VIPsight - April 2012

COMPANIES

Hauck & Aufhäuser Privatbankiers KGaA

Börsen-Zeitung 20.04.2012

Issue:77, Page: 16

Author: ski

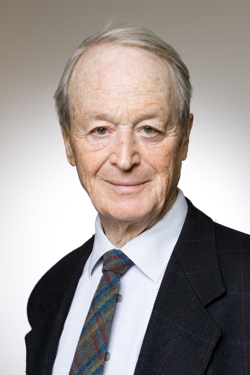

Michael Hauck at 85

ski - Share culture or the lack of it in Germany is a key issue that Michael Hauck will still not let go of. In a chronicle of Hauck & Aufhauser Privatbankiers published at the end of last year, and in the recent Annual Report, the descendant of one founding family and honorary chairman of the bank born of a 1998 Hessian-Bavarian merger came back to it again. Publicizing shares as a form of investment and as a financing tool for businesses should continue to be a major concern for private bankers, Hauck says, adding: "How else should funding for young companies be than through the stock market? Let us not be discouraged by the fact that shares lost in reputation after the collapse of the new economy. Here there is a real gap in the market for good and responsible advice."

ski - Share culture or the lack of it in Germany is a key issue that Michael Hauck will still not let go of. In a chronicle of Hauck & Aufhauser Privatbankiers published at the end of last year, and in the recent Annual Report, the descendant of one founding family and honorary chairman of the bank born of a 1998 Hessian-Bavarian merger came back to it again. Publicizing shares as a form of investment and as a financing tool for businesses should continue to be a major concern for private bankers, Hauck says, adding: "How else should funding for young companies be than through the stock market? Let us not be discouraged by the fact that shares lost in reputation after the collapse of the new economy. Here there is a real gap in the market for good and responsible advice."

Hauck headed the bank Georg Hauck & Sohn as general partner for 38 years until the end of 1993; he had already made his career choice in elementary school, or felt committed. Yet he was and is not just a banker. He also worked for three decades on the board of the Frankfurt Stock Exchange and was its President from 1986 to 1989, so he knows what he's talking about. That may also apply to this quote: "I would never have agreed to the stock market itself being listed as a company on the stock exchange. That is for me a contradiction in terms, for an exchange must also preserve the public interest. A private company cannot."

That shows the "outspoken maverick in the Frankfurt financial centre," as Rüdiger von Rosen, the former Chief of the German Stock Exchange, now managing director of the German Stock Institute, once called him, or "the one-time rebel" of the stock market, as the Börsen-Zeitung wrote in an earlier assessment. One thing is certain: Hauck has never failed to speak his mind. "A very self-confident CEO" of the former Hoechst AG, as Michael Hauck himself tells it, had once said in an Annual General Meeting that he would grant the shareholders attractive subscription rights in a capital increase. Hauck's reply: he can't give shareholders anything at all, after all it's their money. Nowadays that's called Corporate Governance, though it is probably not out of the question for one CEO or the other even today still to want to "grant" his capital providers something.

Regardless of the fact that Hauck was entirely right on the merits: many anecdotes from the in some respects really good old days he likes to tell testify to the fact that he is fond of a laugh. Such as the story of another private banker who invited Hauck long after the close of business, so he wouldn't notice he could no longer afford the porter usual in the industry.

On Sunday, Michael Hauck completes his 85th year of age. A few days later the partners of the bank will hold a festive evening for him, at which the former chief economist of the European Central Bank, Jürgen Stark, will give a lecture. It is unlikely to be primarily about equity culture.

(translated from Börsen-Zeitung, 20.4.2012)