AGMagenda

|

Jan.05,2026 Tabuk Cement in Duba City (SA) |

|

Jan.05,2026 Evraz in Luxembourg (RU) |

|

Jan.05,2026 Fawaz Abdulaziz Alhokair in Riyadh (SA) |

|

Jan.05,2026 Micromem Technologies |

|

Jan.05,2026 Polski Koncern Naftowy Orlen in Plock (PL) |

|

Jan.05,2026 Bank Polska Kasa Opieki in (PL) |

|

Jan.05,2026 Fountaine Pajot in (FR) |

|

Jan.05,2026 Jabal Omar Development in (SA) |

|

Jan.05,2026 Arab National Bank in (SA) |

|

Jan.05,2026 Bank AlJazira in Riyadh (SA) |

|

Jan.05,2026 Zhejiang Hisun Pharmaceutical in (CN) |

|

Jan.05,2026 Voss Veksel Og Landmandsbank in (NO) |

|

Jan.05,2026 SDIC Huajing Power Holdings in (CN) |

|

Jan.05,2026 tegraGen |

|

Jan.05,2026 Telefonica Deutschland Holding in Munich (DE) |

|

Jan.05,2026 S&W Seed |

|

Jan.05,2026 Bastei Luebbe in Cologne (DE) |

|

Jan.05,2026 NSE Holding in Paris (FR) |

|

Jan.05,2026 Shanxi Lanhua Sci-Tech Venture in (CN) |

|

Jan.05,2026 Societatea Nationala Nuclearelectrica in (RO) |

|

Jan.05,2026 Quantum Genomics |

|

Jan.05,2026 Proodeftiki Technical in (GR) |

|

Jan.05,2026 Fair Value REIT in (DE) |

|

Jan.05,2026 Rami Levi Chain Stores Hashikma Marketing 2006 |

|

Jan.05,2026 BHB Brauholding Bayern Mitte in Ingolstadt (DE) |

Search

VIPsight

|

Corporate Governance – portrayed in the individual cultural and legal framework, from the standpoint of equity capital. VIPsight is a dynamic photo archive, sorted by nations and dates, by and for those interested in CG from all over the world. VIPsight offers, every month:

|

VIPsight - 2nd Edition 2016

COMPANIES

278 investors file a lawsuit against VW

Volkswagen faces a multi-billion-euro lawsuit from professional investors in the wake of the emissions scandal in Germany. The Tübingen-based lawyer Andreas Tilp filed a lawsuit at a regional court in Braunschweig brought by 278 institutional investors from around the world for damages of EUR 3.255 billion for share price losses. They accuse the Wolfsburg-based carmaker of failing to inform them about the manipulation of emissions in a timely manner. The Braunschweig regional court confirmed the filing of the lawsuit.

The plaintiffs include 17 financial service providers and insurance firms from Germany and the US pension fund Calpers.

Volkswagen faces a multi-billion-euro lawsuit from professional investors in the wake of the emissions scandal in Germany. The Tübingen-based lawyer Andreas Tilp filed a lawsuit at a regional court in Braunschweig brought by 278 institutional investors from around the world for damages of EUR 3.255 billion for share price losses. They accuse the Wolfsburg-based carmaker of failing to inform them about the manipulation of emissions in a timely manner. The Braunschweig regional court confirmed the filing of the lawsuit.

The plaintiffs include 17 financial service providers and insurance firms from Germany and the US pension fund Calpers.

The living is easy

VONOVIA, Germany's largest residential property company, reported net income of EUR 995 million in 2015 (up from EUR 410 million in 2014). This jump is largely attributable to the integration of Gagfah and Süddeutsche Wohnen. Vonovia (formerly Deutsche Annington) also benefited from higher rents and fewer vacant properties. Rental income rose by 80 per cent to EUR 1.4 billion.

According to CEO Thomas Hegel, the Düsseldorf-based property company LEG was ultimately unaffected by the fact that its planned merger with Deutsche Wohnen in autumn 2015 did not go ahead: "We have emerged from the situation in a stronger position," he said at the presentation of the company's results. At the end of 2015 LEG agreed to buy 13,570 units from the Vonovia company. This increases LEG's stock to 130,000 residential units. The company had just 91,000 when it was floated at the start of 2013.

LEG's operating profit increased by 25.9 per cent to EUR 206 million in 2015. Shareholders have reason to be pleased not just with an almost 22 per cent jump in the share price last year but also with a higher dividend. The Board and Supervisory Board have proposed a dividend of EUR 2.26 per share (up from EUR 1.96 last year).

A turbo-charged bonus at Porsche

Employees of Porsche are rejoicing. Each of the carmaker's approximately 15,600 employees has received a bonus of EUR 8,911 "for the best business year on record", as Porsche reported. The sports car manufacturer sold approximately 225,000 vehicles in 2015, a new record figure. Porsche also posted record sales revenue and operating profit.

Employees of Porsche are rejoicing. Each of the carmaker's approximately 15,600 employees has received a bonus of EUR 8,911 "for the best business year on record", as Porsche reported. The sports car manufacturer sold approximately 225,000 vehicles in 2015, a new record figure. Porsche also posted record sales revenue and operating profit.

German companies suffer reputational damage

Private investors believe that recent scandals such as those affecting VW and Deutsche Bank are harming the international reputation of German companies. More than one in two (58 per cent) think that the reputational damage will be long term. Sound corporate governance is a key consideration for private investors, as a Forsa survey commissioned by Union Investment shows.

Anyone prepared to invest their money in stocks pays particular attention to responsible management (79 per cent). Furthermore, private investors have clear views on sound corporate management. Asked what sets a company apart, three particular aspects were mentioned: good treatment of employees (95 per cent), transparency regarding the manufacture of products (86 per cent) and environmental awareness (80 per cent).

Jens Wilhelm, the Member of Union Investment's Management Board responsible for Portfolio Management and Real Estate, sees parallels here with the behaviour of professional investors: "In the course of implementation of Principles for Responsible Investment (PRI) the so-called ESG criteria are increasingly coming to the fore in institutional capital investment." Individually this means ecological criteria (environment), social criteria (social) and aspects of good business management (governance). And there is a clear calculation here: "Not just institutional investors but also private investors are increasingly recognising that companies which are well managed in the broadest sense of ESG are less susceptible to risks and therefore more robust and more successful in the long term," explains Wilhelm. Private investors consider companies themselves to hold primary responsibility for the implementation of corporate governance principles. Seventy per cent of respondents do not believe that the state should impose regulations regarding the responsible management of companies. Instead they advocate ESG disclosure by companies on a voluntary basis.

Union Investment commissioned the market research institute Forsa to gauge the attitude of private investors to the theme of corporate governance in January and February 2016. 500 financial decision-makers in private households aged from 20 to 59 with at least one financial investment were surveyed.

Sleeping soundly

bmp Holding AG, an e-commerce group focussing on the sleep product segment (bed products, bedroom furniture, mattresses), performed in line with expectations in 2015. In the year that it repositioned itself as an e-commerce company, consolidated sales stood at EUR 4.8 million, with over half of this total achieved in the fourth quarter.

It should be noted that sleepz GmbH was consolidated into bmp Holding for the first time in May and the companies of the Matratzen Union group were consolidated into bmp Holding for the first time in December. Therefore bmp’s consolidated sales in 2015 contained only part of their annual sales. Annualised sales at bmp subsidiaries amounted to EUR 12.8 million in 2014.

The revenue guidance of EUR 25-40 million for 2016 remains effective. Sales are expected to increase compared with 2015 thanks to organic growth at the subsidiaries and further acquisitions. For the subsidiaries alone, the sales target for 2016 exceeds EUR 20 million, of which more than EUR 4 million is attributable to the first quarter.

LPKF Laser&Electronics AG: Major order from the solar industry

Sunny skies for LPKF Laser & Electronics: From its headquarters in Garbsen by Hannover, the company has announced successfully securing a series of substantial orders worth 17 million Euros from a customer in the solar generating field. Invoicing will take place in 2016-17. In 2015, LPKF’s turnover amounted to 87.3 million Euros, with a negative EBIT of 3.7 million Euros. The Prime Standard listed company announced that the forecast 10 percent increase in turnover and the double-digit margin took these new orders into account.

Steilmann SE: Break-up looms

Bankrupt apparel company Steilmann is facing dismemberment. The bankruptcy receiver announced that talks are ongoing with potential investors who, however, are only interested in certain parts of the company. As things stand, therefore, it is looking unlikely that the entire group will be taken up. Steilmann SE filed for bankruptcy on 24 March 2016 and its subsidiary followed suit on 6 April. The day-to-day business is being conducted as usual.

Wacker Chemie AG: New facility in the USA

Wacker Chemie AG has begun producing polysilicon in its new Tennessee factory. At a cost of 2.5 billion dollars, it is the largest single investment in the company’s history. It took 5 years to build and when production gets up to speed, it will employ 650 staff. At the inauguration ceremony, group chief executive Rudolf Staudigle stressed the growth potential that will materialise with the success worldwide of solar panels. Wacker estimates that the generating capacity installed in the course of this year will continue to rise to between 60 and 70 Gigawatts. The increase will be particularly marked in China, the USA, Japan and India. According to the communiqué, silicon-based solar panels are better that those that run on other technologies.

Wacker Chemie AG has begun producing polysilicon in its new Tennessee factory. At a cost of 2.5 billion dollars, it is the largest single investment in the company’s history. It took 5 years to build and when production gets up to speed, it will employ 650 staff. At the inauguration ceremony, group chief executive Rudolf Staudigle stressed the growth potential that will materialise with the success worldwide of solar panels. Wacker estimates that the generating capacity installed in the course of this year will continue to rise to between 60 and 70 Gigawatts. The increase will be particularly marked in China, the USA, Japan and India. According to the communiqué, silicon-based solar panels are better that those that run on other technologies.

The German Mittelstand

German SMEs: no misgivings on Brexit

SMEs in Germany are feeling upbeat about the future. Just as the KfW-ifo-Mittelstandsbarometer April results were going to press, optimism was on the upswing for the first time since November 2015. In terms of numbers, the change was reported at between 1.8 and 12.7 points. Dr. Jörg Zeuner, KfW’s head economist, breathed a sigh of relief: “Spring is coming to SMEs as well. [https://www.kfw.de/PDF/Download-Center/Konzernthemen/Research/PDF-Dokumente-KfW-ifo-Mittelstandsbarometer/2016/KfW-ifo-Mittelstandsbarometer_2016-03.pdf]

Unfortunately the generous breathing space could turn out to be shorter than expected. On June 23 the UK is called to vote on an historic referendum on whether or not it is to remain a member state of the European Union. All the experts are in agreement in the event of its departure, the economic effects would be felt in all the other member states. The debate is more about the extent to which the shock wave will affect the various sectors.

The SME Institut für Mittelstandsforschrung (IFM) is worried about te German SMEs. Brexit could have negative repercussions on companies that manufacture for export; in 2011 approximately eight percent of SME sales to EU countries went to the UK. If the UK abandons the European Economic free-trade area as well, ad hoc customs procedures will have to be put in place, with an increase in duties and separate procedures for the authorisation and assay of German manufactured goods, states Dr. Friederike Welter, chairman of IFM.

The truth is that no one knows what will really happen. Those pushing for the referendum are upset by the speeding up of European political integration while quite happy to reap the economic benefits – the UK enjoys not unsubstantial conditions of favour by its EU membership. There are good reasons to hope, therefore, that in the event of Brexit, the UK will stay inside the European Economic Area, not the least of which being the coming into force of the TTIP free trade agreement between the USA and Europe which would put United Kingdom exports at an even greater disadvantage.

German SMEs need have no fear of Brexit. After weathering the economic hardships of 2009/10, SMEs are in better health than ever. The percentage of equity capital is up and regional diversification in exports is broader based. SMEs are the backbone of the German economy. And if Brexit reaIly does happen – well, we’ll survive!

Buhlmann's Corner

Corporate Governance is when everyone does what I think

So, who am I? I’m you, obviously. What about the stock-market, though? Their share pricing? Are they playing this game of mirrors too?

So, who am I? I’m you, obviously. What about the stock-market, though? Their share pricing? Are they playing this game of mirrors too?

In November 2015, Oddo SeydlerBank and Banca IMI (the investment division of Banca Intesa San Paolo, Italy’s biggest and most successful bank) placed Steilmann Holding SE on the stock market but it didn’t even get as far as the end of the first AGM. A mere one hundred days later the fashion company went bust, though certified by KPMG, and lost its shirt. So exactly what were the big three – Oddo, Intesa and KPMG – so busy keeping an eye on? Themselves in the mirror, perhaps, wondering how to make the world a better place? Who knows?

Siemens placed its illuminated sister company OSRAM on the stock market but then lost its cool when 18 months later sister changed her strategy. Apparently it didn’t occur to sister to ask what mother thought, strange indeed seeing as how Siemens has a seat on the OSRAM Supervisory Board which gives it a say in deciding this and all new strategies. As things turned out, it was all over bar the shouting at last February’s AGM. The executive board Chairman was discharged with a paltry 71% of the vote while his fellow board member responsible for the less than convincing communication campaign, rang up a respectable discharge vote of 97%. He was, admittedly, out of the company 60 days later, as the activist shareholder Siemens learned its lesson.

Wirecard is no stranger to this kind of game. The executive and Supervisory boards as well as (especially) the shareholders could only look on as a pack of thieves who grab shareholder assets set about scaremongering casting doubts and spreading rumours about no profits. MLP and SIXT are only two classic examples of this and some even say that “this disease began in America”.

Stroer is itself living proof of this, a company which, with the help of a major shareholder carved out a future for itself by undergoing an incredible transformation from bill-sticker to advertising producer on 4.0. media. The success stories are just as clear-cut and extensive, Axel Springer in Berlin, for example. The onslaught was launched by the aptly named Muddy Water Research who collect their profits from under the noses of the shareholders losing out.

Everybody was looking but nobody knew a thing about what was going on. Certainly not Commerzbank who as though as pure as the driven snow tried to mislead its shareholders shortly before facing accusations of cum-cum (or perhaps cum-ex….) trading before the notary’s ink had dried on the company register. Volkswagen, dragged down by unknown forces, was hard put to keep its head above water while, accompanied by the applause of the local trade union boss and deputy chairman, the owning family’s private “sister” was handing out a five times richer dividend. Then Deutsche Bank, which by commercial law could and by company-shareholder law should set and distribute a dividend, is looking like they haven’t the slightest intention of doing so but prefer to catch up with bonuses frittered away in recent years.

In conclusion, I wonder if trade unions have corporate governance too, or, more to the point, whether they should have it.

There are top-level officials who join executive boards (recently OSRAM and Thyssen Krupp) and there are ministers who, instead of facing up to their responsibilities exploit the third-sector trade-union ver.di to settle or lay down anti-trust decisions – to suit their own agenda.

So, like I said. Corporate Governance is when everyone does what I think. Hey Panama! You don’t need a weatherman – I can tell which way the wind blows!

ACTIONS CORNER

German CEOs earn less than their peers in Europe and the US

Chief executive officers in Germany earn less than their counterparts in other European countries and the US. The major players from Germany listed on the European Dow Jones STOXX Europe 50 earned an average of EUR 6.1 million in 2015 - a slight -0.9 per cent year-on-year decline. The non-German companies on the same index, on the other hand, paid their CEOs an average of approximately EUR 6.9 million. The CEOs of companies listed on the US Dow Jones Industrial Index received an average of EUR 17.1 million in 2015 (information based on annual reports published to date for 2015). "The average remuneration of a CEO in the US is significantly higher than the level in Germany and Europe. Executive compensation is typically far higher in the US and there are cultural reasons for this," explains Ralph R. Lange, Manager Board & Executive Compensation at Willis Towers Watson.

Chief executive officers in Germany earn less than their counterparts in other European countries and the US. The major players from Germany listed on the European Dow Jones STOXX Europe 50 earned an average of EUR 6.1 million in 2015 - a slight -0.9 per cent year-on-year decline. The non-German companies on the same index, on the other hand, paid their CEOs an average of approximately EUR 6.9 million. The CEOs of companies listed on the US Dow Jones Industrial Index received an average of EUR 17.1 million in 2015 (information based on annual reports published to date for 2015). "The average remuneration of a CEO in the US is significantly higher than the level in Germany and Europe. Executive compensation is typically far higher in the US and there are cultural reasons for this," explains Ralph R. Lange, Manager Board & Executive Compensation at Willis Towers Watson.

People

Deutsche Bank's Thoma to Step Down and New York Parent to take over

Deutsche Bank AG supervisory board member Georg Thoma is stepping down after a week of turbulence at Germany’s biggest lender after criticism that he went too far in probing potential wrongdoing within its ranks – made public by the deputy.

Deutsche Bank AG supervisory board member Georg Thoma is stepping down after a week of turbulence at Germany’s biggest lender after criticism that he went too far in probing potential wrongdoing within its ranks – made public by the deputy.

Thoma resigning from the board’s integrity committee with immediate effect.

Deutsche Bank dropped 3.1 percent to 16.83 euros the shares have declined about 25 percent this year, more than an index.

Deutsche Bank supervisory board member Louise Parent, ( Cleary, Gottlieb Steen & Hamilton LLP), will take as chairwoman of the integrity committee assisted by board member Johannes Teyssen. That panel monitors and analyzes the company’s legal risks – historical and future.

Deutsche Bank’s costs and provisions for fines and lawsuits have amounted to 12.6 billion euros ($14.3 billion) since 2012 when VIP together with EOS from Hermes cirtizied the board with countermotions against board-discharge – and found 24.6% followers from voting shareowners.

Annual General Meeting of Deutsche Bank AG on 31 May 2012 - counter-motion pursuant to §126 AktG on Agenda Item 4

Executive level changes at the private bank Sal. Oppenheim

Chief Financial Officer Jürgen Dobritzsch and Nicolas von Loeper, the Executive Board member responsible for Private and Institutional Clients, have stepped down at the Cologne-based private bank Sal. Oppenheim. The two executives will be replaced internally. Only Chairman Wolfgang Leonie remains of the old Executive Committee.

Henning Heuerding (51), previously employed at the parent Deutsche Bank and Deputy Chairman of the Supervisory Board at Sal. Oppenheim, takes over as Chief Financial and Risk Officer from April. Marco Hauschildt (43), Managing Director of Sal. Oppenheim's Hamburg location since 2007, takes over as the head of the Private Client business at the same time, albeit not as a member of the expanded executive team.

Thomas Buberl for AXA by the Seine

Thomas Buberl is to step down as CEO of AXA Germany and take over as CEO of the Group. The Board has chosen the 42-year-old as its new head. From 1 May he will replace Jacques de Vaucleroy, who is stepping down after six years and will leave the AXA Group in the middle of 2016. Buberl will focus on his duties at the company's Paris headquarters. Chief Financial officer Etienne Bouas-Laurent is replacing Buberl as head of AXA's German subsidiary until a successor has been found.

Thomas Buberl is to step down as CEO of AXA Germany and take over as CEO of the Group. The Board has chosen the 42-year-old as its new head. From 1 May he will replace Jacques de Vaucleroy, who is stepping down after six years and will leave the AXA Group in the middle of 2016. Buberl will focus on his duties at the company's Paris headquarters. Chief Financial officer Etienne Bouas-Laurent is replacing Buberl as head of AXA's German subsidiary until a successor has been found.

Top salaries for top managers

According to a survey, Germany's top managers earned an average of EUR 4.9 million last year. According to the advisory, broking and solutions company Willis Towers Watson, this means that the pay of the bosses of 20 of the 30 Dax-listed companies whose data was available as of 11 March rose by one per cent in 2015. The EBIT of Germany's stock market heavyweights, in contrast, fell by seven per cent to an average of EUR 3.08 billion.

According to a survey, Germany's top managers earned an average of EUR 4.9 million last year. According to the advisory, broking and solutions company Willis Towers Watson, this means that the pay of the bosses of 20 of the 30 Dax-listed companies whose data was available as of 11 March rose by one per cent in 2015. The EBIT of Germany's stock market heavyweights, in contrast, fell by seven per cent to an average of EUR 3.08 billion.

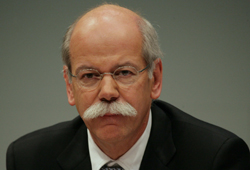

According to the figures released to date, Daimler CEO Dieter Zetsche leads the field with total pay of EUR 9.7 million. Bottom of the ranking was Norbert Steiner, Chairman of the fertiliser and salt producer K+S, with pay of EUR 2.3 million.

Woman power at Allianz

Allianz is restructuring its Board. Asset management chief Jay Ralph and investment management head Maximilian Zimmerer are stepping down. Ralph will be succeeded on 1 July by Jacqueline Hunt. The 47-year-old was until recently responsible for Prudential's insurance business in the UK, continental Europe and Africa. Zimmerer will be replaced on 1 January 2017 by Günther Thallinger. The 44-year-old is currently CEO of Allianz Investment Management (AIM).

Allianz is restructuring its Board. Asset management chief Jay Ralph and investment management head Maximilian Zimmerer are stepping down. Ralph will be succeeded on 1 July by Jacqueline Hunt. The 47-year-old was until recently responsible for Prudential's insurance business in the UK, continental Europe and Africa. Zimmerer will be replaced on 1 January 2017 by Günther Thallinger. The 44-year-old is currently CEO of Allianz Investment Management (AIM).

Zetsche remains at the wheel

The Supervisory Board of Daimler AG has extended Dieter Zetsche (62)'s contract by three years until 31 December 2019.

The Supervisory Board of Daimler AG has extended Dieter Zetsche (62)'s contract by three years until 31 December 2019.

Zetsche has been a a member of the Board of Management since 16.12.1998 and Chairman of the Board of Management since 1.1.2006. He is also Head of the Mercedes-Benz Cars Division. Dieter Zetsche's contract was due to expire on 31 December 2016. Daimler chairman Manfred Bischoff had informed the company's annual meeting on 1 April 2015 of the supervisory board's intention to prolong the contract of Dieter Zetsche.

The German chemical industry association VCI nominates a new president

The German chemical industry association VCI has nominated Dr Kurt Bock, Chairman of the Board of Executive Directors of BASF, as candidate for the next presidency. He will be put forward to succeed Marijn Dekkers, Chairman of Bayer, at the general assembly on 23 September in Düsseldorf.

New women for Fresenius

Iris Löw-Friedrich from the Belgian pharmaceutical company UCB and Hauke Stars, a Member of the Executive Board of Deutsche Börse, have been nominated for the six-strong supervisory board of the healthcare company Fresenius. They will replace Roland Berger and Gerhard Roggemann in May.

Drillisch: brother replaces brother as company head

Telecommunications group Drillisch AG gets a new frontman. Citing personal reasons, Paschalis Chroulidis will stand down towards year’s end as member and spokesman of the executive board. The company has appointed his brother Vlasios Choulidis as spokesman with effect from 1 July. Paschalis Choulidis has offered to continue as a member of the company’s Supervisory Board.

Tom Tailor: new CFO

After some 10 years of continuity, Hamburg-based fashion group Tom Tailor, has a new CFO. The present incumbent, Axel Rebien, who has directed the company finances since 2005 is resigning on agreed terms with effect 30 June 2016. The company’s Supervisory Board has appointed 58-year-old Thomas Dressendörfer to replace him with effect from 1 July 2016. Dressendörfer’s responsibilities will cover finance and accounting, control, investor relations, human resources and legal affairs.

The company has highlighted Dressendörfer’s extensive experience as CFO in high profile companies and major business units or geographic areas. He has served as CFO in such companies as Swiss dental implant manufacturer Straumann and Uste Technologies, also a Swiss-based concern, both of which are SIX-listed on the Swiss stock exchange. The fashion group points out that latterly he worked as a freelance consultant advising companies involved in complex business initiatives and restructuring programmes.

PNE WIND AG: change of air

Marco Lesser will soon be the group’s number one. His future responsibilities as CEO will extend to the entire company and its strategic management, not only for operative business and project development. At the end of May he will become chair of the executive board of which he has been a member since May 2011. Lesser follows in the footsteps of Per Hornung Pedersen, appointed by the Supervisory Board as interim member of the executive board. His mandate, during which his functions as member of the Supervisory Board have been temporarily put on hold, will expire at the next shareholders meeting set for 25 May.

Marco Lesser will soon be the group’s number one. His future responsibilities as CEO will extend to the entire company and its strategic management, not only for operative business and project development. At the end of May he will become chair of the executive board of which he has been a member since May 2011. Lesser follows in the footsteps of Per Hornung Pedersen, appointed by the Supervisory Board as interim member of the executive board. His mandate, during which his functions as member of the Supervisory Board have been temporarily put on hold, will expire at the next shareholders meeting set for 25 May.

Capital News

Pro Sieben Sat 1 in the top division The TV conglomerate Pro Sieben Sat 1 has crowned its growth story by entering the benchmark Dax index, in the process becoming the first German media company to play in the same league as Siemens, BMW, Volkswagen and Deutsche Post. Thanks to its increased stock market value Pro Sieben Sat 1 replaced the fertiliser producer K+S.

The TV conglomerate Pro Sieben Sat 1 has crowned its growth story by entering the benchmark Dax index, in the process becoming the first German media company to play in the same league as Siemens, BMW, Volkswagen and Deutsche Post. Thanks to its increased stock market value Pro Sieben Sat 1 replaced the fertiliser producer K+S.

With a value of almost EUR ten billion the TV broadcaster is now more expensive than the traditional groups Lufthansa, Thyssen-Krupp and RWE. "We see our rise as a reward for our work in recent years and as an incentive to continue to successfully pursue our diversified growth strategy moving forward," explained CEO Thomas Ebeling after the decision was announced. In addition to its traditional TV business, Ebeling is driving the expansion of Pro Sieben Sat 1. online and in TV productions with the aim of achieving significant future growth in its revenues - which totalled €3.3 billion in 2015 - and profit.

Two new additions to the TecDAX

Deutsche Börse has made two changes to its TecDAX index of leading technology sector shares. The metal-based 3D printing manufacturer SLM Solutions and the semiconductor industry equipment supplier Süss MicroTec will replace the Cologne-based IT service provider QSC and the electronics specialist LPKF this spring.

ADIDAS forges ahead ADIDAS posted record sales and profit in 2015. Sales rose by 16 per cent to EUR 16.9 billion while profit advanced by 12 per cent to EUR 720 million. Shareholders will receive a dividend of EUR 1.60 per share, an increase of ten cents compared with 2015.

ADIDAS posted record sales and profit in 2015. Sales rose by 16 per cent to EUR 16.9 billion while profit advanced by 12 per cent to EUR 720 million. Shareholders will receive a dividend of EUR 1.60 per share, an increase of ten cents compared with 2015.

BMW revs up

BMW sold a record number of around 2.2 million cars in 2015. Group revenues advanced almost 15% to EUR 92.2 billion and profit before tax climbed almost 6 per cent to EUR 9.2 billion. The Bavaria-based carmaker reported a 10 per cent year-on-year rise in group net profit to EUR 6.4 billion.

More shareholders in Germany

Over nine million people in Germany possessed shares and/or units in equity funds last year. This is the highest figure since 2012. The year-on-year increase was 6.7% or 560,000 people.

Among under 40s the increase in the number of shareholders stood at 170,000, an even greater 10% increase.

Supervisory boards: term of office too short

The average term of office of supervisory board members on the DAX index is 5.9 years (MDAX 5 years). Very few boards have very high average terms of office, which could indicate a limited self-renewal capacity. The current terms of office of supervisory board members are mainly significantly lower than the EU recommendation of 15 years, which means that the limited capacity for self renewal of supervisory boards that the Corporate Governance Commission is seeking to address in fact only exists in isolated cases. This is the finding of a current study by the FOM University of Applied Sciences for Economics and Management. For the study the current terms of office of all supervisory board members of companies listed on Germany's benchmark DAX and MDAX indices were investigated by Prof. Dr. Peter Ruhwedel, a leading authority on corporate governance.

The average term of office of a supervisory board member of a DAX-listed company is 7.7 years (MDAX 7.2 years). "Longer terms of office are appropriate considering the high demands on supervisory board and audit committee chairs and the necessary period of vocational adjustment," says Professor Peter Ruhwedel. "In my view mechanistic rules that do not take into account company-specific conditions are not effective."

Wilex AG: Fresh money Increases in capital keep Wilex on course in its financing strategy announced in November 2015.

Increases in capital keep Wilex on course in its financing strategy announced in November 2015.

The stage launched at the beginning of April provides for an increase in share capital of up to 2,248,272.00 Euros from authorised capital to bring the total up to 12,927,564.99 Euros, through the issue of up to 2,248,272 new no par value bearer shares in return for cash contributions. The new shares will be offered exclusively to existing shareholders at a 19:4 ratio by means of an indirect subscription right. Hence, shareholders will be entitled to subscribe for 4 new shares for each 19 existing shares held. The subscription period began on 8 April 2016 and will end on 22 April 2016 at 4:00 pm. The subscription price is fixed at EUR 1.84. There will be no organised trading in subscription rights. The subscription offer was published in the Federal Gazette on 7 April 2016.

New unsubscribed shares can be offered by the principal shareholder dievini Hopp BioTech holding GmbH & Co. KG of Walldorf as part of a private placement, provided the price does not exceed 1.84 Euros per share. The company has stated its willingness to take up the new unsold shares as part of the subscription offers and additional subscription. Integration of the new shares is set for 29 April 2016.

WILEX AG announced that it intended to use the net proceeds expected from the transaction of some 4.13 million Euros to pay for broadening the portfolio in such areas as continuing development of the proprietary antibody-drug-conjugate technology platform, creating a pipeline of ADC products to combat tumour related diseases, and evaluating clients’ specific research requests.

MPC Capital: base capital base bolstered

![]() In March, MPC Capital AG’s gross proceeds from the sale of 2,212,939 new shares to institutional investors priced at 5.70 Euros each amounted to 12.6 million Euros. Shareholder option rights were excluded. MPC Capital AG’s share capital stands at 24,342,333.00 Euros. The new shares should be included in the 24 March 2016 trading session. The MPC Capital AG group announced its intention to fund the expected growth such as co-investing in alternative assets which are already present in today’s planning pipeline.

In March, MPC Capital AG’s gross proceeds from the sale of 2,212,939 new shares to institutional investors priced at 5.70 Euros each amounted to 12.6 million Euros. Shareholder option rights were excluded. MPC Capital AG’s share capital stands at 24,342,333.00 Euros. The new shares should be included in the 24 March 2016 trading session. The MPC Capital AG group announced its intention to fund the expected growth such as co-investing in alternative assets which are already present in today’s planning pipeline.

Biofrontera AG: fresh money for expansion in the USA

As part of an increase in capital, Biofrontera AG succeeded in its attempt to raise some 4.9 million Euros from institutional investors. Approximately 2.5 million shares were issued at 2.0 Euros each. The company announced that the share capital was oversubscribed three-fold. According to a communiqué, these new resources will be put to use to fund current business and create and sell products that combat Ameluz skin cancers in the USA. The Leverkusen-based concern expects to get the green light to proceed with sales to the world’s biggest pharmaceutical market by mid-May 2016.

M & A

United Internet to become largest shareholder of Tele Columbus AG

Via its subsidiary United Internet Ventures AG, United Internet AG today contractually secured the acquisition of a share package amounting to approx. 15.31% of shares in Tele Columbus AG, Berlin, Germany. The closing of the acquisition is subject to approval by the German anti-trust authority ("Bundeskartellamt").

Via its subsidiary United Internet Ventures AG, United Internet AG today contractually secured the acquisition of a share package amounting to approx. 15.31% of shares in Tele Columbus AG, Berlin, Germany. The closing of the acquisition is subject to approval by the German anti-trust authority ("Bundeskartellamt").

If the acquisition is approved, United Internet AG would have a total indirect shareholding – together with further shares acquired in the course of today – of 25.11% in Tele Columbus AG.

United Internet believes that Tele Columbus AG is a well positioned company with attractive market opportunities.

Ralph Dommermuth, CEO of United Internet, says: "We know Tele Columbus and its CEO Ronny Verhelst and value his successful management of the company. As a strategic investor, we plan to accompany the ongoing development of Tele Columbus AG and benefit from its growth in value."

United Internet AG does not, however, currently intend to acquire an equity stake of 30% or more in Tele Columbus AG – which would oblige it to submit a mandatory bid to all other shareholders of Tele Columbus AG – nor to make a voluntary takeover bid.

Bastei Lübbe AG: blueprint for enhancing value

Publisher Bastei Lübbe AG has purchased a majority stake in Buch Partner GmbH, acknowledged leader in book wholesale in the German-speaking areas of Europe. This acquisition will enhance its prestige and value in classical publishing and sales in traditional bookshops. According to a communiqué, Buch Partner GmbH has a staff of some 220 in addition to the 800 deployed at local level as support personnel available to retail outlets. Their task is to ensure the availability of the 2500 products, in particular for the promotion and discount initiatives. Buch Partner’s clients include all the major retail groups – the Edeka group (Edeka and Marktkauf), the REWE group (REWE and Penny), Kaufland, Familia, HIT, Saturn, Media Markt, Metro and Real. The actual price of the transaction has not been disclosed.

Rocket Internet strikes a deal with Chinese internet colossus, Alibaba

Rocket Internet has sold its 9.1 percent stake in Lazada to Chinese internet giant Alibaba. E-commerce company Lazada was established in 2012 and is the acknowledged leader in e-commerce sales for local and international brands to clients in the six South Asian markets including Indonesia, Singapore and Vietnam The price of the transaction – 137 Million US Dollars – was based on a extremely watered down assessment of Rocket Internet’s stake in Lazada.

According to the press communiqué, the agreement between Lazada and Alibaba was for Alibaba to increase Lazada’s capital by 500 Million US Dollars and so acquire control of the company, a transaction based on Lazada’s worth being assessed at 1.5 billion dollars. Once the transaction had been finalised, including Alibaba’s capital increase, Rocket Internet’s bare-bones stake in Lazada was only 8.8 percent. According to the company, the assessment was arrived at by multiplying Rocket Internet’s capital investment in Lazada of 18 Million Euros by a factor of 15.

Nanogate: still shopping

Entry Standard-listed Nanogate AG is pushing ahead with its growth-oriented agenda, and has purchased a 75 percent stake in plastic materials specialist Walter Goletz GmbH. It forecasts an even higher medium-term turnover than its target, itself in excess of 100 million Euros. The new venture presently employs some 130 staff. Part of the price of the transaction is pegged to the results and will be paid in instalments over the coming years. Nanogate may use a scale model of this transaction to purchase the remaining stakes. Part of the purchase price will be met by shares (by means of a capital increase through contribution in kind) .

In a note, Nanogate states that this acquisition will enable it to extend its scope in systems in the development and production of plastic components. The future aim of the company is to provide a one-stop coverage in development, production and multifunctional finishing of components. The new venture is strongly placed in the market especially as regards designer, and small- to medium-size components, while up to now Nanogate’s specialisation has been in larger size components.

Welcome to VIPsight archives 2016/17

VIPsight seeks to inform and to clarify positions.

VIPsight offers German and international clients a monthly up-to-date snapshot of German corporate governance.

VIPsight invites people from other countries and cultures of the world to enrich the monthly issues with information on their own corporate governance, thus making it available to involved and interested friends globally.

Welcome to VIPsight Asia - Uzbekistan

|

|

| Zufar Ashurov |

27 December 2019

On 10 December 2019 Mr. Zufar Ashurov, an Acting Deputy Director and Senior Research Scientist of the Center for Research of Problems in Privatization, Development of Competition and Corporate Governance, Tashkent, Uzbekistan, and a country reporter of VIPsight International was awarded a PhD in Economic Sciences degree after successfully defending his PhD dissertation titled “Improvement of Organizational and Economic Mechanism of Corporate Governance in the Joint-Stock Enterprises” at the Scientific Council of Tashkent State University of Economics on 25 October 2019.

His PhD dissertation is aimed at developing the theoretical and methodological foundations of one of the topical issues of present time in Uzbekistan – corporate governance, at elaborating the proposals and recommendations for improving the organizational and economic mechanism of corporate governance in the joint-stock enterprises on the basis of modern international standards. The researches were carried out in the case of JSC Uzkimyosanoat and joint-stock companies of chemical industry incorporated in its structure.

The scientific results of the dissertation, which have the theoretical significance, are that there:

- worked out the general scientific methodology for research of corporate governance;

- formulated the definitions of the concept of “corporate governance” from economic, financial, legal, political, sociological and psychological points of view;

- methodologically disclosed in a new way the essence of the concepts of “corporate governance” and “corporate management”, and proved that they are distinct concepts from each other;

- revealed various characters for classification of corporate governance, and carried out a preliminarily scientific classification of corporate governance;

- concretized the concept of “joint-stock enterprise” which distinguishes in its individual specificity among other corporate structures;

- arranged in a sequence the categories widely used in the sphere of corporate governance, such as “corporate governance”, “corporate control”, “corporate culture”, “corporate stewardship”, “corporate social responsibility”, “corporate citizenship” by their influence on the corporation, and specified their position and significance in the entire corporate system;

- scientifically disclosed the essence and meaning of the organizational and economic mechanism of corporate governance, developed its conceptual model and proposed its practical implication.

The scientific results of the dissertation, which have the practical significance, are that there:

- investigated in a new way the specificities of legal and economic development of corporate governance system of Uzbekistan, identified the existing problems in corporate governance, and for solving these problems there worked out the proposals on improvement of normative-legal base of corporate governance system of Uzbekistan on the basis of international standard «G20/OECD Corporate Governance Principles» (these proposals were included in articles 12, 23, 57, 59, 62, 65, 68, 75, 83, 107 of the Law of the Republic of Uzbekistan «On Joint-Stock Companies and Protection of Shareholders’ Rights» adopted on 6 May 2014 in the new edition);

- elaborated the proposals on improvement of the Corporate Governance Code of Uzbekistan, including on applying long-term strategic planning in the activity of joint-stock companies, on introducing independent member to the structure of supervisory board, on determining remuneration for the members of supervisory board linking it with the performance of joint-stock company, on creating committees of supervisory board (these proposals were included in chapter 5, clauses 18, 19, 25 of the Corporate Governance Code of Uzbekistan adopted on 31 December 2015);

- developed “The Guidelines for Compliance with Some Provisions of the Corporate Governance Code” that includes the ways of effective adhering to the international principle of corporate governance «comply or explain» in joint-stock companies, to the approaches of elaborating the long-term development strategy, to the mechanisms of internal control and to the rules for protection of shareholders’ rights (these guidelines were deposited with the Agency on Intellectual Property of the Republic of Uzbekistan No.000886 as of 17.08.2018 and introduced by the State Competition Committee of the Republic of Uzbekistan in the managerial activity of joint-stock companies);

- developed the comprehensive proposals and recommendations on improving the organizational and economic mechanism of corporate governance in the joint-stock enterprises of the chemical industry (these proposals and recommendations were introduced in the managerial activity of JSC Uzkimyosanoat and JSC Navoiyazot, and as a result, this has enabled the government to make decision on selling the state blocks of shares to potential foreign investors, to develop the effective dividend policy, to enhance the effectiveness of corporate governance system of the enterprises);

- elaborated the methodology for rating-based assessing the effectiveness of the organizational and economic mechanism of corporate governance (this methodology was deposited with the Agency on Intellectual Property of the Republic of Uzbekistan No.000890 as of 27.08.2018);

- developed “The Guidelines for Conducting an Independent Assessment Procedure of the Corporate Governance System of Joint-Stock Company” (these guidelines were deposited with the Agency on Intellectual Property of the Republic of Uzbekistan No.000539 as of 22.08.2017);

- proposed new positions of executive officers, such as Chief Corporate Governance Officer, Chief Strategic Planning Officer, Chief Risk Management Officer, in order to bring the management structure of joint-stock companies in line with modern international standards (these positions were included in “The classifier of the main positions of employees and professions of workers” approved by the Resolution of Cabinet of Ministers of the Republic of Uzbekistan No.795 as of 04.10.2017).

The scientific novelties of Mr. Ashurov’s PhD dissertation were accepted for use in the Legislative Chamber of the Oliy Majlis of the Republic of Uzbekistan, State Competition Committee, Ministry of Employment and Labor Relations of the Republic of Uzbekistan, JSC Uzkimyosanoat, JSC Navoiyazot, National Center for Training of Specialists of New Markets, and the certificates on their implementation into practice were received.

Taking this opportunity, we wish Dr. Zufar Ashurov success in his future scientific works.

12 August 2019

Significant Changes Made in the Company Act of Uzbekistan

On March 2019 a number of significant amendments and additions were made in the Law “On Joint-Stock Companies and Protection of Shareholders’ Rights” (Company Act) in order to further improve the corporate governance and enhance the business climate in Uzbekistan in accordance with the World Bank’s annual “Doing Business” report.

Firstly, the requirement on mandatory presence of a share (at least 15%) of foreign investors in the joint-stock company was canceled. Previously, as it was required by the law, the joint-stock companies were forced to attract foreign investors whose share should make of not less than 15% of the company’s authorized capital. Since it was not easy to find such an investor, more than 100 joint-stock companies have transformed into other forms of ownership (e.g. limited liability company etc).

Secondly, the requirement on the minimum size of the company’s authorized capital was excluded from the law. Previously, when registering joint-stock company, its authorized capital could not be lower than the minimum established – a sum equivalent to the 400 thousands US dollars on the rate of the Central Bank of the Republic of Uzbekistan. Now, the founders of the company are free to determine the size of the authorized capital, there are no lower boundaries.

Thirdly, when a company places shares and equity securities convertible into shares paid for in cash, the shareholders – owners of voting shares – have the preemptive right to acquire those shares. Earlier, the General Meeting of Shareholders, by a majority of votes of the holders of voting shares, could decide not to apply this preemptive right for a period not exceeding one year. Thus, if the shareholders owning a sufficient block of shares decided not to include in the company charter the provisions on the exercise of the preemptive right to purchase securities by existing shareholders, this would lead to a violation of the rights of minority shareholders whose share would decrease each time with an additional issue of shares. A new amendment to the law proposes to establish that during a public offering of shares, all shareholders have the opportunity to keep their stakes in the company’s authorized capital, regardless of the existence of this norm in the company charter.

Fourthly, the decision on determining the audit organization for the mandatory audit, on the maximum amount of payment for its services and on conclusion (termination) of agreement with it, is taken now by the General Meeting of Shareholders. These changes were made in order to improve the position of the Uzbekistan in the World Bank’s “Doing Business” report. Previously, a decision on conducting an audit was adopted by the Supervisory Board. Meanwhile, in world practice, the decision to approve an external audit organization and terminate the agreement with it, is taken by the General Meeting of Shareholders. Now, the Supervisory Board retained this authority only in terms of proactive audits.

Fifthly, the procedure for disclosing information on holding a General Meeting of Shareholders has been adjusted. Now, a message about holding a General Meeting of Shareholders should be published on the Single Portal of Corporate Information (www.openinfo.uz), on the company’s official website and in the mass media, and be also sent to shareholders by e-mail no later than 21 days (earlier, it was 7 days), but no earlier than 30 days before the date of holding the general meeting.

Sixthly, creation of committees within the Supervisory Board has been legitimated. Thus, it is established by law that from among the members of the Supervisory Board, committees may be created to consider the most important issues and make recommendations to the Supervisory Board. Before, this requirement was only in the Code of Corporate Governance.

Seventhly, the additional requirements have been established for the joint-stock companies whose shares are listed in the stock exchange:

a) in the company, without fail, there should be created an Audit Committee, consisting solely of members of the Supervisory Board. The internal audit service of the company (if any) is accountable to this committee in its activities;

b) it isobligatory to publish on the Single Portal of Corporate Information and on the company’s official website the information about the ownership of 5% or more of the shares (stakes) of other legal entities. Such information should be published within 72 hours from the date of acquisition of shares (stakes).

c)the Supervisory Board must have at least one independent member who can be re-elected annually. A person is acknowledged as an Independent Member of Supervisory Board who:

- has not worked at the company and/or at its affiliated organizations for the past three years;

- is not a shareholder of the company and/or a founder (shareholder, participant) of its affiliated organizations;

- does not have civil law relations with a major client and/or a major supplier of the company, and (or) of its affiliated persons/organizations;

- does not have any agreements with the company and/or its affiliated persons/organizations of the company, with the exception of those related to ensuring the performance of tasks and functions of a member of Supervisory Board;

- is not a spouse, parent (adoptive parent), child (adopted as a son/daughter), blood or half brother or sister of a person who is or has been, for the past three years, a member of the governing and internal control bodies of the company and/or of the affiliated persons/organizations of the company;

- is not an employee of a government body or of a state-owned enterprise.

Eighthly, the authority of a member of Supervisory Board, director or a member of Management Board of the company may be terminated by a court decision, with a ban on taking a managerial position in business companies for a period of at least 1 year, if the court admits their guilt in causing property damage to the company.

These persons, as well as the investment assets management company, may be held liable for damage caused to the company as a result of providing misleading information or knowingly false information or a proposal to conclude and/or make decisions on the conclusion of a major transaction and/or transaction with affiliated persons/organizations for the purpose of obtaining by them or by their affiliate persons/organizations the profit (income).

Ninthly, the shareholders are guaranteed the right to receive from the company and from witnesses all documents that may be relevant to the case, except for state secrets or other secrets protected by law, during the consideration by the court of a lawsuit regarding the recognition of a major transaction or transactions with affiliated persons/organizations as invalid.

Zufar Ashurov

Acting Deputy Director & Senior Research Scientist

Center for Research of Problems in Privatization,

Development of Competition and Corporate Governance

13 March 2016

The Code of Corporate Governance adopted and introduced into practice in Uzbekistan

In February 2016 the Code of Corporate Governance was adopted and introduced into practice in Uzbekistan by the Commission for Enhancement of Performance of Joint-Stock Companies and Improvement of Corporate Governance. The current voluntary Code of Corporate Governance will be applied in the structure of joint-stock companies to enhance their performance and comprises recommendations which the joint-stock companies will voluntarily follow demonstrating their commitment to the honest and transparent business conduct.

A need for development of the Code of Corporate Governance, aimed at creation of favorable conditions, introduction of modern methods in the corporate governance system, intensification of a role of shareholders in strategic management of the company, is related with implementation of reforms in the country economy as well as with improvement of legislation in the sphere of corporate governance. In the process of developing the Uzbek Code of Corporate Governance there were studied the codes of corporate governance of Germany, the United Kingdom, Russian Federation, Ukraine and Kazakhstan.

For the purpose of this Code, the corporate governance is defined as a system of relationship between executive body of the joint-stock company, its supervisory board, shareholders, representatives of the employees and other stakeholders including creditors in order to attain the balance of interests of mentioned persons for providing effective organization of activity of the joint-stock company, modernization, technical and technological re-equipping of production capacities, for output of competitive products and their export to foreign markets.

Thus, the Uzbek Code of Corporate Governance consists of 42 clauses which are grouped into the following eleven chapters:

I. General Provisions

II. Ensuring Transparency of Activity

III. Introducing Mechanisms of Effective Internal Control

IV. Ensuring Implementation of Rights and Legal Interests of Shareholders

V. Specifying Development Strategy and Tasks for Long-Term Prospect

VI. Introducing Mechanisms of Effective Interaction of Executive Body with Shareholders and Investors

VII. Conflict of Interests

VIII. Introducing Standard Organizational Structure

IX. Publication of Information on the Basis of International Auditing and Financial Reporting Standards

X. Monitoring Adoption of Recommendations of the Code

XI. Final Provisions

By the decision of the aforementioned Commission, the public administrative authorities and local governmental authorities were entrusted to organize introduction of the Code in the joint-stock companies with prevailing state share in the equity capital where they serve as shareholders. The Code of Corporate Governance establishes that the joint-stock companies may fulfill intracorporate actions on introduction of the Code taking into consideration their industrial specificity and functioning features. In case of impossibility of following certain recommendations of the Code, the joint-stock companies should disclose in detail the reasons in the mass media, following the international principle of “comply or explain”.

Some main features of the Uzbek Code of Corporate Governance:

- according to clause 18, the joint-stock companies should include no less than one independent member in the composition of supervisory board (but no less than 15% of a number of members of supervisory board stipulated in the articles of association);

- for ensuring the rights and legal interests of shareholders, the governing and control bodies of the joint-stock company should create, for shareholders who cannot attend in person the general meeting of shareholders, an opportunity and conditions to vote through e-mail (authenticated with digital signature) or to hold general meeting of shareholders by means of videoconferencing;

- clause 25 sets that for introduction of mechanisms of effective interaction of the executive body with shareholders and investors, the company’s governing bodies should bring into service a position of corporate consultant; insure the company’s business risks and the responsibility of executive body; coordinate the amount of remuneration of the members of supervisory board with the results of independent evaluation of corporate governance system and financial results of company’s activity;

- according to chapter 10, in order to monitor introduction of recommendations of the Code, the joint-stock companies should evaluate their corporate governance system no less than one time per year, for implementation of which it is recommended to involve the independent organization.

We do believe that the Uzbek Code of Corporate Governance will enable to introduce high standards of transparent activity, strengthen responsibility of directors, raise a role of shareholders, including minority ones, in corporate governance, and regulate corporate disputes, attain greater effectiveness of the corporate governance system in Uzbekistan.

Zufar Ashurov

Researcher, Department of Corporate Governance

Tashkent State University of Economics

2 February 2016

Uzbekistan to Reform and Improve the Corporate Governance

Today Uzbekistan, one of the independent Central Asian countries, has headed for reforming and improvement of corporate governance system followed by the Presidential speech in the meeting of the Cabinet of Ministers dedicated to the outcomes of social and economic development of country in 2014 and the most important priority areas of economic agenda for 2015, where he specified corporate governance reforms as one of the main priority areas of economic development, and drew attention to radical changes of principles and approaches in the corporate governance system, to introduction of modern international standards of corporate management of production, foreign-economic and investment processes.

At present, a reform program, namely the Program for Radical Improvement of Corporate Governance System approved by the Presidential Decree as of 24 April 2015 “On Measures for Introduction of the Modern Methods of Corporate Governance in the Joint-Stock Companies” is being actively implemented in order to create favorable conditions for wide attraction of direct foreign investment, enhance performance of joint-stock companies, enhance openness and transparency of companies’ activity, provide their attractiveness for potential investors, including for foreign ones, introduce modern methods of corporate governance and strengthen the role of shareholders in strategic management of a company. Up to date, as a result of implementation of this Program there have been introduced significant improvements in the corporate governance system of Uzbekistan, including:

- a standard organizational structure for the joint-stock companies taking into account the new divisions and new C-suite positions (such as chief business development officer, chief investment officer, chief financial officer, chief marketing and sales officer, chief supply and logistics officer, chief procurement officer) were introduced into practice;

- there established a procedure according to which the decision on assigning company’s chief executive officer is made on the basis of competition where the foreign managers may also take part in;

- a word “state-owned” was struck out from the names of joint-stock companies, regardless of a share size of the government in their authorized capital;

- all joint-stock companies were urged to publish their annual financial reports and to conduct external audit in accordance with the International Standards on Auditing (ISA) and International Financial Reporting Standards (IFRS) during 2015-2018;

- regulation on criteria of evaluation of performance effectiveness of the joint-stock companies was developed and put into practice;

We need to note that corporate governance reforms in Uzbekistan were put in the economic agenda because of the fact that until recently, there were observed a number of unsolved problems in the system of corporate governance. Particularly, it concerned the joint-stock companies where the government was the main shareowner. In such companies the shareholders, especially minority ones, in fact were really torn away from the governance and decision making due to minor and scattered size of their shares. As a result, actual management of a company was carried out by directorate which was not interested in effective use of resources, diversification, reduction of production cost and increase of competitiveness of the products, and which had remained to be a follower of the old administrative-command style of management. Today, as of 1 January 2016 in Uzbekistan there functioning 714 joint-stock companies, the aggregate authorized capital of which makes up 16.4 trillion sums that is about 5.8 billion US dollars.

We believe that further implementation of the reform program will, undoubtedly, lead to significantly improvement of the quality of corporate governance in the Uzbek joint-stock companies. Yet, under this reform program Uzbekistan is about to develop and put into practice the Code of Corporate Governance of Uzbekistan which would provide for recommendations on adopting modern methods of corporate governance including determination of development strategy and tasks for long-term prospect, system of internal control and mechanisms of effective interaction of executive body with shareholders and investors, recommendation on enhancing transparency of companies’ activity, on publishing information on the basis of international standards of auditing and financial reporting.

Zufar Ashurov

Researcher, Department of Corporate Governance,

Tashkent State University of Economics, Uzbekistan

Grusswort Clemens J. Vedder

210 Milliarden Euro. Damit ist nicht der Staatshaushalt von Schweden gemeint. Dies ist die exorbitante Summe, die 20 der weltweit größten Banken seit Ausbruch der Finanzkrise für Bußgelder, Entschädigungszahlungen und für Verstöße gegen Sanktionsbestimmungen ausgeben mussten. Und längst sind noch nicht alle Rechnungen bezahlt . . .

Mit an der Speerspitze der Büßer – die Deutsche Bank. Bisher kam der Abbau der Altlasten schleppend voran, jedoch scheinen mir John Cryan und sein fähiges Team den glaubhaften Willen zu haben, den Wandel erfolgreich herbeizuführen. Nun drängt auch die Zeit, das Schiff endlich hochseetauglich zu machen, sehen doch nicht nur die Matrosen im Krähennest von Goldman Sachs die dritte Welle der Finanzkrise auf uns zurollen. Die Indikatoren: kontinuierlich fallende Rohstoffpreise, kaum Wachstum in den Schwellenländern und ein globaler Trend zu sehr niedriger Inflation.

Auch wenn Institutionen wie der IWF bezüglich des Zustands der Weltwirtschaft Optimismus verbreiteten, erklingen vielerorts Kassandrarufe wie der von der weltgrößten Reederei für Containerschifffahrt. Wie wohl kein anderes Unternehmen hat Mærsk als Lastkahn der Weltwirtschat sein Ohr am Puls der Konjunktur und warnt öffentlich, dass der Zustand schlechter sei als offiziell angezeigt. Auch die Erholung in den USA, der vermeintlichen Lokomotive der globalen Konjunktur, ist, entgegen vielfacher Beteuerungen, schwach. In den vergangenen sechs Jahren wuchs die Wirtschaft gerade mal um durchschnittlich 2,2 Prozent. Halb so stark wie die Erholung nach den vorherigen vier Krisen.

Neben der nun folgenden Summe sind die Strafzahlungen der internationalen Großbanken lächerlich gering. Insgesamt rund 12 Billionen Dollar haben die weltweiten Notenbanken seit Beginn der Finanzkrise in die dümpelnden Märkte gepumpt. Mit aneinandergereihten 100-Dollar-Noten könnte mit dieser Summe die Entfernung von der Erde zum Mond fast 50-mal ausgelegt werden, berichtete jüngst die Tageszeitung Die Welt. Die Finanzstabilität wird durch die Niedrigzinsen massiv gefährdet. Die Notenbanker müssen endlich einsehen, dass in einer Welt mit verschwindend geringer Inflation die Fixierung auf ein Inflationsziel obsolet ist.

Auch die angestrebten höheren Investitionen werden bisher mit der expansiven Geldpolitik nicht bewirkt. Vier potentielle Gründe dafür wurden jüngst im Handelsblatt formuliert: 1. Die Finanzkrise hat die Firmen nachhaltig traumatisiert. 2. Die Privatwirtschaft hat es in vielen Ländern der Euro-Zone nicht geschafft, sich wesentlich zu entschulden – das liegt u.a. daran, dass in Europa zu wenige Banken abgewickelt wurden. 3. Wichtige Märkte benötigen weitere strukturelle Reformen. 4. Die moderne digitale Wirtschaft ist weniger kapitalintensiv, so hat sich seit den 1970er Jahren der Preis für Investitionen in computergestützte Maschinen halbiert.

Solange die Politik harte Strukturreformen scheut, bleibt die Konjunktursteuerung in den Händen der Hexenmeister des Geldes. Dabei muss nicht nur der Verbraucher dringend weg vom Kredit und wieder hin zum lohnenswerten Sparbuch. In den USA kursiert zurzeit das Oxymoron der »gut verdienenden Armen«. Trotz guter Gehälter sind zu viele Verbraucher aufgrund der niedrigen Zinsen verführt, oftmals unsinnig Kredite aufzunehmen. Auf die Gefahr hin, dass ich mich wiederhole: je länger die Zinsen nahe Null bleiben, desto mehr wächst die Gefahr von Blasen auf dem Aktien-, Anleihe- und Immobilienmarkt. Nach einer äußerst robusten Entwicklung auf dem US-amerikanischen Häusermarkt kam es im vergangenen September zu einem extremen Einbruch der Häuserpreise – ein Menetekel. Eine weitere fiskalpolitische Expansion zum Kampf gegen eine Rezession können wir uns vermutlich schlicht nicht leisten.

Gute Nacht sagt

Ihr Clemens J. Vedder

GOLDSMITH Group: http://goldsmithcapitalpartners.com/