Welcome to VIPsight America - Mexico

|

|

| Martín Dâvila |

16 August 2017

Chiara Lubich and her fight against poverty

At present and for a long time we have been fighting against a great scourge to humanity as a whole, and this is represented by poverty. According to Oxfam Mexico in its 2015 annual report, is where it is mentioned that, "While the wealth of the 4 richest millionaires in Mexico now accounts for 9% of Gross Domestic Product (GDP), 55.3 million people live in poverty", as well as the National Council on the Evaluation of the Social Development Policy (CONEVAL, for its acronym in Spanish for Consejo Nacional de Evaluación de la Política de Desarrollo Social), confirms that 55.3 million people in Mexico, representing 46.2% of the Mexicans, find themselves in a situation of poverty. However, Silvia Lubich, better known by Chiara Lubich, has designed a very simple idea, in addition to brilliant how tackling poverty, and that is what is known as the Economy of Communion.

Silvia Lubich had a wonderful life, full of many achievements and successes, despite having undergone some vicissitudes. All of these events he forged a character beautiful and by other kind, same as I go sharing later. She was born in Trento, Italy, on January 22nd, 1920, and dies at the age of eighty-eight years in Rocca di Papa, Italy, on March 14th, 2008. In the words of Silvia Lubich, she tells us how it is to be closer to God; "I was 19 years old and a great thirst for God", so that every time he was with a priest asked "Tell me of God", due to the incessant thirst for God, she tries to register at the Catholic University of the Sacred Heart in Milan (Università Cattolica del Sacro Cuore), however his family did not have the means to cover that expense, so that Silvia Lubich enters a contest to be able to get a scholarship for the study because it had 33 places available for that scholarship, unfortunately she left in the place number 34 for a free admission at the Catholic University of the Sacred Heart in Milan. After that fact in her life, she tells us the following "I remember how much I cried, because I believe that in the Catholic University talked about God. And I remember, that in the midst of that crying, in the living room with my mother, inside of me I felt someone told me: I will be your teacher."

The next major event in the life of Silvia Lubich is when in October 1939, makes a trip to Loreto, Italy, during a course for young people of Catholic Action, where you visit the Marian shrine of the house of the Holy Family of Nazareth, in the words of Silvia Lubich tells us; "I was invited to a congress of Catholic students in Loreto, where it is guarded according to the tradition, in a large church-fortress, the house of the Holy Family of Nazareth… participated in a school in the course with all the other; but, whenever I can, I run there. I knelt down next to the wall blackened by the lamps. Something new and divine surrounds me, it is almost as if I was crushed. It is with the thought life of the three (…). Every thought I have, I squeezed the heart, the tears fall without control. In each interval of course, I am always there. It is the last day. The church is full of young people. I pass through the mind a clear idea, that will never be erased: you will be followed by a legion of virgins". As she mentions at the end, he entered the sanctuary on the day before and found it full of people so they stayed in the back of the church, she tells us, "in some way, during the solemn Mass, while everyone was following closely the development in their missals, I knew that I had found 'my way'. Then came the image of a procession of the Virgin, dressed in white, who followed me in that way. I didn't know what that could mean, but that is what I experienced", therefore Silvia Lubich was when he felt the voice of God in his heart that thinks "I will continue to be a multitude of virgins". The outline of the new way of the Lord is the Focolare, a community of people which will be "virgins and married, all donated to God". So for Silvia Lubich, the birth of the Focolare in reality is during this trip. Virginia Azcuy writes about that event in the life of Silvia Lubich, "This was the first intuition of the Focolare, in contemplating the life of Nazareth: a 'family' normal and exceptional at the same time, a simple family of workers that are not in any of the others, but where God lives”.

After that trip to Loreto she is dedicated to study and work. She is part of the Faculty of Philosophy at the Università Ca'Foscari in Venice, however, the arrival of the Second World War prevented him to continue with his studies and therefore to return to his native Trento to work as a teacher, so during the school year 1940-1941 gives classes in the Seraphic Opera of Trento, directed by fathers cappuccinos. In 1943 a father cappuccino invites her to join the Third Order of the Franciscans, a lay branch, and it is when, in love for God, takes the name of Chiara, for the Santa Chiara of Assisi, a fervent follower of Saint Francis of Assisi, with whom he founded the Second Franciscan Order or of Poor Clare Sisters, so since then it is known as Chiara Lubich.

Also in 1943, after four years of that trip to Loreto, to Chiara Lubich is the most decisive event of his life: it is a cold winter day, at that time did not have milk so that his mother Luigia Lubich asked the daughters smaller than go find milk. Chiara Lubich in a gesture of charity toward their little sisters, offers to go herself by the milk due to the intense cold that feels, but let to Chiara Lubich we tell this fact: "When I was going down the street, I felt as if God said: Date all to me, date all to me. I stop in surprise. I'm going to look for the milk, go home, and I write a letter to a priest", in this letter tells the Father Casimir Bonetti, a priest cappuccino, what he had felt in his soul and his great desire to give themselves to God.

For those who expressed their desire to consecrate herself to God, in those years, you are advised to do so by a particular time and repeat it several times in such a way that a strengthening in its purpose. However, for the Father Casimir Bonetti, the desire to Chiara Lubich by consecrating oneself to God, I was so entrenched and so decided, after colloquium deep, authorized to be made immediately and for life.

Very early on the morning of December 7th, 1943, when Chiara Lubich is directed only to the Church, and with the accompaniment of the Father Casimir Bonetti, tells us the following memories of that day: "Outside had triggered a great storm," "I had the impression of having the world against me", "I had prepared a pew near the altar and had a small Missal in the hand. I do pronounce the formula by which I totally to God forever. I was so happy that I didn't even realize what he was doing, because I was very young. Only that, when you pronounce the formula, I had the impression that a bridge was falling behind me, that I couldn't go back because it was all in God. And there I dropped a tear in the missal. But, the happiness was immense!", "I married with God, therefore I hope all the good possible. It will be a divine adventure. I married with God! And then we saw that it was really as well".

As Virginia Azcuy mentioned, "Later, it was recognized that date symbolically as the home of the Focolare Movement", which was later adopted by the Catholic Church with the official name of Work of Mary. According to the official page of the Focolare Movement, today is present in 194 countries on 5 continents, with stable centers in 85 nations. They are a part, as members, some 120,000 people, 1'500,000 of adherents and sympathizers. Through initiatives and social works are regularly to reach one million people. In addition to Catholic Christians, are part of the Focolare Movement 25 thousand of Christians from 350 churches and ecclesial communities; they share in a different way the spirituality and the objectives more than 7 thousand believers of different religions and 10 thousand people of non-religious convictions.

There are many very important events in the life of this remarkable woman, I suggest that you review on the official website of the Chiara Lubich Center (www.centrochiaralubich.org), where it is exposed a chronological summary of all relevant events in the life of this famous woman where in detail each of these events.

Finally I wanted to get to this point, with the birth of the Focolare Movement, in May 1991, Chiara Lubich launches project of Economy of Communion, in the Mariapolis Ginetta of Sao Paulo, Brazil, as a response to the profound difference between rich and poor. In the words of Chiara Lubich tells us what is the fundamental principle of the Economy of Communion; "Unlike the consumerist economy, which is based on the culture of having, The Economy of Communion is the economy of giving. This may seem difficult, hard, heroic. But this is not so, because man, made in the image of God, who is Love, finds its fulfilment precisely in loving, in giving. This requirement is in the depths of his being, beyond that it is a believer or not. And it is precisely in this finding, confirmed by our experience, is the hope of a universal dissemination of the Economy of Communion".

Dr. Giuseppe Argiolas (a focolarino) tells us that the Economy of Communion is a project of economic development of solidarity in which they are listed all economic entities involved in the economic activity of a country such as: civil society, the government, consumers, suppliers, etc. The project in which the owners of the companies adhere freely and decide to put their profits in the communion of the same and that they have three main objectives:

1. Persons who get into difficulties are helped by these companies through the creation of new sources of employment in order to assist them in their primary needs, emphasizing this assistance that are within the Project.

2. Disseminate widely the precepts of their foundress Chiara Lubich giving and love.

3. The integral development of enterprises in all senses, technical, administrative, and above all the social.

Without a doubt, the life of Chiara Lubich is fascinating and that converges on an idea about how should be the economic activity guided by humanism and the good faith of the people, this concentrates on the basic principles of the Economy of Communion, and that is intended precisely to be able to completely eradicate poverty on the planet. However I think that more is needed on this economic model and therefore there is a big question: How to implement these precepts in all companies? It seems to me that a good way to do it, is to integrate it into the mechanisms of Corporate Governance as well as to the internal Codes of Ethics that each one of the companies have. I thank Dr. Giuseppe Argiolas taught me this new economic system and open my eyes to other economic concepts. I also want to thank Dr. Andrea Arantes for having invited me to the ceremony that took place at the Universidad La Salle in Mexico to commemorate the 20 years of awarding him an honorary doctorate in philosophy to Chiara Lubich (June 6th, 1997), chaired by Dr. Piero Coda, rector of the Sophia University Institute. I only hope that the Economy of Communion begins to be known in more countries and especially here in Mexico. We will have to see…

7 November 2016

The Clintons

The other side of the coin for election to the presidency of the United States is, for the first time in the history of that country, a woman named Hillary Rodham, or better known as Hillary Clinton. The elections in the United States will be the next week and according to several polls she goes to the head in the voters' preferences, in addition to that have given by the winner of three debates that has played in his run to the White House. This means that it is very likely to win these elections and therefore, Americans have a woman president. This is not the first woman president in America but it would be the first woman president to the United States (see table below).

|

America's Women Presidents |

||

|

Name |

Period |

Country |

|

María Martínez |

July 1, 1974 - March 24, 1976 |

Argentina |

|

Lidia Gueiler |

November 16, 1979 - July 17, 1980 |

Bolivia |

|

Ertha Pascal |

March 13, 1990 - February 7, 1991 |

Haiti |

|

Violeta Chamorro |

April 5, 1990 - January 10, 1997 |

Nicaragua |

|

Rosalía Arteaga |

February 9, 1997 - February 11, 1997 |

Ecuador |

|

Janet Jagan |

December 19, 1997 - August 11, 1999 |

Guyana |

|

Mireya Moscoso |

September 1, 1999 - September 1, 2004 |

Panama |

|

Michelle Brachelet |

March 11, 2006 - March 11, 2010 |

Chile |

|

Cristina Fernández |

December 10, 2007 - December 10, 2015 |

Argentina |

|

Laura Chinchilla |

May 8, 2010 - May 8, 2014 |

Costa Rica |

|

Dilma Rousseff |

January 1, 2011 - May 12, 2016 |

Brasil |

|

Michelle Brachelet |

March 11, 2014 - Present |

Chile |

Hillary Clinton was born in the Edgewater Hospital of the city of Chicago, Illinois, on October 26th, 1947, where she spent hers first three years for after moving to the city of Park Ridge, Illinois. She grew up in the womb of a middle class and very conservative family, and besides they belonging to the United Methodist Church (UMC). She is the first daughter of the marriage formed by Hugh Rodham and Dorothy Howell. Hillary Clinton has two younger brothers Hugh and Anthony Rodham. An interesting fact is that belong to a family very conservative, hers political bias logically is in the Republican Party, made their first years in politics were intimately linked to that party, such and how I will show you later, however in 1968, changes its political ideology toward the Democratic Party, which currently militates.

In 1969 he obtained his B.A. in Political Science from the prestigious Wellesley College, which is a private university exclusively for women. In the graduation ceremony held on May 31st, 1969, animated by their classmates, Hillary Clinton gave the speech, being the first student to do so, although they used to make severe criticism toward the republican senator by Massachusetts, Edward Brooke, which is the first African American Senator to be elected by that position and it is also the first to belong for several periods in the Senate (1967 to 1979). Have been because Edward Brooke was black or because he was a Republican Senator, since she had already changed to Democratic Party, only she knows. In addition, her classmates believed that she would be the first woman president of the United States, and I believe that it is not very far from becoming a reality that omen that gave their companions of generation, just as I think that since then, she has always been seen as the President of the United States and has been committed despite who despite.

During the time that she was in the Wellesley College addressed the youth club republicans from 1966 to 1967, in addition in the summer of 1968 her Professor Alan Schechter prompted her to go to Washington D.C. to be as an intern in the Republican Assembly of the Chamber of Representatives of the United States. Likewise, during her stay in the House of Representatives Charles Goodelle, moderated Republican Congressman by New York, invited to participate in the late campaign by the Republican nomination to the presidency of the New York Governor Nelson Rockefeller. From August 5 to August 8, 1968 was carried out the Republican National Convention, in the Miami Beach Convention Center in Miami Beach, Dade County, Florida, to which Hillary Clinton participated as a member of the campaign of Nelson Rockefeller, in which Richard Nixon won the nomination for the presidency with 692 votes, while Nelson Rockefeller was in second place with 277 votes. The foregoing leads us to that not only had the republican ideology, but that was an active member of that party, this is the first inconsistency in the life of this woman.

In 1973, Hillary Clinton graduated from the Law School of Yale University, and this is where she known to her future husband, another student of law at Yale, William Blythe, better known as William (Bill) Clinton. Since the end of the spring of 1971 they became inseparable until now. After the graduation from 1973, Bill Clinton proposed marriage, but she declined because it was not safe to have a future with him (another incongruity).

Finally on October 11st, 1975, the Clintons were married in a Methodist ceremony in the hall of his house in Fayetteville, Arkansas. To the chagrin of both mothers she announced that his name would be Hillary Rodham, according to maintain their professional lives separated and to avoid conflicts of interest, in addition because "showed that remained me" (a new incongruity of this woman). In November 1976 they moved to the capital of Arkansas, Little Rock, due to that Bill Clinton had been elected as attorney general of Arkansas.

There began the political life of the couple, as Bill Clinton was elected governor of Arkansas on two occasions from 1979 to 1981 and then in two periods in a row from 1983 to 1987 and from 1987 to 1992. In that year began his career (both) by the White House to be elected as the president number 42 in the periods 1993 to 1997 and a second period of 1997 to 2001.

Hillary Clinton agreed to stay with her marriage in spite of the fact that her husband had been unfaithful with Monica Lewinsky in 1998, any woman with a little dignity had been divorced, and more about the way in which things happened, this did precisely in order to continue her career toward the White House, their dignity is something that she are not interested in, what is of interest to this megalomaniac women is her excessive ambition to achieve its sole objective in her entire life, to be president of the United States. In addition, as Jeff Gerth and Don Van Nattra say in their book "Her Way: The hopes and ambitions of Hillary Rodham Clinton”, the popularity that managed to Hillary Clinton in 1998 have been the highest in that a first lady has had (around 70 percent) but are not by personal or political achievements, but also to be seen as a victim of the scandal of media in the that was wrapped Bill Clinton.

Hillary Clinton being First Lady was also a Senator from the state of New York in 2000, again showing its unbridled ambition to such a degree that their opponents accused her of being a carpetbagging, because never before had resided in New York. In 2006 was elected in the Senate once again. Since October 2002 had already announced their aspirations to contend for the presidency of the United States, however in 2008 to be in campaign looking for the first time the nomination by the Democratic Party, decides to abandon its campaign on June 7th, 2008, making with that on August 28th, 2008, Barack Obama was named the Democratic candidate to the presidency of the United States. As a consolation prize, Barack Obama appointed her as Secretary of State, confirming her in the post by the Senate on January 21st, 2009.

Another inconsistency more is when Hillary Clinton had said that she was not going to run for the presidency of the United States and on April 12nd, 2015, she formally announced her candidacy for the presidency through an email and a video where at the end she uses the following phrase "Each day, Americans need an advocate. And I want to be that advocate". At the Democratic National Convention held in the Wells Fargo Center of Philadelphia Pennsylvania, July 26th, 2016, she was officially proclaimed the candidate by that party for the presidency of the United States.

After seeing so many inconsistencies in the life of Hillary Clinton, I still strange that many people, including those who are not of their ideology or party, are willing to vote for her. A few days ago I had the fortune to meet a remarkable Mexican because that is the first Mexican to get a Michelin star. This friend is already a U.S. citizen and lives in Chicago, Illinois, in the hometown of Hillary Clinton, the obvious question was, dear friend for whom you going to vote?, to what he answered me that he does not understand as was that among the 325 million inhabitants of the United States of whom 164 million are women, could not have chosen to another woman to be able to contend for the White House, he definitely not going to vote for her, because it seems that it is not suitable for directing the destinations in the United States. In my humble opinion, like my friend, I do seem to me to be the right person, and it is not because it is women, but by everything that represents, inconsistencies in his life, his lack of dignity when he knows about the infidelity of her husband, her immense ambition to become finally the first woman president of the United States, the petty corruption which has handled including the scandal of the e-mails and the private server that had in her house, same as attentive to the national security of her country, the ineffectiveness that insurance will lead to their management and many more little things that has to have around it. Frankly, if I were American, would not vote for this woman, I hope that does not win. Hopefully in this occasion, my predictions going to capitalize. We will have to see…

9 October 2016

Super Trump

Never before I had concerned the United States elections, however, it has now called a lot of my attention to the fact that one of the candidates for the presidency of the most powerful country in the world is to be an entrepreneur and a billionaire named Donald Trump. Although has the backing by the Republican Party, Donald Trump is not a career politician, for the same Republican politicians, Trump is an "outsider", which has earned him many followers outside of the political circles since it began his campaign. In spite of what many think of him, it seems to me that this personage, to reach the presidency, would mark a before and after in what refers to the public administration, since that could make the way of handling a country is very similar to what is the management of a company. And if that were not enough, I think that in regard to concepts and theories related to the Corporate Governance mechanisms as are the transparency, accountability and efficiency, he could put into practice in its management as the federal executive of the United States, despite whoever disagrees.

Due to the foregoing many of American politicians, including the same of the Republican Party that promotes to Trump, are fearful (better said, horrified) if he reaches to the White House, because they are ultimately their comfort zone and the perks of they have been enjoying until now. I am quite sure that Donald Trump is going to prove to everyone that a country can be handled in a different way to as has up to now been. This means that also in many other countries of the world continue with too carefully the elections approaching in the United States (November 8th, 2016), for the same reasons that have U.S. politicians.

Donald Trump was born on June 14th, 1946 in Queens, New York, is the fourth son of a real estate entrepreneur, Frederick Trump and of a Scottish immigrant Mary Anne MacLeod. Donald Trump obtained his BA in Economics and Anthropology of the Wharton School of Finance from the University of Pennsylvania in 1968, although it began his university studies at Fordham University in the Bronx during two years, however went to the Wharton School of Finance because it was one of the few universities at that time which had a program in the real estate sector. Likewise, during the years in which he studied at Wharton, began working with his father in the company what Fred Trump founded to its 22 years with his mother Elizabeth Trump in 1927, before call Elizabeth Trump & Son.

As Donald Trump graduated from the university in 1968, formally joined to his father’s Firm and to 1971 assumed full control of the Firm, as well as the change of name to The Trump Organization, being the current Chairman and President of one of the most important real estate companies of New York and the United States. According to the magazine specialized in business Forbes, the current fortune of Donald Trump is 3.7 trillion dollars, being the number 156 of the list of this magazine in its section “Forbes 400 / The Wealthiest In America”. So, he is rich, he shall not steal any dime to the public purse from the US taxpayers.

When I to be looking for information about this personage, I found it in his official web page in the section of biography an appointment very interesting about him: “Donald J. Trump is the very definition of the American success story, continually setting the standards of excellence while expanding his interests in real estate, sports, and entertainment. He is the archetypal businessman – a deal maker without peer”. As well as a note about what he thought about his father: “My father was my mentor, and I learned a tremendous amount about every aspect of the construction industry from him”. Similarly Fred Trump mentions about her Son: “Some of my best deals were made by my son, Donald ... everything he touches seems to turn to gold”. Then it means that Donald Trump is a kind of modern “King Midas”. In addition to the foregoing gives us to understand what nearby which were he and his father as well as the appreciation and mutual affection they felt for one another. It is clear from the above that Donald Trump is much more than they have already criticized that is a “Good Man” and which could also make the difference in the management of a country like the United States.

I think that like what happens in our country (Mexico), Donald Trump grew weary of the situation in which his country has been governed and therefore on June 16th, 2015 takes the wise decision (and the guts that many of us do not have) of officially start their wishes to reach the presidency of the United States. This he did in his hometown of New York City, and of course at the Trump Tower, with a slogan that shows what I mentioned before “Make America Great Again”. At the beginning his campaign manager was Corey Lewandowski, to then give the opportunity to Paul Manafort and currently the persons who manage his campaign are Steve Bannon and Kellyanne Conway.

The arguments and speeches that has given against illegal immigration, on Muslims, about free trade, of the item of military interventionism and above all by the insistence on the construction of a wall border between Mexico and the United States has brought several adherents of the middle class of his country. It seems to me that what Donald Trump said is just what many Americans think but do not dare to say, however, in saying that he and the way in which he has said, has caused that now has many followers as well as many critics, including Latinos who are there illegally. Although, I recognize that to me nor I liked the form and the way to say this because I believe that it is not appropriate, since it seems rude, offensive and on many occasions it is be until vulgar, however, that is his style that has led him to that on July 19th, 2016 in the National Convention of the Republican Party (founded on March 20th, 1854) they have chosen as the official candidate to run for the presidency of the United States, who obtained the support of 1,725 delegates, followed by Ted Cruz with 475, John Kasich 120 and Marco Rubio 114, while Jeb Bush, ended up with only three (3) votes.

The following table shows all the presidents that the United States has had to date today, it can be clearly seen that in 18 occasions have been republicans and 15 times have you been democrats. It seems to me that is a harbinger, Americans are conservative and that will again will elect a president who come of the Republican Party.

|

United States' Presidents |

|

|||

|

Number |

Name |

Period |

Party |

|

|

44 |

Barack Obama |

January 20, 2009 - Present |

Democratic |

|

|

43 |

George W. Bush |

January 20, 2001 - January 20, 2009 |

Republican |

|

|

42 |

Bill Clinton |

January 20, 1993 - January 20, 2001 |

Democratic |

|

|

41 |

George H. W. Bush |

January 20, 1989 - January 20, 1993 |

Republican |

|

|

40 |

Ronald Reagan |

January 20, 1981 - January 20, 1989 |

Republican |

|

|

39 |

Jimmy Carter |

January 20, 1977 - January 20, 1981 |

Democratic |

|

|

38 |

Gerald Ford |

August 9, 1974 - January 20, 1977 |

Republican |

|

|

37 |

Richard Nixon |

January 20, 1969 - August 9, 1974 |

Republican |

|

|

36 |

Lyndon B. Johnson |

November 22, 1963 - January 20, 1969 |

Democratic |

|

|

35 |

John F. Kennedy |

January 20, 1961 - November 22, 1963 |

Democratic |

|

|

34 |

Dwight D. Eisenhower |

January 20, 1953 - January 20, 1961 |

Republican |

|

|

33 |

Harry S. Truman |

April 12, 1945 - January 20, 1953 |

Democratic |

|

|

32 |

Franklin D. Roosevelt |

March 4, 1933 - April 12, 1945 |

Democratic |

|

|

31 |

Herbert Hoover |

March 4, 1929 - March 4, 1933 |

Republican |

|

|

30 |

Calvin Coolidge |

August 2, 1923 - March 4, 1929 |

Republican |

|

|

29 |

Warren G. Harding |

March 4, 1921 - August 2, 1923 |

Republican |

|

|

28 |

Woodrow Wilson |

March 4, 1913 - March 4, 1921 |

Democratic |

|

|

27 |

William Howard Taft |

March 4, 1909 - March 4, 1913 |

Republican |

|

|

26 |

Theodore Roosevelt |

September 14, 1901 - March 4, 1909 |

Republican |

|

|

25 |

William McKinley |

March 4, 1987 - September 14, 1901 |

Republican |

|

|

24 |

Grover Cleveland |

March 4, 1893 - March 4, 1897 |

Democratic |

|

|

23 |

Benjamin Harrison |

March 4, 1889 - March 4, 1893 |

Republican |

|

|

22 |

Grover Cleveland |

March 4, 1885 - March 4, 1889 |

Democratic |

|

|

21 |

Chester A. Arthur |

September 19, 1881 - March 4, 1885 |

Republican |

|

|

20 |

James A. Garfield |

March 4, 1881 - September 19, 1881 |

Republican |

|

|

19 |

Rutherford B. Hayes |

March 4, 1877 - March 4, 1881 |

Republican |

|

|

18 |

Ulysses S. Grant |

March 4, 1869 - March 4, 1877 |

Republican |

|

|

17 |

Andrew Johnson |

April 15, 1865 - March 4, 1869 |

National Union |

|

|

16 |

Abraham Lincoln |

March 4, 1861 - April 15, 1865 |

Republican |

|

|

15 |

James Buchanan |

March 4, 1857 - March 4, 1861 |

Democratic |

|

|

14 |

Franklin Pierce |

March 4, 1853 - March 4, 1857 |

Democratic |

|

|

13 |

Millard Fillmore |

July 9, 1850 - March 4, 1853 |

Whig |

|

|

12 |

Zachary Taylor |

March 4, 1849 - July 9, 1850 |

Whig |

|

|

11 |

James K. Polk |

March 4, 1845 - March 4, 1849 |

Democratic |

|

|

10 |

John Tyler |

April 4, 1841 - March 4, 1845 |

Whig |

|

|

9 |

William Henry Harrison |

March 4, 1841 - April 4, 1841 |

Whig |

|

|

8 |

Martin Van Buren |

March 4, 1837 - March 4, 1841 |

Democratic |

|

|

7 |

Andrew Jackson |

March 4, 1829 - March 4, 1837 |

Democratic |

|

|

6 |

John Quincy Adams |

March 4, 1825 - March 4, 1829 |

Democratic-Republican |

|

|

5 |

James Monroe |

March 4, 1817 - March 4, 1825 |

Democratic-Republican |

|

|

4 |

James Madison |

March 4, 1809 - March 4, 1817 |

Democratic-Republican |

|

|

3 |

Thomas Jefferson |

March 4, 1801 - March 4, 1809 |

Democratic-Republican |

|

|

2 |

John Adams |

March 4, 1797 - March 4, 1801 |

Federalist |

|

|

1 |

George Washington |

April 30, 1789 - March 4, 1797 |

Nonpartisan |

|

I definitely think that today, Donald Trump is the best option to have the Americans to achieve a radical change in what refers to its domestic policy. Trump will be the president number 45 of the United States and which will achieve what many of the presidents at the global level have not succeeded, eradicate corruption and inefficiency of public administration, that is guaranteed with this personage, another way will continue with the same rhetoric of the whole life. At the beginning I mentioned that never before had me interested by the U.S. policy, but now I see it in another way. On July 21st, 2016 in Cleveland, Ohio, Donald Trump gave his acceptance speech at the Republican National Convention, on that occasion I saw completely. Ivanka Trump, his daughter, did an excellent presentation of his father and in my humble opinion I think that I could not been better for her to make the speech of welcome. Donald Trump at the start of his speech now if I thought it was coherent and fairly well taken, that gave me a lot of confidence in what I hope that comes to the United States, to speak again of the wall, has a lot of reason, if in the house of every one of us enters someone illegally which is what we do? We will built a wall more high, we put alarms and surveillance cameras, why do not have to make the United States? I would therefore like to see the change in the United States! Super Trump you have my vote! I hope you win! We will have to see…

17 July 2016

To Brexit or Not to Brexit…

The past June 23th 2016, the Great Britain has decided "democratically" leave the European Union, and it was precisely to next day of this famous date, throughout the world has generated a real scandal for the media. "Experts", "analysts", "statesmen" and "government officials" have decided to speak on what represents the output of Great Britain of the European Union. I think that many of them have valid arguments both in favor and against the output of Great Britain in the European Union and its economic, political and social consequences, however, I believe that even today it is still too early to be able to quantify and magnify it really has been this historic decision that has been in that day. Although it must be emphasized that the vast majority of financial markets in the world reacted badly to the news, since the majority of stock markets have had low significant, as well as some currencies in the world have reacted bad, especially the pound sterling that has had a depreciation of more than 10% with respect to the US dollar, a level that had not had since 1985, and with respect to the euro had a depreciation by nearly 7 per cent.

Talk about the origins and the impact that it did and that has been the formation of the European Union, it would be a great treaty, by which I summarize these origins in the following way.

On May 9th 1950, the French Minister of Foreign Affairs, Robert Schuman made the statement that bears his name (Schuman Declaration), which proposed the creation of a European Coal and Steel Community (ECSC) in which, the member countries would in common the production of coal and steel. This is due to the fact that the European nations came to the conclusion that, by pooling the production of coal and steel would make the frictions that there has always been between Germany and France, which were perceived as the historic rivals, would result in terms of the declaration that a situation of armed conflict would be "not only unthinkable but materially impossible" in the words of Robert Schuman. With the foregoing was thought, rightly, that the merger of the economic interests would contribute to raising the living standards of the countries and would constitute the first step toward a more united Europe. Since then that the inclusion to the ECSC was open to other European countries who so wish. In addition Robert Schuman together with Konrad Adenauer (Prime Minister of Germany) were the architects for the creation and consolidation of West Germany (May 23th 1949, of the Basic Law of Germany which formed the Federal Republic of Germany), which was the result of the union of the three zones of occupation controlled by the United States, France and Great Britain, leaving to one side to the area occupied by the Soviet Union. Doing a parenthesis in this, it is a real pity that only in Germany has been implemented the Social Market Economy and not permeating in the emerging "European Union", I think that would have made a more robust economy for member countries.

Therefore the Schuman Declaration is the basis with which Germany, Belgium, France, Italy, Luxembourg and the Netherlands on April 18th 1951 finally signed the treaty in which manage their heavy industries such as coal and steel were could manage as a whole, and that no country can individually make the weapons of war for use with any of the other member countries, as had happened in the past. This is, this treaty was the first attempt to "European Union", which had been carried out with the main objective of preventing armed conflicts in the future and to be able to correct the errors that occurred in the Versailles treaty signed on June 28th 1919 at the Palace of Versailles at the end of the First World War (a curious fact is that this treaty was signed exactly to the 5 years of the assassination of Archduke Franz Ferdinand of Austria in Sarajevo, Bosnia i Herzegovina, a fact which gave rise to the First World War).

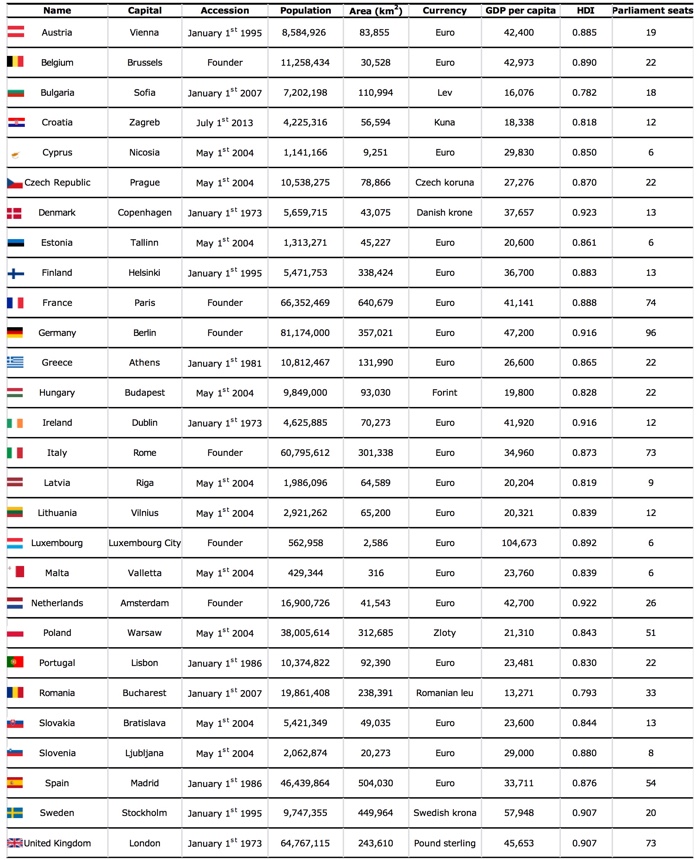

The European Union is currently composed of 28 nations (Croatia was the last to be annexed to the European Union on July 1st 2013). In the following table I, according to the official website of the European Union, the listing of all member countries. The order is alphabetic, and there are two important columns to observe in the table. One is with reference to the Gross Domestic Product (GDP) per capita, that have each one of the member countries of the European Union and another column is important with reference to the Human Development Index (HDI). It should be emphasized that the values that are present in each one of these columns is very high compared with other countries.

In the following table, I present some countries of the world, which are obviously out of the European Union. It is important to note that the European countries that appear in the following table are the countries that are about to be accepted in the European Union according to the official website. It is also important to highlight that in the following table are the 5 largest countries in extension of the world (Russia, Canada, United States, China and Brazil). As in the previous table, it is important to take into account the columns relating to Gross Domestic Product per capita in each of the countries and the Human Development Index.

When comparing the two tables we find that on average in the European Union, the gross domestic product per capita is 33,682 and the Human Development Index is 0.866. While in the second table where there are countries around the world gross domestic product per capita is 20,682 and the Human Development Index is 0.788. In regard to the gross domestic product per capita, the European Union is around 39% higher than the countries that are ready in the second table, and on the Human Development Index The European Union presents a 9% more than the countries of the second table. In addition, the European countries that could be accepted as potential members of the European Union have the values of per capita gross domestic product (11,109) and the Human Development Index (0.762) below the average displayed in the second table.

I think that if they are accepted within the European Union, these values could rise significantly as it happened to most of the countries that have gone by appending to the European Union.

It will be interesting to see what will be the performance of these two values for the now ex-Union Great Britain. I believe that the British politicians who were in favor of Brexit were unaware of this, or maybe they believe that they are going to be better than the average that would have the whole of the European Union. To review the values, the Great Britain is well above the average for the European Union, this is the gross domestic product per capita is 45,653 around 26% more than the average for the European Union and the Human Development Index is 0.907 around 4.5% above the European average. I only hope that these two indicators do not fall dramatically in a medium term for that has had success this output of the European Union.

Meanwhile here in Mexico, the next day (June 24th 2016) The Secretary of Finance and Public Credit (SHCP, for its acronym in Spanish for Secretaría de Hacienda y Crédito Público), Luis Videgaray; the Secretary of Economy (SE, for its acronym in Spanish for Secretaría de Economía), Ildefonso Guajardo and one of the deputy directors of the Bank of Mexico, Roberto del Cueto, " get out of bed early" and very early, at 8:00 a.m., local time of the Mexico City, held a press conference to give the following messages:

Luis Videgaray announces a cut in public expenditure of 31,715 million pesos (around 1,700 million USD), which does not include cuts to Mexican Petroleum Company (PEMEX for its acronym in Spanish for Petróleos Mexicanos). The previous amount, only 21,079 million pesos (1,100 million USD) near the 91.7% will correspond to current expenditure. This reduction is in addition to that had been announced in February by a number 132,300 million pesos (6,950 million USD) equivalent to 0.7 percent of the Mexican Gross Domestic Product. In addition, Luis Videgaray stressed that the Commission of changes (formed by the Ministry of Finance and the Bank of Mexico), will only act when the depreciation of the peso is very large and that came to affect the inflation target that have been proposed.

Ildefonso Guajardo stresses that the trade balance and current account of Mexico will not be affected since the commercial relationship between our country and the Great Britain is hardly 5,000 million USD per year, which represents only 0.7 per cent of trade that Mexico has with the world, by which ensures that it will continue with Ildefonso Guajardo negotiations now in a direct way with the Great Britain to continue and strengthen the commercial relationship that has up to now.

Roberto del Cueto mentions that the Bank of Mexico will wait until June 30th 2016, the date on which have their quarterly board to implement actions on monetary policy. For today, this meeting has already been carried out and effectively the Bank of Mexico opted for increasing 50 basis points the reference interest rate, to have a value of 4.25%. This action represents a restrictive monetary policy, in such a way that you want to pre-empt situations that jeopardize the inflation target that is foreseen for this year of 3 per cent.

From my humble point of view, the Great Britain has never been part of the European Union that it retains its own currency (pound sterling), which makes many of the decisions of monetary policy are still taking only by the Great Britain. The Brexit will affect more Britain to other countries. In the case of Mexico, the ads that apparently were taken as a pretext to Brexit so as to be able to correct mistakes that by itself were already present in the Mexican economy. The cut that made the SHCP is the largest that has been given since 2007. However, and despite the actions taken, the Mexican economy remains very vulnerable, but not only in the economic issue, it is now the social issue which has been undermine little by little, the downside of this is that the government has already been exceeded by far in question of the social problems that we have right now, and this is not because of external shocks. It is we can survive all the ineptitude that has shown the current Mexican government? We will have to see…

11 January 2016

Ente Nazionale Idrocarburi (ENI) enters triumphant to Mexico

On the basis of the Mexican Energy Reform, which was enacted on August 12nd 2013, and which was approved until December 11st 2013 by the Chamber of Senators, and immediately adopted by the Chamber of Deputies on December 12nd 2013, and constitutionally declared by the legislature on December 18th 2013, so that finally the Executive Branch the enact into law on December 20th 2013, as it appears in the Official Journal of the Federation (DOF, for its acronym in Spanish for Diario Oficial de la Federación, www.dof.gob.mx), so that it is not until now that begins in operation this Energy Reform, in the sense that the past December 1st 2015, has been signed the contract between the Secretariat of Energy (SENER, for its acronym in Spanish for Secretaría de Energía, www.sener.gob.mx), the National Commission of Hydrocarbons (CNH, for its acronym in Spanish for Comisión Nacional de Hidrocarburos, www.cnh.gob.mx) and the Italian company Ente Nazionale Idrocarburi, Società per Azioni (ENI, S.p.A.) (National Hydrocarbons Corporation) to comply with the contract in the second call of the call round one, which represents the granting of the first tenders to the private sector in the Mexican hydrocarbons sector, so ENI, S.p.A. has announced that it will invest around 1,100 million dollars (mdd) for the extraction of crude oil in the fields of Amoca, Miztón and Teocalli.

According to the CNH on its Internet homepage and in official statement, the Italian company ENI, S.p.A. is awarded the tender for the second call in the round one in the oil province called Southeast Watershed which comprises the Contractual area number 1. This area covers 67 km2 and includes the 3 fields Amoca, Miztón and Tecoalli, which contain reserves the type 2P, which means that it has 34 billion barrels of crude oil equivalent (MMbpce, for its acronym in Spanish for millones de barriles de petróleo crudo equivalente) for the field Amoca, 70 billion barrels of crude oil equivalent (MMbpce) for the field Miztón and 18 billion barrels of crude oil equivalent (MMbpce) for the field Tecoalli, in addition, 107 million barrels of light oil and 69 billion cubic feet of gas. These hydrocarbons are stored in areas of the Pliocene with a water strap of 33 meters of depth and 93 kilometers from the coast of the state of Tabasco, as mentioned the CNH.

According to what was said by the Secretary of Energy (SENER), Pedro Joaquin, "The company (ENI, S.p.A.) will be the first large-scale that comes to invest in Mexico under the new contractual model", as mentioned by the Commissioner President of the National Commission of Hydrocarbons (CNH), Juan Zepeda, "The company must invest 251 million dollars (mdd) in the first two years for the tasks of evaluation, despite that resources already tested in that area"; thus Juan Zepeda said that "From Today starts the transition phase of starting, with a duration of 90 days in which ENI will carry out the assessment of social impact and the studies that allow Set the baseline environmental". Federico Arisi, the executive vice president for the Americas of ENI International mentions "We are confident that our operation in Mexico will soon be considered as another of our successful projects", additionally Federico Arisi emphasis on saying that "for us is of great importance to start operations in Mexico with this project in the area one, which has very important reserves in the three discoveries that contemplates", and furthermore Federico Arisi confirms that "We have the best willingness to work in this country, where without a doubt we will give the best of our company, resources and experience, especially our capacity to develop projects in conventional waters with high efficiency and low costs using our technologies".

With all the above, the Mexican government hopes that the contracts awarded to date to the following companies: the Italian ENI, S.p.A., Argentina's Pan American Energy-E&P, and the US Fieldwood Energy-Petrobal, generate investments of 5,800 million dollars (mdd) in the next 25 years, which will be the minimum duration of the contracts.

Enrico Mattei was commissioned at the end of the Second World War to liquidate the public company Azienda Generale Italiana Petroli (AGIP), Italian General Company oil, that was founded in the year of 1926 by the Government of the Kingdom of Italy at the time of the apogee of fascism, which controlled the oil in Italy. However, he ignored these orders and encouraged the technicians and engineers to continue working because of the oil exploration to be had in the Po Valley in northern Italy, in addition to that would be discovered there to 1946 a large deposit of methane and small quantities of oil. An important detail is that Enrico Mattei, due to a great Italian nationalism, personally insisted and in turn got his company had the exclusivity of the exploitation of the area with the objective of preventing other foreign companies to undertake such exploitation.

In this way on February 10th 1953 founded to the Italian State company Ente Nazionale Idrocarburi, Società per Azioni (ENI, S.p.A.) (National Corporation of Hydrocarbons) with the main objective that the Italian State to compete directly with the oil companies of private capital, especially foreign ones. Enrico Mattei was the President of ENI until his death on October 27th 1962.

ENI, S.p.A. has followed a course similar to that which has been Petroleos Mexicanos (PEMEX), in the sense that since its beginning has had a great participation on the part of the state, however unlike PEMEX, in 1992 was converted into a Public Limited Company (private sector company) and the Italian State has been selling important part of equity in five phases between the years 1995 and 2001, although in the end have been left with an equity participation by more than 30% with the aim of continuing with an effective control of the company, in addition to that has the right to appoint the Chairman and the Chief Executive Officer (CEO) that for these dates are Giussepe Recchi and Paolo Scaroni respectively. Currently, listed in the Stock Exchange of Milan and with ADR's on the American Stock Exchange. ENI is now present in some 90 countries with almost 78,000 employees, being with this the largest Italian company of that country, its activities are in the oil sector, gas and petrochemical, but also produces electrical energy and engineering for the construction in the oil industry and with the sale of firm Snamprogetti to Saipem forays in engineering services offshore and onshore, that is precisely what is going to do to Mexico with the contract which it recently signed.

With the arrival of ENI, S.p.A. to Mexico as has been saying, represents a major step in the modernization of PEMEX. In the official page of the CNH, mentioned that the objectives of the Mexican Energy Reform is precisely to modernize and make more productive to the energy industry in Mexico. Additionally it has mentioned that there will be an increase in employment and the development of the country, in addition to reducing energy costs for the entire population. So I was thinking that if the Mexican government recognizes that until now has not been able to take this, why it want to continue to be the owner of this company so inefficient? Why does a scheme such as that which has precisely ENI?, that is, retain a small participation in the equity of the company (PEMEX) and the rest is left for that private capital to become part of the same company and probably everything they are looking for in terms of efficiency, modernization, transparency and profitability was given de facto. From what I have seen, in my humble opinion is that it is going to remain the same Inefficient and Corrupt company (PEMEX). I really hope I am wrong in this regard and that in the coming years they shout my big mouth with a situation totally contrary to what it is today. We will have to see…

9 December 2015

Pemex raids into the US market

With domicile in 7922 Park Place Boulevard, Houston, Texas, United States, the present December 3th, 2015, the parastatal company Petroleos Mexicanos (PEMEX), begins operations in the competed American market. This will be the first of 5 service stations that the businessman of Pakistani origin Adam Virani, plans to open in the United States, the business model is through the franchise that offers the parastatal PEMEX. At the opening ceremony were Jose Carrera, Director of Corporate Alliances and New Business of PEMEX and Marcelo Parizot, Director of Marketing and industrial processing of PEMEX, as well as the Governor of Campeche Rafael Moreno (namesake of the Puebla’s Governor, Rafael Moreno, please do not confuse them), among other personalities.

According to the official website of PEMEX in its National Newsletter 117, where it is mentioned that, "The city of Houston was chosen, in this initial stage, due to its high population of Latin origin, specifically Mexican, as well as being a city with a high level of competition in the gas driven market. Furthermore, it is an ideal place to test the penetration of the Pemex brand because it is the market most of the world competed, involving a significant number of future competitors in Mexico".

(http://www.pemex.com/saladeprensa/boletines_nacionales/Paginas/2015-117-nacional.aspx).

In addition to this newsletter is the claims that, "The opening of the stations of Pemex is with franchise investment of third parties, who are the owners of these service stations and determine the retail selling prices of the fuels, in accordance with market conditions in Houston. It should be noted that the gasoline that will be sold in these service stations will come from the American wholesale market. This opening is part of a strategy of PEMEX to expand in the United States in accordance with its mandate to focus on activities that will generate economic value in the environment of competition resulting from the Energy Reform".

(http://www.pemex.com/saladeprensa/boletines_nacionales/Paginas/2015-117-nacional.aspx).

Some data that we have to remember with regard to the operation of the business model that has PEMEX with their franchises. With the desire to cover all of the Mexican territory, on February 1st, 1992, it begins to sell gas stations in a format of franchises in such a way that private investors begin to handle the service stations with the mark of PEMEX throughout Mexico, the above is a model very similar to the system that has just started in the United States.

In addition to the above, the Energy Reform that was promulgated on August 12nd, 2013, and a year later on August 11st, 2014, the Law of Petroleos Mexicanos was promulgated, is precisely where there is the pattern for that franchising can be sold abroad, where it is this first franchise outside of the national territory.

However for PEMEX the competition is not so simple, because between the companies Exxon, Shell, Chevron and some others have close to 160 thousand gas stations in the United States, with very competitive prices as well as the quality of the gasolines that there are sold.

As if that were not enough, the competition does not end here, there is to see how we can find the reserves of crude oil with which Mexico account, it then presented a table which shows the top 20 countries with regard to their proven oil reserves, it is noted that Mexico is located in the 18th position:

|

Rank |

Country |

Reserves (barrels) |

Year |

|

1 |

Venezuela |

298'350'000,000 |

2011 |

|

2 |

Saudi Arabia |

267'501'000,000 |

2010 |

|

3 |

Canada |

178'100'000,000 |

2009 |

|

4 |

Iraq |

177'500'000,000 |

2010 |

|

5 |

Iran |

137'600'000,000 |

2009 |

|

6 |

Kuwait |

101'500'000,000 |

2009 |

|

7 |

United Arab Emirates |

97'800'000,000 |

2009 |

|

8 |

Russia |

79'000'000,000 |

2009 |

|

9 |

Libya |

46'000'000,000 |

2009 |

|

10 |

Nigeria |

36'220'000,000 |

2009 |

|

11 |

Kazakhstan |

30'002'000,000 |

2009 |

|

12 |

Argentina |

29'500'000,000 |

2015 |

|

13 |

Qatar |

27'190'000,000 |

2009 |

|

14 |

United States |

17'320'000,000 |

2014 |

|

15 |

China |

15'700'000,000 |

2009 |

|

16 |

Algeria |

15'150'000,000 |

2009 |

|

17 |

Angola |

13'500'000,000 |

2009 |

|

18 |

Mexico |

12'692'000,000 |

2010 |

|

19 |

Brazil |

12'620'000,000 |

2009 |

|

20 |

Ecuador |

6'990'000,000 |

2012 |

In addition in accordance with article 10 of the Regulation of the Statutory Law of article 27 of the Constitution in the Oil Industry:

1) The reports of quantification of reserves of Mexico, prepared by Petroleos Mexicanos, must be approved by the National Commission of hydrocarbons (CNH, for its acronym in Spanish for Comisión Nacional de Hidrocarburos).

2) The Energy Secretariat (SENER, for its acronym in Spanish for Secretaría de Energía) be recorded and will be announced the hydrocarbon reserves of Mexico based on the information provided by the CNH. So the last June 30th, 2015, the CNH ruled favorable reservations 2P and 3P published by Petroleos Mexicanos. That information indicates the following:

At January 1st, 2015, the proven hydrocarbon reserves amounted to 13,017 million barrels of crude oil equivalent (MMbpce, for its acronym in Spanish for millones de barriles de petróleo crudo equivalente), of these the 75% corresponds to crude oil; 8% to condensed and plant fluids and 17% on dry gas equivalent.

Of the total proven reserves, 8,490 MMbpce or 65% are developed, i.e. reservations that are expected to be recovered from existing wells including the reservations that can be produced using the existing infrastructure and the implementation of modest investment. The 71% of developed reserves are located in the complex Ku-Maloob -Zaap, Cantarell and Antonio J. Bermúdez and in the fields Jujo-Tecominoacán, Tsimin-Xux, Ixtal, Xanab, Kuil and Kambesah.

The proved undeveloped reserves, i.e. volumes that require additional goods and infrastructure for its production, amount to 4,527 MMbpce or 35% of proven reserves. The 53% of these reserves are concentrated in the complex Ku-Maloob -Zaap and Antonio J. Bermúdez, as well as the fields Ayatsil, Jujo-Tecominoacán, Kayab, Pit, Xux and Xanab.

With all of the above is as PEMEX began operations in the United States, however, and almost like an insult to the Mexican people, the price per gallon of unleaded gasoline of 95 octane (the comparable in Mexico is the so-called Magna) was launched with this service station is USD 1.549, which means that a liter will cost in the United States USD 0.4087, while in Mexico, the price per liter is USD 0.8192, which represents around 50% cheaper in US than in Mexico. In the case of diesel, a gallon at that service station selling for USD 2.05 or what is the same a liter of diesel is in USD 0.5541, while that in Mexico the liter of diesel is in USD 0.8573, for this case the diesel in the United States is around 35% cheaper than in Mexico. As I mentioned a while ago, this is a mockery to the Mexican consumer, because up to this point we realize that we are paying a tax on gasoline use in addition to the value-added tax (VAT or IVA for its acronym in Spanish for Impuesto al Valor Agregado). We can do with this, if in addition to the majority of people that use car in Mexico, the gasoline represents a perfectly inelastic good and due to this PEMEX takes advantage of this situation. I think it is time to make this company completely private, so that another companies reach the Mexican oil market and compete between them, with the purpose that the prices now if to become lower as in the United States, that is the unique solution, and that would represent a real and effective Energy Reform. Does not seem that way? We will have to see…

25 September 2015

Martin Winterkorn and his responsibility at the head of Volkswagen, AG.

Less that there might do a high executive of a company of the size, the importance and the prestige of the Group Volkswagen AG., it was to resign, as it made it the Chief Executive Officer (CEO) of the corporate the Professor Dr. Martin Winterkorn. I recognize the great value that he had (that in Spanish would be said of another form and I think that some translation does not exist) and that it represents what is to take the responsibility in his hands. Independently for if the Dr. Winterkorn is directly responsible or if at least he had knowledge of what was going on to Volkswagen's interior and all its subsidiaries. Precisely in this moment on September 23th, 2015, after the scandal of last few days, the Board of Directors in its division of Supervision has just finished its meeting and this one is the official communiqué that they announced in press conference (I took the following paragraphs of Volkswagen Group's corporate web site):

1. The Executive Committee takes this matter extremely seriously. The Executive Committee recognizes not only the economic damage caused, but also the loss of trust among many customers worldwide.

2. The Executive Committee agrees that these incidents need to be clarified with great conviction and that mistakes are corrected. At the same time, the Executive Committee is adamant that it will take the necessary decisive steps to ensure a credible new beginning.

3. The Executive Committee has great respect for Chairman Professor Dr. Winterkorn’s offer to resign his position and to ask that his employment agreement be terminated. The Executive Committee notes that Professor Dr. Winterkorn had no knowledge of the manipulation of emissions data. The Executive Committee has tremendous respect for his willingness to nevertheless assume responsibility and, in so doing, to send a strong signal both internally and externally. Dr. Winterkorn has made invaluable contributions to Volkswagen. The company’s rise to global company is inextricably linked to his name. The Executive Committee thanks Dr. Winterkorn for towering contributions in the past decades and for his willingness to take responsibility in this criticall phase for the company. This attitude is illustrious.

4. Recommendations for new personnel will be presented at the upcoming meeting of the Supervisory Board this Friday.

5. The Executive Committee is expecting further personnel consequences in the next days. The internal Group investigations are continuing at a high tempo. All participants in these proceedings that has resulted in unmeasurable harm for Volkswagen, will be subject to the full consequences.

6. The Executive Committee have decided that the company will voluntarily submit a complaint to the State Prosecutors’ office in Brunswick. In the view of the Executive Committee criminal proceedings may be relevant due to the irregularities. The investigations of the State Prosecutor will be supported in all form from the side of Volkswagen.

7. The Executive Committee proposes that the Supervisory Board of Volkswagen AG create a special committee, under whose leadership further clarifying steps will follow, including the preparation of the necessary consequences. In this regard, the Special Committee would make use of external advice. Further details about this will be decided at the Supervisory Board meeting on Friday.

8. The Executive Committee is aware that coming to terms with the crisis of trust will be a long term task that requires a high degree of consistency and thoroughness.

9. The Executive Committee will work on these tasks together with the employees and the Management Board. Volkswagen is a magnificent company that depends on the efforts of hundreds of thousands of people. We consider it our task that this company regains the trust of our customers in every respect.

The words of now ex-CEO of Volkswagen Group in which it assumes his total responsibility in front of the Board of Directors' meeting are: “I am shocked by the events of the past few days. Above all, I am stunned that misconduct on such a scale was possible in the Volkswagen Group. As CEO I accept responsibility for the irregularities that have been found in diesel engines and have therefore requested the Supervisory Board to agree on terminating my function as CEO of the Volkswagen Group. I am doing this in the interests of the company even though I am not aware of any wrong doing on my part. Volkswagen needs a fresh start – also in terms of personnel. I am clearing the way for this fresh start with my resignation. I have always been driven by my desire to serve this company, especially our customers and employees. Volkswagen has been, is and will always be my life. The process of clarification and transparency must continue. This is the only way to win back trust. I am convinced that the Volkswagen Group and its team will overcome this grave crisis."

Not even the message that Dr. Winterkorn gave yesterday (September 22nd, 2015) on the situation so complicated by that there was happening with Volkswagen AG, could save him, since for this Friday on September 25th, 2015, he was expecting to be confirmed in his position for other 3 years, until 2018, that he has been in this post from 2007. In words of the Dr. Winterkorn: “The irregularities that have been found in our Group’s diesel engines go against everything Volkswagen stands for. At present we do not yet have all the answers to all the questions. But we are working hard to find out exactly what happened. To do that, we are putting everything on the table, as quickly, thoroughly and transparently as possible. And we continue to cooperate closely with the relevant government organizations and authorities. This quick and full clarification has the highest priority. We owe that to our customers, our employees and the public. Manipulation and Volkswagen – that must never be allowed to happen again. Millions of people all over the world trust our brands, our cars and our technologies. I am deeply sorry that we have broken this trust. I would like to make a formal apology to our customers, to the authorities and to the general public for this misconduct. We will do everything necessary to reverse the damage. And we will do everything necessary to win back trust – step by step. In our Group, more than 600,000 people work to build the best cars for our customers. I would like to say to our employees: I know just how much dedication, how much true sincerity you bring to your work day after day. Therefore, it would be wrong to cast general suspicion on the honest, hard work of 600,000 people because of the mistakes made by only a few. Our team simply does not deserve that. That is why we are asking for trust as we move forward: We will get to the bottom of this. We are working very hard on the necessary technical solutions. And we will do everything we can to avert damage to our customers and employees. I give you my word: we will do all of this with the greatest possible openness and transparency.”

Meanwhile here in Puebla, where one finds one of the biggest plants of the Volkswagen's corporate out of Germany, has been speculating on the possible closing of the Puebla plant after the scandal. Due to the fact that this scandal concerns directly the Poblan plant since several of the models involved as the Jetta, the Golf and of exclusive production for the Bettle Coupé and the Beetle Cabriolet here in Puebla, Mexico. At least if the Puebla plant does not close, the economy of the State is intimately tied by Volkswagen. The governor of Puebla, Rafael Moreno, who has his aspirations to assume the presidency of Mexico for 2018, has seen with very much displeasure the news and even already looking for a meeting with the high executives of Volkswagen de Mexico, S.A. de C.V., to analyze the possible consequences for the State of Puebla could have of the "Emissionsgate" (the scandal of the emissions).

The numbers that concern the current scandal in which there is involved the Group Volkswagen are the following ones:

Under the command of the Professor Dr. Martin Winterkorn, last year (2014) the group obtained historical earnings for 11 billion Euros and a business volume of about 202,000 million Euros for the whole consortium.

For the first semester of this 2015, Volkswagen finally could displace Toyota of the first place of sales that was showing the Japanese factory.

Audi in 1989 his first model presented with a motive Turbocharged Direct Injection (TDI) for the diesel engines, which makes them more powerful and with fewer emission. In 2014 they were done 25 years of this. For what from this date, Audi has produced 7.5 million cars with the TDI engines, only in 2013, 600,000 vehicles were produced.

The past Friday, September 18th, 2015, the United States Environmental Protection Agency (EPA) revealed that 482,000 cars made between 2009 and 2015 of the brands Volkswagen and Audi were equipped with a software that was manipulating the results of the emission with the purpose of issuing false information.

The possible cost, if it is that there turns out to be guilty the Group Volkswagen of manipulating the software for the models with Turbocharged Direct Injection (TDI) for the turbodiesel technology, it will be of about 18 billion dollars.

For Volkswagen de Mexico, S.A. de C.V., which is a plant located in the State of Puebla in Mexico and that shelters 14,646 employees, according to the Mexican Association of Automotive Industry (AMIA, for its acronym in Spanish for Asociación Mexicana de la Industria Automotriz) this scandal has represented a loss of about 2.6 million UD dollars every day of its exports towards USA, all that on the sales of the vehicles having engines with diesel technology (TDI).

Only the market in US for the models with diesel technology, both of Volkswagen and of Audi is 23%.

For the American market, 500,000 cars were sold with diesel engines (TDI) on the part of Volkswagen, which might be involved in the scandal.

The shares of the Volkswagen Group also met affected. In The Frankfurt Stock Exchange the name of the share for market stock is Volkswagen AG VZ, the ISIN is DE0007664039, its WKN is 766403 and its key symbol is VOW3. The past Friday, September 18th, 2015, the share closed in 162.40 Euros per share, but for Monday, September 21st, 2015, the share closed in 132.20 Euros per share, what it represent a fall of 18.60%. For Tuesday, September 22nd, it continues the fall to close in 106.00 Euros per share, which represented a fall of 19.82%. The previous thing was a fall in two days of 34.73%. Maybe with the advertisement of the resignation of the Professor Dr. Martiin Winterkorn, this September 23th, 2015, the share recovered marginally in 5.19% reaching a closing on the stock market of 111.50 Euros per share.

The most serious thing of everything this scandal represents the situation that would have to avoid Germany, since it might affect his national economy, in Germany there are 29 plants of the consortium and its work force is near to 274,000 employees.

The Emissionsgate teach us that the mechanisms of Corporate Governance work in a correct way, since the Board of Directors in its commission of Supervision took the control in the matter and acted in an immediate and effective way. Nevertheless I want to recognize and to applaud the great courage that the Professor Dr. Martin Winterkorn with his decision to give up and leave in Matthias Müller's hands (nowadays chief of Porsche) the future of the consortium Volkswagen, with the aim to extract afloat to the company of the current crisis. As curious information, the prominent figures who initiated all that are Peter Mock and John German of the group environmentalist Clean Transportation, a few total strangers. Ironic, isn’t it? I think that this will fix up in a best possible way, or at least I want to think it because I live here and the economy of this region depends on this plant, nevertheless, though the things could improve will come difficult years for us. Only I hope that it is the minor possible time. We will have to see…

1 June 2015

Index to move closer to the Social Market Economy

Businesses are the economic engine of the countries and therefore of society. Hence arising from both employment and income we enjoy many of us. If that wasn't enough, both economic growth and economic development come from corporations, because of this, it would be very difficult to perceive the world without the same. For this reason, you must generate indicators of industrial activity in order to be able to measure in some way the situation in which companies are located with respect to the overall economic indicators of a country, in addition to that are of the utmost importance for the proper functioning of signatures, because that would guarantee an increase in the productivity, competitiveness and on all its stay in the market. In addition, it is important to take into account the economic order in which companies operate because this would be a determining factor for the strategies in terms of competitiveness and productivity of firms, as well as how they interact with the society and some other agents (such as for example the State) that might be involved with them.

One of the Economic Orders that has boomed in the last few decades is the of the Social Market Economy (ESM), to which several authors call the third way between the command economy (socialism), which is regarded as highly ineffective, and the free market economy (capitalism) own of the nineteenth century, to which he had also considered inefficient. According to the philosophy of the Social Market Economy, mentions that it is not enough that there is an ethical order in the form of the functioning of the economy which is considered as the basis of any stable society, if not that it is felt that the Government should take a more active participation, in such a way that could provide a permanent social policy (Marktanner & Winterberg, 2009). The ESM focuses its efforts in order to stress that this is a model in which the participation of society is crucial.

Alfred Muller-Armack is the first to coin the term of Social Market Economy (ESM), in 1947 they released their book Leadership in the economic policy and market-oriented economic policies (Wirtschaftsordnung und Wirtschajtpolitik, by its title in German), and which mentions with the goal of creating an economy that from the base of the competition combines free initiative with a social progress thereby ensuring the economic capacity. Here is presented in a way a theoretical scheme of what it is called the third way, namely, the two that were in force at that time were socialism (command economy) and capitalism (market economy). After the Second World War, the resurgence of the destroyed Germany, originated the idea that the economy should have as spine the free market but should be headed by the social criteria, this is, is an economic system hybrid between the freedom that should have the market and the steering by the State in economic policies very linked to the society. Alfred Muller-Armack called this the Formula Irena that refers to the Greek goddess of peace Eirene (daughter of Zeus). This is due to the fact that the ESM conceives of social peace as the result of a well-functioning market economy with social participation and humanist by part of the State.

The theories presented by Alfred Muller-Armack, are a combination of elements of the Ordoliberalism (also called German neoliberalism), of the liberalism of the sociological and Social Doctrine of the Church.

Walter Eucken (considered a the intellectual father of ordoliberalism, which raises to the so-called School of Freiburg, Freiburger Schule), which is joined by other intellectuals of the era as: Franz Böhm, Hans Großmann-Doerth and Leonhard Miksch, later they were also joined Wilhelm Röpke, Alexander Rustow, Alfred Muller-Armack and Ludwig Erhard, which are a group of economists that make up finally the movement of the Social Market Economy (Soziale Marktwirtschaft).

With the formation of the School of Freiburg, is gestured the German Miracle, with the purpose to get out of the crisis so severe that he faced at the end of the Second World War as well as reestablish the economic and social order.

The best way to argue about whether in Mexico, there is the Social Market Economy or that both come close to that economic order can be done through the creation of an Index to move closer to the Social Market Economy.

The Bertelsmann Foundation in conjunction with the Center for Research on Applied Economics at the University of Münster in Germany, the foundations have been set on the construction of Index of the Modern Market Economy, in which they proposed to do several surveys to verify that both the countries are approaching toward the social market economy. This index is based on four key areas in which they have carried out their studies, these are:

1. Competitiveness and efficiency of the markets: (a) open markets, b) cash price system and c) Competition.

2. Efficiency and property rights. (a) Rights of ownership, (b) freedom of contract and c) responsibility.

3. Economic and ecological sustainability. (a) financial stability, b) consistency in policy and c) efficient environmental protection.

4. Social Inclusion: (a) labor market cash and b) social mobility.

To conform with the above an index to Mexico can be found several situations with respect to each of the components of them.