VIPsight - January 2012

COMPANIES

Exchange merger in the balance

The merger of Deutsche Börse with the New York Stock Exchange (NYSE) is possibly threatened with failure. The EU’s competition authorities signaled their concern that a dominant provider of derivatives might arise from the proposed merger in Europe with Eurex and Liffe. Although the merger partners had already agreed in November to sell more parts of the equity-derivatives business if necessary, this offer in turn met with criticism by the Hessian Economics Ministry. According to uncommented reports, Liffe’s European business in derivatives on individual stocks is to be sold off. Hessian Economics Minister Dieter Posch must give his approval for the merger, and has let it be known that he would veto the proposal if jobs at the headquarters of Deutsche Börse in Eschborn could be lost through the sale of the derivatives business. Originally, the merger of the two exchanges was to be in place by the year’s end. After the offer by the two merger partners, the EU Commission now has time until 9 February to take a decision. Then Hesse will decide on a possible veto. But the clock is ticking: on 31 March the joint merger agreement lapses, and would have to be renegotiated from scratch if it did not come about. Reto Francioni, CEO of Deutsche Börse, has already stated that he does not want to fight the merger through at any price.

The merger of Deutsche Börse with the New York Stock Exchange (NYSE) is possibly threatened with failure. The EU’s competition authorities signaled their concern that a dominant provider of derivatives might arise from the proposed merger in Europe with Eurex and Liffe. Although the merger partners had already agreed in November to sell more parts of the equity-derivatives business if necessary, this offer in turn met with criticism by the Hessian Economics Ministry. According to uncommented reports, Liffe’s European business in derivatives on individual stocks is to be sold off. Hessian Economics Minister Dieter Posch must give his approval for the merger, and has let it be known that he would veto the proposal if jobs at the headquarters of Deutsche Börse in Eschborn could be lost through the sale of the derivatives business. Originally, the merger of the two exchanges was to be in place by the year’s end. After the offer by the two merger partners, the EU Commission now has time until 9 February to take a decision. Then Hesse will decide on a possible veto. But the clock is ticking: on 31 March the joint merger agreement lapses, and would have to be renegotiated from scratch if it did not come about. Reto Francioni, CEO of Deutsche Börse, has already stated that he does not want to fight the merger through at any price.

Deutsche Post has too much money

![]() At the end of September, Deutsche Post had €2.8 billion in cash reserves. Operating cash flow amounted to €1.1 billion. Following extensive restructuring, CEO Frank Appel also raised the profit forecast in November to €2.4 billion. Actually, good news, but the bubbling finances are bringing the Bonn-based company into trouble, because a rise in the rating from the current BBB+ to a higher level would create problems. While the former State company could refinance cheaper, it would then have to keep up a degree of liquidity to secure the rating. Chief Financial Officer Larry Rosen is therefore supposedly considering distributing parts of the cash in the form of a special dividend to shareholders.

At the end of September, Deutsche Post had €2.8 billion in cash reserves. Operating cash flow amounted to €1.1 billion. Following extensive restructuring, CEO Frank Appel also raised the profit forecast in November to €2.4 billion. Actually, good news, but the bubbling finances are bringing the Bonn-based company into trouble, because a rise in the rating from the current BBB+ to a higher level would create problems. While the former State company could refinance cheaper, it would then have to keep up a degree of liquidity to secure the rating. Chief Financial Officer Larry Rosen is therefore supposedly considering distributing parts of the cash in the form of a special dividend to shareholders.

MAN tidies up

After years of dispute with the Arab state fund IPIC over its 70-percent stake in the plant builder Ferrostaal, the parent company MAN agreed in late November to take back the Ferrostaal shares from IPIC and pay the investors from Abu Dhabi 350 million euros for this.The Arabs had bought the 70 percent of MAN’s subsidiary in 2008, but had, contrary to the agreement, refused after the announcement of the MAN corruption scandal to take the remaining 30 percent as agreed. MAN is passing on the Ferrostaal holding almost free of charge to the Hamburg-based trading house MPC, which is a much smaller company building major petrochemical plants. In addition to the MPC owner Axel Schroeder and his sons, an investor from Abu Dhabi is taking up to 50 percent of Ferrostaal’s shares, reports Financial Times Deutschland. The sale proceeds are estimated to total €160 million, €110 million of it fixed. However, MAN will place an equal amount of €110 million into Ferrostaal’s funds. The liberation will cost the MAN result some 450 million euros. MPC also expects a loss of €60 million for the current year at Ferrostaal. MAN is currently tidying up energetically. In November, the Munich group had already got rid of the insolvent printing-equipment company Manroland. The background to this is also the merger of the truck maker with Volkswagen subsidiary Scania and the related incorporation in the VW group structure.

After years of dispute with the Arab state fund IPIC over its 70-percent stake in the plant builder Ferrostaal, the parent company MAN agreed in late November to take back the Ferrostaal shares from IPIC and pay the investors from Abu Dhabi 350 million euros for this.The Arabs had bought the 70 percent of MAN’s subsidiary in 2008, but had, contrary to the agreement, refused after the announcement of the MAN corruption scandal to take the remaining 30 percent as agreed. MAN is passing on the Ferrostaal holding almost free of charge to the Hamburg-based trading house MPC, which is a much smaller company building major petrochemical plants. In addition to the MPC owner Axel Schroeder and his sons, an investor from Abu Dhabi is taking up to 50 percent of Ferrostaal’s shares, reports Financial Times Deutschland. The sale proceeds are estimated to total €160 million, €110 million of it fixed. However, MAN will place an equal amount of €110 million into Ferrostaal’s funds. The liberation will cost the MAN result some 450 million euros. MPC also expects a loss of €60 million for the current year at Ferrostaal. MAN is currently tidying up energetically. In November, the Munich group had already got rid of the insolvent printing-equipment company Manroland. The background to this is also the merger of the truck maker with Volkswagen subsidiary Scania and the related incorporation in the VW group structure.

Bidding race for Kaufhof

After the Metro Supervisory Board at its last meeting on 16th December accepted none of the three bidders, the race for the department-store chain Kaufhof is still open. The Metro subsidiary’s 100 department stores and 16 sports shops, with a turnover of 3.6 billion euros and an operating profit of €138 million in 2010, are estimated at a value of two to three billion euros, mainly because of the valuable downtown property. Besides Karstadt owner Nicolas Berggruen and the private-equity group Blackstone, which had rectified their joint offer even in the runup to the Supervisory Board meeting, is an offer from Austrian investor René Benko and one from a consortium headed by ex KarstadtQuelle chairman Wolfgang Urban. Benko and his real-estate company Signa were recently accused of money laundering. An assessment by the Austrian Federal Office of Criminal Investigation before Christmas refuted the suspicions as untenable, however. Benko is pushing for a timely agreement on his binding offer for Kaufhof, rumoured to be 2.05 billion euros. In Benko’s Signa Consortium sits former Porsche CEO Wendelin Wiedeking, who after a possible takeover wants to work in the Kaufhof Advisory Board. The outgoing Metro CEO Eckhard Cordes told the Frankfurter Allgemeine Zeitung the sale of the Kaufhof chain will likely drag on for some time.

MTU wants Volvo Aero

The Munich engine company MTU Aero Engines is planning an indicative bid for Sweden’s Volvo Aero, which is involved in the construction of a new fuel-efficient engine for the Airbus A320 Neo, reported Financial Times Deutschland in early December. The value of this first non-binding bid is estimated at €800 million. MTU thus aims for the third time to take over Volvo’s engine activities. In 2007, Munich’s billion-euro bid failed in the Volvo Supervisory Board, and in 2009 a second takeover attempt also failed. In November, the Swedes had announced they would hive off the aircraft-engine division and concentrate on truck operations. With sales of €837 million, the engine division was at three percent of total Volvo sales. MTU is, however, targeting a doubling of its own revenues to six billion euros by 2020. CEO Egon Behle announced that there would be no takeover at all costs.

SAP takes over SuccessFactors

In early December, software giant SAP announced it wanted to take over the international market leader in cloud-based human-capital solutions, SuccessFactors. In mid December SAP submitted to the U.S. company’s shareholders a €3.4 billion offer, which runs for 20 business days, and in its train the Germans want to take a 50.1 percent majority of SuccessFactor. The CEO of the cloud provider, Lars Dalgaard, should after approval by the SAP Supervisory Board in early 2012 move up to the Walldorf board and continue to run his company as an independent subsidiary. By optimizing processes, SAP wants together with the Americans to become market leader in the market for cloud applications. The acquisition must still be approved by the antitrust authorities. A California shareholder dissatisfied with the price has filed suit against the takeover.

In early December, software giant SAP announced it wanted to take over the international market leader in cloud-based human-capital solutions, SuccessFactors. In mid December SAP submitted to the U.S. company’s shareholders a €3.4 billion offer, which runs for 20 business days, and in its train the Germans want to take a 50.1 percent majority of SuccessFactor. The CEO of the cloud provider, Lars Dalgaard, should after approval by the SAP Supervisory Board in early 2012 move up to the Walldorf board and continue to run his company as an independent subsidiary. By optimizing processes, SAP wants together with the Americans to become market leader in the market for cloud applications. The acquisition must still be approved by the antitrust authorities. A California shareholder dissatisfied with the price has filed suit against the takeover.

German Telekom remains active in the U.S.

The agreed takeover of the U.S. subsidiary of Deutsche Telekom, T-Mobile USA, by AT&T has failed. Both the U.S. Department of Justice and the telecommunications regulator FCC had registered objections that through the $39 billion takeover AT&T will extend its leading position on the U.S. market and become unreachable for the competition. In order to break the blockade by the U.S. competition authorities, AT&T was willing to sell radio frequencies or assign customers to smaller rivals. But then on 24 November AT&T withdrew the transfer application to the FCC, to await the outcome of a parallel lawsuit on the sale first. But after this withdrawal, the judge threatened, the court proceedings would become irrelevant. A cancellation or postponement of the court decision, scheduled for February, would have thrown the merger timetable into turmoil. It stipulated that the sale had to be completed by 20 September 2012. Against the background of these unbridgeable hurdles, both parties then proclaimed the final end of the deal on 19 December, after the close of trading in the U.S. The failed sale is a blow for René Obermann, the CEO of Deutsche Telekom. Although under the contract he still receives compensation of three billion U.S. dollars in cash in 2011, plus multi-year agreements for roaming services and a package of wireless frequencies to the value of a further three billion U.S. dollars, Obermann must now take problem child T-Mobile USA back onto the balance sheet and give up the planned debt reduction.

ThyssenKrupp sells civilian shipbuilding

The Essen-based steel group ThyssenKrupp has sold the civil division of its Hamburg shipyard Blohm + Voss to British private-equity firm Star Capital. The purchase contract for the deal, estimated at a three-digit million euro sum, was signed by both sides in mid-December. Civilian shipbuilding in the Blohm + Voss Shipyards, Blohm + Voss Repair and Blohm + Voss Industries companies along with their subsidiaries, with the construction of luxury yachts, is currently loss-making for the Essen-based company and thus falls victim to a group restructuring proclaimed in May. After the sale ThyssenKrupp is focusing on naval shipbuilding. The submarine builder HDW, Blohm + Voss Naval with its naval ships and a Swedish shipyard with expertise in military ships are to remain in the group. The deal is subject to approval by the Supervisory Board and the competition and foreign-trade authorities. Closing is targeted for the first quarter of 2012.

The Essen-based steel group ThyssenKrupp has sold the civil division of its Hamburg shipyard Blohm + Voss to British private-equity firm Star Capital. The purchase contract for the deal, estimated at a three-digit million euro sum, was signed by both sides in mid-December. Civilian shipbuilding in the Blohm + Voss Shipyards, Blohm + Voss Repair and Blohm + Voss Industries companies along with their subsidiaries, with the construction of luxury yachts, is currently loss-making for the Essen-based company and thus falls victim to a group restructuring proclaimed in May. After the sale ThyssenKrupp is focusing on naval shipbuilding. The submarine builder HDW, Blohm + Voss Naval with its naval ships and a Swedish shipyard with expertise in military ships are to remain in the group. The deal is subject to approval by the Supervisory Board and the competition and foreign-trade authorities. Closing is targeted for the first quarter of 2012.

TUI wants to get rid of Hapag-Lloyd

TUI CEO Michael Frenzel wants to withdraw permanently from the shipping business, and made use of his enshrined exit right at Hapag-Lloyd in mid-December by offering the Albert Ballin consortium 33.3 percent of the shares. After the tourism group already reduced its capital commitment at Hapag-Lloyd in 2011 by a billion euros, exercising the right to purchase is the next logical step, says Frenzel. Both parties now have 30 days to agree on the value of the holding. If this fails, the market value will be determined by an auditor. The share package is estimated to be worth one billion euros. By the end of September 2012, a purchase agreement then has to be negotiated. Should this fail, TUI can sell the shipping company to investors. The Frankfurter Allgemeine Zeitung had reported that Kühne and the city of Hamburg could buy at least another 20 percent of the shipping company, to prevent TUI using its selling option. Already in spring Kühne bought a further 11.3 percent of the Hapag shares for 315 million euros. Whether he can, together with the heavily indebted city of Hamburg, offer TUI the target price for the package of shares is questionable. Should the consortium finally decline the 33.3-percent package, it must in turn sell TUI 12 percent of its own shares. Frenzel would then have the majority he could eventually sell to a third party. The consortium’s right to a say, which to date provides for a 75 percent majority of owners for significant decisions, would end.

TUI CEO Michael Frenzel wants to withdraw permanently from the shipping business, and made use of his enshrined exit right at Hapag-Lloyd in mid-December by offering the Albert Ballin consortium 33.3 percent of the shares. After the tourism group already reduced its capital commitment at Hapag-Lloyd in 2011 by a billion euros, exercising the right to purchase is the next logical step, says Frenzel. Both parties now have 30 days to agree on the value of the holding. If this fails, the market value will be determined by an auditor. The share package is estimated to be worth one billion euros. By the end of September 2012, a purchase agreement then has to be negotiated. Should this fail, TUI can sell the shipping company to investors. The Frankfurter Allgemeine Zeitung had reported that Kühne and the city of Hamburg could buy at least another 20 percent of the shipping company, to prevent TUI using its selling option. Already in spring Kühne bought a further 11.3 percent of the Hapag shares for 315 million euros. Whether he can, together with the heavily indebted city of Hamburg, offer TUI the target price for the package of shares is questionable. Should the consortium finally decline the 33.3-percent package, it must in turn sell TUI 12 percent of its own shares. Frenzel would then have the majority he could eventually sell to a third party. The consortium’s right to a say, which to date provides for a 75 percent majority of owners for significant decisions, would end.

Vossloh family remains steadfast

Between the family of the founder Eduard Vossloh and the owner of the Munich rail and truck brake manufacturer Knorr-Bremse, Heinz Hermann Thiele, a race for the majority of the Vossloh rail technology group is emerging. Thiele has applied to the antitrust authorities for approval for the purchase of 25 to 30 percent of the Vossloh papers. At the same time the 100-member Vossloh family, who have brought their votes together in a pool, indicates that some family members are currently increasing their voting shares. Before Christmas the race for votes was running 36 to 15 percent for the family. The Vossloh clan constantly stresses that they always take decisions unanimously and do not want to be booted out by Thiele. A meeting between Thiele and the family spokesman in summer was inconclusive.

Buhlmann's Corner

Nostalgia for patriarchs

“Here you are at Krupp, with the strong forename Thyssen!” calls out the almost 100-year-old über-father Berthold Beitz, when he receives you at the Villa Huegel. The company shows how to invest really convincingly and grow clear management structures. A few years after one of the ablest mergers in German industrial history and a couple of unsuccessful internationalization attempts, the Group has launched a manageable investment in distant Brazil, a steel plant in Rio de Janeiro.

“Here you are at Krupp, with the strong forename Thyssen!” calls out the almost 100-year-old über-father Berthold Beitz, when he receives you at the Villa Huegel. The company shows how to invest really convincingly and grow clear management structures. A few years after one of the ablest mergers in German industrial history and a couple of unsuccessful internationalization attempts, the Group has launched a manageable investment in distant Brazil, a steel plant in Rio de Janeiro.

How carefully the Group’s management has prepared for and adapted to Brazilian culture shows in exemplary fashion these days. There can be few patriarchal family corporations in Brazil that maintain a clearer one-person-oriented management culture than ThyssenKrupp. On the one hand a co-founder of German corporate governance, on the other it holds firmly to the rule “one person, one order”.

Sure, it may be disputed whether ThyssenKrupp gets to grips with investment stress and economic stress better using Brazilian or European management culture – but the point is that with Berthold Beitz things go more sportingly, and this is good for the foundation. Sure, there is the stock-market listing – but that was just the collateral damage in the merger.

Like every great turning point – yes, it will obviously now go uphill at ThyssenKrupp – this one too needs someone to blame. Here it was the old CEO Ekkehard Schulz, spontaneously acclaimed onto the Supervisory Board only last year. As with Volkswagen and Porsche, the patriarch is first promoted up and only later made a scapegoat. As a member of a Supervisory Board that for six years claimed ignorance, failing to ask the right questions or do anything more than look on, he has done the right thing by “paying himself” only a low fee.

It’s different at Deutsche Bank. Here the proud, honoured Supervisory Board focuses on one of its main duties, namely settling personnel matters, and fails at the third public attempt at a solution to the succession to Josef Ackermann. In a model company with national and international standing, the many-headed body played with all conceivable variations on a leaderless succession – a fine example of how not to do it. One can only thank the management team that the company is still out in front – although the supervision for years demonstrated less than consistent excellence. The global operations team is now so good that the managers agreed to lead them in a duumvirate. The shareholders will decide that – or at least a third of them will, since no more come to the AGM.

"First of wait and see"

Interview with Portfolio Adviser Stefan Heieck*

Mr. Heieck, the Varus Fund launched by Heieck Siebrecht Capital Advisors AG (HSCA) began in September 2009 and already has $100 million in assets under management. The investment capital comes primarily from family offices, private investors and funds of funds. A few weeks ago New Alpha Management of Paris got involved in HSCA. How did 2011 go for you?

Heieck: Our target return was 15 percent. In 2011, we earned, calculated in euros, a return of 21.0 percent. And volatility was 7.5 percent with a market correlation of 0.2.

Did you reach this in day trading or with a big scoop?

Heieck: No, we exclude intraday trading. 80 percent of the revenue comes from stocks that have a market capitalization of one to five billion euros. We always invest just below the reporting requirement of three percent and put a maximum of 15 percent of our assets under management into a single investment.

How do you go about it exactly?

Heieck: We select, in the first place, fundamentally interesting values, and invest only in assets that we understand very well and have long been tracking. Investments in biotechnology, pure pharmaceutical, pipeline companies and natural resources equity, for example, we rule out from the outset.

What does this mean specifically?

Heieck: For thirteen years we have been watching shares in Germany and in core Europe, i.e. Benelux, France, Britain, Northern Italy, Austria, Switzerland and Scandinavia. We have identified a focus portfolio of 100 stocks that we constantly keep under observation and know very well. We analyse the markets in these very intensively, but also in comparison companies, both in Europe and in Asia and the U.S., and then select the stocks to which we commit ourselves for a maximum of 12 months. We do not invest in Asia or the USA, and use these companies only for our peer group analysis.

So then you’re on the safe side?

Heieck: Next, we look for events - called catalysts - that might affect that development in the short term - road shows, say, or the announcement of quarterly results. We then include this in our buying and selling decisions. But we have also installed an additional backup.

And what’s that?

Heieck: When we are engaged in a long or short position, we consider what hedging positions reduce the risks. To give an example: If we go long on HeidelbergCement, we hedge by getting involved with Holcim, Italcementi, Lafarge or Wienerberger.

With the same amount?

Heieck: Not always. We have put quite a lot of work into the core exposure and thus have a very good opinion about the company. Thus in this case, HeidelbergCement will have a 60:40 or 70:30 weighting. That means we have a belief in the business, but associate it with a macro approach. If we are no longer in a positive mood at the macro level, we reduce our commitment. Basically, we span across the company a “rainbow”, a risk overlay. We then reinforce this by investing in futures, for example, or one of the 19 Euro Stoxx subindices. So then I am long the company and short the sector.

By now you have $100 million in assets under management. Do you invest it it all?

Heieck: Not at the moment. Currently we are screening where an investment is particularly rewarding. But we will wait for several months with our commitments.

Why?

Heieck: In our assessment, there will be massive negative profit revisions in the coming weeks, especially in the automotive sector. We want to wait and see.

*Stefan Heieck is a founding partner of Heieck Siebrecht Capital Advisors AG, Zurich, and Portfolio Adviser of the Varus Fund

ACTIONS CORNER

Rolf-Ernst Breuer has been spared a lengthy criminal trial. The proceedings at Munich District Court against the former CEO of Deutsche Bank were stayed with no ruling on 19 December on payment of €350,000. Breuer is therefore still considered as without criminal record. Judge Anton Winkler had proposed this compromise, because among other things the prospects of success for the prosecution were small. Breuer had been accused of having lied in a previous civil case brought against him and the bank by the late Leo Kirch. Since February, he is also a defendant in currently dormant proceedings for damages by the media mogul against the bank at the Higher Regional Court. The Chamber is accused of bias.

Rolf-Ernst Breuer has been spared a lengthy criminal trial. The proceedings at Munich District Court against the former CEO of Deutsche Bank were stayed with no ruling on 19 December on payment of €350,000. Breuer is therefore still considered as without criminal record. Judge Anton Winkler had proposed this compromise, because among other things the prospects of success for the prosecution were small. Breuer had been accused of having lied in a previous civil case brought against him and the bank by the late Leo Kirch. Since February, he is also a defendant in currently dormant proceedings for damages by the media mogul against the bank at the Higher Regional Court. The Chamber is accused of bias.

Prosecutors have found the Deutsche Bank partly to blame in the case of a multimillion-dollar tax fraud with CO2 emission rights. Without its participation the VAT reimbursements could never have been procured, lead prosecutor Attorney General Thomas Gonder argued before the Regional Court of Frankfurt. The six defendants unjustifiably collected a total of more than €230 million in VAT from the tax office for certificates they had obtained from abroad and sold to the bank. The court sentenced the six accused to sometimes long prison sentences and is still investigating seven employees of Deutsche Bank. The bank itself is not charged.

The French competition authority on 8 December imposed an antitrust fine of €92.3 million on Henkel. The Autorité de la Concurrence found it proven that the detergent producer had in 1997-2004, together with Procter & Gamble, Colgate Palmolive and Unilever, illegally fixed prices of, among other things, the detergent “Persil”. The Düsseldorf-based company said it accepted neither the fine nor the legal evaluation. Henkel announced its intention to appeal against the penalty.

The French competition authority on 8 December imposed an antitrust fine of €92.3 million on Henkel. The Autorité de la Concurrence found it proven that the detergent producer had in 1997-2004, together with Procter & Gamble, Colgate Palmolive and Unilever, illegally fixed prices of, among other things, the detergent “Persil”. The Düsseldorf-based company said it accepted neither the fine nor the legal evaluation. Henkel announced its intention to appeal against the penalty.

In connection with the Siemens corruption scandal, the SEC, the U.S. Department of Justice and the FBI have filed a complaint against several former employees of the electronics company, including former board member Uriel Sharef. As the authorities announced on 13 December, the managers were allegedly involved in a 100 million dollar bribe deal to secure a major contract worth a billion dollars from the Argentine government for the construction of a new identity card system. The bribes allegedly went in part to senior government officials.

AGM Dates

| Company | Event | Date | Time | Place | Address | Published on |

| DAX | ||||||

| Siemens | ord. AGM | 24.01.2012 | 10:00 | 80809 München | Coubertinplatz, Olympiahalle im Olympiapark | 06.12.2011 |

| The Agenda for the ordinary AGM of Siemens AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Siemens AG earned balance-sheet profits of €2742.61m last business year. Of the profits, €2628.53m is to be paid out as dividend and €114.08m carried forward to a new account. | ||||||

Politics

New stress test shows gaps

At 115 billion euros, the capital gap that opens up at European banks as a result of simulated failures on government bonds is a veritable hole. Overall, the European Banking Authority EBA scoured the balance sheets of 71 banks at the target date of 30 September 2011, in a newly launched stress test to see the extent to which they must reckon with failures of government securities. Six German banks need capital of 13.1 billion euros. The Commerzbank alone is 5.3 billion euros short of what it needs to reach a hard core capital ratio of nine percent by the end of June 2012. The gap at the Deutsche Bank amounts to €3.2 billion and at DZ Bank to €353 million euros.

At 115 billion euros, the capital gap that opens up at European banks as a result of simulated failures on government bonds is a veritable hole. Overall, the European Banking Authority EBA scoured the balance sheets of 71 banks at the target date of 30 September 2011, in a newly launched stress test to see the extent to which they must reckon with failures of government securities. Six German banks need capital of 13.1 billion euros. The Commerzbank alone is 5.3 billion euros short of what it needs to reach a hard core capital ratio of nine percent by the end of June 2012. The gap at the Deutsche Bank amounts to €3.2 billion and at DZ Bank to €353 million euros.

Against the backdrop of this huge cash requirement, Federal Finance Minister Wolfgang Schäuble at first aimed for a forced capitalization of the troubled financial houses. After strong criticism from both the banking federation and shareholder associations, however, he moved away from this solution. The federal government decided in return to revive the bank rescue fund SoFFin in early 2012 and use it to offer the necessary funds to the banks. Banks can then obtain by request a total of 80 billion euros of new capital and up to 400 billion euros in guarantees. SoFFin II, unlike its predecessor, is to make it possible to move not only structured products but also government securities, to 90 percent of their value, to a governmental Bad Bank.

The affected German institutions now have time until 20 January to tell the Federal Financial Supervisory Authority (BaFin) how they want to close their capital gap. The Deutsche Bank wants to redeem around two billion euros through the sale of large parts of its asset management. The first non-binding offers of the 50 potential bidders, including private-equity houses, will be available in January or February. Germany’s largest private bank is confident of achieving the nine-percent target. The net credit exposure of Commerzbank to heavily indebted eurozone countries was a total of 14.7 billion euros in summer. Commerzbank CEO Martin Blessing has ruled out his house for support once more by the now-revived bank rescue fund SoFFin. Blessing wants to reduce the balance-sheet risks by up to 30 billion euros and so cut down the need for additional capital by up to €2.7 billion. The second-largest German private bank already bought back bonds in December, which should have a positive impact on earnings and increase equity capital, says Blessing. The idea is also to sell non-core businesses, retain profits and limit new loan business to Germany and Poland. The biggest impact comes through the real-estate financier Eurohypo, which Blessing has to get rid of by 2014 anyway according to conditions imposed by the European Commission. Without the burden of the real-estate subsidiary the Frankfurt bank could probably meet the equity requirements. Hiving off Eurohypo to a bad bank would be the most elegant solution for Commerzbank - where after the banking crisis of 2009 the federal government still holds 25 percent - releasing capital of around five billion euros. The option to generate equity capital through capital increases is hardly likely to find takers at present. Blessing held intensive talks in Berlin in mid-December, but denied they were about a potential state-aid package.

Meanwhile, Europe’s monetary watchdog Mario Draghi and EBA chief Andrea Enria warned the banks against downsizing and reducing their assets more than slightly. Otherwise there could be a credit crunch that could promote a recession.

Women buck things up

Although Family Minister Kristina Schröder (CDU) already laid out her bill for a “flexi-quota” for women on supervisory boards in early October, internal party disagreements on the quota of women on the control bodies of companies have to date prevented publication. The draft is aimed initially at businesses with a State holding of at least 25 percent and plans to commit them to an individual quota by early 2013, and then also publicly traded companies by early 2015. To avoid a split in the CDU/CSU parliamentary group or even the conservative-liberal coalition, CDU leader Volker Kauder has not yet placed the issue on the agenda. in mid-December, however, the impatience of some women broke through: a group of women from the CDU/CSU faction allied itself with fellow activists from the FDP, SPD, Greens and the Left. In their joint appeal, the so-called Berlin Declaration, they call for a legal quota of at least 30 percent of women on supervisory boards, at latest by 2018. The call is a challenge to Schröder, who wants to allow companies a free hand in the decision of their individual rate, and only asks for an explanation if the flexible rate is not to be achieved. Among the supporters of the Berlin Declaration is also Labour Minister Ursula von der Leyen (CDU). Schröder’s draft will now be discussed at the next meeting of the coalition leaders in the new year.

Although Family Minister Kristina Schröder (CDU) already laid out her bill for a “flexi-quota” for women on supervisory boards in early October, internal party disagreements on the quota of women on the control bodies of companies have to date prevented publication. The draft is aimed initially at businesses with a State holding of at least 25 percent and plans to commit them to an individual quota by early 2013, and then also publicly traded companies by early 2015. To avoid a split in the CDU/CSU parliamentary group or even the conservative-liberal coalition, CDU leader Volker Kauder has not yet placed the issue on the agenda. in mid-December, however, the impatience of some women broke through: a group of women from the CDU/CSU faction allied itself with fellow activists from the FDP, SPD, Greens and the Left. In their joint appeal, the so-called Berlin Declaration, they call for a legal quota of at least 30 percent of women on supervisory boards, at latest by 2018. The call is a challenge to Schröder, who wants to allow companies a free hand in the decision of their individual rate, and only asks for an explanation if the flexible rate is not to be achieved. Among the supporters of the Berlin Declaration is also Labour Minister Ursula von der Leyen (CDU). Schröder’s draft will now be discussed at the next meeting of the coalition leaders in the new year.

Small auditing firms against large ones

After EU Internal Market Commissioner Michel Barnier published a first draft of the reorganization of the audit rules in Europe at the end of September, both proponents and opponents spoke out. Barnier wants to break the existing oligopoly of the ‘big four’, KPMG, Deloitte, Ernst & Young and PricewaterhouseCoopers (PwC). The midsized accountants, in a letter to the Commissioner in Brussels, backed his plans and even warned against a looming softening of his proposals. They insist that so-called joint audits be bindingly introduced and not be softened. With such ‘tandem auditing’, one of the big four is flanked by a small auditing firm in the audit. Against such joint audits, however, Denmark and Sweden have expressed concerns. Barnier’s proposals further provide for a change of auditing firm every six years, as well as the separation of auditing and consulting. The big four dominate about 85 percent of the market in Europe.

Banks threatened with BaFin Special Representative

The EBA is asking six German banks for additional capital totalling 13.1 billion euros. In order to enforce the European Banking Authority’s more stringent capital requirements, the Federal Financial Supervisory Authority (BaFin) is if necessary to be given the opportunity, at any risk to financial stability, to set standards for capital adequacy of banks through a special representative at board level, says the draft legislation to revive the bank rescue fund SoFFin approved by the Cabinet on 14 December. The Special Representative can not only outvote the Board, but also demand plans to increase equity, and amendments to them. This is considered in government circles as a strong incentive for the banks themselves to seek the way to the bank rescue fund if they are in doubt.

People

At Allianz, four of the future eleven divisions are to see new appointments. Helga Jung and Gary Bhojwani join the board on 1 January 2012. With Jung, the insurance group takes the first woman onto the board in its 121-year history. Bhojwani, currently CEO of Allianz Life USA, will take over the U.S. insurance division. In addition, Dieter Wemmer takes charge of insurance activities in Western Europe from January. Maximilian Zimmerer takes office only as from 1 June 2012. currently head of Allianz Life Insurance, he will succeed CFO Paul Achleitner.

At Allianz, four of the future eleven divisions are to see new appointments. Helga Jung and Gary Bhojwani join the board on 1 January 2012. With Jung, the insurance group takes the first woman onto the board in its 121-year history. Bhojwani, currently CEO of Allianz Life USA, will take over the U.S. insurance division. In addition, Dieter Wemmer takes charge of insurance activities in Western Europe from January. Maximilian Zimmerer takes office only as from 1 June 2012. currently head of Allianz Life Insurance, he will succeed CFO Paul Achleitner.

Wayne T. Smith joins the Executive Board of BASF at the AGM on 27 April 2012. The American takes over the Chemicals board spot from Andreas Kreimeyer, who remains spokesman for research and will take over responsibility for crop protection, paints, South America and plant biotechnology from Stefan Marcinowski, who is retiring after the shareholder meeting.

Wayne T. Smith joins the Executive Board of BASF at the AGM on 27 April 2012. The American takes over the Chemicals board spot from Andreas Kreimeyer, who remains spokesman for research and will take over responsibility for crop protection, paints, South America and plant biotechnology from Stefan Marcinowski, who is retiring after the shareholder meeting.

After the Beiersdorf AGM next year, Stefan F. Heidenreich is to succeed Thomas B. Quaas, who is moving to the Supervisory Board. Heidenreich is already moving from the Hero Group to the Beiersdorf Board in early 2012. James C. Wei leaves the company at the turn of the year. The Asia director of the cosmetics group has to go after three-digit million write-offs in his department. Until further notice, Thomas B. Quaas will focus primarily on business in China.

After the Beiersdorf AGM next year, Stefan F. Heidenreich is to succeed Thomas B. Quaas, who is moving to the Supervisory Board. Heidenreich is already moving from the Hero Group to the Beiersdorf Board in early 2012. James C. Wei leaves the company at the turn of the year. The Asia director of the cosmetics group has to go after three-digit million write-offs in his department. Until further notice, Thomas B. Quaas will focus primarily on business in China.

Stephan Engels is expected to become Financial Manager of Commerzbank on 1 April 2012. The 49-year-old has since 2007 been Head of Finance & Controlling at Mercedes-Benz and Head of Group Controlling and Reporting at Daimler. On 2 December, the bank presented the Daimler manager as successor to Eric Strutz, who declared in early August he would let his contract expire at the end of March 2012.

Stephan Engels is expected to become Financial Manager of Commerzbank on 1 April 2012. The 49-year-old has since 2007 been Head of Finance & Controlling at Mercedes-Benz and Head of Group Controlling and Reporting at Daimler. On 2 December, the bank presented the Daimler manager as successor to Eric Strutz, who declared in early August he would let his contract expire at the end of March 2012.

Angela Titzrath, the first woman on the board of Deutsche Post, will in future be responsible for Human Resources. The former Daimler manager will replace Personnel Director and Labour Director Walter Scheurle on the management committee in 2012, as soon as the senior manager on the board retires at his own request after twelve years. The exact date of the change is not fixed yet.

Because of “differences in opinion over strategic direction, particularly in the intermodal segment”, Sebastian Jürgens is leaving the board of Hamburger Hafen und Logistik by consensus at the end of the year, according to a release from the €1.5 billion MDAX company. The responsibilities of Logistics Director will be assumed until further notice by Klaus-Dieter Peters.

Lothar Steinebach goes into retirement at the end of June 2012. Henkel has, however, already presented its future CFO, on 13 December. As the largest German consumer-goods producer announced, the 42-year-old Carsten Knobel should officially take up his post on 1 July 2012. Steinebach’s successor is 21 years younger and comes from the house, thus following the group’s tradition of building up top managers themselves.

Lothar Steinebach goes into retirement at the end of June 2012. Henkel has, however, already presented its future CFO, on 13 December. As the largest German consumer-goods producer announced, the 42-year-old Carsten Knobel should officially take up his post on 1 July 2012. Steinebach’s successor is 21 years younger and comes from the house, thus following the group’s tradition of building up top managers themselves.

Rüdiger Andreas Günther is to become the new CFO at JENOPTIK. The financial expert will as from April 2012 replace Frank Einhellinger, whose contract is at his own request not being extended, the laser and measurement technology specialists announced on 15 December after a board meeting. Günther was previously CFO of the now insolvent Arcandor Group. He will have a three-year contract.

Jan Peter Nonnenkamp is surprisingly leaving K + S at the year’s end. The Finance Director and the Board of the Kassel fertilizer group agreed this by consensus. Originally, the manager’s contract ran until 31 May 2012. His duties will be taken until further notice by CEO Norbert Steiner. Nonnenkamp came to K + S only in 2009. Reasons for the premature departure were not disclosed.

With the appointment of Mark Frese as the new CFO of METRO, the Supervisory Board has completed the board again. The 47-year-old has been working for the retail group for 17 years and before his time with Cash & Carry was Head of Controlling for the Düsseldorfers. The post is free because Olaf Koch moved at the turn of the year to the chair of the Supervisory Board.

With the appointment of Mark Frese as the new CFO of METRO, the Supervisory Board has completed the board again. The 47-year-old has been working for the retail group for 17 years and before his time with Cash & Carry was Head of Controlling for the Düsseldorfers. The post is free because Olaf Koch moved at the turn of the year to the chair of the Supervisory Board.

With effect from 1 January 2012 Ain Papperger moves up to the Board of Rheinmetall. The previous area board member in the defence sector will in future head the arms division, until now run by Klaus Eberhardt, simultaneously responsible as CEO for directing the Group as a whole. With the expansion Rheinmetall means inter alia to take account of the company’s growth.

Uwe Hertel is resigning from SMA Solar Technology at the year’s end for health reasons. The Chief Operating Officer will in future as Senior Vice President accompany the strategic development of the business operations of the TECDAX company, it was announced on 6 December. The tasks the 51-year-old manager was responsible for will be taken in future by the other members of the leadership.

At the year’s end Professor Ekkehard Schulz is leaving the Supervisory Board of ThyssenKrupp. The now 70-year-old thus takes responsibility for the disaster that ThyssenKrupp is currently experiencing in the mangrove swamps of Brazil. Billions in write-downs are driving the company into crisis, and have raised the question of responsibility. The honorary chairman of the Supervisory Board, Professor Berthold Beitz, apparently asked Schulz a few days earlier to rethink his role so as to stop the press campaign.

Campus

Shareholders often in the dark

If a company’s own shareholders have not been identified, investor-relations activities are often ineffective. All the more surprising are the findings of the Investor Relations Panel, in which in the third quarter of 2011 the consulting firm cometis asked IR managers about their knowledge of their company’s shareholders: only two thirds of companies surveyed identify their shareholders. As a reason for the omission, 40 percent of respondents said the costs and benefits were in no reasonable relation. Companies in indices more frequently determine who is among their shareholders than smaller companies. Some 81 percent use data providers such as Bloomberg and FactSet in evaluating shareholders. While 69 percent of companies have registered shares, only half of the companies are also in active dialogue with their shareholders partly through external service providers. Eight out of ten respondents claimed to know about half of the shareholders who hold over 0.5 percent of company shares. The most common distinguishing criterion for IR work is the classification into institutional shareholders and private investors. There follow geographical location, investment style and share of votes. Amazingly, approximately one third of companies that have determined their shareholders do not incorporate this knowledge into their IR work.

If a company’s own shareholders have not been identified, investor-relations activities are often ineffective. All the more surprising are the findings of the Investor Relations Panel, in which in the third quarter of 2011 the consulting firm cometis asked IR managers about their knowledge of their company’s shareholders: only two thirds of companies surveyed identify their shareholders. As a reason for the omission, 40 percent of respondents said the costs and benefits were in no reasonable relation. Companies in indices more frequently determine who is among their shareholders than smaller companies. Some 81 percent use data providers such as Bloomberg and FactSet in evaluating shareholders. While 69 percent of companies have registered shares, only half of the companies are also in active dialogue with their shareholders partly through external service providers. Eight out of ten respondents claimed to know about half of the shareholders who hold over 0.5 percent of company shares. The most common distinguishing criterion for IR work is the classification into institutional shareholders and private investors. There follow geographical location, investment style and share of votes. Amazingly, approximately one third of companies that have determined their shareholders do not incorporate this knowledge into their IR work.

SMEs are reluctant about IPOs

In a joint study, the Deutsches Aktieninstitut, Deutsche Börse and the Commerzbank targeted the capital-market orientation and financing of medium-sized companies. The majority of medium-sized German companies reported difficulties in accessing credit as a result of the financial crisis. The external financing of growth through banks is coming up against ever-greater limits for SMEs, while financing aspects are taking on an increasingly larger role in the businesses’ overall strategy. Nine out of ten companies said they want to strengthen their liquidity or their equity capital. They often remain in typical SME financing patterns in which bank credit continues to be the first choice. Although 45 of the 303 companies surveyed, or 15 percent, can in principle imagine having recourse to an IPO, both a general skepticism as well as the currently very volatile market environment curb potential and already envisaged plans. The study identified some 1,250 firms which, measured by sales, growth and return on assets, are market-capable. Their low affinity for the exchange is thus based less on inability than on unwillingness, says the analysis.

Market Regulations for lobbyists called for

The Otto Brenner Foundation, close to IG Metall, has conducted 40 quality expert interviews on the subject of lobbying and cast the results of this survey into concrete proposals to regulate the influence of lobbyists. To date, Germany had neither clarified nor regulated its relationship with the lobbies, criticized Jupp Legrand, managing director of the Otto Brenner Foundation. The “market regulations for lobbyists” worked out by the foundation are thus an appeal to Parliament to regulate the uncontrolled growth of lobbying. Specifically, the regulations would require lobbyists in future to seek formal accreditation, submit to a code of conduct and be listed in a publicly available register. To increase transparency, comments, opinions and expertise would in future be published. The Foundation wants MPs’ secondary activities to be strictly limited, and elected officials are to have a waiting period after leaving politics. In addition, the trade unions want ratification of the UN Convention against corruption. The commissioning of external bills concocted outside parliament should also be restricted, and outsourcing of official work as well as government sponsoring should be banned altogether.

Banks contend with LCR and NSFR

While European banks want to meet the new capital requirements of Basel III speedily, the plans for the new liquidity rules are presenting them with great challenges, according to a study by Boston Consulting Group. By the end of June 2012, banks must reach the new target rate of nine percent core capital ratio and build up a capital buffer against European government bonds. the majority of banks surveyed do not expect to meet the liquidity coverage ratio (LCR) or the Net Stable Funding Ratio (NSFR) early. This shows that refinancing and the liquidity crunch are currently far more explosive topics than capital requirements, according to the study, entitled “Facing New Realities in Global Banking.”

Hardly any lessons from the financial crisis

According to a study among the 30 largest listed banks presented by private bank Sarasin on 13 December, the world’s financial houses have drawn hardly any lessons from the near-collapse of some banks. According to Sarasin, most financial institutions rate from mediocre to bad in the core areas of system relevance, integrating sustainability into core business operations and compliance. There is not yet any sign of a general movement towards more sustainable business models and reduced risks for the general public.

Reports should be made simpler and clearer

Rather than serving their readers, company-report texts often counteracted the true goal of a balance-sheet, namely transparency, said Manfred Piwinger at the 2011 Business Reporting Seminar of the Deutsches Aktieninstitut (DAI). A member of the Main Committee of the German Public Relations Association (DPRG), he explained with examples from annual reports the misleading use of foreign words. There was a lack of employee language skills, and the staff cuts in the media companies had led to significant quality losses. Particularly in the capital market there had developed a technical language that could only understood by experts. Given the increasing need for information that is accessible at all times and the lack of reading time, the reader ought however to be able to rely on a clear presentation in reports.

Rather than serving their readers, company-report texts often counteracted the true goal of a balance-sheet, namely transparency, said Manfred Piwinger at the 2011 Business Reporting Seminar of the Deutsches Aktieninstitut (DAI). A member of the Main Committee of the German Public Relations Association (DPRG), he explained with examples from annual reports the misleading use of foreign words. There was a lack of employee language skills, and the staff cuts in the media companies had led to significant quality losses. Particularly in the capital market there had developed a technical language that could only understood by experts. Given the increasing need for information that is accessible at all times and the lack of reading time, the reader ought however to be able to rely on a clear presentation in reports.

Information about executive pay in 2011

The Federal Gazette (Bundesanzeiger) has this year again published a study on salaries at German listed companies. The analysis asks how the level of remuneration and the share of performance-related components have developed between 2006 and 2010. Is the pay appropriate, and what role do factors such as index, sector, total assets and board size play in the salaries of managers? In what relation does the amount of remuneration stand to the performance-related components? The 111-page study, published in mid November, can be ordered at a price of €325 from the Bundesanzeiger.

Capital News

As RWE announced ad hoc on 5 December, institutional investors were offered a total of 80.4 million shares through an accelerated placement. Of this, 52.3 million were issued as new ordinary shares. Thus, the number of preferred shares increased by ten percent. At the same time the utility sold five percent of its securities currently held in the form of own shares. Purely mathematically, the DAX group took in around 2.1 billion euros from its placement, at a subscription price of €26 per unit. RWE had announced in August it wanted to take in about 2.5 billion euros from the share sale.

As RWE announced ad hoc on 5 December, institutional investors were offered a total of 80.4 million shares through an accelerated placement. Of this, 52.3 million were issued as new ordinary shares. Thus, the number of preferred shares increased by ten percent. At the same time the utility sold five percent of its securities currently held in the form of own shares. Purely mathematically, the DAX group took in around 2.1 billion euros from its placement, at a subscription price of €26 per unit. RWE had announced in August it wanted to take in about 2.5 billion euros from the share sale.

Director's Dealings

| Company | Person | Function | Buy / Sell | Total value in Euro | Number of shares | Datum |

| BASF | Fatoumata Kissa-Diekmann | S | 111.295 | 2.050 | 06.12.2011 | |

| Deutsche Lufthansa | Jürgen Hambrecht | SB | B | 5.627 | 650 | 12.12.2011 |

| Deutsche Lufthansa | Carsten Spohr | B | 29.726 | 3.500 | 23.11.2011 | |

| Deutsche Wohnen | Helmut Ullrich | MB | B | 31.741 | 3.490 | 01.12.2011 |

| Deutsche Wohnen | Silvia Kretschmer | B | 5.997 | 662 | 01.12.2011 | |

| Deutsche Wohnen | Uwe E. Flach | SB-Head | B | 28.210 | 3.100 | 28.11.2011 |

| Deutsche Wohnen | Dr. Florian Stetter | SB | B | 7.298 | 802 | 28.11.2011 |

| Deutsche Wohnen | Jutta Flach | B | 14.105 | 1.550 | 28.11.2011 | |

| Dialog | Jalal Bagherli | MB | Exercising an Option | 18.000 | 150.000 | 30.11.- 01.12.2011 |

| Dialog | Jalal Bagherli | MB | Disposition | 0 | 75.000 | 30.11.2011 |

| Dialog | Jalal Bagherli | MB | S | 2.016.350 | 150.000 | 30.11.- 01.12.2011 |

| Dialog | Julie Duncan | S | 65.268 | 4.900 | 29.11.2011 | |

| Dialog | Udo Kratz | MB | Exercising an Option | 33.560 | 46.672 | 05.12.- 12.12.2011 |

| Dialog | Udo Kratz | MB | S | 631.008 | 46.672 | 05.12.- 12.12.2011 |

| Dialog | Jean-Michel Richard | MB | Exercising an Option | 9.000 | 75.000 | 30.11.- 01.12.2011 |

| Dialog | Jean-Michel Richard | MB | S | 1.006.000 | 75.000 | 30.11.- 01.12.2011 |

| Dialog | Jean-Michel Richard | MB | S | 20.250 | 1.500 | 29.11.2011 |

| Dialog | Russel Shaw | SB | Exercising an Option | 43.294 | 25.210 | 12.12.2011 |

| Dialog | Russel Shaw | SB | S | 321.428 | 25.210 | 12.12.2011 |

| Dialog | Mark Tyndall | MB | Exercising an Option | 19.250 | 75.000 | 30.11.- 01.12.2011 |

| Dialog | Mark Tyndall | MB | S | 1.006.750 | 75.000 | 30.11.- 01.12.2011 |

| Douglas | Lobelia Beteiligungs GmbH | B | 4.537.500 | 150.000 | 05.12.2011 | |

| Douglas | Dr. August Oetker Finanzierungund Beteiligung | B | 119.166 | 4.294 | 23.11.- 25.11.2011 | |

| Drillisch | Horst Lennertz | SB | B | 15.058 | 2.407 | 29.11.2011 |

| Evotec | ROI Verwaltungsgesellschaft | B | 22.330 | 10.000 | 24.11.2011 | |

| GERRY WEBER | N & A Hardieck GmbH & Co. KG | B | 1.984.738 | 92.500 | 12.12.2011 | |

| GERRY WEBER | R + U Weber GmbH & Co. KG | B | 1.794.491 | 80.203 | 21.12.2011 | |

| HeidelbergCement | SC Investment GmbH | B | 32.967.431 | 1.028.625 | 07.12.2011 | |

| HeidelbergCement | VEM Vermögensverwaltung | S | 32.967.431 | 1.028.625 | 07.12.2011 | |

| Henkel | Christoph Henkel | S | 5.723.056 | 130.000 | 19.12.- 20.12.2011 | |

| Henkel | Dr. Lothar Steinebach | MB | B | 292.040 | 8.000 | 01.12.2011 |

| HUGO BOSS | Dr. Hellmut Albrecht | SB-Head | B | 49.934 | 895 | 15.12.2011 |

| K+S | Jan Peter Nonnenkamp | MB | S | 79.000 | 2.000 | 02.12.2011 |

| Linde | Georg Denoke | MB | B | 1.104.060 | 10.000 | 16.12.2011 |

| Linde | Prof.Dr. Wolfgang Reitzle | MB-Head | S | 1.313.706 | 11.750 | 30.11.- 16.12.2011 |

| Münchener Rück | Prof. Dr. Henning Kagermann | SB | B | 200.114 | 2.130 | 27.12.2011 |

| PSI | Karsten Trippel | SB | B | 27.000 | 2.000 | 06.12.2011 |

| PSI | Dr. Harald Schrimpf | MB-Head | B | 13.650 | 1.000 | 06.12.2011 |

| QIAGEN | Roland Sackers | MB | S | 355.444 USD | 23.790 | 01.12.2011 |

| QIAGEN | Roland Sackers | MB | Zugang | 0 | 48.642 | 30.11.2011 |

| RWE | Uwe Tigges | SB | B | 4.995 | 220 | 08.09.- 28.09.2011 |

| RWE | Uwe Tigges | SB | Exercising a rights issue | 1.196 | 46 | 16.12.2011 |

| RWE | Dr.-Ing. Jürgen Großmann | MB-Head | Exercising a rights issue | 321.568 | 12.368 | 19.12.2011 |

| RWE | Alwin Fitting | MB | Exercising a rights issue | 11.284 | 434 | 20.12.2011 |

| RWE | Dr. Rolf Pohlig | MB | Exercising a rights issue | 8.892 | 342 | 19.12.2011 |

| RWE | Dagmar Sikorski-Großmann | Exercising a rights issue | 10.244 | 394 | 19.12.2011 | |

| RWE | Dr. Rolf Martin Schmitz | MB | B | 99.750 | 3.500 | 07.12.2011 |

| SGL CARBON | Theodore H. Breyer | MB | S | 3.369.917 | 73.868 | 30.11.- 15.12.2011 |

| SGL CARBON | Robert J. Köhler | MB-Head | S | 2.731.039 | 121.497 | 05.12.- 15.12.2011 |

| SGL CARBON | Jürgen Otto Walter Muth | MB | S | 38.352 | 825 | 16.12.2011 |

| SGL CARBON | Gerd Wingefeld | MB | S | 135.153 | 3.000 | 12.12.2011 |

| SMA Solar | Pierre-Pascal Urbon | MB | B | 11.364 | 300 | 09.12.2011 |

| SMA Solar | Jürgen Dolle | SB | B | 50.729 | 1.295 | 07.12.2011 |

| Dr. Helmut Becker | MB | Exercising an Option | 202.480 | 4.000 | 06.12.2011 | |

| Dr. Stefan Groß-Selbeck | MB-Head | Exercising an Option | 127.422 | 2.392 | 05.12.2011 |

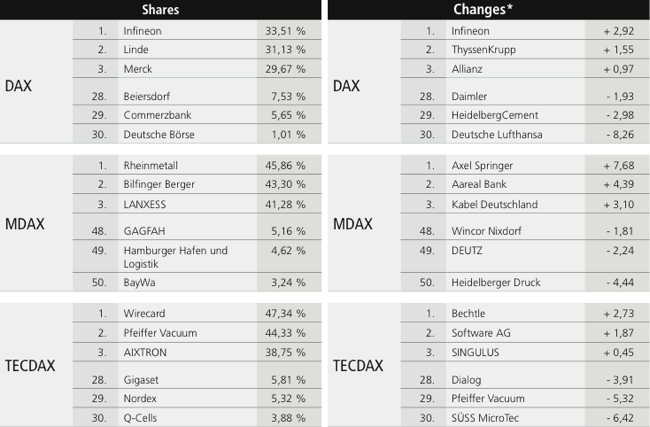

VIPsight Shareholders

in December

Shares held by capital investment companies:

*Changes from previous month, percent

VIPsight Shareholder ID <click here>

Event Diary

24 – 26 January 2012 workshop series on IFRS and Capital Market Communications

Organizers: DIRK and Ernst & Young; venue: Ernst & Young, Mergenthalerallee 3-5, Eschborn; costs: Module 1, Basic Knowledge for IFRS beginners €750; Module 2, Basic Workshop for advanced learners €1500; Module 3, Workshop for IR professionals €1500; info: +49 40 4136 3960

31 January 2012 Revision der Marktmissbrauchsrichtlinie und WpHG-Praxis [review of the Market Abuse Directive and WpHG practice]

Organizer: Deutsches Aktien-Institut; venue: IHK, Börsenplatz 2-4, Frankfurt am Main; cost: €900, info: +49 69 929150

Reading suggestions

Bolder, Markus, and Wergers, Matthias: Modell „Bad Bank”: Hintergrund – Konzept Erfahrungen [The “bad bank” model: Background – Concept – Experience]

Gabler-Verlag, 318 pp, €49.95, ISBN 978-3-8349-3345-4

The “bad bank” model is not new, but since the financial crisis it has grown enormously in importance, not only in Germany, as an instrument of the bank bailout. It’s about running down billion-dollar – some “toxic” – portfolios, and often about taxpayers’ money. Are “bad banks” really “bad banks” or a good solution in a crisis? Why were they created? What kinds of “bad bank” are there? And what is at issue in order to successfully implement the models and turn them on and off? Previously a sound, comprehensive presentation of the topic to the public, or even for the professional audience or in science, was lacking. This anthology thus fills a gap. Professionals who helped build Germany’s first winding-up agency (EAA) bring their findings together in this practical report: from financial-theory, legal and business-oriented perspectives. The authors are board members of the Erste Abwicklungsanstalt, Düsseldorf.

Eberl, Peter, Geiger, Daniel, and Koch, Jochen: Komplexität und Handlungsspielraum – Unternehmenssteuerung zwischen Ordnung und Chaos [Complexity and room for manoeuvre – Corporate management between order and chaos]

Erich Schmidt Verlag, 305 pp, €59.95, ISBN 978-3503-133679-7

If social systems are too complex or too simple, room for manoeuvre gets lost, enabling organizations to suddenly fall into existential crises.The ability of social systems to move precisely between order and chaos thus becomes central to control. In practical terms, the point is to prevent internal structures becoming unmanageable while avoiding the risks of too-simple environmental processing. With this backdrop of modern enterprise management, inspired largely by Georg Schreyögg, well-known experts discuss all this from different perspectives. The book provides a stimulating overview of the current state of development of corporate governance. Peter Eberl is Professor of Business Administration with a focus on personnel management and organization theory at the University of Kassel. Daniel Geiger is Professor of Business Administration with a focus on International Management at the Technical University of Kaiserslautern. Jochen Koch is Professor of Business Administration with a focus on business management and organization at the Viadrina European University in Frankfurt (Oder).

Koch, Wolfgang: Praktiker-Handbuch Due Diligence [Practitioner’s Guide to Due Diligence]

3rd ed., Schäffer-Poeschel Verlag, 233 pp, €69.95, ISBN 978-3-7910-3079-1

The manual provides guidance for planning and implementation of a holistic business analysis for corporate executives and directors, supervisory and advisory board members, investment managers, business consultants, lawyers, accountants and investment bankers. It examines all relevant issues of due diligence and the most important special cases in practice as well as giving a compilation on the analysis of leading indicators for business valuation.

Lindmayer, Karl H.: Geldanlage und Steuer 2012 [Investment and tax 2012]

Gabler-Verlag, 490 pp, €59.95, ISBN 978-3-8349-2938-9

With the euro crisis, the entire investment portfolio should be put to the test. This standard work, published annually, is a helpful guide. Focal points of each chapter are building wealth and securing and systematically expanding savings. On the Internet (www.geldanlageundsteuer.de) there are also practical and useful calculation aids and additional material, such as tax forms, tax treaties and the most important current legal texts.