VIPsight - March 2010

COMPANIES

Infineon rebels fail

At Infineon, British Pension fund Hermes failed with its counter-candidate Willi Berchtold. Instead Klaus Wucherer, favoured by the old board, is to be elected as the new chair. Hermes wanted a change because Wucherer has been on the board since 1999 and does not stand for the necessary new start. Wucherer received 72.5% of votes and Berchtold only 27%. Hans-Martin Buhlmann of the Vereinigung Institutioneller Privatanleger (VIP) complains that procedures for counting votes were changed twice during the AGM so that ultimately the votes were manipulated.

VW creeps into MAN

Utility vehicle maker MAN SE will be closer in personnel terms too to Germany’s biggest carmaker Volkswagen (VW), after the AGM on 1 April. With banker Stefan Ropers leaving the Supervisory Board at his own request, the purchasing head of VW subsidiary Audi, Ulf Berkenhagen, is joining it, becoming the third VW representative on the Supervisory Board beside Audi CEO Rupert Stadler and chair Ferdinand Piёch. Currently VW holds 29.9% of the MAN shares.

The commission payments and corruption accusations at MAN are now having an epilogue. According to the AGM agenda, ex board members Hakan Samuelson, Karlheinz Hornung and Anton Weinmann will not for the moment be given discharge. The background is the still uncompleted special audit for possible breaches of duties by the three executives, who have already left the board.

Commerzbank not free of impositions till 2011

To date an agreement with bank rescue fund SoFFin has prevented semi-nationalized Commerzbank from distributing dividends. Altogether the government has supported Germany’s biggest private bank, in difficulties because of its takeover of the Dresdner Bank, with €18.2 billion; of this €16.4 billion were a silent contribution. As a counterpart the government got 25% plus one share in the institution. As soon as the bank makes profits, it has to pay interest on the silent contribution; thise will run up to €1.5 billion this year. Since however the Frankfurt bank made losses in 2009 and expects them in 2010 too, it need not make these payments for the moment. The requirement not to release any reserves for interest or dividend payments will however run out in 2011. Commerzbank should then also be making a profit again and could release the €7.9-billion-strong reserves. That would enable payment of interests and also of a dividend.

Lax supervision at Bilfinger Berger

After the collapse of the Cologne city archives building on 3 March 2009, investigations of Bilfinger Berger for building errors on the Cologne North-South underground railway are expanding. On 19 February Cologne public prosecutors investigated the consortium of firms involved in building the underground. The investigations were of a dozen suspects including Bilfinger Berger employees. Lately there have been accusations that records on the construction of stabilization anchors have been falsified. Instead of building-in the anchors they are said to have been sold on the side to scrap dealers. As head of the construction group, Bilfinger Berger had already dismissed two construction workers and a finisher. On indications from the public prosecutors, the Mannheim construction firm is also investigating shabby construction on the ICE high-speed stretch from Nuremberg to Ingolstadt. On this 171km stretch, building records are alleged also to have been falsified. Lately suspicions have hardened that on the underground in Düsseldorf too Bilfinger-Berger workers did not build some parts in accordance with regulations. One employee has since been dismissed. Despite the accusations made against Bilfinger-Berger, the company sees no occasion to set aside reserves. They had enough insurance, stressed CEO Herbert Bodner.

Daimler cancels dividend

After losses of €2.6 billion Daimler CEO Dieter Zetsche has cancelled investors’ profit-sharing in 2009. Last year the distribution had already been cut to 60 cents, but now after fourteen years it is disappearing entirely. The news brought the Daimler share price down for a while by 10%.

Frenzel blocks Fredriksen

At this year’s TUI AGM too, Norvegian Investor John Fredriksen had to accept a defeat. Fredriksen has a holding of around 15% in the tourism and shipping group and has been for years fighting for two seats on the Supervisory Board. Together with his confidant Tor Olav Troim, the Norwegian has for long being pursuing a confrontation course against TUI CEO Michael Frenzel, who according to Fredriksen is responsible for the fall in the share price and ought to resign. Criticisms here centre on the TUI financial aid to struggling shipowning subsidiary Hapag-Lloyd, in which TUI still holds 43%, as well as the issue of a convertible bond in autumn 2009. Additionally, the Scandinavians are complaining about the lack of dividend. A special audit called for by Fredriksen did not, however, get a majority at the AGM on 17 February. The Norwegian is also still denied the two seats on the Supervisory Board. Frenzel had offered Fredriksen one seat, but attached to the condition that he would second a neutral person and support management in its strategy. “We are not prepared to pay that price for involvement in the Supervisory Board,” said Troim, rejecting this. Meanwhile TUI is looking in the medium term for an investor for its holding in Hapag-Lloyd, so as to concentrate more intensively on its core tourism business. Lately there have been reports that TUI might buy back Tui Travel, listed in Britain. Management has however denied this.

Foreigners building up holdings

Shares in companies listed in Germany were still in demand by foreign investors in February: US star investor Warren Buffett built up his holding in Munich Re from 3% in late January to 5.02% in mid February. One of the best known short sellers on Wall Street, Gilchrist Berg, came into special packaging maker Gerresheimer at 3.1%. US investment firm Fidelity raised its holding in Qiagen to 10.09% and is thus the only shareholder in the biotech firm with a holding of over 5%.

German EADS holding to stay

A consortium of twelve German banks – including Commerzbank and Deutsche Bank – is to keep German carmaker Daimler’s 7.5% holding in European aerospace Group EADS. The French government and the Lagardère group still hold 22.5% of EADS. In 2007 the Stuttgart carmaker wanted to lower its holding in EADS from 22.5% to 15%. But to keep Franco-German balance at EADS, the German government searched, at the time in vain, for a German investor for the 7.5% block, so that the transitional solution was agreed with the bank consortium. In it, the credit institutions lent Daimler €1.5 billion and took the 7.5% block plus preference dividends as collateral. Now, according to Financial Times Deutschland, the agreement, expiring in July 2010, is to be extended for three years.

E.On to get rid of IT

Electricity group E.On is looking for a buyer for parts of its data-processing subsidiary E.On IS, thereby hiving off some €400 million in turnover and 1,600 employees. Up for sale is the IT infrastructure including computing centres, servicing for the electronic equipment at E.On workplaces, including net access and printers, and technical communications including telephony and video conferencing. The group does not want to sell the software and applications segments or control of power grids and power stations.

Electricity group E.On is looking for a buyer for parts of its data-processing subsidiary E.On IS, thereby hiving off some €400 million in turnover and 1,600 employees. Up for sale is the IT infrastructure including computing centres, servicing for the electronic equipment at E.On workplaces, including net access and printers, and technical communications including telephony and video conferencing. The group does not want to sell the software and applications segments or control of power grids and power stations.

KBA complains at State aid to Heideldruck

Koenig & Bauer (KBA) complain that State aid given to “other firms” was “apparently used to conserve over-capacity, produce for storage and sell off stocks at bargain prices”. KBA stated this in 5 February in a communication disclosing provisional annual figures. The printing-press maker means its competitor Heidelberger Druckmaschinen, which in 2009 received State aid of over €850 million. The bigger rival does not wish to take a position on the accusations. KBA left loss territory in 2009 by a strict course of savings.

Software swallows IDS Scheer

By early February Software had expanded its holding at IDS Scheer to 91.2%. The control and profit transfer agreement has since been entered in the commercial register at Saarbrücken Regional Court and thus has legal effect. The resolution for the agreement was already passed in November 2009. Software wanted to merge IDS Scheer with itself, stated the Saarbrücken firm on 3 February. Integration of the operational processes of the two firms had already begun.

Postbank accounts have mistakes

Deutsche Postbank has to correct its accounts for 2008. The German accountancy regulator DPR has complained that the former Post subsidiary wrongly constituted some €90 million in risk provision only in 2009. These reserves for possible losses ought already to have been shown, according to the accounting watchdogs, in 2008. With the corrections now called for, the loss after tax in 2008 rises from €821 million to €886 million. Before tax there are thus some minus €1.1 billion on the books for 2008. For 2009, however, the correction has a positive effect. Before tax, German’s biggest bank for private customers now has a €90 million better result, though still negative at minus 398 million. The risk provision was increased from €498 million in 2008 to €681 million now.

The DPR pointed out that the quota for the faulty half-year and annual balances in 2009 had again risen. In the DAX it rose from zero to 14%, and also on the MDAX and SDAX, the indexes for medium and smaller firms, the proportion of errors rose from 18 to 27%. Particularly for banks, drawing up accounts had become difficult in the course of the financial crisis. This had also been contributed to, according to the DPR, by the complicated accounting guidelines of International Financial Reporting.

Buhlmann's Corner

Greeks bearing gifts

“Quidquid id est, timeo Danaos et dona ferentes,” says Virgil in his epic on the Trojan War, and that’s precisely the way things are going now with Infineon shareholders in Munich. The old-new Supervisory Board chair, Professor Wucherer, is now the self-styled lame duck. Officially, to secure his chance of election, he is limiting his period in office to 12 months. We’ve no idea what the notary did with that: whether he minuted this declaration. or only the five-year appointment was entered in the document. If the new Supervisory Board is wise, then it won’t appoint the board for five years, but leave that to its successor next year.

“Quidquid id est, timeo Danaos et dona ferentes,” says Virgil in his epic on the Trojan War, and that’s precisely the way things are going now with Infineon shareholders in Munich. The old-new Supervisory Board chair, Professor Wucherer, is now the self-styled lame duck. Officially, to secure his chance of election, he is limiting his period in office to 12 months. We’ve no idea what the notary did with that: whether he minuted this declaration. or only the five-year appointment was entered in the document. If the new Supervisory Board is wise, then it won’t appoint the board for five years, but leave that to its successor next year.

We have several times been asked how such an unexpected voting outcome can be explained. It is a normal thing here that management knows the declared votes well before the meeting and can adjust to that. In a black box, it then tests the instructions long enough in order for the right choice of motion and election procedure to guarantee the “desirable” result. As long as shareholders do not take part in the vote, or are represented at the AGM only blindly with one-way instructions and then display no interest in how the vote actually happened, the owner’s will is going to be subordinate to executive management’s.

Just imagine that a week before the election Angela Merkel could assess the postal-vote ballot boxes, with two thirds of the total votes, to decide whether the election campaign ought to be completed. That is just what happens, and even more. As long as shareholders ask their agents whether the vote was cast – and don’t (want to) see that all they can do is simply confirm having passed on the voting instructions – the stability of this system-for-show will go on working. In practice we know that participation in the vote doesn’t (ever?) come about. As long as institutional voters contentedly file away an incomplete voting receipt, since after all they’ve paid for it, one must still continue to “fear the Greeks, even bearing gifts”.

ACTIONS CORNER

Daimler is paying SEC 200 million dollars to end investigations for alleged slush funds. Two group subsidiaries had pleaded guilty. With the payment, investigations by the US Department of Justice and securities regulator SEC were ended. In 2004 SEC opened investigations of the carmaker after an ex employee had given indications of slush funds. These had been kept in order to bribe foreign government representatives. Neither the company nor the authorities were prepared to make statements.

Eckhard Spoerr and Axel Krieger were rightly condemned for insider trading, found the Federal Court of Justice in Karlsruhe. The ruling, published on 22 February, shows that the former Freenet CEO and CFO could hope for milder punishment. Hamburg Regional Court had fined both in January 2009. Spoerr was to pay €300,000 and Krieger €150,000. On top of this was the gross gain from the share sales, of around €700,000 each. In the judge’s view the fines had been wrongly calculated, to the disfavour of the culprits.

Gabriele Kröner was successful in her action for avoidance against Fresenius. Frankfurt Regional Court found in the favour of the action for avoidance by plaintiff against AGM resolutions of 2009 on all points and declared the disputed AGM resolutions now null and void, stated its presiding judge. The company’s former Supervisory Board member and step-daughter of founder Else Kröner had complained of conflicts of interest on the Supervisory Board of which shareholders had not been adequately informed at the meeting on 8 May 2009.

Munich public prosecutors have brought charges against Thomas Ganswindt. The former Siemens executive has been accused inter alia of corruption. A decision on an administrative fine had already reached the stage of being unappealable. No indications were given as to the amounts claimed. The public prosecutors also imposed an initial administrative fine on ex Board member Jürgen Radomski. He has to pay three million euros.

Investigations of the private life of Pierre-Pascal Urbon, CFO of SMA Solar Technology, have begun. He disputes the accusations against him. To avoid negative repercussions on the Solar Technology group, he has asked to be placed on leave until the investigations are over. The Supervisory Board will then decide on any further action. SMA has so far not given any indications on the object of the proceedings. All it said was that Urbon would engage actively in the investigations so as to provide proof that the accusations against him were false. The public prosecutors suspect Urbon of a sexual offence “against a female employee”.

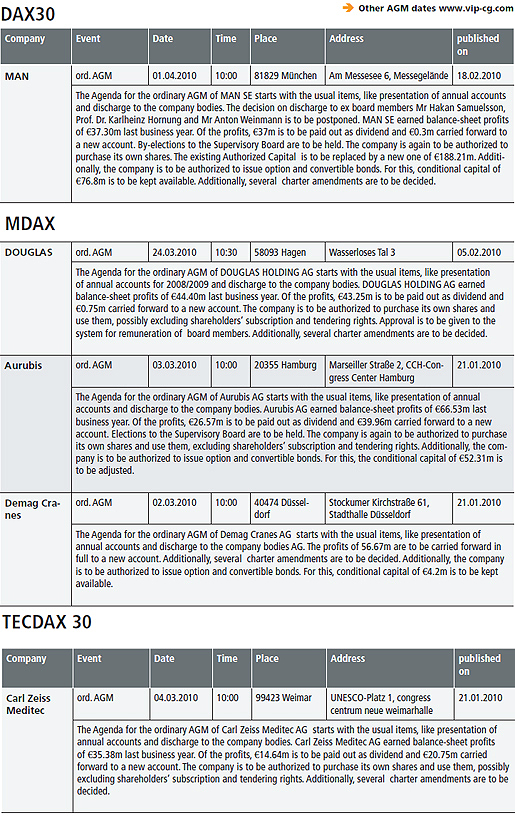

AGM Dates

in March

Politics

Cabinet approves bill limiting bonus payments

The German federal cabinet in mid February approved a bill new regulating bankers’ bonuses, which is to come into force by October this year at latest and apply to both banks and insurance companies. The government is thus giving legal form to a G20 resolution calling for responsible, transparent remuneration systems. The new Act is to give the Federal Institution for Financial Services Oversight (BaFin) the right to limit inappropriately high bonus payments or forbid them entirely. The amendment is to make a considerable proportion of variable remuneration payable only after at least three years and dependent on business success. At least half the variable remuneration must be paid out in the form of shares or similar instruments. Guaranteed bonuses are, according to the draft, permissible only in exceptional cases. The technical details of the Act such as monitoring and further development of remuneration systems are to be embodied in a legal decree after the Act comes into force.

More women on Supervisory Boards

The Corporate Governance Commission is calling for more diversity on German Supervisory Boards and warning that in German firms women, and other nationalities, are still underrepresented on them. Currently only some twelve percent of German Supervisory Board members are women. While on the employee side there are relatively many women, the female sex has not been given appropriate consideration on the shareholder side. Klaus-Peter Müller, chair of the Commission and also Supervisory Board chair of Commerzbank, indicated in an interview with Financial Times Deutschland that the Commission would likely discuss a recommendation on a stronger female presence at its next meeting in May. While there is to be no quota or specific figure, as in Norway, firms should make their own plans as to how many women, and if appropriate foreign experts, they plan to appoint, and in what time frames.

Offensive against credit crunch

Deutsche Bank wants to set up an aid fund for German small businesses still in this first quarter, endowed initially with €300 million. A further 200 million are to be paid in by other banks and companies. Carmaker Daimler has indicated a possible amount, which would benefit the suffering automotive supplier industry. The fund is to support companies with a turnover of up to €100 million. They are to receive credits in the form of mezzanine capital amounting to between two and ten million euros each. Financial and real-estate firms are excluded. The fund, administered by Frankfurt service provider M Cap Finance, can waive interest payments where a company is making losses. The Bundesverband der Deutschen Industrie (BDI) had earlier criticized the delays in setting up the fund, proposed in December by Deutsche Bank CEO Josef Ackermann. The Deutsche Sparkassen- und Giroverband announced a fund of its own that might be endowed with five to ten billion euros. To flank the private fund, the federal government has created the position of a credit mediator. As from March Hans-Joachim Metternich will fill this post. For its part, Commerzbank has appointed Michael Schmid as special board representative for small-business credit. He is to look into rejected credits and act as interlocutor for Metternich.

Deutsche Bank wants to set up an aid fund for German small businesses still in this first quarter, endowed initially with €300 million. A further 200 million are to be paid in by other banks and companies. Carmaker Daimler has indicated a possible amount, which would benefit the suffering automotive supplier industry. The fund is to support companies with a turnover of up to €100 million. They are to receive credits in the form of mezzanine capital amounting to between two and ten million euros each. Financial and real-estate firms are excluded. The fund, administered by Frankfurt service provider M Cap Finance, can waive interest payments where a company is making losses. The Bundesverband der Deutschen Industrie (BDI) had earlier criticized the delays in setting up the fund, proposed in December by Deutsche Bank CEO Josef Ackermann. The Deutsche Sparkassen- und Giroverband announced a fund of its own that might be endowed with five to ten billion euros. To flank the private fund, the federal government has created the position of a credit mediator. As from March Hans-Joachim Metternich will fill this post. For its part, Commerzbank has appointed Michael Schmid as special board representative for small-business credit. He is to look into rejected credits and act as interlocutor for Metternich.

All are in favour of bank levy

The panel of experts (SVR) is calling for banks to pay money into a fund in accordance with their systemic risk. The demand to involve credit institutions in the consequences of the financial crisis was also taken up by the chair of the Bavarian CSU, Horst Seehofer: “Those who can pay bonuses can also bear a levy to the public.” The Bundesverband deutscher Banken (BdB) was also open to a special levy. The Deutsche Sparkassen- und Giroverband (DSGV) said it was in agreement in principle, but warned the levy had to be fair in terms of causality. Finance Minister Wolfgang Schäuble now intends by the end of May to submit a draft regulating financial markets that might contain a compulsory levy on banks. The institutions would then be asked to pay retroactively for their rescue. It is unclear whether any proceeds would go into the already existing rescue fund (SoFFin) or be used to settle costs of the financial crisis.

Bigger rescue fund at work

Josef Ackermann, in his capacity as chair of international banking association IIF, called at the World Economic Forum in Davos for more banker initiative to prevent future financial crises. The Deutsche Bank CEO repeated his call for European banks and governments to pay into a jointly financed European fund that could rescue or wind up institutions in difficulty. Financial Times Deutschland reports that the European Commission has produced a working paper intended to harmonize rules for investment insurance systems in Member States. This system’s resources are to be beefed up within ten years from their current €23 billion to €170 billion. Three quarters of the amount is to be paid in beforehand by credit institutions, with a further quarter to follow as required. Institutions would then have to pay three to five times as much into safety systems as before. According to an internal estimate of consequences, the new system could cut bank profits by up to ten percent. Currently there is a legal deposit guarantee fund in Germany that protects private customers, and a voluntary protection fund by private banks that also guarantees institutional and public investors. The Landesbanks and savings banks guarantee each other. New EU internal market commissioner Michel Barnier will present official proposals for a comprehensive reform of investment protection in spring.

Josef Ackermann, in his capacity as chair of international banking association IIF, called at the World Economic Forum in Davos for more banker initiative to prevent future financial crises. The Deutsche Bank CEO repeated his call for European banks and governments to pay into a jointly financed European fund that could rescue or wind up institutions in difficulty. Financial Times Deutschland reports that the European Commission has produced a working paper intended to harmonize rules for investment insurance systems in Member States. This system’s resources are to be beefed up within ten years from their current €23 billion to €170 billion. Three quarters of the amount is to be paid in beforehand by credit institutions, with a further quarter to follow as required. Institutions would then have to pay three to five times as much into safety systems as before. According to an internal estimate of consequences, the new system could cut bank profits by up to ten percent. Currently there is a legal deposit guarantee fund in Germany that protects private customers, and a voluntary protection fund by private banks that also guarantees institutional and public investors. The Landesbanks and savings banks guarantee each other. New EU internal market commissioner Michel Barnier will present official proposals for a comprehensive reform of investment protection in spring.

Short-selling allowed again

Since early February, so-called uncovered short sales are allowed again on Germany’s exchanges. However, as from 25 March a new transparency system will apply to shares of Aareal, Allianz, Commerzbank, Deutsche Bank, Deutsche Börse, Hanover Re, MLP, Munich Re and Postbank. As soon as market participants hold 0.2 percent of the shares as short-selling positions (after deducting long positions), they must report this to BaFin. Further disclosures must follow on reaching, exceeding and going below each further 0.1 percent of shares issued. As from 0.5 percent the position must be disclosed in anonymized form on the BaFin website. Bafin wants here also to include on- and off-exchange instruments that correspond to a short position.

Susanne Bergius

ESG goes mainstream

Sustainable investments are decoupling in German-speaking countries from general market developments and reaching record volumes, thanks to increases in values and heavy inflows of resources. Increasing numbers of institutional investors are incorporating environmental, social and governance (ESG) aspects into their share analysis and portfolio management.

The volume of sustainable public funds rose in 2009, according to industry service Ecoreporter, from 21 billion euros to almost 35 in Germany, Austria and Switzerland. The 61% increase is four and a half times that of the whole public-funds sector: this rise in the comparison period was 12.9%, says the Bundesverband Investment und Asset Management (BVI). In Germany alone, the sustainables proportion in all public funds rose to 4.6%. They are no longer a niche for hobbyists, but an investment segment to be taken seriously.

The offer has also developed differently from the industry trend. While all over Europe, and in Germany too, initially more investment funds disappeared than new ones were set up, as analysis firms Morningstar and Lipper found, in German-speaking countries, according to the Sustainable Business Institute, 31 new funds were set up and 29 added that were already licensed elsewhere or are newly pursuing sustainability criteria. Only thirteen funds were closed or merged.

Two thirds of the volume was invested in share funds. According to Ecoreporter, their value rose on average by 28%, and they brought in proportionately more before costs and fees than MSCI World. For those already in existence by the end of 2008, the volume rise of 40% was 10% above the value increase and was therefore being fed by inflows to that extent, reckons the SBI. In the US two thirds of sustainable public funds exceeded their benchmark in 2009, reports the Social Investment Forum (SIF). On a three-year and ten-year comparison too, they come out better.

This reflects the fact that environmentally aware, socially responsible business strategies and practices offer economic advantages and image points relevant on the exchange that can often be measured. For instance, they bring lower capital costs, as top management consultancy A.T. Kearney recently found. That is why institutional investors are increasingly taking substantively relevant ESG criteria into account in their investment policies. Munich Re, for instance, invests 80% of its share portfolio sustainably. Some investor groups are asking companies for standardized reports. “We see it as a duty to report on the decisive, quantifiable eco-social risks, opportunities and benefits,” says Ralf Frank, managing director of the Deutsche Vereinigung für Finanzanalyse and Asset Managment (DVFA). This association had central performance indicators (KPI) developed by experts, replacing them in late 2009 by industry-specific ones. The European financial professionals’ organization EFFAS has taken them up, and European network Eurosif also supports the list of criteria.

By now, worldwide over 680 investors, asset managers and financial-services providers with a total of 20 billion dollars have committed themselves to the UN principles of responsible investment (UN PRI). Almost two thirds of those already there a year ago have incorporated corresponding criteria in contracts with asset managers, whereas in 2007 the figure was only 38%. Additionally, 95% of capital owners and asset managers have, in thousands of cases of “shareholder engagement”, been involved in environment, corporate governance and labour-law questions, by casting their votes or dialoguing directly with managements.

This direction is now also being taken by German churches. The Landeskirche in Bavaria has sorted through its portfolio in accordance with ethical and eco-social criteria, separating out delicate cases, and started in 2009 to approach boards and supervisory boards, as its top financial director Jörg Blickle reports. The first successes are coming in. In one case, account was taken of the desire not to build atomic power stations in an earthquake area. Blickle is not naming names, but the conclusion that suggests itself is that this has to do with RWE.

The Landeskirchen in Hesse and Nassau and in Baden, and two Protestant pension funds, are having their proxy rights totalling over a billion Euros exercised(*) through British asset manager F&C. Using the “Responsible Engagement Overlay” (Reo) approach, they verify clients’ worldwide shareholdings for governance, environment, social and ethical aspects, and are able to combine their interests and influence. F&C voted almost twice as often in 2009 as in the previous year: on 58,000 resolutions in 5225 firms in 66 countries. F&C also keenly pursued dialogue. And successfully: every year over 200 firms worldwide implement the measures asked for.

Germany’s protestant church Evangelische Kirche Deutschlands (EKD) has taken up the theme. A working group on ethical and sustainable investment discusses and identifies criteria and guidelines that Protestant investors can follow. In a second group, mainly representatives of Landeskirchen, pension funds and church banks are discussing possibilities of setting up an institution for joint involvement. “We want to reach a decision this year,” says Ekkehard Thiesler, CEO of the church’s KD-Bank.

Also in 2009, an idea was arrived at jointly with the Catholic Bank für Kirche und Caritas (BKC): to set up multidenominational interest representation. BKC is according to its board chairman Richard Böger currently looking for cooperation partners to set up a partnership with an asset manager or found a cooperative organization. The churches administer pension money estimated to total 60 billion euros, and as Germany’s second-biggest employer can also influence small investors. This combined shareholder power is something neither firms nor investors could ignore.

Susanne Bergius*, editor-in-chief of “Handelsblatt Business Briefing zu Nachhaltigen Investments” and TV presenter on sustainable business and investment

*Contributions from guest authors express only their personal opinions, which need not be shared by VIPsight.

People

Since 17 February Wolfgang Bernhard has been responsible on the Daimler board for production and sales in the car division Mercedes Benz Cars and the van division Mercedes Benz Vans. The Stuttgart carmaker’s board thus now again consists of six people. The contracts of CEO Dieter Zetsche and research head Thomas Weber were each renewed on 17 February for 17 years.

Nico Forster died on 16 February at his residence, Schloss Guttenburg in Waldkraiburg (Landkreis Mühldorf), at the age of 48. The executive had studied Philosophy, Theatre Science and Psychology before making a fortune as cofounder of Drillisch. He used his money among other things to restore historic buildings. He is said to have suffered from a severe kidney disease for some time.

At Gerresheimer the CEO is, surprisingly, to change. Axel Herberg is not seeking reappointment and will leave the board when his contract runs out on 21 June. In autumn he will go to Blackstone to head its investment business in German-speaking countries. The Supervisory Board has appointed long-time board member Uwe Röhrhoff as Herberg’s successor as from 22 June.

Stefan W. Ropers is leaving the MAN supervisory board. At the end of the lorry and machine maker’s next AGM on 1 April, the BayernLB executive is resigning. He is said to want more time for the upcoming restructuring of Germany’s second biggest Landesbank, the latter stated. In place of Ropers, Audi executive Ulf Berkenhagen is to be appointed.

Münchener Rückversicherungs-Gesellschaft (Munich Re) has secured Benita Ferrero-Waldner for a post on the Supervisory Board. Munich Regional Court appointed the former EU commissioner and Austrian foreign minister to succeed Supervisory Board member Karel Van Miert, who died in June 2009. She is to be put up for election at the forthcoming ordinary AGM on 28 April.

Thomas Fischer has resigned his Supervisory Board post at RWE as from 31 January, a good year before the expiry of his appointment. No reasons for the resignation were given. Wolfgang Schüssel will replace the former WestLB CEO. He must be confirmed by the AGM on 22 April, but before then he has to be appointed by the district court. These proceedings have already been begun.

SAP board spokesman Léo Apotheker resigned on 7 February with immediate effect. No indications were given as to the reasons. Executive John Schwarz also left with immediate effect. Two board members, Bill McDermott and Jim Hagemann Snabe, were appointed board spokesmen on an equal footing. Additionally, Vishal Sikka was appointed as a board member.

At BMA Solar the contracts of Günther Cramer (CEO) and Peter Drews (COO) are expiring in mid 2011. These founding executives will then complete the generational turnover after 30 years on the board, and are candidates for the Supervisory Board. To guarantee a friction-free transition, the Supervisory Board decided on 23 February to expand the board from April this year until the departure from five to seven members. Uwe Hertel has been newly appointed to the board for the operative business sector. Jürgen Dolle will be in charge of personnel. In recent years employee numbers at the TECDAX heavyweight have risen to over 4000 (including temporary workers). The number of Supervisory Board members has accordingly been raised to twelve.

Jan Marsalek was appointed director for sales and marketing at Wirecard as from 1 February. He has worked in the Wirecard group since 2000 and put his mark on the company’s successful development from the start. Rüdiger Trautmann, board member since autumn 2005, left the company for personal reasons on 31 January. His contract had been renewed in mid 2008 until 2010.

Campus

DAX majority has CG shortcomings

A study done for the first time by Union Investment has located sizeable shortcomings in Corporate Governance among DAX firms. Only 39% of them implement the Code recommendations without exceptions or limitations. The findings of the study on recognition of the Code contradict the most recent analysis by the Berlin Centre of Corporate Governance from spring 2009. The compliance quota in the DAX was then 93.3%. According to indications from the Union Investment analysts, their study is based on the latest version of the Code, amended in summer 2009. Most infringements were observed in connection with the own-risk excess in D & O insurance, recommended duration of executive contracts, the upper limit on severance payments, Supervisory Board members’ pay and moves from boards to Supervisory Board chairs.

A study done for the first time by Union Investment has located sizeable shortcomings in Corporate Governance among DAX firms. Only 39% of them implement the Code recommendations without exceptions or limitations. The findings of the study on recognition of the Code contradict the most recent analysis by the Berlin Centre of Corporate Governance from spring 2009. The compliance quota in the DAX was then 93.3%. According to indications from the Union Investment analysts, their study is based on the latest version of the Code, amended in summer 2009. Most infringements were observed in connection with the own-risk excess in D & O insurance, recommended duration of executive contracts, the upper limit on severance payments, Supervisory Board members’ pay and moves from boards to Supervisory Board chairs.

Speaking time at AGMs limited

The chair of an annual general meeting (AGM) can limit the speaking time of individual shareholders, ruled the Federal Court of Justice (BGH) on 8 February, overruling an earlier decision by Frankfurt Higher Regional Court. To prevent abuses, in future oral statements can be more easily limited than to date, to up to ten minutes. In the specific case, Karl-Walter Freitag, a well-known rebel shareholder, had sued against a charter amendment at the Hessian firm Biotest AG. On the basis of the 2005 amendment to the Companies Act, the firm had incorporated a limitation on the right of questioning and speaking into its charter by the requisite majority. Freitag brought an action against this, and lost. According to the BGH, oral statements can be limited to up to 15 minutes, and for later speakers even to 10 minutes. The chair may additionally allot a shareholder a time account of 45 minutes for questions and oral contributions and switch off the microphone if he exceeds it. Closing debate at 10:30 pm was also admissible if it meant the AGM could thus be finished the same day, says the judgment.

The best at IR

Börse Online readers have for the seventh time elected the German company with the best Investor Relations work. The Bird 2009 (Beste Investor Relation Deutschland) went to MDAX-listed Hamburger Hafen and Logistik AG (HHLA). The silver and bronze trophies went to construction services provider Bauer (MDAX) and chemicals giant BASF (DAX). The two best firms for IR in the DAX after BASF are Kali und Salz AG and Salzgitter AG. In the MDAX, as well as HHLA and Bauer, Deutsche Euroshop was given a distinction. In the TECDAX Manz Automation, Software AG and SMA Solar Technologies took the first three places. In the SDAX readers voted for MVV Energies, H&R Wasag and CeWe Color as the best at IR. For the readers, the most important factors influencing their assessment of IR work are topicality, credibility, comprehensibility and contact to the IR division.

Upswing not till 2011

Twice a year, news aktuell, CAT Consultants, the Handelsblatt and Faktenkontor query IR (Investor Relations) chiefs in various firms, and 27 professionals from IR agencies, online for their views on developments on financial markets. The latest study, done in November 2009, arrives at the finding that half the IR chiefs expect the crisis to end in 2011; only a quarter see it as ending still this year. Similarly, 50% of respondents stated that the economic crisis hardly affected international IR, while a third of IR divisions stated their firms were having to fight falling incoming orders. Earliest by 2010, however, a third of IR divisions expect turnover increases. Refinancing problems were likely to be the exception, estimated the IR specialists. One in four of the IR divisions expects their budget to be cut by up to 10%. IR chiefs see the biggest savings potential amongst service providers and agencies.

Bank advertising must be more honest

In mid-February, Karl-Burkhard Caspari, director of the Federal Institution for Financial Services Oversight (BaFin), stated that banks and financial-services providers are obliged to be honest and unambiguous in advertising their products. As well as opportunities, advertising must also mention the possible risks. A directive to this effect has existed since 2007. However, there is evidently an uncertainty of interpretation, since various institutions were found not to have been correct in their information to customers.

Capital News

HOCHTIEF Pension Trust e.V. has informed the HOCHTIEF board that it intends to sell up to 2,100,950 HOCHTIEF shares on the exchange. The figure corresponds to around 3% of all HOCHTIEF shares, stated the MDAX group on 22 February. If they are all sold, the HOCHTIEF Pension Trust will no longer hold any HOCHTIEF shares. The board has decided to agree to the sale. It could up the Freefloat and the MDAX rating.

On 4 February Pfleiderer placed a total of 5,332,600 new shares from its capital increase by €13,651,456.00 to €150,166,272.00 at a price of €6.50 per share, in an accelerated book-building procedure. Gross proceeds from the issue were €34.7 million. The economically struggling wood-products firm hopes to improve its financial position by this small capital increase. The issue was ex rights. Placement was only with qualified institutional investors at home and abroad. Major shareholder One Equity Partners did not, however, join in, and at 23.3% no longer has a blocking minority. The Pfleiderer family’s share has fallen to 10%. Media manager Hubertus Hoffmann now also holds less than 3%.

Roth & Rau is taking over the solar subsidiary of the Dutch OTB group. The solar plant maker further stated the purchase price was €35.5 million plus the taking on of €25 million in financial commitments, €30 million covered by the issue of 1,379,999 new Roth & Rau shares as a capital increase against cash contributions. A little earlier, the Saxon firm had explicitly stated the purchase price was to be understood as including the financial commitments. OTB will in future hold a bare 10% in the company from Hohenstein-Ernstthal near Chemnitz. The remaining €5.5 million were paid in cash.

SAP announced in early February that in connection with the software group’s share option plan, participants exercising rights had on 1 February taken a total of up to 6.6 million shares in the Walldorf DAX company, which should be sold directly on the market as long as the SAP share price was at or above the option price of €33.66. SAP will in the main service its employees’ option rights out of its own shares. A share buyback would fill up its own shareholding to 38.5 million units again.

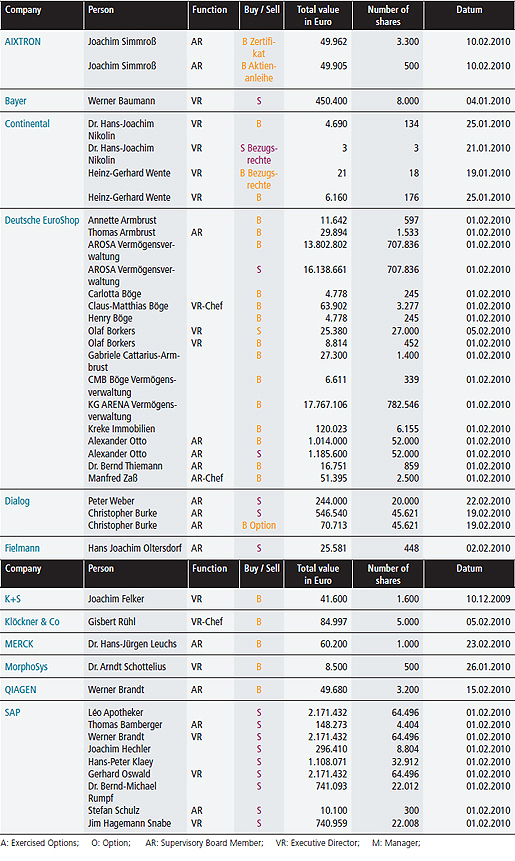

Director's Dealings

in February

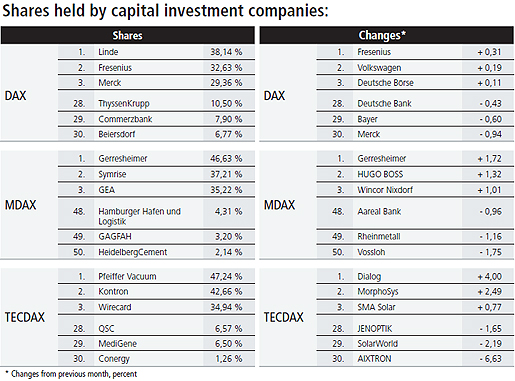

VIPsight Shareholder ID

February 2010

VIPsight Shareholder ID <click here>

Event Diary

16 March 2010 Aktienbasierte Vergütungen und Kapitalbeteiligungen – aktuelle Entwicklungen

organizer: Deutsches Aktien-Institut; place: DVFA Center im Signaris, Frankfurt am Main, Mainzer Landstraße 37-39; cost: €900 (non-members); info: 069 929 15-0

17 March 2010 Stefan Schulte, Frankfurt Airport – von internationalen Luftverkehrskreuz zum zentralen Hub in der Globalisierung

organizer: Frankfurt School; place: Frankfurt School, Frankfurt am Main, Sonnemannstraße; cost: free; info: www.frankfurt-school.de

17 March 2010 Josef Ackermann, Mehr Stabilität für die globalen Finanzmärkte – die Sicht der Banken

organizer: Center for Financial Studies an der Universität Frankfurt; place: Frankfurter Innenstadt; cost: free; info: 069 798-30050

23 March 2010 Dietmar Vogelsang, Fallen und Haftungsrisiken in der Kundenberatung [Traps and liability risks in advising customers]

System-related erroneous and therefore wrongful advice to bank customers is extremely widespread. It is only a question of time until inventive lawyers start bringing liability actions against advisers in banks to unheard-of extents. This compact seminar shows how to prevent them and avoid risks.

organizer: Center for Financial Studies an der Universität Frankfurt; place: CFS, House of Finance Trainings, HPF H5, Frankfurt am Main, Grüneburgplatz 1; cost: €490; info: 069 798-33504

24 March 2010 Kristof Magnusson, Das war ich nicht [It wasn’t me!]

The author reads from his “Novel of the crisis”.

organizer: Frankfurt School; place: Frankfurt School, Frankfurt am Main, Sonnemannstraße; cost: free; info: www.frankfurt-school.de

25 March 2010 Christian Wulff, Kapitalkosten ermitteln [Determining capital costs]

This compact seminar shows how to determine capital costs in a company evaluation.

organizer: Center for Financial Studies an der Universität Frankfurt; place: House of Finance Trainings, HPF H5, Frankfurt am Main, Grüneburgplatz 1; cost: €490; info: 069 798-33504

19 April 2010 Kompaktprogramm ISSP – Investment Spezialist für Strukturierte Produkte [ISSP – Investment Specialist for Structured Products – compact programme]

The ISSP compact programme gives you, in five days, the know-how needed to analyse and understand structured products that constitutes the basis for comprehensive advice. Successful completion gives you the title ISSP – Investment Specialist for Structured Products (DVFA/DBAG).

organizer: DVFA; place: Deutsche Börse Capital Markets Academy, Frankfurt am Main, Neue Börsenstraße 1; cost: €3,900 Euro (early bookings by 8 March €3,690); info: www.dvfa.de/issp

Reading suggestions

Green, Stephen, Wahre Werte

FinanzBuch Verlag, 256 pp, €24.90, ISBN 978-3-89879-561-6

Stephen Green, CEO of HSBC, describes how globalization happened and why capitalism – though not without its imperfections – is still the best system for increasing every individual’s material welfare. The book revealingly conveys the worldview of a succesful top manager.

Reifner, Udo, Die Geldgesellschaft – Aus der Finanzkrise lernen

VS Verlag, 454 pp, €29.95, ISBN 978-3-531-17077-0

What is the financial system? What does it do? What are hedge funds and how does short selling work? What have American consumers to do with our taxes? An analysis of the financial crisis is the occasion for a systematic, readily comprehensible presentation of the modern money society, in which money has risen from a means of worldwide cooperation to the guideline for political action. Reifner is Director of the Institut für Finanzdienstleistungen e.V. in Hamburg and Spokesman of GlobalFairFinance.

Weber, Theo, Hohaus, Benedikt, Buy-Outs

Schäffer-Poeschel Verlag, 273 pp, €99.95, ISBN 978-3-7910-2594-0

In the German market for company transactions, special importance attaches to buy-outs financed by private-equity investors, i.e. purchase of a company or parts of it using outside capital. This practical work presents a comprehensive buy-out cycle, covering the functioning, structuring and concomitantly the evaluation of a buy-out from a process-oriented perspective. As well as due diligence during the transaction, legal and operational implementation involving management and the various forms of exit are discussed.