuneration of board and executive remuneration in this sector contrasts with the nearly 44% decrease in net income since 2009 of the 26 financial companies among the 100 largest Swiss caps and the 7% decline in the number of employees of these companies.

The sustainability report: a major missing part of the reporting of listed companies

Shareholders must also approve annual reports and company accounts. More and more investors expect companies to be more transparent about extra-financial topics, such as risks related to climate change or respect for human and labour rights, particularly in the supply chain. Since 2018, companies can announce to the Swiss stock exchange the existence of a sustainability report (opting in) provided that this report is drafted in accordance with a recognised standard. This proposal allows investors to know which companies are publishing standardised sustainability reports. Ethos notes that, unfortunately, as of today only 13 companies out of more than 200 listed companies in Switzerland have declared the existence of such a report to SIX Swiss exchange. Despite the urgency of climate risks and many social issues, self-regulation is currently still far from being effective.

30 October 2017

Ethos’ Funds are aligned with the 2° climate target

The results of the climate compatibility test organised by the Federal Office for the Environment (FOEN) in collaboration with the non-governmental organisation (NGO) 2° Investing Initiative were published on 23 October 2017. They show that pension funds are not yet aligned with the target of keeping global warming below 2° as set by the Paris Agreement on December 2015 and of which Switzerland is also a signatory. Ethos also submitted its funds to the test to check their compatibility. According to this assessment, the Ethos funds are compatible with the 2° scenario.

The study organised by the FOEN measures the alignment of investor portfolios with the 2° scenarios of the International Energy Agency (IEA). More precisely, the exposition of the stock and bond portfolios of investors to the sectors with the highest greenhouse gas emissions was measured and compared to a 2°C compatible model portfolio. The Swiss pension funds and insurers thus have the chance to measure the alignment of their portfolios free of cost.

Swiss pension funds still very exposed to fossil fuels

79 institutional investors (pension funds and insurers) took part in the study. On the basis of aggregated information, the FOEN published a study which shows that in general, Swiss pension funds maintain a significant exposure to fossil fuels. In particular, the percentage of investments in coal-fired power greatly exceeds the 2°C scenario. The study presents different courses of action to allow pension funds to improve their exposition and take concrete steps.

In the context of its activities, Ethos proposes different services to help investors improve their portfolios:

- 2°C compatible sustainable investment funds

- Exercise of voting rights in Switzerland and abroad

- Dialog programmes (engagement) with Swiss and foreign companies

- Portfolio analysis including measuring the exposition to sensitive sectors such as coal and other fossil fuels

Ethos’ funds are compatible with the 2°C scenario

Ethos also publishes the aggregated assessment of the whole of its investment funds carried out by the NGO 2° Investing Initiative. The analysis shows that Ethos’ funds are perfectly aligned with the target of keeping global warming below 2 degrees. Ethos has been dedicated since many years to reducing the environmental impact of its investment funds. In particular, Ethos excludes companies active in coal extraction or coal-fired power plants. Furthermore, in order to reduce the environmental footprint of its funds, Ethos has developed, in addition to its environmental, social and corporate governance analysis (ESG rating), a carbon rating which minimizes the exposure to the biggest emitters of greenhouse gases. As a signatory of the Montréal Carbon Pledge, Ethos also publishes the carbon footprint of its investment funds.

Since early 2017, the Ethos funds are open to all investor categories.

20 September 2017

A group of 100 global investors amongst whom Ethos and the members of the Ethos Engagement Pool international called on the world’s largest banks for more commitment to fight global warming by financing the transition to a low-carbon economy

In letters sent by investors led by Boston Common Asset Management (US) and ShareAction (UK) to 62 banks – including UBS and Credit Suisse, as well as Citigroup, Goldman Sachs and Deutsche Bank – the group called for enhanced disclosure of banks’ climate-related risks and opportunities and of how these are being managed by banks’ boards and senior executives.

The global banking sector stands at a crossroad on climate. The Paris Agreement became effective in November 2016 and has catalyzed the urgency of climate risks such as ‘stranded assets’ i.e. assets that suffer from premature write-downs due to fossil fuel phase-out. At the same time this shift offers unprecedented opportunities for banks to finance the transition to a low carbon future. These developments are set to have a profound impact on the banking sector over the short, medium, and long term. For these reasons there is a growing need among institutional investors for robust climate-related disclosures and risk management from the banking sector.

Against this backdrop, the central banks have formed the Task Force on Climate-related Financial Disclosures (TCFD) to issue recommendations for climate-related corporate disclosure to investors. The recommendations cover four areas: climate-relevant strategy and implementation, climate-related risk assessments and management, low-carbon banking products and services, and the banks’ public policy engagements and collaboration with other actors on climate change. As these recommendations remain voluntary progress depends on investors pressing companies for action!

As part of this campaign Ethos and the members of the Ethos Engagement Pool international will continue to engage UBS and Credit Suisse to ensure the letter leads to concrete actions and improvements.

5 July 2017

Human Rights: Ethos and other global investors successfully push global apparel brands to improve working conditions in Bangladesh

Four years ago, in the aftermath of the Rana Plaza tragedy, the ‘Accord’ on Fire and Building Safety in Bangladesh (the ‘Accord’) created a five-year, legally binding framework for factory inspections aiming to identify and remediate unsafe working conditions in Bangladesh’s textile industry. By publishing an Investor Statement on the 4th Anniversary of the Rana Plaza tragedy this spring, a coalition of global institutional investors, amongst whom Ethos and the members of the Ethos Engagement Pool International, pushed heavily for a prolongation of the ‘Accord’ until all remediation measures are completed.

To double down on this effort, Ethos and the members of the Ethos Engagement Pool International have followed up the Investor Statement with direct letters to eight key corporate members of the ‘Accord’. The companies were asked to extend the ‘Accord’ for the period of time needed to remediate the remaining issues and to broaden the current scope of the framework to include freedom of association and the right to collective bargaining for workers.

On 29 June 2017, several companies and trade unions have agreed to renew the ‘Accord’ for an additional term of three years. The agreement will enter into effect when the current ‘Accord’ expires in May 2018. The renewed framework builds on its previous features such as independent safety inspections, training of workers in health and safety protocols and remediation of all remaining issues, but adds improvements like granting severance pay to employees when they are laid off or relocated due to safety reasons. Last but not least, the renewed agreement puts greater emphasis on freedom of association and collective bargaining, and broadens the scope of the Accord to include additional parts of the supply chain where similar risks exist.

The explosion of a boiler at a Multifabs factory in Bangladesh on July 3, 2017 which resulted in several fatalities underscores the importance of renewing and strengthening the Accord to ensure that such accidents are avoided in the future.

20 April 2017

Ethos has taken good note of Credit Suisse’s voluntary decision to reduce by 40% the variable remuneration of the executive management and to keep the board’s fees unchanged.

In Ethos’ view, the remunerations are still too high in light of the CHF 2.7 billion loss posted by Credit Suisse in 2016.

Ethos therefore maintains its voting recommendations issued on 7 April 2017. Ethos recommends to oppose the remuneration report, the amount of fees for the board, the fixed and variable remuneration of the executive management, as well as the reelection of the Chairman, Urs Rohner and the Vice-chairman Richard Thrornburgh.

20 April 2017

In the run-up to the general meeting of Credit Suisse on 28 April 2017, Ethos opposes the re-election of several board members as well as the discharge of the board. In addition, in light of the poor results and the concerns regarding the bank’s capital ratio, Ethos also refuses the remunerations of the governing bodies and the dividend proposed by the board.

In light of the significant litigation involving the bank in the past decade, the enormous indemnifications and fines paid as well as the lack of strategic vision at board level, Ethos recommends changes at the top at the bank. Ethos therefore opposes the re-election of the chairman of the board, Urs Rohner, as well as the vice-chairman of the board, Richard E. Thornburgh. Early 2017, the bank was found guilty in the US of having sold toxic financial products in the years preceding the global financial crisis (2005-2007). The two board members were part of the executive management at the time, Urs Rohner as Chief Operating Officer and General Counsel and Richard Thornburgh as Executive Vice Chairman of Credit Suisse First Boston (until end of 2005).

This record fine led Credit Suisse to register new provisions for more than CHF 2 billion between December 2016 and March 2017. Since Urs Rohner has taken over the chairmanship of the board in April 2011, the bank has booked provisions of CHF 10.9 billion and spent CHF 7.4 billion to settle legal cases. In the same time period, Credit Suisse’s share has lost almost half of its value and the number of employees was reduced by 20% to 17’020 at the end of 2016.

In addition, Ethos notes the lack of clarity in the current strategy, in particular as concerns the IPO of the Swiss Bank. Ethos estimates that changes to the board have become necessary to restore investor trust.

Granting the discharge would be premature

The legal cases have multiplied these last years for Credit Suisse and there is no sign of ending as shown by the recent raids at offices of the bank in Amsterdam, Paris and London end of March. In light of pending legal cases, but also of accusations that the bank’s project finance breached internal standards (by financing companies involved in the Dakota access pipeline project that is planned to cross Native American reservations in Dakota in the US), Ethos considers that granting discharge to the governing bodies of Credit Suisse is premature at this point.

Excessive remunerations and an unreasonable dividend

Ethos also recommends opposing all points related to the remuneration of the executive management and the board. Ethos considers that the executive management should not have received a bonus in 2016 given the disappointing results of the bank. It is excessive to pay a total annual bonus of CHF 26 million to the 12 members of the executive management when at the same time Credit Suisse posts a net loss of CHF 2.7 billion. In addition, the average remuneration of CHF 1.5 million for each of the 939 employees designated as “Key Risk Takers” is unacceptable for Ethos.

Finally, Ethos considers that the board’s proposition to pay a dividend of CHF 0.70 per share (in cash and/or in kind) is hard to justify in a time where regulation demands a reinforcement of the capital ratio. The current capital ratio of the bank remains insufficient especially in terms of the Leverage ratio (CET1) which only stands at 3.2% end of 2016 as opposed to the 3.5% demanded by FINMA until 2019. The capital ratio could yet worsen if shareholders opt for a dividend in cash, corresponding to a maximum payout of CHF 1.46 billion.

30 January 2017

Ethos launches the first Swiss stock exchange index dedicated to corporate governance

In the follow-up to its 20th anniversary, the Ethos Foundation launches a new stock exchange index dedicated to corporate governance at Swiss companies. In collaboration with the Swiss Stock Exchange (SIX Swiss Exchange), Ethos publishes the "Ethos Swiss Corporate Governance Index" (ESCGI) which takes into account the main corporate governance best practice criteria in order to define the weight of the different constituents. This is the first index of this type on the Swiss stock market. The index allows investors to reduce the weight of companies that entail a corporate governance risk.

The new index "Ethos Swiss Corporate Governance Index (ESCGI)" privileges the companies that respect corporate governance best practice. The "Ethos Corporate Governance Principles" serve as a reference for the modification of the weighting of the companies comprised in the classic index of the Swiss market, the "Swiss Performance Index (SPI)". For Ethos’ CEO Vincent Kaufmann, "the innovative methodology of this index allows mitigation of the risks of poor corporate governance that are ignored by the classic indices. This provides investors with a better protection from corporate governance risks."

The expertise of SIX Swiss Exchange allows Ethos to benefit from the best competencies in the construction of indexes and to offer investors a credible and professional alternative to the use of traditional indexes. "The Ethos mandate to establish a corporate governance index confirms our index calculation capabilities and supports the positive development of our proprietary index suite," comments Chris Landis, Division CEO SIX Swiss Exchange.

An innovative approach

The index objectives aim to:

- Reduce the corporate governance risks by underweighting or excluding companies that do not apply best governance practices

- Reduce the carbon impact of the index by underweighting companies with significant carbon emissions

- Avoid overweighting companies that are under a serious controversy

- Avoid overweighting companies that have a weight exceeding 15% in SPI

- Overweight companies that do not fall into one of the above categories.

The criteria which are applied in order to measure the corporate governance risk are evaluated according to "Ethos Corporate Governance Principles," which are founded on current best practice in corporate governance in Switzerland and abroad. The following criteria are notably taken into consideration:

- Capital structure: negative impact when there are multiple classes of shares or an opting out/up clause

- Board: negative impact when the level of board independence is low or when there exists a permanent combination of the chairman/CEO function

- Remuneration: negative impact when the variable component of executive management remuneration is very large or when the board receives options.

"Tailor made" indexed fund

As of 30 January 2017, the new ESCGI index will serve as reference for the management of the fund "Ethos – Equities CH indexed Corporate Governance". This fund is managed by Pictet Asset Management and replicates in detail the ESCGI index. It has the advantage of indexed management in terms of reduced management fees while at the same time integrating the Ethos expertise on corporate governance. The associated voting rights are systematically exercised in accordance with the Ethos voting guidelines. The voting positions are communicated on the Ethos website two days before each general meeting and in a quarterly report especially prepared for this purpose. The fund will be open to private investors very soon (process underway at the FINMA).

8 December 2015

Sika: Ethos supports the board in the ongoing legal procedure at the Court of Zug

The Ethos Foundation was accepted as an accessory party in support of the board of directors in the trial opposing it to the Burkard Family at the Cantonal Court of Zug. The family has demanded the cancellation of the decisions taken at the last general meeting where the board decided to limit the registered voting rights of the SWH family holding to 5% of the total registered shares. Precisely one year after the announcement by the Burkard Family of its decision to sell its holding in Sika to the competitor Saint Gobain, Ethos confirms its determination to support the board in its will to preserve the independence of Sika.

On 8.12.2014 the Burkard Family had announced its decision to sell its stake in Sika which corresponds to 16% of the capital and 52% of the voting rights. Since then, the Ethos Foundation has taken different initiatives to contribute to preventing the takeover by Saint Gobain, which is not in the long-term interest of Sika stakeholders. In particular:

- On 23.12.2014 Ethos and 11 institutional investors filed a shareholder resolution at the annual general meeting of 14.4.2015 demanding removal of the opting out clause.

- On 14.1.2015, Ethos launched a support group for the resolution demanding removal of the opting out clause. The group quickly united 220 institutional and private shareholders. The 12 shareholders who initiated the resolution and the members of this group finally represented 7% of the capital and 4% of the voting rights.

- At the annual general meeting on 14.4.2015 the resolution aiming for the removal of the opting out received 97% support from the shareholders with no tie to the family. It was rejected nonetheless as the Burkard Family opposed it and was able to use all of its 52% of voting rights.

- At the extraordinary general meeting of 24.7.2015, Ethos took position against the proposals of the Burkard Family to modify the composition of the board.

- The 8.12.2015, Ethos announces having been accepted by the Court of Zug as an accessory party (according to Art. 74 of the Civil Procedure Code) to support Sika in the litigation opposing it to the Burkard Family. As accessory party, Ethos has access to all documents in the case file. Ethos may also use all means of prosecution or defence as well lodge appeals.

As a long-term shareholder of Sika, the Ethos Foundation has a clear interest that Sika remains independent and does not come under the control of the competitor Saint Gobain, as would have been the case had the sale of the shares of the Burkard Family actually taken place. In this perspective, Ethos supports the decision by the board to limit the registered voting rights of the SWH family holding to 5% of the total registered shares for certain votes which were held at the last general meetings. This measure was taken in line with the Sika articles of association.

Ethos has a overriding interest that the Court of Zug decide in favour of the board, which explains why the Foundation is now engaging itself as an accessory party in support of the board in the case opposing it to the Burkard Family. The letter addressed by the chairman of the board of Sika to the shareholders on 4.12.2015 clearly presents the different reasons why the takeover by Saint Gobain is not in the interest of Sika. Ethos is confident that the Court of Zug will take into account in its judgement the long-term interests of Sika stakeholders.

![]() Letter of 4.12.2015 from the Chairman of Sika to shareholders

Letter of 4.12.2015 from the Chairman of Sika to shareholders

22 November 2015

Swiss agrochemical/agriculture company Syngenta - Request for comprehensive strategic review

by Dr. Folke Rauscher

As shareholders of Syngenta we believe that Syngenta’s potential to create value for all its stakeholders is being substantially compromised. Board and management of Syngenta have missed several opportunities to increase value creation. Due to the ongoing gradual erosion of market share, and the loss of over CHF 10 billion in market value resulting from the rejection of a takeover offer without meaningful negotiations, we have now organized ourselves through the formation of a shareholder alliance. We demand a full and comprehensive strategic review to thoroughly evaluate all opportunities for value creation and urge the Board of Directors to refrain from selling the vegetable and flower seeds businesses.

The Alliance of critical Syngenta-shareholders has been formed in October 2015 by independent private and institutional shareholders and counts on the support of already more than 130 members.

The Alliance of critical Syngenta-shareholders is concerned that the Board of Directors and management of Syngenta have missed several opportunities to improve value creation and did more than once not reach the targets set by themselves.

We want to ensure that the Board undertakes a full and comprehensive strategic review to thoroughly evaluate all opportunities for value creation that promises are kept, financial targets are met and shareholders are informed in a timely and open matter.

If you are disappointed Syngenta shareholder or if you share our Corporate Governance concerns, please join our Alliance: http://www.critical-syngenta-shareholders.com/en-us/

This email address is being protected from spambots. You need JavaScript enabled to view it.

7 October 2015

Ethos Study on the 2015 Swiss Proxy Season: Mixed picture in terms of implementation of Minder Initiative

At the end of the 2015 Swiss proxy season Ethos publishes a study on the different aspects tied to the implementation of the Minder Initiative and the corporate governance of the companies comprised in the Swiss Performance Index (SPI). Ethos has found that the spirit of the Minder Initiative is often circumvented regarding the vote on the remunerations of the board and executive management. In addition, several principles of good governance are often not respected such as the independence of the board or the equal treatment of shareholders.

Circumvention of the Minder Initiative

At the 2015 annual general meetings of Swiss listed companies, shareholders were able for the first time to vote on the global amount of the remuneration for the board and the executive management respectively. The ordinance against excessive remuneration (ORAb) however allows each company to decide on the vote modalities.

Ethos regrets that only 28% of the companies have decided to request a retrospective vote (at the end of the financial year) on the variable remuneration. The others propose to vote on the amount of the bonus in advance when the annual results are not yet known, which constitutes a blank check and does not accurately reflect the spirit of the Minder Initiative. Ethos fully supports the revision project of Swiss company law which prohibits such a practice.

Limited contestation at the annual general meetings

The average support to the board’s proposals remained stable in comparison to last year at around 96%. Ethos was much more critical with only 84% positive recommendations.

The most contested proposals are the advisory votes on the remuneration report with an average support of 88% (Ethos 45%). The capital increase requests received an average support of 91% (Ethos 61%). Finally, the remuneration amounts were accepted at an average rate of 94% (Ethos 65%), despite the amounts often remaining relatively high. This observation casts doubts on the effectiveness of the Minder Initiative.

Remunerations still high

In financial year 2014, the global amount of board and executive remuneration of the 206 companies in the SPI Index rose by 4%, while the SPI itself gained 13%. At the 20 largest companies of the SMI index the remunerations nevertheless often remained very high with an average of CHF 2.5 million for the chairman of the board and CHF 8.2 million for the CEO.

Unequal treatment of shareholders

Ethos points out that half of the SPI companies have a shareholder controlling more than 33% of the voting rights. Most of these companies have also introduced one or several protection measures which allow them to have control over the company with a minority share of the capital. 36 companies have multiple categories of shares with different nominal values and 50 companies limit the exercise of voting rights for certain shareholders. In addition, 57 companies have an opting out (or opting up) clause which releases the purchaser of more than a third of the share capital from making a public offer to the rest of the capital.

The possibilities of unequal treatment of shareholders can present a major risk to minority shareholders. For this reason Ethos proposes to limit discrimination of shareholders in the framework of the Federal Council’s modernization project of Swiss company law.

1 June 2015

Ethos opposes the merger of Holcim and Lafarge at the extraordinary general meeting on 8 May 2015

Ethos recommends rejecting the merger of Holcim and Lafarge at the general meeting on 8 May 2015. Ethos is of the opinion that Holcim on a stand-alone basis is better placed to create long term value than the new entity. Also, the merger will have a negative effect on corporate governance as the new group will have two co-chairmen and a board with less than half independent members. The integration of the decentralised functioning of Holcim and the centralised organisation that is Lafarge entails a major risk of dysfunction.

Ethos analysis of the extraordinary general meeting of Holcim

After having analysed the relevant documents and after several contacts with the representatives of the board and the executive management of the future company, Ethos has come to the conclusion that the proposed merger between Holcim and Lafarge is not in the interest of the shareholders and a majority of the other stakeholders of Holcim. Ethos therefore opposes the share capital increase necessary for the completion of the merger requested at the general meeting on 8 May 2015.

Major financial risks

Ethos is not convinced by the strategic rationale of the merger and is of the opinion that certain assets of Lafarge might have a negative impact on the profitability of the new group. Holcim would be better off delivering value to its shareholders on a stand-alone basis. Lafarge’s goodwill of EUR 11 billion as well as limited investments to improve and renew its infrastructure in the past five years could have a negative impact on the financial results of the new group.

The risk appears even greater when considering that the board of Holcim clearly states not having carried out a detailed due diligence on the quality of the assets of Lafarge. Also, Holcim refuses to publish the two fairness opinions on which the board based its decision to support the operation.

Negative impact on corporate governance

Upon completion of the merger, the new board will have 7 representatives of each company. While five of the 7 representatives of Holcim are independent, this is the case for only one on Lafarge’s side. The new board will thus be far less independent than Holcim’s current one. The chosen solution to appoint two co-chairmen (Messrs. Reitzle and Lafont) constitutes a major risk of confusion and conflict. For example, in case of absence of Mr. Reitzle, it is the vice-president (Mr. Hess) who will replace him and not the co-chairman.

In terms of the integration of the two structures, there exists a legitimate concern regarding the two very different corporate cultures. The decentralised functioning of Holcim stands in contrast to the centralised organisation that is Lafarge. Ethos is of the opinion that there is a major risk of demotivation and departure amongst key employees of Holcim, such as heads of certain markets that will be limited in their autonomy. Finally, no information was given on the impact of the merger on jobs. As synergies are estimated at 250 million Swiss francs by elimination of duplicative functions, it is to be feared that this will lead to several thousand job cuts.

27 December 2014

Ethos and 11 shareholders submit a resolution to the extraordinary general Meeting of Sika to remove the opting out clause

The Ethos Foundation and 11 shareholders (representing 1.7% of the capital, see list below) today filed a shareholder resolution to the agenda of the extraordinary general meeting of Sika, the convocation of which was announced on December 10. The resolution requests the removal of the opting out clause from the articles of association. This provision allows the competitor Saint Gobain to buy from the Burkard Family the company Schenker Winkler Holding, which holds 52% of the voting rights with only 16% of the capital, without making an offer to the rest of the capital. This is very detrimental to minority shareholders and endangers one of the flagships of Swiss industry despite the company currently being well positioned in its market with very good growth perspectives.

The articles of association of Sika currently contain an opting out clause that allows an investor who purchases more than a third of the voting rights to be exempted from the obligation to make an offer to the rest of the capital. This is currently the case with Saint Gobain buying from the Burkard family their Schenker Winkler Holding, a company that controls 52% of voting rights with only 16% of the share capital. The combination of a double class of shares and an opting out clause has allowed the Burkard family to sell its stake with an 80% premium on the share price.

The resolution presented here demands the removal of the opting out clause. This provision strongly penalises minority shareholders in the case of a sale of the shares by a controlling shareholder. After the removal of the opting out clause, the buyer of the shares held by Schenker Winkler Holding will have to make an offer to the rest of the capital. In addition, the offer must be made at equal conditions to all shareholders as the payment of a control premium is prohibited by the Stock Exchange Act (SESTA). It is probable that Saint Gobain will refrain from the purchase under such constraint.

The Schenker Winkler Holding should actually not be allowed to vote on the removal of the opting out clause, as it has a major conflict of interest in this matter. It would thus be only the 48% of voting rights held by the minority shareholders that should have the right to decide on whether to maintain or remove the opting out clause. In case of rejection, Ethos reserves the right to file an appeal with the Swiss Takeover Board (TOB).

Ethos invites the Burkard family to assume its social responsibility by reconsidering the sale of the Schenker Winkler Holding to the competitor Saint Gobain, by committing to not oppose Ethos' resolution and by refraining from removing three current board members.

Shareholders co-filing the resolution at the extraordinary general meeting of Sika:

Ethos Swiss Foundation for Sustainable Development

Aargauische Pensionskasse, Aarau

Anlagestiftung der Migros Pensionskasse, Zurich

Bernische Pensionskasse, Berne

Caisse Inter-Entreprises de Prévoyance Professionnelle (CIEPP), Geneva

Complan (Swisscom Pensionskasse), Berne

Luzerner Pensionskasse, Lucerne

Pensionskasse Basel Stadt, Basel

Pensionskasse Stadt Zürich, Zurich

Pictet Funds SA (Ethos), Geneva

Raiffeisen Futura Swiss Stock, St Gallen

Vontobel Fund CH Ethos Equities Swiss Mid & Small, Zurich

4 December 2014

Ethos' 2015 voting guidelines: A guarantee for good corporate governance

The Ethos Foundation publishes the voting guidelines which it will apply at the 2015 annual general meetings. In particular, this new edition specifies the expectations regarding the application ordinance of the «Minder» initiative. A new appendix concerning the maximum number of external mandates has thus been included. A negative vote recommendation will now be issued when certain governance rules are not respected. In the future, Ethos will systematically oppose the discharge if the board of directors does not include at least four members and it will refuse the election of the chairman if he also serves as CEO.

The Ethos voting guidelines are revised annually in their entirety in light of the latest developments in corporate governance. In particular, the 2015 edition respects all the demands of article 22 of the ordinance against excessive remuneration which stipulates that Swiss pension funds must exercise their voting rights in the interest of their beneficiaries in such a way as to assure the prosperity of the pension fund in a sustainable manner.

The discharge will be refused if the board of directors continues to have less than four members in a permanent manner.

The election of the chairman of the board of directors will be refused if the candidate is simultaneously CEO and this combination of functions is permanent.

The total amount of remuneration for the executive committee can be refused if the amount requested is significantly higher than that of a peer group.

A maximum number of external mandates is set respectively for the members of the board of directors and of the executive committee.

To be considered independent, a member of the board of directors may not receive variable fees or fees paid in options.

8 October 2014

Implementation of the Minder initiative: Vote modalities in contradiction with the spirit of the initiative

Ethos simultaneously publishes its first report on the implementation of the Minder initiative and its 2013 board and executive remuneration study. In general, the companies have become more transparent with regard to their remuneration systems. However, the ordinance of application of the Minder initiative (ORAb) leaves it to the board to propose the modalities of the vote on the remuneration amounts. These modalities are often in contradiction with the spirit of the Minder initiative. In particular, Ethos and many other shareholders cannot accept prospective votes on variable remuneration without adequate safeguards set in the articles of association. This explains why the votes on the statutory modifications related to the ORAb were often the cause of much debate this year.

The 2014 general meetings of Swiss listed companies were dominated by the entry into force on 1 January 2014 of the ordinance against excessive remuneration (ORAb), following the approval by the Swiss people of the Minder initiative in March 2013. The ORAB requires that by the end of 2015 at the latest, the companies must have streamlined their articles of association and submitted the amounts of board and executive remuneration to a binding vote of the shareholders. Halfway to the deadline, Ethos publishes a survey on the implementation of the ORAb by the 150 largest Swiss listed companies.

Of the 136 companies subject to the ORAb, 96 (70%) have already put to the vote various amendments to the articles of association, namely those that fix the vote modalities for board and executive remuneration. However, only 29 companies (21%) have already proposed at the 2014 AGM a binding vote on the amount of board and executive remuneration.

Circumventing the spirit of the Minder initiative

The average rate of approval of the amendments to the articles of association was only 88%, due to the fact that several companies have proposed amendments that circumvent the spirit of the Minder initiative which is not always well perceived by the investors. In particular:

- The vote modalities often stipulate prospective votes for the variable remuneration. A maximum amount is put to the vote at the beginning of the period, instead of retrospectively, at the end of the period, when the results of the companies are known.

- Following the prohibition of severance payments, almost half of the companies have foreseen the possibility to include in the executive contracts remunerated non-compete clauses.

- More than 33% of the companies could pay to their board members performance-based fees instead of solely fixed fees.

The transparency of the annual bonus and incentive plans should be improved

Ethos also published its annual report on board and executive remuneration in Swiss listed companies. In 2013, the remuneration in the 100 largest Swiss listed companies slightly increased (+2%). This is mainly due to the financial sector where the remunerations were up 8%. It is interesting to note that this increase is slower than the increase in both the market cap and the net income of the companies reviewed.

It appears that the obligation to submit the remuneration to shareholder vote is an incentive for many boards to increase transparency and become more vigilant with regard to their remuneration structure. There is however still much room for progress. For example, approx. 40% of the companies under review still refuse to publish the maximum bonus. With regard to long term incentive plans, half of the companies do not publish the precise performance targets for vesting.

18 July 2014

Consultation by economiesuisse on the revision of the Swiss Code of best practice for corporate governance: Ethos' response

The Ethos Foundation commends the decision to carry out a revision of the Swiss Code of best practice for corporate governance. In the current Code dating back to 2002 (with an appendix added in 2007), several points do not reflect international best practice anymore.

An ambivalent project

In general, Ethos is satisfied that the «Comply or explain» principle was introduced in the new version of the Code. This principle is now established in most codes of best practice abroad. Another positive amendment to the Code is the stipulation that the board of directors should pursue the sustainable development of the company.

It is however regrettable that the new version of the Code neither makes mention of the principle of equality of treatment of shareholders (a single class of shares), nor of the “one share one vote” principle (no registration or voting rights limit). These concepts are recognized as fundamental in all international best practice documents.

Numerous exceptions to best practice allowed