VIPsight - January 2010

COMPANIES

New pay structures

The new Act on appropriateness of executive remuneration (VorstAG) is showing its effects. In mid-December carmaker Volkswagen announced that success-related pay would be basically changed, with top managers' pay oriented towards long-term objectives. In 2010 a long-term bonus is to be introduced, linked to strategic objectives. Pay is also to reflect how satisfied customers and employees are, something to be determined in representative surveys. Further components of pay are security of employment, market share and defined sales figures. Share options are to be completely abolished. The long-term bonus is to be calculated on the basis of the past four years, and paid out only if the group is in the black. As well as VW, State-supported Commerzbank has also introduced new pay rules. Executive pay is to be oriented towards long-term success, and if developments are poor can also be cut. Carmaker Daimler announced that its pay system was already in line with the Act. By stressing long-term elements of remuneration and the obligation on directors to hold company shares, the pay structure was oriented to sustainability objectives. At the AGM in April 2010, shareholders are to vote on the pay system for the first time. Siemens, ThyssenKrupp and BASF have similar plans.

Is Zetsche tottering on the brink?

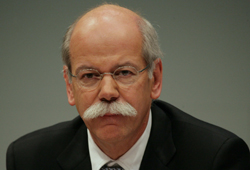

In mid-December the Daimler supervisory board decided that the contract of utility-vehicles director Andreas Rentschler would be renewed for three years. However, the body refrained from also renewing the contract of Daimler CEO Dieter Zetsche. Daimler commented on this non-renewal by saying that the CEO’s contract had still to run until 2010, so that the last year of his term of office had not yet started. However, lawyers say there is a legal possibility for early renewal, which is also laid down in the Corporate Governance Code. The deliberate non-utilization of this option might be a negative indication, says Oliver Maaß, capital-market expert of Munich law firm Heisse Kursawe Eversheds. As well as Zetsche’s renewal, the reappointment of technology director Thomas Weber is also still pending.

In mid-December the Daimler supervisory board decided that the contract of utility-vehicles director Andreas Rentschler would be renewed for three years. However, the body refrained from also renewing the contract of Daimler CEO Dieter Zetsche. Daimler commented on this non-renewal by saying that the CEO’s contract had still to run until 2010, so that the last year of his term of office had not yet started. However, lawyers say there is a legal possibility for early renewal, which is also laid down in the Corporate Governance Code. The deliberate non-utilization of this option might be a negative indication, says Oliver Maaß, capital-market expert of Munich law firm Heisse Kursawe Eversheds. As well as Zetsche’s renewal, the reappointment of technology director Thomas Weber is also still pending.

Changes on the supervisory board are emerging for the New Year. In early 2009 the Emirate of Abu Dhabi had come into the Stuttgart company through its investment company Aabar at 9%, or 2 billion euros. In mid-December the CEO of the investment company, Mohamed al-Husseiny, announced that he wished to come on to the supervisory board in October 2010. It remains open whether a new seat on the supervisory board will be created for the purpose, or whether a member of the capital side will have to vacate his seat.

No insider trading at EADS

In June 2006 it became clear that there would be considerable delays in the major project for the Airbus. The share price of aerospace company EADS fell once the extent of the total amount became known. Previously, both leading managers and the two major shareholders Lagardère and Daimler had got rid of EADS securities. Since then, the penal committee of French stock-exchange watchdogs AMF have been investigating those concerned for insider trading. In June this year an AMF employee had stated that ex EADS head Noel Forgeard, Airbus sales boss John Leahy, Airbus boss Andreas Sperl from Dresden and a further four managers, in office or having left, were punishable for insider trading. On 17 December French stock-exchange regulators have however now absolved all sixteen managers and shareholders accused of the charge of insider trading. EADS welcomed the AMF decision and said it was convinced that the parallel investigations by Paris public prosecutors would also be dropped.

Siemens comes to an agreement with D&O insurers

In December, conglomerate Siemens was able to reach a settlement with all its D&O insurers. Departing from the rule that insurers have to pay compensation only as from a fixed compensation amount, in the course of the agreement all the insurers agreed to participate in the damage that accrued to the group or its managers in the course of the bribery affair between 2004 and 2007. D&O (Directors' and Officers' Liability) insurance enables companies to ensure their managers and themselves against claims by third parties. Since in the course of the settlement Siemens had to pay 150 million euros, the AGM still has to agree to the deal. The insurers are keeping a back door open here: if a court finds that Siemens directors already knew before 1 October that they were in breach of their organizational and supervisory duties and then did not prevent the corruption, the insurers can withdraw from the settlement.

In December, conglomerate Siemens was able to reach a settlement with all its D&O insurers. Departing from the rule that insurers have to pay compensation only as from a fixed compensation amount, in the course of the agreement all the insurers agreed to participate in the damage that accrued to the group or its managers in the course of the bribery affair between 2004 and 2007. D&O (Directors' and Officers' Liability) insurance enables companies to ensure their managers and themselves against claims by third parties. Since in the course of the settlement Siemens had to pay 150 million euros, the AGM still has to agree to the deal. The insurers are keeping a back door open here: if a court finds that Siemens directors already knew before 1 October that they were in breach of their organizational and supervisory duties and then did not prevent the corruption, the insurers can withdraw from the settlement.

VW replaces VW in the Dax

In the course of an extraordinary change in the composition of the DAX, the ordinary shares of car maker Volkswagen (VW) left the top German share index on 23 December. Dispersed holdings had, after the announcement by the Emirate of Qatar that it had built its holding up to 17%, fallen under the minimum proportion of 10%, so the criteria for the share to remain in the index were no longer met. Porsche Holding and Porsche GmbH together hold over 53% of the ordinary shares, and Lower Saxony a further 20%. However, VW still continues to be listed in the DAX: instead of the ordinary shares, VW preference shares entered the first rank of the German stock exchange above competitor Heidelberg Cement. Volkswagen has announced a capital increase for the first half of 2010 in the preference shares. The next regular review of the DAX comes on 3 March 2010.

In the course of an extraordinary change in the composition of the DAX, the ordinary shares of car maker Volkswagen (VW) left the top German share index on 23 December. Dispersed holdings had, after the announcement by the Emirate of Qatar that it had built its holding up to 17%, fallen under the minimum proportion of 10%, so the criteria for the share to remain in the index were no longer met. Porsche Holding and Porsche GmbH together hold over 53% of the ordinary shares, and Lower Saxony a further 20%. However, VW still continues to be listed in the DAX: instead of the ordinary shares, VW preference shares entered the first rank of the German stock exchange above competitor Heidelberg Cement. Volkswagen has announced a capital increase for the first half of 2010 in the preference shares. The next regular review of the DAX comes on 3 March 2010.

VW sorts itself out

For some 1.7 billion euros, VW has bought 19.9% of the shares in Japanese carmaker Suzuki. Suzuki is to be incorporated into the group as its twelfth brand behind Porsche and MAN. As a counterpart, the Japanese are taking a holding of half the purchase price in VW. Shortly before, VW had already taken over some 50% of Stuttgart sports-car maker Porsche, with the objective of integrating it into the group by 2011 as its tenth brand. In the course of the merger with sports-car maker Porsche, carmaker Volkswagen may possibly be taking on a new appearance by 2011. Alongside the private-car sector, as soon as VW has built up its holding in utility-vehicle maker MAN to over 50%, a truck division is to be formed, from MAN and Scania. The VW supervisory board chair and family patriarch Ferdinand Piëch is also chair of the supervisory board at MAN, and is said to have contributed to the resignation of MAN CEO Håkan Samuelsson and CFO Karlheinz Hornung in December. Officially, the MAN bribery case was what sparked off the resignation. As the third pillar in the VW group, financial services could be built up, reported Wirtschaftswoche – however, without any confirmation by VW.

On 3 December 2009, VW shareholders had at an extraordinary general meeting agreed to a capital increase by 135 million in preference shares, to a value of some 8 billion euros, thus setting going the first step towards the takeover of the Porsche group by VW. Subsequently, VW was able in early December to take 49.9% of the Porsche shares, for 3.9 billion euros. In future, the owning families Porsche and Piëch will, according to Wirtschaftswoche, not, as previously assumed, hold 35 to 40%, but now only some 30% of the VW ordinary shares. Lower Saxony is said to hold 20% plus one share, and the Emirate of Qatar 20% minus one share.

MAN clears its table

Around six months after investigators had made raids on utility-vehicle maker MAN SE throughout Germany, the corruption scandal that relates to the years from 2002 through 2009, in which suspicious payments amounting to €51.6 million were shown, is more or less over for the firm. In early December the Munich regional court and public prosecutors found that the two MAN group divisions Utility Vehicles and Turbo each had to pay €75.3 million in fines, for a total of €150.6 million. The compliance structure in the Utility Vehicles division had been defective, and the infringement of the supervision obligation was a breach of administrative regulations, said the court in justifying the fine. Altogether, over a hundred people were accused of having been involved in bribery payments. However, investigations are still going on in relation to individuals possibly liable for fines. In the course of the internal investigations in 80 suspicious cases, 20 MAN employees and the whole management of utility sales around Peter Erichreineke had to go. The company is now looking into whether the fine imposed and the internal investigation cost amounting to 50 million euros can be got back from its former directors by way of compensation payments.

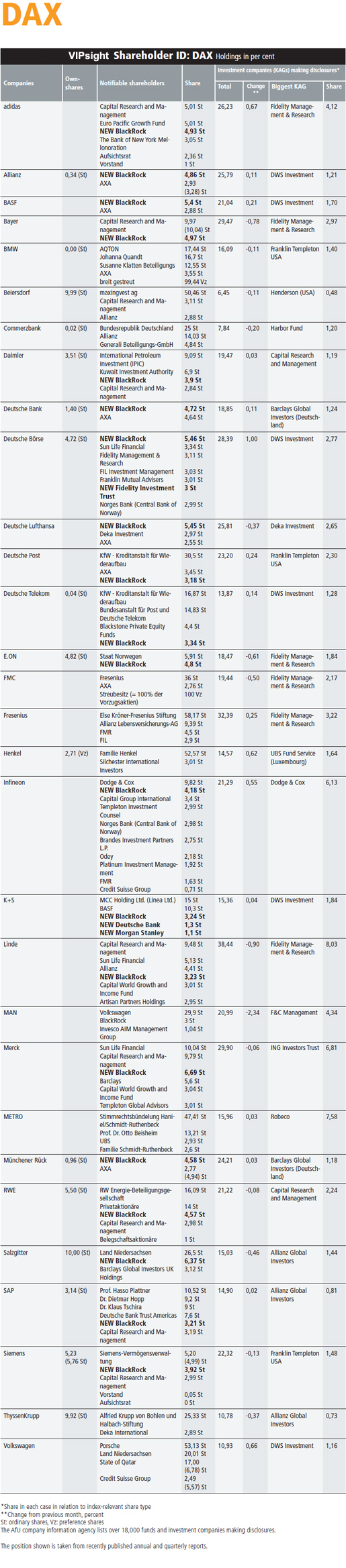

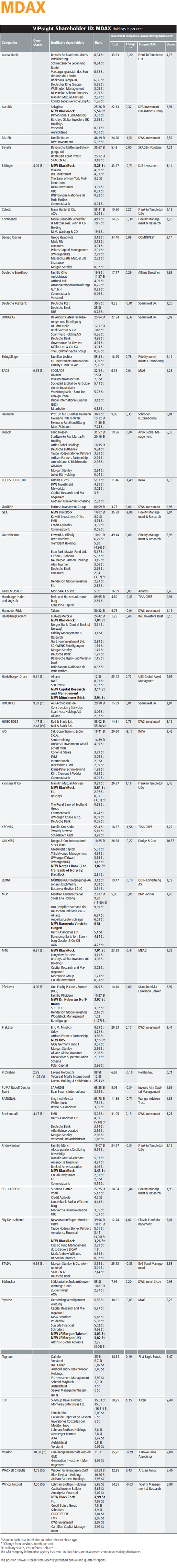

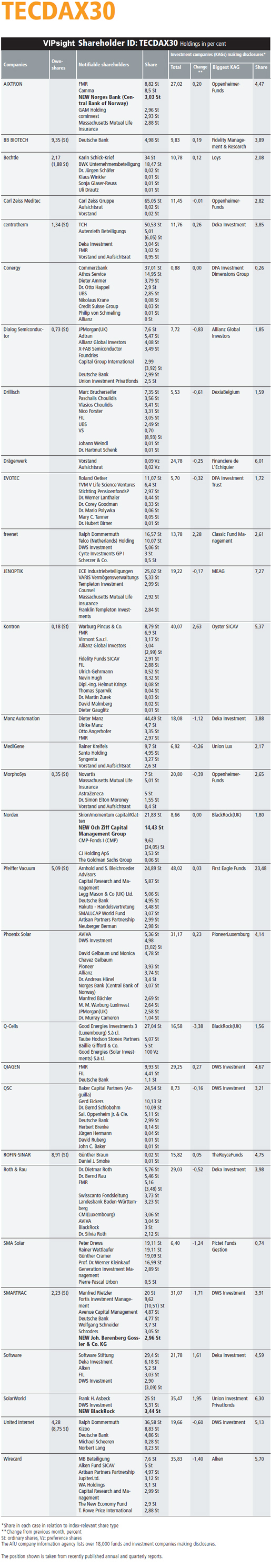

Blackrock heavily involved in the DAX

With the takeover of BGI, Blackrock has at a stroke become a major shareholder in several German companies. The British bank Barclays, heavily affected by the financial crisis, had sold the division in June this year to the US asset manager for some 13.5 billion dollars. Blackrock now holds 5.46% of Deutsche Börse, 5.45% of the Lufthansa shares, 5.4% of BASF, 4.93% of the shares in Adidas, 4.86% in Allianz, 4.58% in Munich Re, 4.8% in E.ON, 4.57% in RWE and 4.55% in MAN. Apart from this, the Americans have holdings in Dax companies K+S (3.24%), SAP (3.21%), Linde (3.23%) and Daimler (3.9%). In the next-lower index MDAX, Blackrock now even holds 10.07% of Gea Group, and 7.04% of the shares of HeidelbergCement. The company has further holdings in Sky Deutschland (3.26%), Bilfinger Berger (5.25%), Aurubis (5.56%), Klöckner & Co (5.61%) and Rhön-Klinikum (3.43%). Additionally, the Americans now have over 3.44% of TecDax company Solarworld.

Conti reschedules its debts

The automotive supplier, in debt for some €9.5 billion, has come to agreement with its 50 or so banks for a postponement of payments on its loan due in August 2010 for up to two years. Conti will – probably in January 2010 - raise its capital by around 1 billion euros. The banks will then make initially some 2.5 billion euros available.

The automotive supplier, in debt for some €9.5 billion, has come to agreement with its 50 or so banks for a postponement of payments on its loan due in August 2010 for up to two years. Conti will – probably in January 2010 - raise its capital by around 1 billion euros. The banks will then make initially some 2.5 billion euros available.

Salzgitter raises its stake in Aurubis

Salzgitter has raised its holding in Aurubis from 23.2% to 25.3%. As the leading European copper producer stated on 16 December, the steel firm held on 15 December 25.260% of the voting rights through its subsidiary Salzgitter Mannesmann. According to earlier statements, an increase up to 29.9% is conceivable.

Post sector receives exemption from turnover tax

Competition on the German postal market is in the view of the monopoly commission “miserable”. Deutsche Post will nonetheless continue in future to receive its controversial turnover-tax privilege for a part of its services. Additionally, however, competitors would also become entitled to turnover-tax exemption for letters and packages. This emerges from a decision by the Federal Cabinet on 15 December.

Competition on the German postal market is in the view of the monopoly commission “miserable”. Deutsche Post will nonetheless continue in future to receive its controversial turnover-tax privilege for a part of its services. Additionally, however, competitors would also become entitled to turnover-tax exemption for letters and packages. This emerges from a decision by the Federal Cabinet on 15 December.

BaFin criticizes Merck

Merck has to make disclosures, ordered by the Federal Financial Services Oversight Institution (BaFin), for errors in its annual accounts for 2008. The German Accounting Centre criticized the forecast report of the Darmstadt family firm as inadequate. The pharmaceuticals group had devoted only eleven lines to explaining that because of the “un-assessable” economic environment no quantitative or qualitative statements on trends were possible. The capital market had thus been deprived of “information of relevance to decisions” on future developments, said BaFin. Merck has lodged objections.

Buhlmann’s Corner

Copenhagen was yesterday

Why did Oppenheim really fail? Because of the wrong ethics with Esch & Co? Because of idolization and self-overestimation (“divine work”, said Blankfein) and self-serving? Or, and especially, because of lack of supervision and influence by the owners?

Why did Oppenheim really fail? Because of the wrong ethics with Esch & Co? Because of idolization and self-overestimation (“divine work”, said Blankfein) and self-serving? Or, and especially, because of lack of supervision and influence by the owners?

Where are the preachers from the churches when it comes to looking after and being responsible for assets? Where are the sales boys with “sustainability” written on their baseball caps, whose blinkers merely get longer after all the expert reports and awards, when the assets lose sustainability? Where are the pension administrators who merely pass on the masses a stage further, but do not ask how they have been dealt with recently? Where are the insurers, who do pay attention in their “technical” business not to accumulate any AIG risks, but on the capital investment side are so fond of practising the cascades of responsibility partly because they are simply not used to anything else?

Copenhagen was yesterday – but how are things going to be tomorrow? It was a charming picture of corporate governance. Was it not just the same as any ordinary shareholders' meeting? The organization may be very well equipped from the canteen point of view, but the meeting is nearly always headed according to what hat the person concerned is wearing – i.e. how important he is. Questions – should they happen to arise – are of course dealt with in the back office. If anyone has anything to say somewhere, that is not going to happen on the stage of events. Some individuals sing particularly well and become celebrated without any objective justification; others make a fuss and thus, even if with less justification, stumble into the reporters' headlines. And if something is after all decided, then either it is obvious anyway, no surprise (same procedure as every year), and in any case a thin brew.

Everybody is against the bonus – so why is it paid? Everybody is against higher temperatures – so why are they rising? And at the end a phoenix from Washington or Salzburg arises from the ashes like a patriarch, and everybody is happy. Over twenty years ago, because of all that, Americans invented a code of ethics called corporate governance, to replace the “honourable businessman”, who had disappeared. That does not mean they squeezed out the businessman, since he was just as past his sell-by date as Sal.Oppenheim & Cie. The only trouble is they forgot one thing, namely to deal with the question how and by whom this corporate governance is going to be monitored.

ACTIONS CORNER

- BaFin has given discharge to Clemens Börsig. The Deutsche Bank supervisory board chair had been accused of having approved of spying efforts. On commission from the bank, detectives had used impermissible methods to spy on disapproving shareholders and some of their own management staff. The financial watchdogs were unable to find any systematic misconduct. There were merely sporadic misconduct by employees of group security and shortcomings in the working processes to be complained of.

- The European Court of Justice on 3 December declared adjustments to the German Telecommunications Act (TKG) in 2004 to protect Deutsche Telekom investments null and void. The regulatory framework conditions for new networks formulated by the last German government were found to infringe European law, since in principle they excluded new markets from regulation by the Federal Network Agency. The competitors of Germany’s market leader had long criticized what critics call the Lex Telekom, saying that the regulators’ lack of power meant that the branch leader had a monopoly in building up its high-speed network (VDSL). Telekom had already, independently of the EU decision, come to agreements with competitors Vodafone and United Internet on a rental price for VDSL lines.

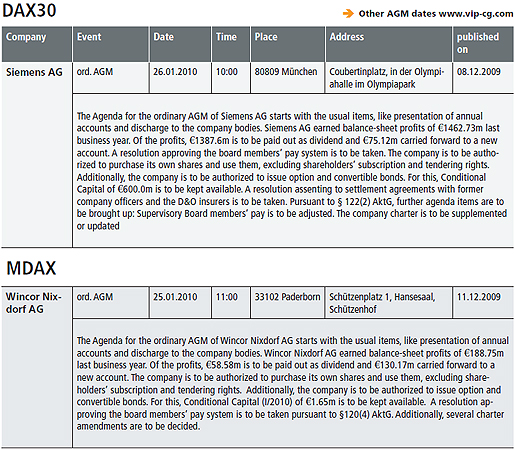

AGM Dates

January

Politics

EU expands financial oversight

EU finance ministers agreed in early December to establish new control authorities for banks, insurers and stock exchanges. In 2010 and 2011 the European Banking Authority (EBA) in London, the European Insurance and Old-Age Pension Authority (Eiopa) in Frankfurt and the European Securities Authority (ESA) in Paris are to be set up. For the first time, the new oversight bodies will be given the power to implement internal-market regulations and check on national control authorities in relation to regulation of border-crossing financial companies. The EU authority could intervene if, for instance, national authorities failed to act in the event of too-small capital reserves or deposit insurance in the institutions. However, the new authorities cannot compel EU countries to utilize tax money. However, the right of intervention is being weakened: national governments can, in the event of a crisis, overturn decisions of the EU authority by a simple majority. They are also to be allowed a second round of voting.

Bank aid to resolve credit squeeze

The credit squeeze has led to a critical situation, says Financial Times Deutschland (FTD), quoting federal chancellor Angela Merkel. In order for the flagging credit provision by banks not to put a brake on the slow upswing, the government is, according to the FTD, planning a new bank aid package. In addition to the 115 billion euros already made available through the Germany Fund, a further 10 billion euros are now to be made available in order to guarantee that loans to firms are serviced and can be paid back. This should stimulate credit provision by the banks.

International banking oversight to regulate more tightly

The Basel Committee, to which central bankers and supervisors of 27 industrial and threshold countries belong, wants to regulate credit institutions more tightly. In February, the banks are to receive questionnaires, and by April supply the overseers with raw data on how many treasury bonds or Pfandbriefe they hold, and which ones. The committee will then test a variety of scenarios. Germany is advocating equal treatment of all legal forms of credit institutions, and is against the already adopted indebtedness limit which is to be introduced by the end of 2010. It has also been announced that in good times banks should build up capital buffers. The overseers can issue a ban on dividends in the event of non-compliance. Definitive rules are to be produced by the end of 2010. By 2012 they should then enter into force.

People

Christian Müller was elected a new board member of Carl Zeiss Meditec on 15 December, taking the finance spot. Müller is also in charge of SBU Chirurgische Ophthalmologie. His predecessor Bernd Hirsch had left the medicine technology company in November after seven years, moving to Symris.

Deutsche Telekom director Hamid Akhavan, who as Chief Operating Officer was in charge of the European mobile telephony network and also of technology in the group, is leaving the telecommunications company and taking the CEO position at Siemens Entreprise Communications. The 48-year-old will move to the network specialists at the end of February 2010 as Chief Executive Officer, stated Siemens on 7 December.

Fresenius Medical Care has extended the contract of long-term CEO Ben Lipps to the end of 2012 and set the process for his succession going. Rice Powell was appointed deputy CEO of the dialysis group with effect from 1 January 2010. The American, who has been twelve years in the firm, and a director since 2004, is to take over from Lipps in early 2013. Board member Mats Wahlstrom left the board on 31 December. The vacant finance post was taken at the start of the year by Michael Brosnan (54), also from the firm. The American succeeds Larry Rosen, who went to Deutsche Post as CFO. Kent Wanzek took up the newly created position of production director on 1 January 2010.

At MAN Karlheinz Hornung resigned with effect from 11 December. The CFO insists on the point that his resignation was not in connection with the corruption case. Utility vehicles head Anton Weinmann also resigned from the board with immediate effect, at his own request. The new CFO of the group is Frank Lutz, who like Klaus Stahlmann was appointed deputy director. That means that only internal candidates were promoted. The current provisional CEO Georg Pachta-Reyhofen was on 11 December additionally appointed by the MAN supervisory board as new board spokesman of the company, with effect from 1 January 2010.

Sky Deutschland has announced that CEO Mark Williams is resigning from the leadership post in the firm for personal reasons after only 14 months, and is leaving the board. Brian Sullivan was appointed deputy CEO with effect from 1 January 2010. The 47-year-old comes from British Sky Broadcasting, and will replace Williams on 1 April 2010.

TUI CFO Rainer Feuerhake will resign his post at the end of the next TUI AGM on 17 February 2010 on reaching the age limit. His post will be taken over by Controlling director Horst Baier. Jürgen Krumnow will be resigning from the supervisory board on 14 December. The supervisory board unanimously proposed Klaus Mangold as new supervisory board member.

Wirecard announced on 10 December that Stefan Klestil is to become the new member of the supervisory board. The 42-year-old was first employed at First Data, a service provider for cashless and card-based payments, and succeeds Paul Bauer-Schlichtegroll, a supervisory board member since August 2005, who resigned on 31 October for time reasons.

Campus

IVOX gives marks for Corporate Governance

IVOX assesses Volkswagen as “by far” the poorest firm on the DAX for Corporate Governance standards. The main points of criticism are: the preference shares, supervisory board members are not independent, board members' salaries are too high and individual shareholders like the State of Lower Saxony are granted special rights. The shareholder service provider produced a ranking on corporate governance of German firms for the first time. The so called CG seal of approval, which constitutes a detailed survey of a company on the basis of over a hundred criteria including capital, ownership structure, anti-takeover measures, management structure, remuneration, auditing and much more, gives an overall assessment of this. Initially, the seal of approval covers the 30 DAX firms. The assessment gave the following result:

Good Corporate Governance:

Adidas, BASF, Bayer, Commerzbank, Deutsche Bank, Deutsche Börse, Deutsche Lufthansa, Infineon, Linde, MAN, Munich Re and SAP.

Acceptable Corporate Governance:

Allianz, BMW, Daimler, Deutsche Post, Deutsche Telekom, E.ON, Fresenius Medical Care, Fresenius, Henkel, K+S, RWE, Siemens and Thyssenkrupp.

Gross shortcomings in Corporate Governance:

Metro, Beiersdorf, Merck, Salzgitter and Volkswagen.

At Metro the preference shares, conflicts of interest on the supervisory board and inadequate information on supervisory board candidates and an authorized capital ex rights were seen critically. The supervisory board of Beiersdorf was overrepresented by Maxingvest, thus not guaranteeing independence. Merck did not publish remuneration of its management people, which while legal for a KGaA, deprived investors of important information. Salzgitter did not publish its statutes and allegedly did not provide sufficient information on the supervisory board.

DAX concerns avoid forecasts.

The majority of the DAX firms, even a few weeks before the end of the business year, are still very reticent about publishing specific takeover and outcomes forecasts, says a current study by management consultancy Kirchhoff Consult. Only one in five firms presented specific figures in their quarterly reports on the expected turnover in 2009. Over half of all DAX concerns gave no clear picture in their quarterly reports on the development of results in the present business year, and over 1/3 provided little information on future development in the industry, while 25% of firms gave no picture of the future overall economic position. Around 70% of DAX firms provided no future outlook at all on their liquidity position. Precise predictions regarding turnover and results were supplied particularly by the pharmaceuticals industry, whereas the auto sector kept its cards very close to its chest.

Rise in company bankruptcies

Big names like Arcandor, Escada or Qimonda appeared on the list of bankruptcies in the past year. By the end of 2009, bankruptcies of firms are likely to rise to over 34,000 instances, says an assessment by the German Federal Statistical Office. In the first nine months, the number of insolvent firms was up 11.2% over the previous year. The total of outstanding receivables rose in September to €42.6 billion - fourteen times the previous year's figure, when the number was still €2.8 billion. The outlook remains clouded: business information firm Creditreform assumes that it will be over 38,000 bankruptcies in the coming year. The negative record was in 2003, when 39,740 insolvencies were declared.

No market manipulation on bonds

The federal panel for financial services oversight (BaFin) has not been able to find any manipulation of prices at the end of the year in 2008 for company bonds on the Frankfurt securities exchange (FWB). This was stated by the authority, which has audited procedures since April, on 21 December. The FWB stock-exchange panel has nonetheless drawn consequences from the several hundred suspicious cases for manipulation of bond prices, appearing by the end of the year 2008/09. Deutsche Börse confirmed in mid December that there would be changes in regulations for leading suspects in share and bond trading. The changes in the stock-exchange regulations have already come into force, in an attempt to avert possible manipulations at the end of the year. They apply to current trading on the FWB and also to electronic trading on the Xetra, and are connected with the assessment prices disregarding turnover. The new aspect here is that price raises for bonds greater than 5% and for shares greater than 10% can in future be found not just by exchange leaders and their trading partners. For bonds whose prices have fallen sharply and shares up to a price of €5, higher margins apply. The exchange leaders are obliged to explain to the FWB trading monitoring office how these prices have been arrived at. Reference markets and documentary reference prices have to be adduced.

Insider trading defined more strictly

The European Court of Justice in a recent judgment formulated stricter provisions for the prosecution of insider trading. According to these, it is already sufficient for someone with inside knowledge to buy or sell shares. Whether the intervention was deliberately used need not be proved, any more than any profit obtained thereby. In th specific case, a Belgian firm had bought back shares before publication of its positive business results. The newspaper FAZ cites here professor of criminal law Christian Schröder: “Joint-stock companies must in future freeze such programmes if during the course of them new business figures arise, until they have disseminated them as an ad hoc disclosure.”

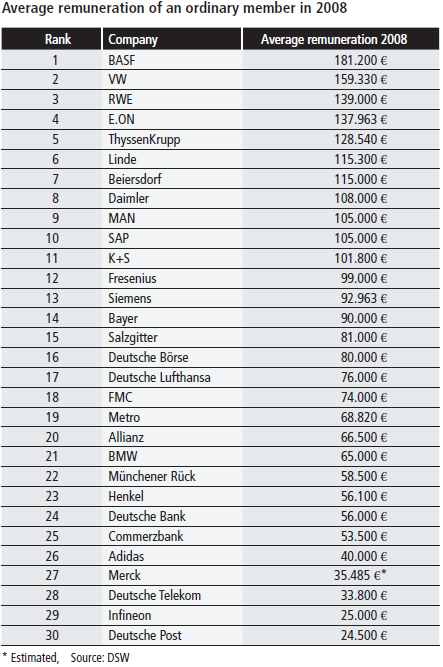

DSW criticizes supervisory board remuneration

Supervisory board remuneration in German firms is according to the view of shareholder association Deutsche Schutzvereinigung für Wertpapierbesitz (DSW) determined too strongly by short-term profits. At the same time, the DSW criticizes the use of dividend as an index, since supervisory board members themselves decide about dividend proposals. The remuneration of supervisory board members fell in the previous year a little, however. Among the 205 people occupying 262 seats on supervisory boards, 23 DAX directors are listed, this being interpreted as a move towards professional supervisory board members and an end to “Deutschland AG”. The most important supervisory board member is Manfred Schneider, who holds supervisory posts at a total of four DAX companies, with annual remuneration of just over 1 million euros.

Private investors mistrust shares

Germany’s private investors, while optimistic and looking forward to continually rising share prices, nonetheless have not laid aside their risk aversion, and tend to avoid investment in shares. According to the latest findings of the investment indicator surveyed quarterly by TNS Infratest on a commission from the DZ BANK, currently almost half of the 1,026 private investors surveyed (46%) expect the German share index to continue to rise in the next six months, while only 14% expect quotations to fall. Nonetheless, only a small part of investors are prepared to invest money in shares or share funds. The representative survey further confirms that investors continue to behave very cautiously, building up reserves on the share market. A striking point is that currently ¾three quarters of all respondents are not at all prepared to engage in risks in investing their money. Of the remaining respondents, some 2/3 tend to invest their money in daily or fixed-money accounts, a quarter in share funds and only a fifth directly in shares.

Code for independent remuneration consultancy

Management consultancy Towers Perrin has developed a “Code for independent remuneration consultancy”. The set of regulations should serve supervisory board members and remuneration advisers as a basis for assessing the independence of external experts in consultancy projects on the remuneration of directors and top management. The basis for the code is a legal report by renowned company lawyer and member of the government commission for the German Corporate Governance Code Professor Theodor Baums. Towers Perrin consultants are committed to rigid implementation of the Code rules. The remuneration consultants in consultancy projects have accordingly to act on the basis of appropriate information and with the necessary technical expertise. Consultancy should be done free of any personal or economic interest of the remuneration consultant liable to influence the outcome of the remuneration consultancy.

The concept of independence relates to the individual commissioned to do the consultancy. Their independence is to be denied where

-

the remuneration consultant personally is simultaneously, on a mandate from the board, advising the company, a board member or a firm associated with the company without the assent of the Supervisory Board – irrespective of the topic,

-

the remuneration consultant is an officer or employee of the company to be advised or a firm dependent on it,

-

a financial or capital connection exists between the company to be advised, a firm dependent on it or a board member and the remuneration consultant/consultancy company of such an extent as to make uninfluenced consultancy unlikely,

-

either the remuneration consultant or the consultancy company where he is a partner or employee has in the last five years derived more than 15 percent of total income from the company or a firm associated with it.

In consultancy projects remuneration consultants must without request and in writing declare their independence to the chair of the Supervisory Board or of the remuneration committee before conclusion of the consultancy contract. Changes regarding their independence are to be notified to the aforesaid forthwith. A further important aspect concerns data utilization. A remuneration consultant must inform the chair of the Supervisory Board or of the remuneration committee if use is to be made in the consultancy of information provided by the board or employees of the company or a firm associated with it. Finally, the consultancy fee must not be oriented to the remuneration of board members or employees of the company to be advised. The “Code for independent remuneration consultancy” can be got free of charge from the Towers Perrin web page www.towersperrin.de.

Capital News

Capital Measures im December

In the USA, Deutsche Post is setting up a so-called sponsored Level-1-American-Depositary-Receipt (ADR) program. Through this ADR program, Deutsche Post wishes to improve its relations with shareholders in the United States and offer still more US investors the possibility of taking a holding in the company and taking part in future growth. Under the symbol DPSGY, the ADRs will be traded as from now in the US on the over-the-counter (OTC) market. Each ADR corresponds to one share in the group. ADRs make it possible for investors to hold shares indirectly in a foreign concern.

K+S has successfully placed its capital increase, collecting gross proceeds from the issue amounting to €689 million from investors. The take-up rate for the new shares was 99.42%, stated the fertilizer and salt producer on 11 December in Kassel. The object is to bring the capital structure back into line following the multi-billion takeover of US salt maker Morton Salt and to pay back loans taken up for the purpose. The two biggest K+S shareholders - MCC/EuroChem and BASF – took their full part in the capital increase.

Rupert Murdoch, through his News Corp, has announced that he is subscribing to a capital increase at Sky Channel. News Corp will be buying up to 49 million shares. The capital increase will put 110 to 120 million euros into the MDAX company's empty pockets. Murdoch’s share will thereby rise from 39.496 to up to 45.4%.

United Internet announced it was withdrawing the 11,625,656 shares bought in buyback programmes. The registered capital will accordingly fall from €251,635,656 to €240 million.

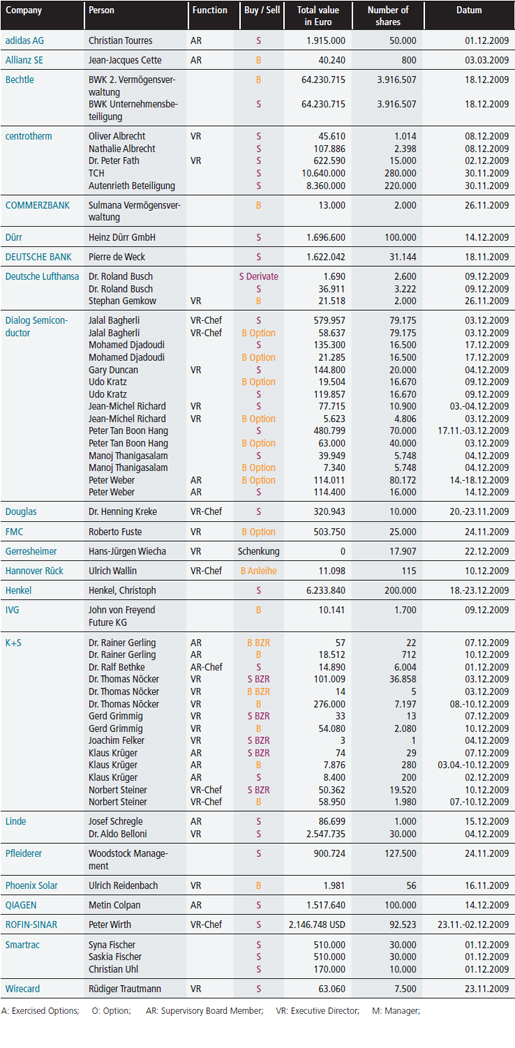

Director's Dealings

in December

VIPsight Shareholder ID

Events Diary

13 January 2010 Carsten Burhop: Die Bankenkrisen von 1873 und 1931 und was wir aus ihnen lernen können

organizer: Frankfurt School of Finance & Management; place: Frankfurt School, Raum 20, Frankfurt am Main, Sonnemannstrasse 9-11, Frankfurter Innenstadt; cost: none, registration: This email address is being protected from spambots. You need JavaScript enabled to view it.

19 January 2010 Prof. Alan S. Kahan, Mind versus Money: The War between Intellectuals and Capitalism

organizer: Frankfurt School of Finance & Management; place: Frankfurt School, Raum 20, Frankfurt am Main, Sonnemannstrasse 9-11, Frankfurter Innenstadt; cost: none, registration: This email address is being protected from spambots. You need JavaScript enabled to view it.

26 January 2010 Aktienemissionen 2010: Marktumfeld und aktuelle rechtliche Fragen

organizer: Deutsches Aktien-Institut; place: Maritim Hotel Frankfurt, Frankfurt am Main; Theodor-Heuss-Allee 3; cost: €900 (non-members); info: 069 929 15-0

2 February 2010 Compliance im Konzern, organizer: Deutsches Aktien-Institut; place: Hessischer Hof, Frankfurt am Main; cost: €900 (non-members); info: 069 929 15-0

Reading suggestions

Farkas-Richling, Dirk, Fischer, Thomas R., Richter, Andreas (eds.), Private Banking und Family Office

Schaeffer-Poeschel Verlag, 548 pp, €99.95, ISBN 978-3-7910-2735-7

In recent years in Germany, alongside private banking the consultancy service of a Family Office for high-net-worth clients has increasingly become established as a separate field of business. Individual attention to these demanding clients is possible only with a comprehensive, interdisciplinary consultancy approach that considers the client‘s overall asset and investment position. The book is illuminating on both the market, consultancy work and products, as well as the legal and fiscal environment. The editors are established practitioners, working for such top-rank firms as M.M. Warburg, Marcard, Stein & CO and P+P Pöllath + Partner.

Gabler Kompakt-Lexikon Bank und Börse

Gabler Verlag, 5th revised ed., 246 pp, €26.95, ISBN 978-3-8349-1861-1

This lexicon will help you with guidance in all financial matters. In over 2,000 headings it gives you everything you want to know about account management, credit, money investment and securities transactions. The effects of new legal provisions after the financial crisis are simply and comprehensibly explained in this 5th revised edition, making this lexicon a perfect everyday reference work for bank staff, trainees in the financial-services sector and anyone who has to do with the stock exchange.

Gabler-Wirtschaftslexikon: www.Wirtschaftslexikon.gabler.de

The Gabler Wirtschaftslexikon has for over 50 years been regarded as a classic of economic literature. In the year of its 80th birthday the Wiesbaden publishing house Gabler – one of the leading German specialized business publishers – presents its flagship reference work with over 25,000 headwords as a freely accessible online lexicon. The 150 authors of the entries are established experts in their various fields. Additionally, the items are continually updated and supplemented. The new search and display functions correspond to the information needs and media possibilities of the Internet: multidimensional search functions, presentation of technical fields using a category tree, automated citation, literature references, abstracts and relation graphs of the terms, short surveys of individual fields and comprehensive in-depth articles and detailed author profiles. Links to thematic journal articles and book recommendations ensure optimum research conditions.

In parallel with the start of the online version the Gabler Wirtschaftslexikon is appearing in its 17th edition as a paperback in the WELT EDITION. As part of media cooperation the printed edition of Gabler is being distributed to the book trade and by the WELT group through www. welt-edition.de.

Hommelhoff, Professor Peter, Hopt, Professor Klaus J., von Werder, Professor Axel, Handbuch Corporate Governance

Schaeffer-Poeschel Verlag, 2nd revised ed., 966 pp, €169.95, ISBN 978-3-7910-2596-4

The handbook presents corporate governance in its various legal and business aspects. It is

addressed to both practitioners and academics. As well as fundamental economic questions and the legal framework, it deals inter alia with structures and bodies, the core processes of corporate governance in companies, the special features in groups, transparency and auditing, and also evaluation and sanctioning. The handbook has been comprehensively revised andbrought up to date in this second edition. Aspects of internationalization have been paid more attention, with a focus on developments in European law.

Raisch, Sebastian, Probst, Gilbert, Gomez, Peter, Wege zum Wachstum

Gabler Verlag, 2nd revised ed., 281 pp, €44.85, ISBN 978-3-8349-1810-9

Profitable growth is the key to long-term success in competition. The authors show in practicerelated chapters how you can sustainably raise your firm‘s growth capacity. The book brings together research findings of the Center for Organizational Excellence (CORE) of the Universities of St. Gallen and Geneva, supplemented by a series of current case studies from business practice. Management staff of companies, as well as students and teachers of business sciences, will find valuable hints. The second edition is revised and contains new findings and examples from current research projects of the Center for Organizational Excellence. Sebastian Raisch is Assistant Professor and Director of the Center for Organizational Excellence at the University of St. Gallen. Gilbert Probst is Professor of Organization and Management at the University of Geneva and Managing Director and Dean of the Global Leadership Program at the World Economic Forum. Peter Gomez is Dean of the Executive School for Management, Technology, and Law of the University of St. Gallen and President of the Administrative Board of the Swiss Stock Exchange SWX Group.

Stiegel, Andreas, Wiesbrock, Michael R., Jesch, Thomas A., Kapitalbeteiligungsrecht

Schaeffer-Poeschel Verlag, 921 pp, €169.95, ISBN 978-3-7910-2250-5

The book contains a comprehensive, practice-oriented commentary on all the essential legal norms of relevance in private-equity situations. For the first time, the draft AIFM directive is also systematically commented on. The authors, from the private-equity industry and the financial administration as well as lawyers, tax consultants and auditors, guarantee an allembracing view and offer an indispensable basis for qualified decisions.