Campus

GCGC requirements implemented

The Center for Corporate Governance founded by Christian Strenger at the Leipzig Graduate School of Management has published its Compliance Report for 2011. The study, “Kodexakzeptanz 2011: Analyse der Entsprechenserklärungen zum Deutschen Corporate Governance Kodex [Code acceptance 2011: Analysis of the Compliance Declarations under the German Corporate Governance Code],” by Professor Dr. Marc Steffen Rapp, Professor Dr. Michael Wolff and Christian R. G. Kohl, is the first systematic and comprehensive look at the Declarations of the largest German listed companies (DAX and MDAX) pursuant to §161 of the German Corporate Governance Code (GCGC). Companies in the DAX and MDAX with an ISIN beginning with DE were analysed (EADS and Gagfah are not subject to the German Corporate Governance Code), as at end of year 2010 (This email address is being protected from spambots. You need JavaScript enabled to view it.). The Center for Corporate Governance reached the following results:

The Center for Corporate Governance founded by Christian Strenger at the Leipzig Graduate School of Management has published its Compliance Report for 2011. The study, “Kodexakzeptanz 2011: Analyse der Entsprechenserklärungen zum Deutschen Corporate Governance Kodex [Code acceptance 2011: Analysis of the Compliance Declarations under the German Corporate Governance Code],” by Professor Dr. Marc Steffen Rapp, Professor Dr. Michael Wolff and Christian R. G. Kohl, is the first systematic and comprehensive look at the Declarations of the largest German listed companies (DAX and MDAX) pursuant to §161 of the German Corporate Governance Code (GCGC). Companies in the DAX and MDAX with an ISIN beginning with DE were analysed (EADS and Gagfah are not subject to the German Corporate Governance Code), as at end of year 2010 (This email address is being protected from spambots. You need JavaScript enabled to view it.). The Center for Corporate Governance reached the following results:

-

On average, the DAX and MDAX companies meet 97 percent of the “target recommendations” of the Code (DAX: 97 percent; MDAX: 96 percent). While many companies have a compliance rate of 100 percent, only a minority meet significantly less than 90 percent of the recommendations.

-

Differences show up especially in Chapter 5 (“Supervisory Board"), but also in Chapter 4 (“Board”). Code section 5.4.1 regarding the composition of the Supervisory Board has the highest deviation rate for all companies.

-

Large companies continue to conform with the Code more.

-

Widely-held companies have higher levels of compliance, thus bringing their internal governance structures more closely into line with the best-practice requirements of the Code.

-

Just a few companies reject parts of the Code recommendations totally. In particular, companies oppose recommendations on own-risk for the D & O insurance of the Supervisory Board, on Board remuneration and on the composition of the Supervisory Board.

-

For 30 percent of all deviations, the companies predict changes such that the corresponding clauses are fully met in the future or will at least be more closely approached. Thus – given the announced large-scale retention of the Code in 2011 – rising levels of compliance can continue to be expected.

-

The Code adaptation in 2010 was met by many of the companies with an updated declaration of compliance only shortly before the year’s end. Some companies have not updated their declaration even after 9 months.

Top 50 price destroyers

Despite the generally good performance on the stock market in 2010, there were black sheep who showed a miserable price performance over a period of five years. The list of the top 50 price destroyers published by the DSW is headed by solar group Solon, which has lost some 91 percent of its value since 2006. It is followed by Swiss private equity specialists Corporate Equity Partners (CEP) and photovoltaic specialists Q-Cells. Altogether, solar stocks did rather badly, partly because of reduced subsidies and competition from the Chinese: included on the list are Colexon Energy, Conergy Solar World, Sunways, Solar Fabrik and Singulus Technologies. While 36 of the booby-prize candidates trade in the Prime Standard of the Frankfurt Stock Exchange, the DSW also lists two large DAX heavies, Commerzbank (15th place) and Deutsche Bank (48th place). There are also four MDAX, five TecDAX and three SDAX securities.

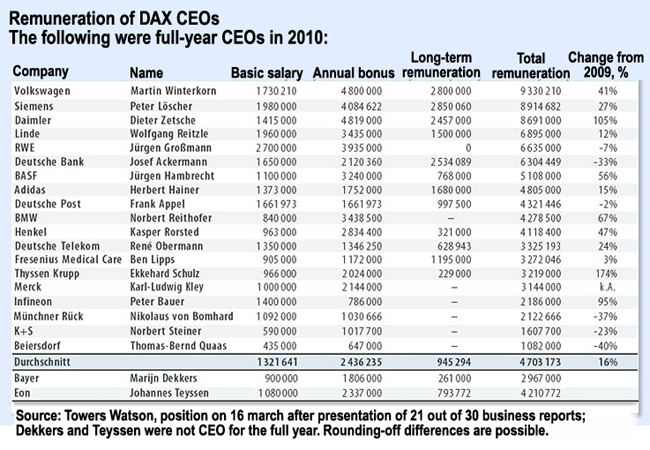

Board members’ earnings back

The remuneration of DAX board members regained pre-crisis levels in 2010. On average, their salaries increased, according to personnel consultancy Kienbaum, by 17 percent, reaching top international levels. Direct fees excluding pensions and benefits in the 21 DAX companies examined rose on average to 4.7 million euros, said consulting firm Towers Watson. In essence, it was companies’ improved profitability that contributed to the jump. As earnings per share in the DAX rose, on average, by 100 percent, directly paid bonus shares jumped upwards by 34 per cent. Fixed salaries grew an average of five percent to 1.2 million euros and account for less than a third of total compensation. For the first time the Act on the appropriateness of executive compensation, which seeks to establish sustainable compensation, also left traces. The basis for calculating bonuses is spread over several years, and salaries are more often tied not to short-term price increases but to internal earnings targets. But switching to long-term forms of compensation will make total compensation rather less transparent, Towers Watson feared, as long-term compensation is variously reported. About 35 percent of variable compensation is paid with a delay. The absolute top earner in 2010 was VW CEO Martin Winterkorn, who received 9.3 million euros. Commerzbank CEO Martin Blessing had again to make do with a salary of only €500,000, because of the cap on executive pay at the bank.

Große Entrup becomes econsense chief

Wolfgang Große Entrup was appointed new CEO by the Forum Nachhaltige Entwicklung der Deutschen Wirtschaft e.V. [Forum for Sustainable Development of German Industry] (econsense). Econsense is a cross-industry network and think tank of 31 leading globally operating companies and organizations of the German economy, which have jointly committed to the guiding principle of sustainable management. Große Entrup is Head of Corporate Environment and Sustainability at Bayer AG. His predecessor, Professor Hanns-Michael Hölz, is Group Sustainability Officer at Deutsche Bank.

More Information for shareholders

Shareholders can in future call up information on the 160 DAX companies (DAX, MDAX, TecDAX and SDAX) on the new Internet portal http://www.hauptversammlung.de of shareholder association Deutsche Schutzvereinigung für Wertpapierbesitz (DSW). On the platform those interested will find comprehensive information on the major German companies, ranging from the agenda and the DSW’s voting recommendations, to basic and insider information (directors’ dealings), to a moderated discussion forum. At the same time, shareholders can exercise their right to vote here online, through DSW. In April, the DSW is also, in cooperation with the European shareholders’ association EuroShareholders, presenting the first pan-European system of voting for individual investors, Eurovote.

Financial professionals like electronic business reports

Financial pros want increased use of electronic business reporting. This is the result of a survey by Frankfurt PR and IR agency ‘financial relations’ among 100 financial-market participants. 68 percent of respondents said that it would be environmentally friendlier and easier if annual reports of listed companies were in future only sent via electronic mail. Electronic annual reports also offered more sources of information, was the unanimous opinion. The majority of study participants would like to get annual and quarterly reports, sales brochures, product brochures, customer magazines and newsletters presented through intelligent use of multimedia and links to Internet content in an attractive mix of text, image, audio and video data. Overall, the study participants complained of fatigue in the use of print media on computer screens or mobile-phone displays. Especially the under-forties regarded the 1:1 conversion as outdated. They invited to take more account of iPhone apps and the like in multimedia communication strategy.

Tricksters and cheats

Accounting fraud, antitrust violations and corruption at company level are widespread throughout the world. For its 2011 annual global corporate responsibility report, Munich-based rating agency Oekom Research AG assessed 3,100 companies from more than 45 industries in over 50 countries. On the topic of corruption, the construction industry with 15.3 percent and the aerospace and defence industries, consumer electronics and communications device makers and the tourism and leisure industry with 12.5 percent each take an infamous lead. In terms of false accounting too, companies from the aerospace and defence industry, consumer electronics and communications equipment makers are to the fore; in these three sectors breaches have been documented in every eighth company. Even more widespread, says Oekom, are antitrust violations: three-quarters of the manufacturers of consumer electronics and more than half of the manufacturers of household and chemical products and building materials are demonstrably involved in anticompetitive behaviour.