People

Deutsche Bank's Thoma to Step Down and New York Parent to take over

Deutsche Bank AG supervisory board member Georg Thoma is stepping down after a week of turbulence at Germany’s biggest lender after criticism that he went too far in probing potential wrongdoing within its ranks – made public by the deputy.

Deutsche Bank AG supervisory board member Georg Thoma is stepping down after a week of turbulence at Germany’s biggest lender after criticism that he went too far in probing potential wrongdoing within its ranks – made public by the deputy.

Thoma resigning from the board’s integrity committee with immediate effect.

Deutsche Bank dropped 3.1 percent to 16.83 euros the shares have declined about 25 percent this year, more than an index.

Deutsche Bank supervisory board member Louise Parent, ( Cleary, Gottlieb Steen & Hamilton LLP), will take as chairwoman of the integrity committee assisted by board member Johannes Teyssen. That panel monitors and analyzes the company’s legal risks – historical and future.

Deutsche Bank’s costs and provisions for fines and lawsuits have amounted to 12.6 billion euros ($14.3 billion) since 2012 when VIP together with EOS from Hermes cirtizied the board with countermotions against board-discharge – and found 24.6% followers from voting shareowners.

Annual General Meeting of Deutsche Bank AG on 31 May 2012 - counter-motion pursuant to §126 AktG on Agenda Item 4

Executive level changes at the private bank Sal. Oppenheim

Chief Financial Officer Jürgen Dobritzsch and Nicolas von Loeper, the Executive Board member responsible for Private and Institutional Clients, have stepped down at the Cologne-based private bank Sal. Oppenheim. The two executives will be replaced internally. Only Chairman Wolfgang Leonie remains of the old Executive Committee.

Henning Heuerding (51), previously employed at the parent Deutsche Bank and Deputy Chairman of the Supervisory Board at Sal. Oppenheim, takes over as Chief Financial and Risk Officer from April. Marco Hauschildt (43), Managing Director of Sal. Oppenheim's Hamburg location since 2007, takes over as the head of the Private Client business at the same time, albeit not as a member of the expanded executive team.

Thomas Buberl for AXA by the Seine

Thomas Buberl is to step down as CEO of AXA Germany and take over as CEO of the Group. The Board has chosen the 42-year-old as its new head. From 1 May he will replace Jacques de Vaucleroy, who is stepping down after six years and will leave the AXA Group in the middle of 2016. Buberl will focus on his duties at the company's Paris headquarters. Chief Financial officer Etienne Bouas-Laurent is replacing Buberl as head of AXA's German subsidiary until a successor has been found.

Thomas Buberl is to step down as CEO of AXA Germany and take over as CEO of the Group. The Board has chosen the 42-year-old as its new head. From 1 May he will replace Jacques de Vaucleroy, who is stepping down after six years and will leave the AXA Group in the middle of 2016. Buberl will focus on his duties at the company's Paris headquarters. Chief Financial officer Etienne Bouas-Laurent is replacing Buberl as head of AXA's German subsidiary until a successor has been found.

Top salaries for top managers

According to a survey, Germany's top managers earned an average of EUR 4.9 million last year. According to the advisory, broking and solutions company Willis Towers Watson, this means that the pay of the bosses of 20 of the 30 Dax-listed companies whose data was available as of 11 March rose by one per cent in 2015. The EBIT of Germany's stock market heavyweights, in contrast, fell by seven per cent to an average of EUR 3.08 billion.

According to a survey, Germany's top managers earned an average of EUR 4.9 million last year. According to the advisory, broking and solutions company Willis Towers Watson, this means that the pay of the bosses of 20 of the 30 Dax-listed companies whose data was available as of 11 March rose by one per cent in 2015. The EBIT of Germany's stock market heavyweights, in contrast, fell by seven per cent to an average of EUR 3.08 billion.

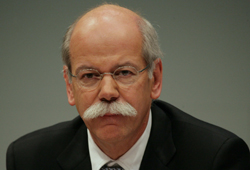

According to the figures released to date, Daimler CEO Dieter Zetsche leads the field with total pay of EUR 9.7 million. Bottom of the ranking was Norbert Steiner, Chairman of the fertiliser and salt producer K+S, with pay of EUR 2.3 million.

Woman power at Allianz

Allianz is restructuring its Board. Asset management chief Jay Ralph and investment management head Maximilian Zimmerer are stepping down. Ralph will be succeeded on 1 July by Jacqueline Hunt. The 47-year-old was until recently responsible for Prudential's insurance business in the UK, continental Europe and Africa. Zimmerer will be replaced on 1 January 2017 by Günther Thallinger. The 44-year-old is currently CEO of Allianz Investment Management (AIM).

Allianz is restructuring its Board. Asset management chief Jay Ralph and investment management head Maximilian Zimmerer are stepping down. Ralph will be succeeded on 1 July by Jacqueline Hunt. The 47-year-old was until recently responsible for Prudential's insurance business in the UK, continental Europe and Africa. Zimmerer will be replaced on 1 January 2017 by Günther Thallinger. The 44-year-old is currently CEO of Allianz Investment Management (AIM).

Zetsche remains at the wheel

The Supervisory Board of Daimler AG has extended Dieter Zetsche (62)'s contract by three years until 31 December 2019.

The Supervisory Board of Daimler AG has extended Dieter Zetsche (62)'s contract by three years until 31 December 2019.

Zetsche has been a a member of the Board of Management since 16.12.1998 and Chairman of the Board of Management since 1.1.2006. He is also Head of the Mercedes-Benz Cars Division. Dieter Zetsche's contract was due to expire on 31 December 2016. Daimler chairman Manfred Bischoff had informed the company's annual meeting on 1 April 2015 of the supervisory board's intention to prolong the contract of Dieter Zetsche.

The German chemical industry association VCI nominates a new president

The German chemical industry association VCI has nominated Dr Kurt Bock, Chairman of the Board of Executive Directors of BASF, as candidate for the next presidency. He will be put forward to succeed Marijn Dekkers, Chairman of Bayer, at the general assembly on 23 September in Düsseldorf.

New women for Fresenius

Iris Löw-Friedrich from the Belgian pharmaceutical company UCB and Hauke Stars, a Member of the Executive Board of Deutsche Börse, have been nominated for the six-strong supervisory board of the healthcare company Fresenius. They will replace Roland Berger and Gerhard Roggemann in May.

Drillisch: brother replaces brother as company head

Telecommunications group Drillisch AG gets a new frontman. Citing personal reasons, Paschalis Chroulidis will stand down towards year’s end as member and spokesman of the executive board. The company has appointed his brother Vlasios Choulidis as spokesman with effect from 1 July. Paschalis Choulidis has offered to continue as a member of the company’s Supervisory Board.

Tom Tailor: new CFO

After some 10 years of continuity, Hamburg-based fashion group Tom Tailor, has a new CFO. The present incumbent, Axel Rebien, who has directed the company finances since 2005 is resigning on agreed terms with effect 30 June 2016. The company’s Supervisory Board has appointed 58-year-old Thomas Dressendörfer to replace him with effect from 1 July 2016. Dressendörfer’s responsibilities will cover finance and accounting, control, investor relations, human resources and legal affairs.

The company has highlighted Dressendörfer’s extensive experience as CFO in high profile companies and major business units or geographic areas. He has served as CFO in such companies as Swiss dental implant manufacturer Straumann and Uste Technologies, also a Swiss-based concern, both of which are SIX-listed on the Swiss stock exchange. The fashion group points out that latterly he worked as a freelance consultant advising companies involved in complex business initiatives and restructuring programmes.

PNE WIND AG: change of air

Marco Lesser will soon be the group’s number one. His future responsibilities as CEO will extend to the entire company and its strategic management, not only for operative business and project development. At the end of May he will become chair of the executive board of which he has been a member since May 2011. Lesser follows in the footsteps of Per Hornung Pedersen, appointed by the Supervisory Board as interim member of the executive board. His mandate, during which his functions as member of the Supervisory Board have been temporarily put on hold, will expire at the next shareholders meeting set for 25 May.

Marco Lesser will soon be the group’s number one. His future responsibilities as CEO will extend to the entire company and its strategic management, not only for operative business and project development. At the end of May he will become chair of the executive board of which he has been a member since May 2011. Lesser follows in the footsteps of Per Hornung Pedersen, appointed by the Supervisory Board as interim member of the executive board. His mandate, during which his functions as member of the Supervisory Board have been temporarily put on hold, will expire at the next shareholders meeting set for 25 May.