Welcome to VIPsight Americas

Marc Lane's book on best corporate governance practices, "Representing Corporate Officers and Directors," was first published in 1987.[1][2] He revisited his treatise on corporate governance in 2005.[3][4] The new version is updated annually with the most recent supplement for the year 2010.[5][6] With the goal of promoting positive social change, Lane provides companies and their directors, officers, auditors and shareholders with insights for the compliance of new legislation, rules and responsibilities in response to the avalanche of corporate accounting scandals.[7][8]

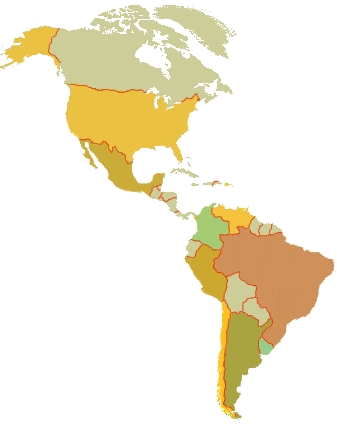

The Roundtable, a joint initiative of the OECD, IFC and GCGF, convened policy-makers, regulators, stock exchanges, corporate governance institutes and private sector representatives from 19 countries.

2010's Latin American Corporate Governance Roundtable concluded with agreed actions four key corporate governance issues:

- To issue revised recommendations for Institutional Investors to strengthen their impact on corporate governance in the region;

- To further develop its seven-country comparative survey and proposed recommendations to enhance the effectiveness of boards of directors;

- To further develop its comparative survey of 20 countries on preventing abuse of privileged information/insider trading and to follow up with a survey to address abuse of related party transactions;

- To develop new analytical work to review stock exchange initiatives to develop corporate governance indexes and ratings.