VIPsight - June 2013

COMPANIES

Rate change at Deutsche Bank reprimanded

The “quick-fix action” with which the Deutsche Bank surprisingly increased its capital by around three billion euros in late April has made shareholders “suspicious,” says Union Investment. It was always stressed that the bank did not need fresh capital, though it had long been at the bottom of the comparison group, Ingo Speich wondered, asking further why the need was suddenly seen for a capital increase, whereas with a core capital ratio of 8.8 percent the bank had been well under way at the end of March. While the Union Investment fund manager and other shareholder representatives also found words of praise for the capital-market transaction, they almost unanimously denounced the bank's continued high legal risks and public scandals. It has been struggling with countless lawsuits from disgruntled clients for many years. To this end, it has made provisions in the billions. High employee bonuses that are according to reasoning by shareholder representatives grossly disproportionate to the dividend amount also meet with a negative response.

The “quick-fix action” with which the Deutsche Bank surprisingly increased its capital by around three billion euros in late April has made shareholders “suspicious,” says Union Investment. It was always stressed that the bank did not need fresh capital, though it had long been at the bottom of the comparison group, Ingo Speich wondered, asking further why the need was suddenly seen for a capital increase, whereas with a core capital ratio of 8.8 percent the bank had been well under way at the end of March. While the Union Investment fund manager and other shareholder representatives also found words of praise for the capital-market transaction, they almost unanimously denounced the bank's continued high legal risks and public scandals. It has been struggling with countless lawsuits from disgruntled clients for many years. To this end, it has made provisions in the billions. High employee bonuses that are according to reasoning by shareholder representatives grossly disproportionate to the dividend amount also meet with a negative response.

Aixtron: Through drastic treatment back to its former strength

With a five-point plan and severe cuts, Aixtron SE wants to make its way back to sustainable profitability from the current bleak outlook: At the AGM in May, CEO Martin Goetzeler announced the elimination of about 20 percent of the jobs in Germany. He also wants to reduce operating expenses by 20 percent from the previous year.

Another point is the optimization of process and project procedures, especially in product development, and review of the service business. The company from Herzogenrath also aims to focus more on its core competency and integrate external partners more intensively. The specialized plant manufacturer wants thus to regain its leadership in technology for LED production.

The TecDax company had a disastrous start to 2013: in the first quarter losses exceeded sales. In view of a loss of 145 million euros last year, shareholders have no dividend. Despite the current situation Aixtron is, according to the company's board, free of debt. The chief executive did not want to give a forecast for 2013, given the uncertain market outlook. The reason for the poor result was, among other things, the drop in demand from LED manufacturers.

Jenoptik: Optimistic thanks to foreign demand

One of the few East German TecDax companies weakens: Jenoptik AG is suffering from reduced demand for lasers and optical systems from the semiconductor industry. The technology group's proceeds declined in the first quarter of 2013 by approximately four percent to €132 million. However, the board maintains its positive forecast of up to five percent revenue growth for the current year.

According to the Board the company is less sensitive to economic cycles due to the internationalization of business and will not immediately come into the red in the event of fluctuations. Thus, demand from abroad is still stable, especially from the U.S. and Chinese auto sectors. In 2014 Jenoptik again expects a turnover increase of ten percent. In 2017 the Thuringians want to cross the 800-million-euro annual turnover threshold. Last year, sales amounted to €585 million.

CEWE Color: Successfully reoriented

CEWE Color Holding AG continues to be on the growth track: the photo service provider is off to a good start in the first quarter and has confirmed its forecast for the full year 2013. In the usually weakest quarter the SDax company's turnover increased by almost twelve percent to around €107 million. Shareholders can be pleased too: the dividend rises to 1.45, from 1.40 in the previous year.

The online printing sector showed particularly strong growth, of more than 85 percent. The photofinishing segment has gained about 6 percent. The company has successfully adapted to the “digital revolution”: at the turn of the millennium the group was positioned more as a developer of analog photos, but now offers high-margin value-added products in digital photography - such as the CEWE photo book, the growth driver of the Group. Customers can order this printed photo album in various designs over the Internet and stock it online their with own digital photos.

The German Mittelstand

Unloved guarantor of prosperity

Why Germany supports the euro

Anyone looking at Germany from outside the country might well sometimes be troubled. The only issue that still makes for excitement in this country is of central importance for Europe - if not indeed for the world economy: the debate about the euro. Meanwhile, a party has even been established that is clamouring for the “exit” of Germany from the monetary union, as if it were a club membership. It wants to compete in the national elections in September 2013. In addition, in regular surveys a large number of German citizens “wants the Deutschmark back.”

But closer examination shows there is no cause for concern. In the population, the new party has little support: in surveys, they finally came to two percent, and would therefore not even make it into the Bundestag under German electoral law. At the same time, the approval ratings for Chancellor Merkel, who wants to preserve the euro with carrot and stick, are stable at a high level. And what is true for the majority of citizens, also applies to the majority of companies. For they know very well the dangers leaving the euro involves.

First, increasing transaction costs would fall to the companies, because they would again have to hedge against currency fluctuations and pay exchange fees. Much more serious, however, would be a dramatic appreciation of the German currency against the euro and other currencies. An export slump with rising unemployment would be the inevitable result. And all emotions aside, this is no real alternative. The euro, even if it is not loved, is accepted, at least as a guarantee of prosperity.

Buhlmann's Corner

They called an AGM, and nobody came

The king called and ... a few came

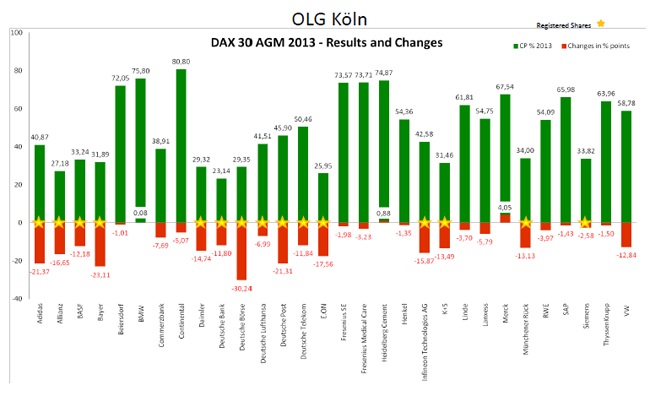

The German DAX general meetings are over, and attendance was lower than previous years by up to 30-40%. Is everything in Germany so good that it no longer needs shareholder democracy? In VIPsight you can now find a summary of the figures.

The German DAX general meetings are over, and attendance was lower than previous years by up to 30-40%. Is everything in Germany so good that it no longer needs shareholder democracy? In VIPsight you can now find a summary of the figures.

The top rate came (of course) at the Deutsche Bank, 22%, but Adidas and Bayer also had surprising shortfalls in attendance. Even the OBO/NOBO shadow system in the U.S. seems more transparent than the European depositary chains. Undoubtedly, the consultants and registrars, Ipreo or Georgeson, have made great efforts, as have the many busy hands in the depositary chains – especially the troops of Broadridge – and are not the cause of the missing votes, and thus the vast chance of random majorities. With a few billion purchased or borrowed votes the DAX companies are now fair game, and the superficial commentators have identified the Higher Regional Court in Cologne as the source of the problems.

In one memorable case, the court had applied the long-standing practice of the WpHG (German Securities Exchange Act) rules as the law specified but no one had yet done. Since the case is still pending and no one was sure how he had to act ... obviously, many simply stopped acting.

The real causes I see in the missing message to investors – no one knows or has noticed THAT, although his voting messages were sent, they were not received ... if they were ever interested in voting – and secondly in the (completely unnecessary) complexity of the global (and also domestic) depositary chains. There is a huge potential for improvement here: after years of permanent cost savings we are now also facing the consequences, as well the need to take a big step now or simply to be satisfied with what has been achieved.

Curiosities occurred on the very edge: the candidate for the chair of the Lufthansa Supervisory Board withdrew his withdrawal of candidacy – and was elected. Truly historic! For the same Wolfgang Mayrhuber is also chairman at Infineon, where he was elected as a result of a shareholder revolt originally aimed at the renewal of the chair.

Deutsche Telekom made history with the first offer of a dividend in kind in the form of shares (stock-dividend), and was extremely successful with a cash rate of (only) 62% cash and 38% stock dividend. You have to not think it, but just do it.

Volkswagen – still in the DAX although even more so than BMW long a family operation with listing – is one of the exotics, like ThyssenKrupp, which simply destroyed market capital in two international investments. And yet, the Supervisory Board remained unpunished at the AGM – the chair was replaced later by the Krupp Foundation, with its right to appoint. So the father of ThyssenKrupp and even more of the German Corporate Governance Code was driven out into the desert, scapegoat fashion. There would be many other absurdities to tell, like SAP, despite poor earnings figures, receiving only praise by the shareholders, or the Commerzbank collecting capital increases just as fast as it destroys the capital again in mergers – not a compelling business model for a bank, but the chairman is still chairman of the German Corporate Governance Code Commission. But who really wants to know, apparently fewer than last year – who asks his depositary “are my share votes just sent off, or do they also arrive at the vote?”

It used to be different: The king called all, and all came – so it was in 1913 on German 2 and 3 Mark coins; and after all that’s hardware, or, only cash is real.

http://de.wikipedia.org/wiki/An_Mein_Volk

http://www.muenzkatalog-online.de/katalog/muenzen/muenze_597.html

Mr German Corporate Governance – a tribute

When he came into the world in 1943, it was as it was for Robert De Niro, Mick Jagger, Roy Black and Silvia of Sweden – they were born into a bloody world.

When he came into the world in 1943, it was as it was for Robert De Niro, Mick Jagger, Roy Black and Silvia of Sweden – they were born into a bloody world.

Sheep is the mythical animal and Water the element for a person born on this day, 29 May, if we consider the very old art of Chinese astrology.

When he was 20 years old, with his university entrance qualifications under his belt, the New Zealander Edmund Hillary, together with the Nepalese Tenzing Norgay, reached the highest point on earth for the first time – on 29 May, his birthday.

When he joined Deutsche Bank, Hermann Josef Abs was still the model for the bank and for bankers – then he saw Alfred Herrhausen come, and all too violently go. At DB he had found a corner that he worked, led and took charge of for decades – now only his corner has survived in the German banking world, and today, with nearly 44 billion in assets under management and 300 million in commissions, is the last asset manager of a bank. When in 2004 the Deutsche took over the last shares of the asset manager once confirmed the day after his birth, his fate was decided backstage at a general meeting.

The one who sent him away became for decades a problem for the bank. He instead went and acted on what he had seen – he wanted to make the world better and more decent, to balance out the various currents in the same and opposite directions as skilfully as good corporate governance requires. He was Mr Corporate Governance Germany, though preferably on the golf course and not with tuba and trombone on the concert stages of these issues. He kicked and stabbed, he won and moved on – leaving by the roadside few corpses, but many of the chastened. I say thank you to him for many a lesson, for many a strategic idea, for what he did – because it had to be done. I will continue to pay attention to what comes between the words on his lips, for that is where his thoughts and the next thing he will say and do are.

He has just had a birthday – we salute Christian Strenger.

70 years young – my wishes are: stay fresh, healthy, bright-eyed and bushy-tailed for good corporate governance.

Other children of 1943 are Lech Walesa, Horst Köhler and Jil Sander “Queen of the Less”....

ACTIONS CORNER

Schering acquisition has a sequel for Bayer

The acquisition of Schering more than six years ago is to cost Bayer €300 million more. A ruling by the Berlin Regional Court in first instance says shareholders, who received €89.36 per share through the acquisition by the pharmaceutical and chemical company under the then control agreement, will now get €124.65, announced specialist corporate-law firm Dreier Riedel. In addition, the annual compensation was increased by €1.49 to €5.11. Moreover, the difference in the settlement must bear interest from 27 October 2006. By the decision of the Berlin Regional Court, Schering minority shareholders were confirmed in their legal opinion that they had been pushed out of the company far under value, said Peter Dreier. A Bayer spokesman said on 6 May the Group continues to hold the former payment appropriate. In addition, an opinion on the information had been rejected. A spokeswoman for the Berlin Regional Court was unwilling to comment on the proceedings.

The acquisition of Schering more than six years ago is to cost Bayer €300 million more. A ruling by the Berlin Regional Court in first instance says shareholders, who received €89.36 per share through the acquisition by the pharmaceutical and chemical company under the then control agreement, will now get €124.65, announced specialist corporate-law firm Dreier Riedel. In addition, the annual compensation was increased by €1.49 to €5.11. Moreover, the difference in the settlement must bear interest from 27 October 2006. By the decision of the Berlin Regional Court, Schering minority shareholders were confirmed in their legal opinion that they had been pushed out of the company far under value, said Peter Dreier. A Bayer spokesman said on 6 May the Group continues to hold the former payment appropriate. In addition, an opinion on the information had been rejected. A spokeswoman for the Berlin Regional Court was unwilling to comment on the proceedings.

AGM Dates

| Company | Event | Date | Time | Place | Address | Published on |

| DAX | ||||||

| SAP AG | ord. AGM | 04.06.2013 | 10:00 | 68163 Mannheim | Xaver-Fuhr-Straße 150, in der SAP Arena | 26.04.2013 |

| The Agenda for the ordinary AGM of SAP AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. SAP AG earned balance-sheet profits of €6,603.88m last business year. Of the profits, 1,013.37m is to be paid out as dividend, €500m allocated to reserves and €5,090,51m carried forward to a new account. The Company shall be authorized to purchase its own shares and use them, to the exclusion of shareholders' subscription and tender rights. | ||||||

| TecDAX | ||||||

| ADVA Optical Networking SE | ord.AGM | 04.06.2013 | 11:00 | 98617 Meiningen | Georgstraße 1, im Hotel Sächsischer Hof | 24.04.2013 |

| The Agenda for the ordinary AGM of ADVA Optical Networking SE starts with the usual items, like presentation of annual accounts and discharge to the company bodies. The profits of €20.28m are to be fully carried forward to a new account. .Elections to the Supervisory Board are to be held. The variable remuneration of the Supervisory Board for fiscal 2012 and the fixed remuneration of the Supervisory Board for fiscal 2012 and subsequent years is to be fixed. The authorized capitals 2008/III and 2009/I are to be cancelled A new authorized capital of €23.91m (Authorized Capital 2013/I) is to be created, with the possibility of excluding subscription rights. The existing Conditional Capital 2003/2008 is to be reduced to €2.23m. The extension of the authorization to issue stock options (stock option programme 2011) is to be decided. For this, the existing Conditional Capital 2011/I is to be increased to €2.55m. Additionally, several charter amendments are to be decided. | ||||||

| JENOPTIK AG | ord.AGM | 04.06.2013 | 11:00 | 99423 Weimar | UNESCO-Platz 1, im congress centrum neue weimarhalle | 24.04.2013 |

| The Agenda for the ordinary AGM of JENOPTIK AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. JENOPTIK AG earned balance-sheet profits of €22.66m last business year. Of the profits, €10.3m is to be paid out as dividend and €12,36m carried forward to a new account.. Furthermore, the Company is to be authorized to issue option and / or convertible bonds, with the possibility of excluding subscription rights. For this, conditional capital in the amount of €28.6m (Conditional Capital 2013) is to be kept available. The existing authorization to issue option and / or convertible bonds and Conditional Capital 2009 are to be cancelled. Additionally, several charter amendments are to be decided. | ||||||

| Nordex SE | ord.AGM | 04.06.2013 | 11:00 | 18055 Rostock | Lange Straße 40, im Konferenzzentrum des Radison Blu Hotels | 24.04.2013 |

| The Agenda for the ordinary AGM of Nordex SE starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Elections to the Supervisory Board are to be held. | ||||||

| MorphoSys AG | ord.AGM | 04.06.2013 | 10:00 | 80636 München | Lazarettstraße 33, im Konferenzzentrum München, Hanns-Seidel-Stiftung | 16.04.2013 |

| The Agenda for the ordinary AGM of MorphoSys AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. The profits of €3.12m are to be fully carried forward to a new account. . An amendment to the authorization to issue convertible bonds based on the decision of the General Meeting of 14 May 2008 to avoid deviating profit entitlement of shares is to be adopted. A new authorized capital of €2.34m (Authorized Capital 2013/I), with the option of excluding subscription rights, is to be created. Additionally, several charter amendments are to be decided. | ||||||

| Kontron AG | ord.AGM | 05.06.2013 | 10:00 | 85356 Freising | Luitpoldanlage 1, in der Luitpoldhalle | 25.04.2013 |

| The Agenda for the ordinary AGM of Kontron AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Kontron AG earned balance-sheet profits of €17.92m last business year. Of the profits, €2.22m is to be paid out as dividend and €15,69m carried forward to a new account.. Approval of the system of executive remuneration is to be decided. Elections to the Supervisory Board are to be held. | ||||||

| STRATEC Biomedical AG | ord.AGM | 06.06.2013 | 14:00 | 75172 Pforzheim | Waisenhausplatz 1-3, im CongressCentrum Pforzheim, Mittlerer Saal | 29.04.2013 |

| The Agenda for the ordinary AGM of STRATEC Biomedical AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. STRATEC Biomedical AG earned balance-sheet profits of €26.1m last business year. Of the profits, €5.86m is to be paid out as dividend and €20,24m carried forward to a new account. Approval of the system of executive remuneration is to be decided. The remuneration of the Supervisory Board is to be re-regulated. Furthermore, the conclusion of a control and profit-transfer agreement between STRATEC Biomedical AG and Stratec Newgen GmbH in favour of STRATEC Biomedical AG is to be agreed. The existing Conditional Capital V is to be reduced to €0.2 million . The authorization to grant stock options of 20 May 2009 is to be repealed to the extent that only existing options can be used. The Management Board and Supervisory Board shall be authorized to issue stock options to employees of the Company and its affiliates or members of the board or managerial members of affiliated companies. For this, conditional capital in the amount of €0.9 million (Conditional Capital VI) is to be kept available. Additionally, several charter amendments are to be decided. | ||||||

| Evotec AG | ord.AGM | 12.06.2013 | 10:00 | 22335 Hamburg | Flughafenstraße 2-3, im Radisson Blu Hotel, Hamburg Airport | 03.05.2013 |

| The Agenda for the ordinary AGM of Evotec AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Elections to the Supervisory Board are to be held. . The remuneration of the Supervisory Board is to be re-regulated. Additionally, several charter amendments are to be decided. | ||||||

| Bechtle AG | ord.AGM | 18.06.2013 | 10:00 | 74072 Heilbronn | Allee 28, im Konzert- und Kongresszentrum Harmonie | 06.05.2013 |

| The Agenda for the ordinary AGM of Bechtle AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Bechtle AG earned balance-sheet profits of €21m last business year. The profits are to be fully paid out as dividend. Elections to the Supervisory Board are to be held. Furthermore, a control and profit-transfer agreement between Bechtle AG and Bechtle Immobilien GnbH in favour of Bechtle AG is to be agreed. The existing authorized capital of the Company is to be cancelled. A new authorized capital in the amount of €10.5 million is to be created, with the possibility of excluding subscription rights.. Additionally, several charter amendments are to be decided. | ||||||

| CANCOM SE | ord.AGM | 18.06.2013 | 11:00 | 80333 München | Max-Joseph-Straße 5, im Haus der Bayerischen Wirtschaft | 03.05.2013 |

| The Agenda for the ordinary AGM of CANCOM SE starts with the usual items, like presentation of annual accounts and discharge to the company bodies. CANCOM SE earned balance-sheet profits of €7.41m last business year. Of the profits, €4m is to be paid out as dividend and €3,41m allocated to reserves. Elections to the Supervisory Board are to be held. Furthermore, the Company is to be authorized to issue option and / or convertible bonds. For this, conditional capital in the amount of €2m is to be kept available. Additionally, several charter amendments are to be decided. | ||||||

| Süss MicroTec AG | ord.AGM | 19.06.2013 | 10:00 | 80333 München | Max-Joseph-Straße 5, im Haus der Bayerischen Wirtschaft | 08.05.2013 |

| The Agenda for the ordinary AGM of Süss MicroTec AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. The profitsof €5.54m are to be fully carried forward to a new account. A new authorized capital in the amount of €2.5m is to be created, with the possibility of excluding subscription rights. The Company shall be authorized to purchase its own shares and use them, to the exclusion of shareholders' subscription and tender rights. The existing Conditional Capital 2008 I is to be cancelled. Additionally, several charter amendments are to be decided. | ||||||

| Wirecard AG | ord.AGM | 20.06.2013 | 10:00 | 80333 München | Max-Joseph-Straße 5, im Haus der Bayerischen Wirtschaft | 10.05.2013 |

| The Agenda for the ordinary AGM of Wirecard AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Wirecard AG earned balance-sheet profits of €41.92m last business year. Of the profits, €12.34m is to be paid out as dividend and €29,58m carried forward to a new account. | ||||||

| MDAX | ||||||

| BayWa AG | ord.AGM | 04.06.2013 | 10:00 | 81823 München | ICM Internationales Congress Center München, Messegelände | 24.04.2013 |

| The Agenda for the ordinary AGM of BayWa AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. BayWa AG earned balance-sheet profits of €22.32m last business year. The profits are to be fully paid out as dividend. Elections to the Supervisory Board are to be held. A new authorized capital of €10m (Authorized Capital 2013) is to be created, with the possibility of excluding subscription rights. Furthermore, amendments and revisions of existing profit-transfer agreements of the Company and various subsidiaries and the conclusion of a control and profit-transfer agreement with BayWa Agrar Beteiligungs GmbH in favour of BayWa AG are to be agreed. Additionally, several charter amendments are to be decided. . | ||||||

| KUKA AG | ord.AGM | 05.06.2013 | 10:00 | 86159 Augsburg | Gögginger Straße 10, im Kongresszentrum Kongress am Park Augsburg | 19.04.2013 |

| The Agenda for the ordinary AGM of KUKA AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. KUKA AG earned balance-sheet profits of €8.29m last business year. Of the profits, €6.78m is to be paid out as dividend and €1,51m carried forward to a new account. Elections to the Supervisory Board are to be held. Approval of the system of executive remuneration is to be decided. Furthermore, the Company is to be authorized to issue option and / or convertible bonds, income bonds and equity interests (or a combination thereof), with the option of excluding subscription rights. For this, conditional capital in the amount of €39.93 million (Conditional Capital 2013) is to be kept available. The current authorization to issue option and / or convertible bonds, income bonds and equity interests is to be cancelled. The existing Conditional Capital 2010 is to be reduced to €4.16 million. Additionally, several charter amendments are to be decided. | ||||||

| STADA Arzneimittel AG | ord.AGM | 05.06.2013 | 10:00 | 60327 Frankfurt am Main | Ludwig-Erhard-Anlage 1, Congress Center Messe Frankfurt, Congress Ebene 2, Saal Harmonie | 26.04.2013 |

| The Agenda for the ordinary AGM of STADA Arzneimittel AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. STADA Arzneimittel AG earned balance-sheet profits of €31.55m last business year. Of the profits, €29.62m is to be paid out as dividend and €1,93m carried forward to a new account. The existing authorized capital is to be replaced by a new one of €77.13 million. Furthermore, the Company is to be authorized to issue option and / or convertible bonds, equity interests and/or income bonds, with the option of excluding subscription rights. For this, conditional capital in the amount of €69.19 million (Conditional Capital 2013) is to be kept available. The current authorization to issue option and / or convertible bonds, equity interests and/or income bonds is to be cancelled. The Company is to be authorized to purchase its own shares and use them, to the exclusion of shareholders' subscription and tender rights. The existing authorization shall accordingly be revoked. Elections to the Supervisory Board are to be held. The remuneration of the Supervisory Board is to be re-regulated. Additionally, several charter amendments are to be decided. | ||||||

| MAN SE | ord.AGM | 06.06.2013 | 10:00 | 81829 München | Am Messesee, auf dem Gelände der Messe München GmbH, Internationales Congress Center München (ICC), Zugang über ICM, Hallen C1 und C2 | 26.04.2013 |

| The Agenda for the ordinary AGM of MAN SE starts with the usual items, like presentation of annual accounts and discharge to the company bodies. MAN SE earned balance-sheet profits of €167.7m last business year. Of the profits, €147.04m is to be paid out as dividend and €20,67m carried forward to a new account. Elections to the Supervisory Board are to be held.. The Annual General Meeting is in future be held at the company headquarters or at the headquarters of a German stock exchange or in a German city with more than 100,000 inhabitants. In addition, the conclusion of a control and profit-transfer agreement between MAN SE and Truck & Bus GmbH in favour of Truck & Bus GmbH is to be agreed. Additionally, several charter amendments are to be decided. | ||||||

| Gerry Weber International AG | ord.AGM | 06.06.2013 | 10:00 | 33790 Halle | Weserstraße 14, im GERYY WEBER Event-Center, am GERRY WEBER Stadion | 25.04.2013 |

| s | ||||||

| Rhön-Klinikum AG | ord.AGM | 12.06.2013 | 10:00 | 65929 Frankfurt am Main | Pfaffenwiese, Jahrhunderthalle Frankfurt | 03.05.2013 |

| The Agenda for the ordinary AGM of Rhön-Klinikum AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Rhön-Klinikum AG earned balance-sheet profits of €66.98m last business year. Of the profits, €34.55m is to be paid out as dividend, €32.42m allocated to reserves and €0,01m carried forward to a new account. Elections to the Supervisory Board are to be held. At the request of a shareholder the Agenda is to be supplemented as follows: a resolution to amend the Articles of Association by deleting §17(4), first subparagraph, is to be taken. (§17(4), first subparagraph, is the requirement of a majority of more than 90% for important resolutions of the General Meeting.) | ||||||

| Hamburger Hafen und Logistik AG | ord.AGM | 13.06.2013 | 10:00 | 20355 Hamburg | Am Dammtor/Marseiller Straße 2, im CCH - Congress Center Hamburg, Saal 1 | 30.04.2013 |

| The Agenda for the ordinary AGM of Hamburger Hafen und Logistik AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Hamburger Hafen und Logistik AG earned balance-sheet profits of €232.16m last business year. Of the profits, €48.78m is to be paid out as dividend and €183,38m carried forward to a new account. The remuneration of the Supervisory Board is to be re-regulated..Furthermore, the Company is to be authorized to issue option and / or convertible bonds, with the possibility of excluding subscription rights. For this, conditional capital in the amount of €6.9m (Conditional Capital 2013) is to be kept available. The current authorization to issue option and / or convertible bonds and the existing contingent capital are to be cancelled. Special resolutions of A-shareholders and S-shareholders to renew the authorization to issue option and / or convertible bonds and to create contingent capital will follow. Additionally, several charter amendmentsl are to be decided. | ||||||

| TAG Immobilien AG | ord.AGM | 14.06.2013 | 11:00 | 20457 Hamburg | Trostbrücke 6, im Haus der Patriotischen Gesellschaft | 08.05.2013 |

| The Agenda for the ordinary AGM of TAG Immobilien AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. TAG Immobilien AG earned balance-sheet profits of €119.51m last business year. Of the profits, €32.68m is to be paid out as dividend and €86,83m carried forward to a new account. Elections to the Supervisory Board are to be held. A new authorized capital of €20m (Authorized Capital 2013 / I) is to be created, with the possibility of excluding subscription rights. Furthermore, the Company is to be authorized to issue option and / or convertible bonds, with the possibility of excluding subscription rights. For this, conditional capital in the amount of €13m is to be kept available (Contingent Capital 2013 / I). The remuneration of the Supervisory Board for committee activities is to be re-regulated. An amendment to the intergroup agreement between Tag Immobilien AG as controlling company and Tag Beteiligungs- und Immobilienverwaltungs GmbH as controlled company is to be approved.Additionally, several charter amendments are to be decided. | ||||||

| GSW Immobilien AG | ord.AGM | 18.06.2013 | 10:00 | 10623 Berlin | Fasanenstraße 85, im Konferenzzentrum im Ludwig-Erhard-Haus | 08.05.2013 |

| The Agenda for the ordinary AGM of GSW Immobilien AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. GSW Immobilien AG earned balance-sheet profits of €607.59m last business year. Of the profits, €45.47m is to be paid out as dividend and €562,11m carried forward to a new account. Furthermore, the Company is to be authorized to issue option and / or convertible bonds, participation rights and / or income bonds with or without conversion or option rights (or combinations thereof), with the option of excluding subscription rights. For this, conditional capital in the amount of €7.5m (Conditional Capital 2013) is to be kept available. The existing authorization to issue convertible bonds is to be partially cancelled. The existing Conditional Capital 2012 is to be reduced to €5.05m. The authorization for the simplified exclusion of subscription rights in Authorized Capital 2012 is to be repealed and replaced by a new authorization. The modification of existing control and profit-transfer agreements between GSW Immobilien AG and GSW Acquisitions 3 GmbH and with GSW Grundvermögens- und Vertriebsgesellschaft mbH is to be agreed. Furthermore, the conclusion of a control and profit-transfer agreement between GSW Immobilien AG and GSW Corona GmbH in favour of GSW Immobilien AG is to be agreed. Approval of the remuneration system for the Executive Board is to be decided. Additionally, several charter amendments are to be decided. At the request of a shareholder the agenda is to be supplemented by the following resolutions: the dismissal of Supervisory Board member Dr. Eckart John von Freyend is to be decided. Confidence in CEO Dr. Bernd Kottmann is to be withdrawn. | ||||||

| KRONES AG | ord.AGM | 19.06.2013 | 14:00 | 93073 Neutraubling | Regensburger Straße 9, in der Stadthalle Neutraubling | 07.05.2013 |

| The Agenda for the ordinary AGM of KRONES AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. lKRONES AG earned balance-sheet profits of €74.04m last business year. Of the profits, €23.69m is to be paid out as dividend and €50,34m carried forward to a new account.Charter amendments concerning contribution and takeover provisions, special benefits and formation expenses and Company announcements are to be decided. | ||||||

| Brenntag AG | ord.AGM | 19.06.2013 | 10:00 | 40474 Düsseldorf | Stockumer Kirchstraße 61, im Congress Center Düsseldorf (CCD Ost), DüsseldorfCongress | 10.05.2013 |

| The Agenda for the ordinary AGM of Brenntag AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Brenntag AG earned balance-sheet profits of €123.6m last business year. The profits are to be fully paid out as dividend. | ||||||

| Deutsche EuroShop AG | ord.AGM | 20.06.2013 | 10:00 | 20355 Hamburg | Holstenwall 12, in der Handwerkskammer Hamburg | 08.05.2013 |

| The Agenda for the ordinary AGM of Deutsche EuroShop AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Deutsche EuroShop AG earned balance-sheet profits of €80.64m last business year. Of the profits, €64.74m is to be paid out as dividend and €15,91m carried forward to a new account. Elections to the Supervisory Board are to be held. The existing authorized capital is to be replaced by a new one of €26.97m. Additionally, several charter amendments are to be decided. | ||||||

Politics

Cabinet approves strengthening of owners' rights

For the remuneration of managers, in the face of criticisms more stringent requirements are to apply in future. Shareholders of listed companies are in future to get more control rights on the remuneration of the Executive Board. So says a reform of company law adopted by the cabinet in Berlin on 8 May. The shareholders instead of the Supervisory Board are annually to decide mandatorily and bindingly on the remuneration system of top management. Maximum limits a top executive can reach should also be known. There should not, however, be a legal limit. So far, shareholders can only vote on executive pay if the board allows it. “Reason and measure” should not be lost in the payment of managers, said Max Stadler (FDP). The new regulation is an effective and appropriate response to excessive compensation of individual managers and should avoid “self-service” in large corporations, the Parliamentary State Secretary of Justice went on. Now the Bundestag too must approve the plans of the government coalition. The change can then be added to the current company-law amendment already before the Bundestag and come into force in this legislative term. In early March, the debate on the appropriateness of executive pay in listed companies heightened after citizens in Switzerland approved the “popular initiative against the rip-off”.

For the remuneration of managers, in the face of criticisms more stringent requirements are to apply in future. Shareholders of listed companies are in future to get more control rights on the remuneration of the Executive Board. So says a reform of company law adopted by the cabinet in Berlin on 8 May. The shareholders instead of the Supervisory Board are annually to decide mandatorily and bindingly on the remuneration system of top management. Maximum limits a top executive can reach should also be known. There should not, however, be a legal limit. So far, shareholders can only vote on executive pay if the board allows it. “Reason and measure” should not be lost in the payment of managers, said Max Stadler (FDP). The new regulation is an effective and appropriate response to excessive compensation of individual managers and should avoid “self-service” in large corporations, the Parliamentary State Secretary of Justice went on. Now the Bundestag too must approve the plans of the government coalition. The change can then be added to the current company-law amendment already before the Bundestag and come into force in this legislative term. In early March, the debate on the appropriateness of executive pay in listed companies heightened after citizens in Switzerland approved the “popular initiative against the rip-off”.

People

The Annual General Meeting of Aareal Bank elected Richard Peters to the Supervisory Board. Marija Korsch is the new chairman and thus first female chief overseer of a listed bank in Germany. She is now also the second female supervisory-board chair of a MDAX-listed company. She succeeds Hans W. Reich, who had announced his retirement in March.

The Annual General Meeting of Aareal Bank elected Richard Peters to the Supervisory Board. Marija Korsch is the new chairman and thus first female chief overseer of a listed bank in Germany. She is now also the second female supervisory-board chair of a MDAX-listed company. She succeeds Hans W. Reich, who had announced his retirement in March.

The Supervisory Board of Deutsche Lufthansa appointed two new members, Bettina Volkens and Harry Hohmeister, to the Group Executive Board at its meeting on 1 July. They replace Stefan H. Lauer, leaving the airline at the end of June after thirteen years as Labour Director and board member. Thus, the management expands from four to five people. From Lauer's portfolio as Labour Director Volkens takes over the Human Resources and Legal departments. The 49-year-old is only a year at Lufthansa. After CFO Simone Menne she is the second woman in the narrower Lufthansa leadership. Having first headed the Corporate Executives department, she is currently responsible for the entire Group's human resources. Hohmeister is assigned responsibility for partner airlines and logistics.

The Supervisory Board of Deutsche Lufthansa appointed two new members, Bettina Volkens and Harry Hohmeister, to the Group Executive Board at its meeting on 1 July. They replace Stefan H. Lauer, leaving the airline at the end of June after thirteen years as Labour Director and board member. Thus, the management expands from four to five people. From Lauer's portfolio as Labour Director Volkens takes over the Human Resources and Legal departments. The 49-year-old is only a year at Lufthansa. After CFO Simone Menne she is the second woman in the narrower Lufthansa leadership. Having first headed the Corporate Executives department, she is currently responsible for the entire Group's human resources. Hohmeister is assigned responsibility for partner airlines and logistics.

Deutsche Telekom has announced that Thomas Dannenfeldt is to lead the finance department of the Group from 1 January 2014. The Supervisory Board so decided on 15 May. The Director of Finance and Controlling of Telekom's Germany business is the successor of Timothy Höttges, when he takes over as CEO from René Obermann. Höttges had strongly advocated Dannenfeldt as candidate.

Thomas Sparrvik, who as deputy chief executive at crisis-ridden Kontron is also heading the Americas and Asia-Pacific regions, will leave the small-computer manufacturer at the end of June to take on new business challenges, the company announced on 21 May. The Supervisory Board expressed its appreciation to him for his contribution to the success of the Kontron Group.

At the Annual General Meeting (AGM) next year Professor Detlev H. Riesner wants to leave his post at QIAGEN. He is a member of the Supervisory Board since 1996 and its Chairman since 1999. A joint meeting also discussed the proposal to nominate Werner Brandt successor to the co-founder as chair of the Supervisory Board in 2014, when he retires from his current position as a member of the SAP Executive Board. At the AGM this year on 26 June Lawrence A. Rosen is also to move onto the Supervisory Board. Stéphane Bancel has also been proposed for election to the Supervisory Board. Erik Homnaess and Heino von Prondzynski, retiring from the Supervisory Board of the biotech heavyweight after 15 and 6 years respectively, will no longer run.

![]() Volkswagen CEO Martin Winterkorn is leaving the Supervisory Board of Salzgitter. He has not offered himself for re-election, after 15 years. As a reason chairman Rainer Thieme indicated the manager's many obligations. In addition, Arno Morenz, CEO of Aachener Rückversicherung, Hartmut Möllring, former Finance Minister of Lower Saxony, and Rudolf Rupprecht, Chairman of the Executive Board of MAN, resigned from the Supervisory Board. Four new shareholder representatives were elected at the Annual General Meeting on 23 May on the proposal of the Supervisory Board. Newcomers to the Supervisory Board include Peter-Jürgen Schneider (SPD). The company's former personnel director and current Finance Minister of Lower Saxony had left the Group for politics on 19 February. He was proposed for election by Hannoversche Beteiligungsgesellschaft, the investment company that holds more than 25 percent of the voting rights in Salzgitter in which the State of Lower Saxony holds all shares. The three other new shareholder representatives are Ulrike Brouzi, board member of the NORD/LB Norddeutsche Landesbank Girozentrale, Thea Dückert, Visiting Scientist at the Carl-von-Ossietzky University, and Roland Flach, Chairman of the Management Board of Klöckner-Werke. On the employee representatives' side Hannelore Elze and Helmut Weber resigned. Two other employee representatives were elected employee delegates as early as 14 May. Konrad Ackermann and Annelie Buntenbach are the new members. Altogether, the Supervisory Board of the second-largest steel producer comprises 21 people, including three women. According to CEO Hans Jörg Fuhrmann, Salzgitter does not plan to increase the proportion of women by quota.

Volkswagen CEO Martin Winterkorn is leaving the Supervisory Board of Salzgitter. He has not offered himself for re-election, after 15 years. As a reason chairman Rainer Thieme indicated the manager's many obligations. In addition, Arno Morenz, CEO of Aachener Rückversicherung, Hartmut Möllring, former Finance Minister of Lower Saxony, and Rudolf Rupprecht, Chairman of the Executive Board of MAN, resigned from the Supervisory Board. Four new shareholder representatives were elected at the Annual General Meeting on 23 May on the proposal of the Supervisory Board. Newcomers to the Supervisory Board include Peter-Jürgen Schneider (SPD). The company's former personnel director and current Finance Minister of Lower Saxony had left the Group for politics on 19 February. He was proposed for election by Hannoversche Beteiligungsgesellschaft, the investment company that holds more than 25 percent of the voting rights in Salzgitter in which the State of Lower Saxony holds all shares. The three other new shareholder representatives are Ulrike Brouzi, board member of the NORD/LB Norddeutsche Landesbank Girozentrale, Thea Dückert, Visiting Scientist at the Carl-von-Ossietzky University, and Roland Flach, Chairman of the Management Board of Klöckner-Werke. On the employee representatives' side Hannelore Elze and Helmut Weber resigned. Two other employee representatives were elected employee delegates as early as 14 May. Konrad Ackermann and Annelie Buntenbach are the new members. Altogether, the Supervisory Board of the second-largest steel producer comprises 21 people, including three women. According to CEO Hans Jörg Fuhrmann, Salzgitter does not plan to increase the proportion of women by quota.

Lars Dalgaard, responsible for business with software that is rented via the Internet (cloud computing) for nearly a year, is leaving SAP. Luisa Deplazes Delgado is also leaving the software giant officially at the end of June, the DAX company said on 24 May. Vishal Sikka will take on Dalgaard's additional tasks and from June direct all areas of innovation.

Jürgen Dolle ended his work at SMA Solar Technology on 15 May for health reasons. He was appointed to the Board In April 2010. The staff and operations tasks he was previously responsible for are being handled by Lydia Sommer. Sommer has been with the world market leader for photovoltaic inverters since November 2012. The operational business will be taken by Pierre-Pascal Urbon.

Susanne Klatten was chosen as the successor of Max Dietrich Kley in the chair of the Supervisory Board of SGL Carbon. Robert Koehler's rise to the position is thus blocked. The chemical company will also in future ward off too strong influence of its major shareholders with a Control Committee of the Supervisory Board. The MDAX-listed company thus agreed to a proposal by Christian Strenger.

Matthias Wiedenfels has been appointed to the Board of STADA Arzneimittel with immediate effect, and will be in charge there of Corporate Development & Central Services, including human resources, legal, IT/patents, compliance, risk management and export control, said the pharmaceutical company from Bad Vilbel near Frankfurt. The former general counsel received a contract until the end of 2016.

SHW: The cards are shuffled

SHW AG gets a new CEO in August. Thomas Buchholz replaces Andreas Rydzewski, currently still acting CEO of the automotive supplier listed since 2011. Buchholz was most recently CEO of TI Automotive. Previously, he worked for 17 years for the automotive supplier Mahle.

Only recently there was much movement on the board of the company, listed in the Prime Standard of the Frankfurt Stock Exchange: former CEO Wolfgang Krause left all of a sudden, and shortly after, the contract of CFO Oliver Albrecht was not renewed. Both were officially “by mutual agreement”. In early May Sascha Rosengart, former CFO of Hengst Automotive, became the new CFO.

R. Stahl: SDax is the goal

With Bernd Marx as its new CFO, the explosion-protection specialist R. Stahl AG wants to be better known in the capital market. Marx is to professionalize communication with investors and thus pave the way into the SDax. Marx has worked for R. Stahl for nine years already, most recently as Head of Finance. As CFO of Indian and Brazilian subsidiaries of the company he provided for their turnaround.

Leifheit: Sudden departure

Leifheit AG in late May surprisingly separated from its CEO Georg Thaller. The manufacturer of household items does not yet have a successor. Consequently, CFO Claus-Otto Zacharias will lead the company on an interim basis as the sole director. The reason for the sudden separation was "different views on the future strategic direction" of the group. Sales discussions for the shares of the majority shareholders begun in December 2012 failed according to the company because of differing ideas (see M & A).

Thaller came to Leifheit as CEO in 2009. In his time calm and continuity again reigned and the group managed significant price increases. For the Supervisory Board, however, the restructuring - according to sources close to the body - did not go fast enough.

Campus

Code committee implements proposals

The Government Commission on the German Corporate Governance Code on 13 May adopted rules for more transparency in executive compensation largely as provided in the draft. In the comment period, nearly 40 responses had been received, in which agreement in principle had been expressed, said Klaus-Peter Müller. The aim of the Code amendment was to further professionalize and strengthen the Supervisory Board's work, said the Commission's chairman. In the new version, the Supervisory Board is to limit upwards both the compensation of the members as a whole and the variable components. The body is also to consider the relation of compensation to pay of senior management and the workforce as a whole and observe this over time. Regarding pension plans, the Supervisory Board is to determine the respective target pension level for the board and consider the derived annual and long-term expense for the company. In addition, some editorial changes to streamline the Code and improve readability have been made. The revision of the rules on corporate governance will come into force after publication in the Federal Gazette. This step is expected within the next few weeks. Müller attributes little effect to the coalition's plans to cap salaries.

The Government Commission on the German Corporate Governance Code on 13 May adopted rules for more transparency in executive compensation largely as provided in the draft. In the comment period, nearly 40 responses had been received, in which agreement in principle had been expressed, said Klaus-Peter Müller. The aim of the Code amendment was to further professionalize and strengthen the Supervisory Board's work, said the Commission's chairman. In the new version, the Supervisory Board is to limit upwards both the compensation of the members as a whole and the variable components. The body is also to consider the relation of compensation to pay of senior management and the workforce as a whole and observe this over time. Regarding pension plans, the Supervisory Board is to determine the respective target pension level for the board and consider the derived annual and long-term expense for the company. In addition, some editorial changes to streamline the Code and improve readability have been made. The revision of the rules on corporate governance will come into force after publication in the Federal Gazette. This step is expected within the next few weeks. Müller attributes little effect to the coalition's plans to cap salaries.

The Federation of German Industry (BDI) has also put the legislature in its place. The repeated interventions in detail issues of corporate governance have weakened the acceptance of the Code in the economy, said Ulrich Grillo. The constant call for statutory regulation ran against the Commission's work. Instead, the German Corporate Governance Code had always established itself in practice. It was a key component of good corporate governance in Germany, the BDI president said on 23 May in Berlin, against the background of the current discussion about the work of the Government Commission on the German Corporate Governance Code. The DAX30 companies followed the Code's recommendations 96 percent.

Consistent: Export orientation stabilizes SMEs in the crisis

Mainly export-oriented larger SMEs and mid-sized niche providers are, according to a study by the Institut für Mittelstandsforschung (Institute for SME Research – IfM), resistant to the crisis compared to large companies. Through their activity on foreign markets they compensate for the fluctuations in domestic demand and remain stable even in times of crisis in employment.

In particular, the export-intensive trade and transport sector has risen in employment by around 18 per cent between 2001 and 2009. Even in the crisis year 2008-9, in trade and transport SMEs employment increased by more than two percent, while large companies suffered a loss of employment of five percent in the same area.

Capital News

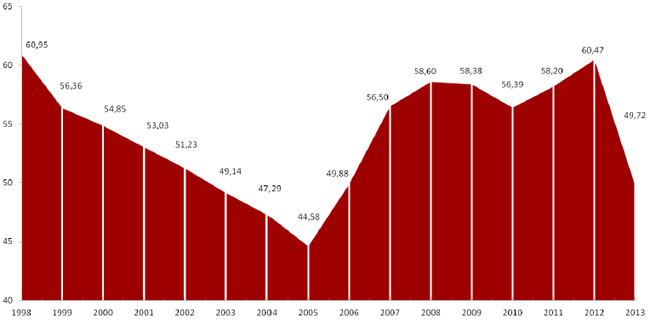

Entwicklung der Kapitalpräsenzen

Durchschnittliche Präsenz DAX®30 (1998-2013)

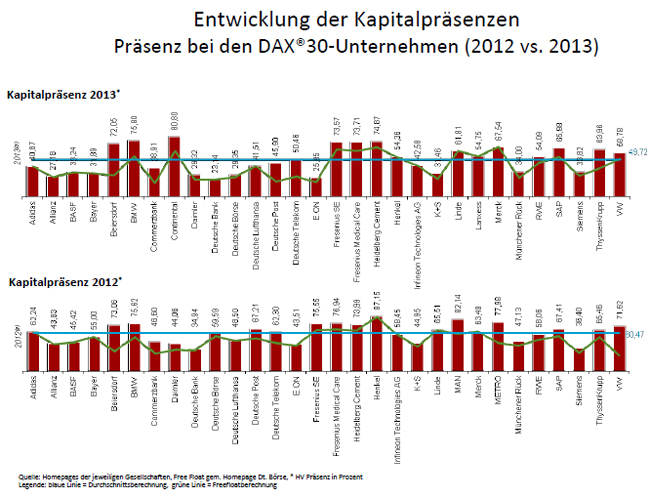

| Company | CP % 2012 | CP % 2013 | Changes in % points |

| Adidas ** | 62,24 | 40,87 | -21,37 |

| Allianz ** | 43,83 | 27,18 | -16,65 |

| BASF ** | 45,42 | 33,24 | -12,18 |

| Bayer ** | 55 | 31,89 | -23,11 |

| Beiersdorf | 73,06 | 72,05 | -1,01 |

| BMW | 75,72 | 75,8 | 0,08 |

| Commerzbank | 46,6 | 38,91 | -7,69 |

| Continental | 85,87 | 80,8 | -5,07 |

| Daimler ** | 44,06 | 29,32 | -14,74 |

| Deutsche Bank ** | 34,94 | 23,14 | -11,8 |

| Deutsche Börse ** | 59,59 | 29,35 | -30,24 |

| Deutsche Lufthansa ** | 48,5 | 41,51 | -6,99 |

| Deutsche Post ** | 67,21 | 45,9 | -21,31 |

| Deutsche Telekom ** | 62,3 | 50,46 | -11,84 |

| E.ON ** | 43,51 | 25,95 | -17,56 |

| Fresenius SE | 75,55 | 73,57 | -1,98 |

| Fresenius Medical Care | 76,94 | 73,71 | -3,23 |

| Heidelberg Cement | 73,99 | 74,87 | 0,88 |

| Henkel | 55,71 | 54,36 | -1,35 |

| Infineon Technologies AG ** | 58,45 | 42,58 | -15,87 |

| K+S ** | 44,95 | 31,46 | -13,49 |

| Linde | 65,51 | 61,81 | -3,7 |

| Lanxess | 60,54 | 54,75 | -5,79 |

| Merck | 63,49 | 67,54 | 4,05 |

| Münchener Rück ** | 47,13 | 34 | -13,13 |

| RWE | 58,06 | 54,09 | -3,97 |

| SAP | 67,41 | 65,98 | -1,43 |

| Siemens ** | 36,4 | 33,82 | -2,58 |

| ThyssenKrupp | 65,46 | 63,96 | -1,5 |

| VW | 71,62 | 58,78 | -12,84 |

| Ø Präsenz DAX30 | 58,97 | 49,72 | -9,25 |

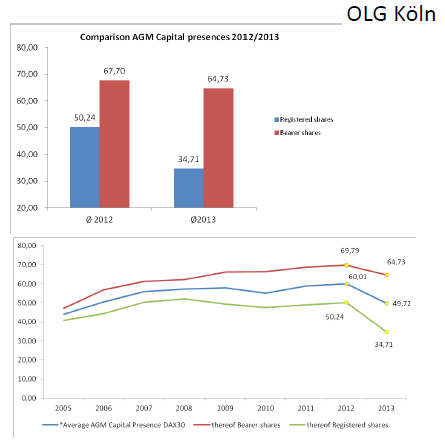

| DAX 30 Class of stocks | Ø 2012 | Ø2013 | Ø Changes in % points |

| Registered shares ** | 50,24 | 34,71 | -15,53 |

| Bearer shares | 67,7 | 64,73 | -2,97 |

<click here> complete version (PDF)

Commerzbank collects 2.5 billion

The Commerzbank has completed its capital increase and is thus gradually buying out the state influence. As planned, the new capital increase flushed 2.5 billion euros into the Frankfurt bank's coffers. Shareholder interest in the new paper was great, despite some significant criticism of the measure, the bank announced. 99.7 percent of the subscription rights were exercised.

The Commerzbank has completed its capital increase and is thus gradually buying out the state influence. As planned, the new capital increase flushed 2.5 billion euros into the Frankfurt bank's coffers. Shareholder interest in the new paper was great, despite some significant criticism of the measure, the bank announced. 99.7 percent of the subscription rights were exercised.

It was a so-called mixed cash/kind capital increase. That had to do with the fact that SoFFin, who owned 25 percent plus one share in Commerzbank, could not or would not put in more money. Accordingly, it placed a portion of its stake on the exchange through a syndicate of banks, without subscription rights. Consequently, the federal share dropped to 15 percent in the first step. But in a second step SoFFin did exercise these subscription rights, by conversion of the silent contribution. Thus, the rescue fund came to a 17 per cent share in Commerzbank again, but gave up the blocking minority whereby decisions can be blocked. But all the other shareholders had to carry out the capital increase in cash. The hard-core capital ratio, i.e. Commerzbank's crisis buffer, improved from 7.5 percent to 8.4 percent, taking into account all the new rules. The successful completion of the capital increase was “the federal government's entry into the phase-out from Commerzbank,” affirmed the bank. To attract investors, the Institute offered the new securities at a discount of about 50 percent to the current share price. Yet to come to the projected proceeds of 2.5 billion euros, the bank announced on 14 May it would nearly double the number of shares. Thus, the shares of the existing shareholders were diluted even more than expected. To avoid the risk of drifting into a penny stock-existence, Commerzbank had, finally, merged the shares at a ratio of ten to one. The rate heavily diluted by various capital increases was thus made ten times higher. The shareholders had until midnight on 15 May to decide whether to go along or not. With the fresh money Commerzbank wipes out the remaining direct government assistance from the financial crisis (€1.6 billion) and the Allianz silent participation (€750 million).

The finance committee of the Bundestag had already on 15 May held unscheduled discussions of the DAX Group's capital increase. The federal government should, it was said, take a stance on the question of short-selling of Commerzbank shares in the context of the capital increase and the role of hedge funds. The stock had “become a playground for hedge funds”, which was why the share price could fluctuate more in the short term. A portion of the hedge funds allegedly bet on rising prices. A second group was betting on falling prices, through short-selling. They had borrowed Commerzbank shares in advance, immediately sold them again and wanted to stock up on them again cheaper now in the capital increase.

Wallenborn: New wind bond

Wallenborn Adria Wind is to issue a corporate bond of 80 million euros to refinance a Croatian wind farm. The bond is according to the Dresden-based company to be secured with wind turbines in the park, through an independent trustee. The paper is to be traded after issue on the Munich Stock Exchange, but the release date is not yet known.

The wind farm, which has already been on the grid for two years, is located on the Adriatic coast near the town of Senj and has a capacity of 42 megawatts. Its location is so favourable that it gets many more full-load hours than German parks.

Director's Dealings

| Company | Person | Function | Buy / Sell | Total value in Euro | Number of shares | Date |

| adidas AG | Tourres, Christian | AR | V | 2224764 | 25572 | 20.05.2013 |

| adidas AG | Tourres, Christian | AR | V | 2845770 | 32710 | 21.05.2013 |

| AIXTRON SE | SBG Beteiligung GmbH | V | 1438426 | 116500 | 24.05.2013 | |

| AIXTRON SE | SBG Beteiligung GmbH | V | 627610 | 50000 | 27.05.2013 | |

| BASF SE | Oswald, Robert | AR | K | 7724 | 110 | 29.05.2013 |

| Carl Zeiss Meditec AG | Monz, Ludwin | VR-CHEF | V | 24870 | 1000 | 17.05.2013 |

| Carl Zeiss Meditec AG | Müller, Dr. Christian | VR | V | 49730 | 2000 | 17.05.2013 |

| Carl Zeiss Meditec AG | Guthoff, Dr. Markus | AR | V | 23152 | 950 | 21.05.2013 |

| COMMERZBANK AG | Altenschmidt, Hans Hermann | AR | V | 2649 | 953 | 24.05.2013 |

| COMMERZBANK AG | Altenschmidt, Hans Hermann | AR | K | 2736 | 608 | 28.05.2013 |

| COMMERZBANK AG | Annuscheit, Frank | VR | K | 0 | 0 | 22.05.2013 |

| COMMERZBANK AG | Annuscheit, Frank | VR | K | 11331 | 2518 | 28.05.2013 |

| COMMERZBANK AG | Annuscheit, Harriet | K | 0 | 0 | 22.05.2013 | |

| COMMERZBANK AG | Annuscheit, Harriet | K | 144 | 32 | 28.05.2013 | |

| COMMERZBANK AG | Beumer, Markus | VR | K | 0 | 0 | 17.05.2013 |

| COMMERZBANK AG | Beumer, Markus | VR | K | 7718 | 1715 | 28.05.2013 |

| COMMERZBANK AG | Blessing, Martin | VR-CHEF | V | 0 | 0 | 21.05.2013 |

| COMMERZBANK AG | Blessing, Martin | VR-CHEF | K | 169988 | 37775 | 28.05.2013 |

| COMMERZBANK AG | Burghardt, Stefan | AR | V | 3 | 2 | 21.05.2013 |

| COMMERZBANK AG | Burghardt, Stefan | AR | K | 1985 | 441 | 28.05.2013 |

| COMMERZBANK AG | Engels, Stephan | VR | K | 7458 | 2200 | 20.05.2013 |

| COMMERZBANK AG | Engels, Stephan | VR | K | 18000 | 4000 | 28.05.2013 |

| COMMERZBANK AG | Klösges, Jochen | VR | V | 16587 | 4996 | 22.05.2013 |

| COMMERZBANK AG | Klösges, Jochen | VR | K | 21960 | 4880 | 28.05.2013 |

| COMMERZBANK AG | Leiberich, Oliver | AR | K | 3240 | 720 | 28.05.2013 |

| COMMERZBANK AG | Müller, Klaus-Peter | AR-CHEF | K | 0 | 0 | 22.05.2013 |

| COMMERZBANK AG | Müller, Klaus-Peter | AR-CHEF | K | 117819 | 26182 | 28.05.2013 |

| COMMERZBANK AG | Priester, Barbara | AR | V | 142 | 51 | 24.05.2013 |

| COMMERZBANK AG | Reuther, Michael | VR | K | 331 | 100 | 21.05.2013 |

| COMMERZBANK AG | Reuther, Michael | VR | K | 9000 | 2000 | 28.05.2013 |

| COMMERZBANK AG | Schoffer, Margit | AR | V | 1809 | 545 | 22.05.2013 |

| COMMERZBANK AG | Sieber, Ulrich | VR | K | 0 | 0 | 23.05.2013 |

| COMMERZBANK AG | Sieber, Ulrich | VR | K | 17177 | 3817 | 28.05.2013 |

| COMMERZBANK AG | Tschäge, Silke | V | 311 | 112 | 24.05.2013 | |

| COMMERZBANK AG | Tschäge, Uwe | AR | V | 776 | 279 | 24.05.2013 |

| COMMERZBANK AG | Zielke, Martin | VR | K | 0 | 0 | 23.05.2013 |

| COMMERZBANK AG | Zielke, Martin | VR | K | 21267 | 4726 | 28.05.2013 |

| Daimler AG | Renschler, Andreas | VR | A1 | 1960650 | 45000 | 06.05.2013 |

| Daimler AG | Renschler, Andreas | VR | V | 1955250 | 45000 | 06.05.2013 |

| Daimler AG | Renschler, Andreas | VR | K | 150698 | 3490 | 08.05.2013 |

| Daimler AG | Weber, Dr. Thomas | VR | A1 | 2614200 | 60000 | 06.05.2013 |

| Daimler AG | Weber, Dr. Thomas | VR | V | 2607000 | 60000 | 06.05.2013 |

| Daimler AG | Weber, Dr. Thomas | VR | K | 201066 | 4650 | 08.05.2013 |

| DEUTSCHE BANK AG | Morris, Steve | V | 84253 | 2368 | 03.05.2013 | |

| DEUTSCHE BANK AG | Folkerts-Landau, David | V | 647993 | 18078 | 13.05.2013 | |

| DEUTSCHE BANK AG | Stevens, David | V | 294400 | 8000 | 17.05.2013 | |

| Deutsche Telekom AG | Höttges, Timotheus | VR | K | 254704 | 26030 | 15.05.2013 |

| Deutsche Telekom AG | Clemens, Reinhard | VR | K | 230063 | 25000 | 23.05.2013 |

| Deutsche Telekom AG | van Damme, Niek Jan | VR | K | 240715 | 26500 | 29.05.2013 |

| Drägerwerk AG & Co. KGaA | Klein, Stefan | AR | K | 2646 | 27 | 26.04.2013 |

| Drägerwerk AG & Co. KGaA | Klein, Stefan | AR | K | 15210 | 150 | 14.05.2013 |

| Dürr AG | Becker, Mirko | AR | V | 21655 | 230 | 08.05.2013 |

| ElringKlinger AG | Schmauder, Karl | VR | K | 7529 | 300 | 05.02.2013 |

| ElringKlinger AG | Schmauder, Karl | VR | K | 8166 | 300 | 25.02.2013 |

| freenet AG | Thoma, Prof. Dr. Helmut | AR | V | 123500 | 6500 | 02.05.2013 |

| Fresenius Medical Care AG & Co. KGaA | Gatti, Dr. Emanuele | VR | A2 | 2143212 | 40269 | 24.05.2013 |

| Fresenius Medical Care AG & Co. KGaA | Runte, Dr. Rainer | VR | A2 | 5307278 | 99600 | 24.05.2013 |

| FUCHS PETROLUB AG | Rudolf Fuchs GmbH & Co KG | K | 152759 | 2723 | 17.05.2013 | |

| FUCHS PETROLUB AG | Rudolf Fuchs GmbH & Co KG | K | 43077 | 767 | 20.05.2013 | |

| FUCHS PETROLUB AG | Rudolf Fuchs GmbH & Co KG | K | 112312 | 2000 | 21.05.2013 | |

| FUCHS PETROLUB AG | Rudolf Fuchs GmbH & Co KG | K | 284017 | 5000 | 22.05.2013 | |

| FUCHS PETROLUB AG | Rudolf Fuchs GmbH & Co KG | K | 652443 | 11596 | 23.05.2013 | |

| FUCHS PETROLUB AG | Rudolf Fuchs GmbH & Co KG | K | 74386 | 1304 | 24.05.2013 | |

| FUCHS PETROLUB AG | Rudolf Fuchs GmbH & Co KG | K | 148703 | 2600 | 27.05.2013 | |

| Henkel AG & Co. KGaA | Henkel, Christoph | A1 | 0 | 14.05.2013 | ||

| Henkel AG & Co. KGaA | Henkel, Christoph | A1 | 2515200 | 40000 | 17.05.2013 | |

| Henkel AG & Co. KGaA | Henkel, Christoph | A1 | 0 | 100000 | 27.05.2013 | |

| Henkel AG & Co. KGaA | von Braun, Dr. Kaspar | AR | V | 634900 | 10000 | 10.05.2013 |

| Henkel AG & Co. KGaA | von Braun, Dr. Kaspar | AR | V | 63800 | 1000 | 13.05.2013 |

| Henkel AG & Co. KGaA | von Braun, Dr. Kaspar | AR | V | 737035 | 11500 | 14.05.2013 |

| Henkel AG & Co. KGaA | von Braun, Dr. Kaspar | AR | V | 643500 | 10000 | 15.05.2013 |

| Henkel AG & Co. KGaA | von Braun, Dr. Kaspar | AR | V | 647700 | 10000 | 16.05.2013 |

| Henkel AG & Co. KGaA | von Braun, Dr. Kaspar | AR | V | 324300 | 5000 | 22.05.2013 |

| Henkel AG & Co. KGaA | von Braun, Dr. Kaspar | AR | V | 382025 | 5900 | 27.05.2013 |

| Henkel AG & Co. KGaA | von Braun, Dr. Kaspar | AR | V | 976500 | 15000 | 28.05.2013 |

| K+S AG | Nöcker, Dr. Susanne | K | 986 | 30 | 04.02.2013 | |

| K+S AG | Nöcker, Dr. Susanne | K | 3198 | 100 | 23.04.2013 | |

| K+S AG | Nöcker, Dr. Thomas | VR | K | 71925 | 2000 | 14.05.2013 |

| KUKA AG | Reuter, Dr. Till | VR-CHEF | V | 3850000 | 100000 | 16.05.2013 |

| KUKA AG | Wyser-Pratte, Guy P. | AR | V | 2656121 | 73333 | 23.05.2013 |

| LEONI AG | Probst, Klaus | VR-CHEF | K | 210295 | 6000 | 07.05.2013 |

| LEONI AG | Bellé, Dieter | VR | K | 143280 | 4000 | 14.05.2013 |

| METRO AG | Frieling, Hubert | AR | K | 9010 | 340 | 31.05.2013 |

| NORMA Group AG | Belker, Dr. Othmar | VR | V | 536380 | 19000 | 10.05.2013 |

| NORMA Group AG | Belker, Katrin | V | 536380 | 19000 | 10.05.2013 | |

| NORMA Group AG | Belker, Dr. Othmar | VR | V | 480487 | 17500 | 13.05.2013 |

| NORMA Group AG | Belker, Katrin | V | 480487 | 17500 | 13.05.2013 | |

| NORMA Group AG | Belker, Dr. Othmar | VR | V | 419235 | 15000 | 14.05.2013 |

| NORMA Group AG | Belker, Katrin | V | 419235 | 15000 | 14.05.2013 | |

| QIAGEN N.V. | Brandt, Werner | AR | A1 | 1743 | 29.04.2013 | |

| QIAGEN N.V. | Brandt, Werner | AR | V | 686 | 30.04.2013 | |

| QIAGEN N.V. | Colpan, Metin | AR | A1 | 1743 | 29.04.2013 | |

| QIAGEN N.V. | Colpan, Metin | AR | V | 976 | 30.04.2013 | |

| QIAGEN N.V. | Hornnaess, Erik | AR | A1 | 1743 | 29.04.2013 | |

| QIAGEN N.V. | Hornnaess, Erik | AR | V | 976 | 30.04.2013 | |

| QIAGEN N.V. | Karobath, Manfred | AR | A1 | 1743 | 29.04.2013 | |

| QIAGEN N.V. | Karobath, Manfred | AR | V | 976 | 30.04.2013 | |

| QIAGEN N.V. | Riesner, Detlev | AR-CHEF | A1 | 1743 | 29.04.2013 | |

| QIAGEN N.V. | Riesner, Detlev | AR-CHEF | V | 976 | 30.04.2013 | |

| QIAGEN N.V. | von Prondzynski, Heinz Norbert Ferdinand Maria genannt Heino | AR | A1 | 1743 | 29.04.2013 | |

| QIAGEN N.V. | von Prondzynski, Heinz Norbert Ferdinand Maria genannt Heino | AR | V | 686 | 30.04.2013 | |

| RATIONAL AG | Maerz, Dr. Hans | AR | V | 85229 | 350 | 28.05.2013 |

| RWE AG | Günther, Dr. Bernhard | VR | K | 94727 | 3462 | 20.05.2013 |

| Siemens AG | Requardt, Prof. Dr. Hermann | VR | V | 167370 | 2000 | 28.05.2013 |

| Symrise AG | Huchthausen, Karl-Heinz | AR | K | 0 | 200 | 15.05.2013 |

| TUI AG | Teck Capital Management | V | 1160784 | 120000 | 16.05.2013 | |

| TUI AG | Teck Capital Management | V | 1162596 | 120000 | 17.05.2013 | |

| TUI AG | Teck Capital Management | V | 1254305 | 130000 | 20.05.2013 | |

| TUI AG | Teck Capital Management | V | 418920 | 43900 | 21.05.2013 |

VIPsight Shareholders

in May

VIPsight Shareholder ID <click here>

M & A

Steigerwald: Stomach remedy producer swallowed

DAX-listed Bayer AG intends to take over Steigerwald Arzneimittel GmbH and thus extend its range of treatments for stomach and intestinal disorders. The medium-sized company from Darmstadt specializes in herbal supplements, including the well-known remedy Iberogast. With the acquisition Bayer also plans to strengthen its presence in Germany and in Central and Eastern Europe.

Last year Steigerwald achieved a turnover increase of around six percent, for a total of about €61 million. The Darmstadt site with its 180 employees should be kept, according to Bayer. The Group did not specify the purchase price for the medium-sized pharmaceutical manufacturer. Bayer wants the acquisition in the bag by early July.

Indus: Replenished portfolio

Indus Holding AG took over the Swiss housings specialists Hakama completely in late April. The bulk of the SME already belongs to the Indus group, since 2010. Now the holding company has bought the remaining 40 percent of shares. The two successors of the Hakama founding family and partner, Marius Haberthür and Fritz Kasper, worked until recently as Managing Directors of Hakama AG.

The planned follow-up solution provided for Indus to acquire the remaining shares. The new CEO is Kristin Lindauer, a biologist with experience in the pharmaceutical, chemical and printing industries. Most recently, she worked as a manager of a medium-sized Swiss metal-processing company.

In Bättwil, Switzerland, Hakama produces housings and assemblies, primarily for medical systems, analytical and diagnostic equipment and coffee machines. The company has around 160 employees and a turnover of approximately €23 million in 2012. The portfolio of Indus Holding, now the sole owner, includes not only Hakama but 38 other companies. Still further investments are planned for 2013.

Leifheit: One step forward, two steps back

The sales discussions at Leifheit AG have surprisingly been cancelled. Originally the Schuler-Voith and Knapp-Voith families wanted to sell their majority stake of around 60 percent. After the company failed to agree with potential investors from home and abroad due to differing views, the owner stopped the sale plans.

Leifheit AG products can be found in almost every German household, especially scales and clothes dryers. All the same, the owner families wanted to get rid of the company's shares; but only 60 percent of them, which according to an insider unsettled interested parties like the Dutch retail group Blokker or the U.S. group Jarden.

Ownership circles say that the children of the Schuler-Voith family have other interests and the shares were therefore to be sold. Already in 2012, the family had sold their shares in the machine builder Schuler to the Austrian Andritz Group.