VIPsight - June 2010

COMPANIES

CG à la Cromme

Gerhard Cromme, former chair of the Government Commission on the German Corporate Governance Code, has chosen former Siemens director Heinrich Hiesinger to succeed ThyssenKrupp CEO Ekkehard Schulz. The 49-year old Hiesinger most recently headed the industrial division at the Munich conglomerate. Hiesinger will join the board of the Essen steel group in early October, succeeding Schulz as ThyssenKrupp CEO on 21 January 2011. Since Cromme, as Supervisory Board Chair of Siemens, has at the same time let the obviously talented executive go, open criticism was rife. A legal opinion secured in advance on cautionary grounds, however, certifies that there is no infringement in this of either company-law provisions or principles of good corporate governance. At any rate, though, the agreement that next year current ThyssenKrupp CEO Schulz will join the Supervisory Board is not in line with the spirit of the code.

Gerhard Cromme, former chair of the Government Commission on the German Corporate Governance Code, has chosen former Siemens director Heinrich Hiesinger to succeed ThyssenKrupp CEO Ekkehard Schulz. The 49-year old Hiesinger most recently headed the industrial division at the Munich conglomerate. Hiesinger will join the board of the Essen steel group in early October, succeeding Schulz as ThyssenKrupp CEO on 21 January 2011. Since Cromme, as Supervisory Board Chair of Siemens, has at the same time let the obviously talented executive go, open criticism was rife. A legal opinion secured in advance on cautionary grounds, however, certifies that there is no infringement in this of either company-law provisions or principles of good corporate governance. At any rate, though, the agreement that next year current ThyssenKrupp CEO Schulz will join the Supervisory Board is not in line with the spirit of the code.

Funds call for billions from Porsche

To date 35 hedge funds have sued Porsche and its former executives Wendelin Wiedeking and Holger Härter in New York for compensation for damages. They are accused of false information and market-price manipulations in connection with the failed takeover of VW. According to the accusations, in October 2008 they deliberately misinformed investors, thus manipulating the price of the VW share. That price then shot upwards to as much as €1,000, after Porsche claimed it held 74% of VW. The funds are claiming damages of at least 2 billion dollars. Other funds are preparing actions. The time-limit for such lawsuits in the US expires at the end of October. The proceedings will, say initial estimates in the Wirtschaftswoche, last at least until mid 2011. As long as possible damage claims have not been definitively cleared up, the Volkswagen board will not agree to a merger with Porsche.

To date 35 hedge funds have sued Porsche and its former executives Wendelin Wiedeking and Holger Härter in New York for compensation for damages. They are accused of false information and market-price manipulations in connection with the failed takeover of VW. According to the accusations, in October 2008 they deliberately misinformed investors, thus manipulating the price of the VW share. That price then shot upwards to as much as €1,000, after Porsche claimed it held 74% of VW. The funds are claiming damages of at least 2 billion dollars. Other funds are preparing actions. The time-limit for such lawsuits in the US expires at the end of October. The proceedings will, say initial estimates in the Wirtschaftswoche, last at least until mid 2011. As long as possible damage claims have not been definitively cleared up, the Volkswagen board will not agree to a merger with Porsche.

VW on an expansion course

Since late April the two lorry makers MAN and Scania have been holding talks about technical cooperation. VW holds 71.9% of Scania and 29.9% of MAN. Analysts expect that a takeover by VW of a majority in MAN is now only a question of time. In the meantime, Japanese carmaker Suzuki is expanding its holdings in VW. In late March the Japanese held 2 million VW ordinary shares, or 0.68% of them, corresponding to a value of around €140 million. After VW bought, in the course of cooperation, just over 20% of the Suzuki shares for some €1.7 billion, the Japanese carmakers want to buy VW shares for a maximum of half this amount. However, VW shares are thin on the ground at the moment, since 90% of VW voting rights are with major shareholders Porsche, Lower Saxony and Qatar. Suzuki CEO Osamu Suzuki had already called on VW in January to give his group access to VW share capital.

Since late April the two lorry makers MAN and Scania have been holding talks about technical cooperation. VW holds 71.9% of Scania and 29.9% of MAN. Analysts expect that a takeover by VW of a majority in MAN is now only a question of time. In the meantime, Japanese carmaker Suzuki is expanding its holdings in VW. In late March the Japanese held 2 million VW ordinary shares, or 0.68% of them, corresponding to a value of around €140 million. After VW bought, in the course of cooperation, just over 20% of the Suzuki shares for some €1.7 billion, the Japanese carmakers want to buy VW shares for a maximum of half this amount. However, VW shares are thin on the ground at the moment, since 90% of VW voting rights are with major shareholders Porsche, Lower Saxony and Qatar. Suzuki CEO Osamu Suzuki had already called on VW in January to give his group access to VW share capital.

Daimler bids New York goodbye

A further German group, Daimler, is leaving Wall Street. This also removes the need for reporting to American stock-exchange regulator SEC. 17 years ago, the Stuttgart carmaker was a pioneer with its US listing. The reasons for it then were, as well as high liquidity in international securities trading, easier access to foreign investors for capital measures, but in the meantime the costs and the benefits have proved not to be in any reasonable proportion. Daimler will in future rely more heavily on electronic trading in Germany.

A further German group, Daimler, is leaving Wall Street. This also removes the need for reporting to American stock-exchange regulator SEC. 17 years ago, the Stuttgart carmaker was a pioneer with its US listing. The reasons for it then were, as well as high liquidity in international securities trading, easier access to foreign investors for capital measures, but in the meantime the costs and the benefits have proved not to be in any reasonable proportion. Daimler will in future rely more heavily on electronic trading in Germany.

Massachusetts v. Deutsche Bank

Oversight authorities in the US State of Massachusetts suspect a number of major institutions, including Deutsche Bank, of having exploited financial products for the financing of municipal debts to their own advantage. Thus, the banks are said on the one hand to have secured a good income from the creation of the products, but on the other they have used CDSs to bet against the bonds, thus making money twice. The US financial watchdogs are calling on the banks to produce within the next two weeks appropriate documents on all municipal loans subscribed and credit defaults once entered into. Public prosecutors are already looking, together with the SEC, at the mortgage businesses of six of the ten banks under suspicion. It is not yet clear whether the investigation in Massachusetts is part of these investigations, which became known on 13 May. Deutsche Bank took no position on the investigations. A spokesman additionally said that no transactions in municipal bonds were handled.

Suspicion against ProSiebenSat.1 and RTL

German anti-trust body Bundeskartellamt on 19 May searched offices of ProSiebenSat.1 in Munich and RTL in Cologne. The two private TV channels are alleged to have made forbidden agreements on encrypting hitherto free-to-air programmes. Thus, digital Free-TV programmes are henceforth to be made accessible only for an additional payment. Furthermore, copy-protection functions and advertising blockers were involved, said a spokesman for the anti-trust authority. The Munich TV group confirmed the search without giving details.

BASF wants to swallow up Cognis

The BASF Supervisory Board has agreed to a takeover offer to Cognis majority owners Goldman Sachs and Permira. Details of the purchase offer are not yet known, though Cognis estimated its rough notion of the price at around 3 billion Euros. The chemicals firm was sold in 2001 by Henkel to the Goldman Sachs private-equity division and financial investor Permira, who subsequently restructured the company and cut costs. As Financial Times Deutschland (FTD) reports, Goldman Sachs and JP Morgan were also, in parallel with the direct sale, preparing for an IPO for Cognis, but that this was only the second-best solution for the owners.

At the BASF AGM on 29 April, it was decided to convert the bearer shares to personal shares. The exchange of the 918.5 billion shares is to come on 2 August 2010.

Commerzbank has new pay system

Again in 2010, Commerzbank executive pay continues to have a ceiling of €500,000, as long as the interest on the money lent by the government has not been fully paid back. For its rescue, Commerzbank had received €16 billion as a silent contribution and 2.2 billion as fresh capital, on the condition of limiting executive salaries for the duration of the aid, but initially for 2008 and 2009. The Commerzbank AGM has now brought out a new remuneration system, which is to apply retroactively to 1 January 2010. In it, executives will in future receive a fixed annual salary of €750,000 plus variable salary consisting of short-term components limited to one year of a maximum of €250,000 and a long-term component for four years, with a maximum of €750,000, which could be cut by a Malus system. The CEO would on a new arrangement receive not the present 1.5 times an ordinary board member, but 1.75 times. At the request of CEO Martin Blessing, this arrangement is to be suspended till the end of the appointment period on 31 October 2011. Blessing at the same time announced that the bank would be paying back the borrowed money to the special fund for financial market stabilization (SoFFin) by 2012 at latest. The government’s silent contribution is currently costing 9% interest. However, EU finance ministers recently demanded that all guarantees to be extended as from the beginning of July should have costs oriented more closely on market conditions.

Again in 2010, Commerzbank executive pay continues to have a ceiling of €500,000, as long as the interest on the money lent by the government has not been fully paid back. For its rescue, Commerzbank had received €16 billion as a silent contribution and 2.2 billion as fresh capital, on the condition of limiting executive salaries for the duration of the aid, but initially for 2008 and 2009. The Commerzbank AGM has now brought out a new remuneration system, which is to apply retroactively to 1 January 2010. In it, executives will in future receive a fixed annual salary of €750,000 plus variable salary consisting of short-term components limited to one year of a maximum of €250,000 and a long-term component for four years, with a maximum of €750,000, which could be cut by a Malus system. The CEO would on a new arrangement receive not the present 1.5 times an ordinary board member, but 1.75 times. At the request of CEO Martin Blessing, this arrangement is to be suspended till the end of the appointment period on 31 October 2011. Blessing at the same time announced that the bank would be paying back the borrowed money to the special fund for financial market stabilization (SoFFin) by 2012 at latest. The government’s silent contribution is currently costing 9% interest. However, EU finance ministers recently demanded that all guarantees to be extended as from the beginning of July should have costs oriented more closely on market conditions.

There were critical comments at the AGM from shareholder association Schutzgemeinschaft der Kapitalanleger (SdK) on the authorized capital decided. According to the decision, Commerzbank can until May 2015 increase the subscribed capital on one or more occasions by a maximum of €1.54 billion, or up to 50%. Shareholders’ subscription rights may be excluded. The shareholder association stigmatized this as a blank check for the government to get out non-transparently at shareholders’ expense. The capital could be diluted in unforeseeable arrangements and devalued. Moreover, the shareholders were having their voice taken away, and not, as called for in the Financial Market Stabilization Act, being given preference in any re-privatization, continued the SdK’s criticism.

Gallois to do without variable pay

In spring, the Frenchman heading the European aerospace group EADS, Louis Gallois, had already waived the variable part of his pay, giving away some €1.55 million. As last year, Gallois proposed to the AGM on 1 June that this year too he waive the variable part of his pay – at least €1.14 million – and content himself with his fixed salary of €900,000.

Fresenius changes its shares and becomes a KgaA

Shareholders in medical technology group Fresenius SE set going the conversion of the preference shares to ordinary shares and a change of legal form to a partnership limited by shares (KGaA) at the AGM in mid May. At the earliest in the second half of this year, the non-voting preference shares will be exchanged in a 1:1 ratio for ordinary voting shares. The group wishes in this way to enhance the attractiveness of its share and at the same time strengthen its position on the capital market. The transformation into a KGaA makes Fresenius Management SE into a general partner. It is 100% backed by the Else-Kröner-Fresenius Foundation. The foundation currently has a 58.11% holding in Fresenius SE. The new company’s management will be identical with the current board of Fresenius SE. Critics are complaining, says Financial Times Deutschland (FTD), that the change in form will give the foundation too much power.

HeidelbergCement in the DAX

With effect from 21 June HeidelbergCement moves up from the MDAX into the DAX. At the same time Salzgitter goes down from the DAX into the MDAX.

Buhlmann's Corner

I was there – you too?

At the Deutsche Bank AGM last month in Frankfurt I was there, with all my shares, and thousands of other people too. The voting attendance, the quorum for taking decisions, amounted to a bare 6% of share capital. Any further questions? Perhaps some concern? Why, after all it’s nothing unusual: there is an AGM and nobody goes. VIP was there.

At the Deutsche Bank AGM last month in Frankfurt I was there, with all my shares, and thousands of other people too. The voting attendance, the quorum for taking decisions, amounted to a bare 6% of share capital. Any further questions? Perhaps some concern? Why, after all it’s nothing unusual: there is an AGM and nobody goes. VIP was there.

Anyone who does not yet understand why at Infineon a Supervisory Board member could be appointed against the majority of shareholders, and what risks are associated with these AGM attendance figures, would please not ask us anything any more. Well, these were individual cases, were they, Infineon and Deutsche? Yes, it may well be, but in that case the majority of cases are in this category. At IVG, with a capital presence of 60%, in part only 60% voted. So that means around a third of the voting attendance? Not to forget that is like that at Commerzbank: there are individual shareholders there with holdings in the double digits. At IVG – rumours run – it would have taken only one of the two young major shareholders not voting in order for the opposition to win. The rumour is all the more piquant, because just that almost happened, because of inattention. At Commerzbank things would not get that far, since after all the State’s involvement sees to that; all the same, it abstained when it came to SoP.

What actually unites these “cases“? Is it really just criticisms by individual shareholders of the Supervisory Board, or of Supervisory Board members? Ought a Supervisory Board member with 50% of less than a 100% discharge to be continuing? Ought an attendance of 6% at a global bank to be taken as an opportunity to continue with “business as usual”?

In Spain it is regarded as almost normal for attendances to be over 100%. In Germany we will only waken up when attendance falls below zero. I’ve already got the point, I was there – you too?

ACTIONS CORNER

Deutsche Postbank is to pay a €120,000 administrative fine for misusing account data for soliciting customers. The data were passed on until autumn 2009 to some 4,000 self-employed commercial representatives of a subsidiary, to enable it to target products to these customers.

The EU Commission has imposed fines totalling €331 million on ten memory-chip firms, including Infineon, for illegal price agreements. The DAX member is the only European firm in the cartel, and will have to pay €56.7 million. The investigations by the Brussels authority cover the period from 1998 to 2002 in which the chipmakers, according to the Commission, made price and quantity agreements about DRAM memory chips. This was a “very grave infringement of market rules,” said Competition Commissioner Joaquín Almunia on 19 May in Brussels. It had driven retail prices for computers upwards.

The EU Commission has imposed fines totalling €331 million on ten memory-chip firms, including Infineon, for illegal price agreements. The DAX member is the only European firm in the cartel, and will have to pay €56.7 million. The investigations by the Brussels authority cover the period from 1998 to 2002 in which the chipmakers, according to the Commission, made price and quantity agreements about DRAM memory chips. This was a “very grave infringement of market rules,” said Competition Commissioner Joaquín Almunia on 19 May in Brussels. It had driven retail prices for computers upwards.

Polish competition authorities have served Praktiker Polska, the operative Polish subsidiary of the Praktiker Bau- und Heimwerkermärkte Holding group, with a fine notice in the amount of €9.4 million. Praktiker is accused of illegal price-fixing between 2000 and 2006. The German DIW retail chain is currently looking into whether it can seek legal remedies against the anti-trust fine and whether it needs to form appropriate reserves. According to a compulsory disclosure, this would be likely to influence the result for the second quarter.

AGM Dates

| Company | Event | Date | Time | Place | Address | Published on |

| DAX | ||||||

| Salzgitter AG | ord.AGM | 08.06.2010 | 11:00 | 38102 Baunschweig | Leonhardplatz, Stadthalle | 30.04.2010 |

| The Agenda for the ordinary AGM of Salzgitter AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Salzgitter AG earned balance-sheet profits of €15.1m last business year. Of the profits, €15.02m is to be paid out as dividend and €0.08m carried forward to a new account. Supervisory Board pay is to be adjusted. The company is again to be authorized to purchase its own shares and use them, possibly excluding shareholders’ subscription and tendering rights. Additionally, the company is to be authorized to issue option and convertible bonds. For this, Conditional Capital of €71.26m is to be kept available. Additionally, several charter amendments are to be decided. | ||||||

| SAP AG | ord.AGM | 08.06.2010 | 10:00 | 68163 Mannheim | Xaver-Fuhr-Str. 150, Sap Arena | 30.04.2010 |

| The Agenda for the ordinary AGM of SAP AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. SAP AG earned balance-sheet profits of €4304.69m last business year. Of the profits, €594.86m is to be paid out as dividend and €3709.82m carried forward to a new account. The system of remuneration for board members is to be approved. Additionally, several charter amendments are to be decided. A decision on the adjustment of §4 (1), (6) and (10) of the charter to interim capital changes is to be made. The existing Capitals I, Ia, II and IIa are to be repealed. A new Authorized Capital I in the amount of up to €250.0m is to be created. A new Authorized Capital II also in the amount of up to €250.0m is to be created. Additionally, the company is to be authorized to issue option and convertible bonds. For this, Conditional Capital III of €30.0m is to be kept available. The company is to be newly authorized to purchase its own shares and use them, possibly excluding shareholders’ subscription and tendering rights. Supervisory Board pay is to be adjusted. | ||||||

| MDAX | ||||||

| BAUER AG | ord.AGM | 24.06.2010 | 10:00 | 86529 Schrobenhausen | BAUER-Straße 1 (vormals Wittelsbacherstr. 5) | 11.05.2010 |

| The Agenda for the ordinary AGM of BAUER AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. BAUER AG earned balance-sheet profits of €33.02m last business year. Of the profits, €10.28m is to be paid out as dividend, €5.0m allocated to reserves and €17.41m carried forward to a new account. The company is again to be authorized to purchase its own shares and use them, possibly excluding shareholders’ subscription and tendering rights. The system of remuneration for board members is to be approved. Additionally, several charter amendments are to be decided. | ||||||

| Pfleiderer AG | ord.AGM | 23.06.2010 | 10:30 | 80538 München | Am Tucherpark 7, Hotel Hilton München Park | 12.05.2010 |

| The Agenda for the ordinary AGM of Pfleiderer AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies,with the discharge for the business year 2009 to retired board member Dr. Robert Hopperdietzel to be postponed. Mr. Ernst-Herbert Pfleiderer has resigned as Supervisory Board member of the Company with effect from the end of the 23 June 2010 Annual General Meeting. Mr. Hans Theodor Pfleiderer is to be elected to the Supervisory Board. Additionally, several charter amendments are to be decided. The existing Authorized Capital is to be replaced by a new one of €75.08m. Additionally, the company is again to be authorized to issue option and convertible bonds. For this, a new conditional capital of €23.46m is to be kept available. The company is to be authorized to purchase its own shares. A resolution is to be taken on assent to the conclusion of a control and profit-transfer agreement with Pfleiderer erste Holding GmbH. | ||||||

| HUGO BOSS AG | ord.AGM | 21.06.2010 | 10:00 | 72622 Nürtingen | Stadthalle Nürtingen | 04.05.2010 |

| The Agenda for the ordinary AGM of HUGO BOSS AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Elections to the Supervisory Board are to be held. The company is to be newly authorized to purchase its own shares and use them, excluding shareholders’ subscription and tendering rights. A resolution is to be taken on the extent of disclosure of executive salaries. Additionally, several charter amendments are to be decided. | ||||||

| BayWa AG | ord.AGM | 18.06.2010 | 10:00 | 81823 München | ICM Internationales Congress Center München, Messegelände | 10.05.2010 |

| The Agenda for the ordinary AGM of BayWa AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. BayWa AG earned balance-sheet profits of €26.38m last business year. Of the profits, €13.59m is to be paid out as dividend and €12.79m carried forward to a new account. The existing Authorized Capital is to be replaced by a new one of €5.0m. The system of remuneration for board members is to be approved. Supervisory Board pay is to be adjusted. Additionally, several charter amendments are to be decided. A resolution pursuant to §§ 286(5), 314(2) HGB on exemption from the obligation of individualized disclosure of executive pay is to be taken. | ||||||

| Deutsche EuroShop AG | ord.AGM | 17.06.2010 | 10:00 | 20355 Hamburg | Holstenwall 12, Handwerkskammer Hamburg | 06.05.2010 |

| The Agenda for the ordinary AGM of Deutsche EuroShop AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. The balance-sheet profits of €46.32m are to be fully paid out as dividend. The existing Authorized Capital is to be replaced by a new one of €22.06m. Additionally, several charter amendments are to be decided. | ||||||

| Hamburger Hafen und Logistik AG | ord.AGM | 16.06.2010 | 10:00 | 20355 Hamburg | Am Dammtor/Marseiller Str. 2, CCH | 04.05.2010 |

| The Agenda for the ordinary AGM of Hamburger Hafen und Logistik AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Hamburger Hafen und Logistik AG earned balance-sheet profits of €109.9m last business year. Of the profits, €30.69m is to be paid out as dividend and €79.21m carried forward to a new account. The system of remuneration for board members is to be approved. The company is again to be authorized to purchase its own A-shares and use them, possibly excluding shareholders’ subscription and tendering rights. Additionally, the company is to be authorized to issue option and convertible bonds. For this, conditional capital of €6.9m is to be kept available. A resolution is to be taken on assent to the conclusion of a profit-transfer agreement between the company and HHLA Energiehandelsgesellschaft. Additionally, several charter amendments are to be decided. | ||||||

| KRONES AG | ord.AGM | 16.06.2010 | 14:00 | 93073 Neutraubling | Regensburger Str. 9, Stadthalle Neutraubling | 10.05.2010 |

| The Agenda for the ordinary AGM of KRONES AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. The system of remuneration for board members is to be approved. A resolution on disclosure of executive pay is to be taken. The company is again to be authorized to purchase its own shares and use them, possibly excluding shareholders’ subscription and tendering rights. Additionally, several charter amendments are to be decided. | ||||||

| Rhön-Klinikum AG | ord.AGM | 09.06.2010 | 10:00 | 65929 Frankfurt am Main | Pfaffenwiese, Jahrhunderthalle | 30.04.2010 |

| The Agenda for the ordinary AGM of Rhön-Klinikum AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Rhön-Klinikum AG earned balance-sheet profits of €41.47m last business year. Of the profits, €41.46m is to be paid out as dividend and €0.01m carried forward to a new account. The system of remuneration for board members is to be approved. The company is again to be authorized to purchase its own shares and use them, possibly excluding shareholders’ subscription and tendering rights. Elections to the Supervisory Board are to be held. Additionally, several charter amendments are to be decided. | ||||||

| STADA Arzneimittel AG | ord.AGM | 08.06.2010 | 10:00 | 60327 Frankfurt am Main | Ludwig-Erhard-Anlage 1, Congress Ebene C2 | 29.04.2010 |

| The Agenda for the ordinary AGM of STADA Arzneimittel AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. STADA Arzneimittel AG earned balance-sheet profits of €32.79m last business year. Of the profits, €32.31m is to be paid out as dividend and €0.48m carried forward to a new account. Elections to the Supervisory Board are to be held. Additionally, several charter amendments are to be decided. | ||||||

| TecDAX | ||||||

| freenet AG | ord.AGM | 06.07.2010 | 10:00 | 20355 Hamburg | Am Dammtor/Marseiller Straße, Congress Center Hamburg | 21.05.2010 |

| The Agenda for the ordinary AGM of freenet AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. freenet AG earned balance-sheet profits of €315.25m last business year. Of the profits, €25.6m is to be paid out as dividend and €289.64m carried forward to a new account. A resolution approving the system of remuneration for board members is to be taken. The company is again to be authorized to purchase its own shares and use them, possibly excluding shareholders’ subscription and tendering rights. In addition, a resolution authorizing the use of equity derivatives in the context of the acquisition of own shares is to be taken. Additionally, several charter amendments are to be decided. | ||||||

| Conergy AG | ord.AGM | 28.06.2010 | 45131 Essen | Norbertstraße 5 | 19.05.2010 | |

| The Agenda for the ordinary AGM of Conergy AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Conergy AG earned balance-sheet profits of €1.39m last business year. Of the profits, €0.11m is to be paid out as dividend and €1.28m allocated to reserves. Supervisory Board pay is to be adjusted. Mr Dieter Schmitt, Mr Peter Jänsch and Mr Heinrich Grütering are to be elected to the Supervisory Board. The company is to change its name to con|energy AG. A resolution on the hiving off of con|energy agentur and con|energy akademie is to be taken. | ||||||

| Q-Cells SE | ord.AGM | 24.06.2010 | 10:00 | 04356 Leipzig | Messe-Allee 1, CCL | 17.05.2010 |

| The Agenda for the ordinary AGM of Q-Cells SE starts with the usual items, like presentation of annual accounts and discharge to the company bodies. The company is again to be authorized to purchase its own shares and use them, possibly excluding shareholders’ subscription and tendering rights. Additionally, several charter amendments are to be decided. Supervisory Board pay is to be adjusted. The by-election of Mr Helmut Gierse to the Supervisory Board is to be held. Resolutions on changes to the Stock Option Programmes 2007, 2008 and 2009 are to be taken. Additionally, the company is to be authorized to issue option and convertible bonds. For this, conditional capital of €52.35m is to be kept available. A new authorized capital of up to €8.23 million (Authorized Capital 2010) is to be decided. | ||||||

| centrotherm photovoltaics AG | ord.AGM | 22.06.2010 | 10:00 | 89231 Neu-Ulm | Silcherstr. 49, Edwin-Scharff-Haus | 12.05.2010 |

| The Agenda for the ordinary AGM of centrotherm photovoltaics AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. The balance-sheet profits of €45.9m are to be fully carried forward to a new account. The company is again to be authorized to purchase its own shares and use them, possibly excluding shareholders’ subscription and tendering rights. Additionally, the company is again to be authorized to issue option and convertible bonds. For this, a new conditional capital of €2.12m is to be kept available. A resolution on the introduction of "centrotherm photovoltaics AG Stock Option Plan 2010" for the issue of option rights on shares to executives and other key employees of centrotherm photovoltaics AG and its affiliated companies and on the creation of an additional conditional capital is to be taken. The system of remuneration for board members is to be approved. | ||||||

| Manz Automation AG | ord.AGM | 22.06.2010 | 10:00 | 70794 Filderstadt | Tübinger Str. 40, Filharmonie Filderstadt | 11.05.2010 |

| The Agenda for the ordinary AGM of Manz Automation AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. The balance-sheet profits of €4.38m are to be fully carried forward to a new account. The election of Mr Peter Leibinger to the Supervisory Board is to be held. Additionally, several charter amendments are to be decided. The company is again to be authorized to purchase its own shares and use them, possibly excluding shareholders’ subscription and tendering rights. | ||||||

| Wirecard AG | ord.AGM | 17.06.2010 | 10:00 | 80333 München | Max-Joseph-Str. 5, Haus der Bayerischen Wirtschaft | 11.05.2010 |

| The Agenda for the ordinary AGM of Wirecard AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Wirecard AG earned balance-sheet profits of €13.66m last business year. Of the profits, €9.16m is to be paid out as dividend and €4.5m carried forward to a new account. The system of remuneration for board members is to be approved. A confirmatory election to be held. The company is again to be authorized to purchase its own shares and use them, possibly excluding shareholders’ subscription and tendering rights. Additionally, several charter amendments are to be decided. | ||||||

| Bechtle AG | ord.AGM | 16.06.2010 | 10:00 | 74072 Heilbronn | Allee 28, Konzert- und Kongresszentrum Harmonie | 05.05.2010 |

| The Agenda for the ordinary AGM of Bechtle AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. The balance-sheet profits of €12.6m are to be fully paid out as dividend. The company is again to be authorized to purchase its own shares and use them, possibly excluding shareholders’ subscription and tendering rights. A resolution is to be taken on refraining from individualized disclosure of executive pay. Supervisory Board pay is to be adjusted. A resolution is to be taken on assent to the conclusion of a control and profit-transfer agreement between Bechtle Aktiengesellschaft and Bechtle Managed Services AG. | ||||||

| Phoenix Solar AG | ord.AGM | 16.06.2010 | 11:00 | 82256 Fürstenfeldbruck | Fürstenfeld 12, Veranstaltungsforum Fürstenfeld | 07.05.2010 |

| The Agenda for the ordinary AGM of Phoenix Solar AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Phoenix Solar AG earned balance-sheet profits of €43.35m last business year. Of the profits, €1.34m is to be paid out as dividend and €42.0m carried forward to a new account. Re-elections to the Supervisory Board are to be held as well as the election of Mr Oliver Gosemann and Dr. Torsten Hass. The company is again to be authorized to purchase its own shares and use them, possibly excluding shareholders’ subscription and tendering rights. The existing Authorized Capital is to be replaced by a new one of €3.35m (Authorized Capital 2010). Additionally, the company is to be authorized to issue option and convertible bonds. For this, a new Conditional Capital 2010 of €2.81m is to be kept available. Additionally, several charter amendments are to be decided. | ||||||

| EVOTEC AG | ord.AGM | 10.06.2010 | 10:00 | 20148 Hamburg | Rothenbaumchausee 11, Curio-Haus | 30.04.2010 |

| The Agenda for the ordinary AGM of EVOTEC AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. The company is again to be authorized to purchase its own shares and use them, possibly excluding shareholders’ subscription and tendering rights. Additionally, several charter amendments are to be decided. | ||||||

| JENOPTIK AG | ord.AGM | 09.06.2010 | 11:00 | 99423 Weimar | UNESCO-Platz 1, congress centrum neue weimarhalle | 27.04.2010 |

| The Agenda for the ordinary AGM of JENOPTIK AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. The company is again to be authorized to purchase its own shares and use them, possibly excluding shareholders’ subscription and tendering rights. The existing Authorized Capital is to be replaced by a new one of €13.53m. The object of business is to be updated. Additionally, several charter amendments are to be decided. | ||||||

| Kontron AG | ord.AGM | 09.06.2010 | 10:00 | 85356 Freising | Luitpoldanlage 1, Luitpoldhalle | 30.04.2010 |

| The Agenda for the ordinary AGM of Kontron AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Kontron AG earned balance-sheet profits of €13.43m last business year. The profits are to be paid out as a dividend of €0.20 per share entitled to dividend, and the remainder carried forward to a new account. Elections to the Supervisory Board are to be held. The company is again to be authorized to purchase its own shares and use them, possibly excluding shareholders’ subscription and tendering rights. The stock option programme 2003 and 2007 is to be amended. The existing Authorized Capital is to be replaced by a new one of €27.84m. Additionally, several charter amendments are to be decided. Additionally, the company is to be authorized to issue option and convertible bonds. For this, Conditional Capital of €16.88m is to be kept available. | ||||||

| Nordex SE | ord.AGM | 08.06.2010 | 11:00 | 18055 Rostock | Lange Straße 40, Radisson Blu Hotel | 28.04.2010 |

| The Agenda for the ordinary AGM of Nordex SE starts with the usual items, like presentation of annual accounts and discharge to the company bodies. The company is again to be authorized to issue its own shares against contributions in cash and/or in kind. | ||||||

Politics

DCGK wants a higher female quota

The German Corporate Governance Commission (DCGK) fleshed out its existing diversity recommendation for German supervisory boards more at its plenary session on 26 May. The proportion of women and international representatives on German supervisory boards should be sustainably increased. Thus, a supervisory board should in future set specific targets for its composition that should lead to more diversity and a higher proportion of women. The supervisory board’s proposals to the AGM should take account of these targets. The DCGK further recommends in future disclosing the supervisory board’s specific target and progress on reaching it in the corporate-governance section of the business report. At the same time, the Commission made a recommendation to boards that in filling executive functions in future it should pay attention to diversity and aim at involving more women. Also newly laid down in the Code are provisions that supervisory board members should undertake the necessary training and refresher courses needed for their tasks on their own responsibility. In the existing Code recommendation to supervisory board members not to take more than three appointments, appointments with unlisted companies that comparable demands on members will in future also count.

The German Corporate Governance Commission (DCGK) fleshed out its existing diversity recommendation for German supervisory boards more at its plenary session on 26 May. The proportion of women and international representatives on German supervisory boards should be sustainably increased. Thus, a supervisory board should in future set specific targets for its composition that should lead to more diversity and a higher proportion of women. The supervisory board’s proposals to the AGM should take account of these targets. The DCGK further recommends in future disclosing the supervisory board’s specific target and progress on reaching it in the corporate-governance section of the business report. At the same time, the Commission made a recommendation to boards that in filling executive functions in future it should pay attention to diversity and aim at involving more women. Also newly laid down in the Code are provisions that supervisory board members should undertake the necessary training and refresher courses needed for their tasks on their own responsibility. In the existing Code recommendation to supervisory board members not to take more than three appointments, appointments with unlisted companies that comparable demands on members will in future also count.

Activism against short-selling

The Federal Institute for Financial Services Oversight (BaFin) in mid May, surprisingly and with no prior coordination with its European partners, banned short-selling in Germany. Initially, BaFin banned naked short-selling by ten German financial groups including Allianz and Deutsche Bank, as also sovereign Credit Default Swaps (CDSs) on Euro-zone States and naked short-selling of Euro-zone government securities. Once the euro’s fall has stopped and the first attacks on the German manoeuvre have died away, Finance Minister Schäuble is planning to extend the ban to all naked short-selling of shares on the regulated market and of currency derivatives on the Euro that are not being used to hedge real transactions. Additionally, according to the draft, there will also be a ban on euro currency derivatives. Through increased disclosure thresholds, Schäuble also wants to prevent investors from secretly creeping up on firms in takeovers. Schäuble’s bill is to be decided in cabinet in June.

Horse-trading over transaction tax

If things go as Finance Minister Wolfgang Schäuble (CDU) wants, the G20 meeting in June in Toronto, Canada, should mark a turning towards introduction of a worldwide transaction tax, imposing a levy on trading in shares, derivatives and bonds. If, however, Canada, Brazil and Australia continue to oppose this tax on stock-exchange transactions, so that there cannot be an international arrangement, then Germany’s Finance Minister will alternatively look for a European solution. Accordingly Schäuble, by contrast with Angela Merkel and Jean-Claude Juncker, who heads the group of Euro-area finance ministers, is initially aiming at worldwide taxation of transactions. Juncker had announced in mid May that all sixteen Euro countries were basically agreed on introducing a stock-exchange turnover tax and were thus also paving the way for a possible European solution without the US. Merkel too seems to have laid aside any belief in a worldwide arrangement, relying instead on the International Monetary Fund, which, like Merkel, prefers a tax on financial-market activities. It would tax the bonuses and salary payments of bankers. In the course of negotiations over support for the euro, Merkel was able to get the Liberals on board for the introduction of a global or at least Europe-wide tax – whether in the form of a tax on financial transactions or on financial activities. The German government wants to use this new tax to make the financial industry take a share of the cost of the financial crisis, additionally to the bank levy.

If things go as Finance Minister Wolfgang Schäuble (CDU) wants, the G20 meeting in June in Toronto, Canada, should mark a turning towards introduction of a worldwide transaction tax, imposing a levy on trading in shares, derivatives and bonds. If, however, Canada, Brazil and Australia continue to oppose this tax on stock-exchange transactions, so that there cannot be an international arrangement, then Germany’s Finance Minister will alternatively look for a European solution. Accordingly Schäuble, by contrast with Angela Merkel and Jean-Claude Juncker, who heads the group of Euro-area finance ministers, is initially aiming at worldwide taxation of transactions. Juncker had announced in mid May that all sixteen Euro countries were basically agreed on introducing a stock-exchange turnover tax and were thus also paving the way for a possible European solution without the US. Merkel too seems to have laid aside any belief in a worldwide arrangement, relying instead on the International Monetary Fund, which, like Merkel, prefers a tax on financial-market activities. It would tax the bonuses and salary payments of bankers. In the course of negotiations over support for the euro, Merkel was able to get the Liberals on board for the introduction of a global or at least Europe-wide tax – whether in the form of a tax on financial transactions or on financial activities. The German government wants to use this new tax to make the financial industry take a share of the cost of the financial crisis, additionally to the bank levy.

Bank levy takes shape

The German government wants banks to be involved in the rescue costs resulting from the financial crisis. Alongside a tax, of whatever form, financial institutions are according to a cabinet resolution to be asked to pay a bank levy, depending on their systemic risk. The financial institutions are to pay this into a fund of the Financial Market Stabilization Institution (FMSA). This is to be run by bank rescue fund SoFFin, and collect up to €1.2bn a year. Criticisms are coming in from the German cooperative banks, who point out that they neither caused nor benefited from the governmental rescue measures, so that they ought to be spared. The Federal Association of German Cooperative and Raiffeisen Banks (BVR) is threatening if necessary to go to court against any such levy. The insurance industry too has called for exemption of insurance firms and pension funds from the levy.

In a paper, EU Commissioner Michel Barnier has called on EU States to set up a national rescue fund. This would be fed from the compulsory levies on banks. Barnier wishes in this way to create uniform minimum standards within the EU for a bank levy and national rescue fund, thus avoiding the risk of distortions of competition among European countries. According to Barnier’s ideas, the bank rescue fund should be separate from the national budget and not mixed with deposit guarantee funds, which should remain reserved to savers alone. The funds precise tasks, as well as what assessment basis should apply, are points left open in the paper. The proposals are to be discussed at the EU summit in mid-June and to lead to detailed proposals in autumn.

Resistance to EU banking oversight

In Strasbourg a conflict is growing between the European Parliament and three Member States, Germany, Britain and France, over banking oversight. MEPs called in a draft agreed among various political groups that border-crossing institutions should contribute to a European bank rescue fund and be directly subject to a new EU oversight body to be set up. The national authorities for banks, insurers and stock exchanges would on this model henceforth just work under the European authority, giving up their powers. In disputed cases, the EU authority would have the last word and be able to give the institutions instructions directly. The new European fund would then step in to rescue the institutions in crisis cases. Britain, Germany, and also France, are sceptical as regards such intervention rights for the EU and do not want to see the powers of their national oversight authorities clipped. In late 2009 the EU had also drawn up a safeguard clause. According to this, EU decisions would not apply if a national government’s currency was affected. Parliament now wishes to build in high hurdles against this suspension of EU decisions, with the objective of making it very hard for States in future to keep themselves free of crisis management by the EU watchdogs.

European corporate governance for banks

Just as banking oversight is to made to be made uniform Europe-wide, EU internal-market Commissioner Michel Barnier is now also advocating harmonizing corporate governance rules for banks and insurance companies Europe wide. In a green paper he wishes to present in early June, the French Commissioner warns that many Supervisory Boards had not understood risky products from their companies and thus slivered blindly into the crisis, as Financial Times Deutschland (FTD) writes. To guarantee that in future Supervisory Board members will be able to get a better grip of the matter in future, they are not to be allowed to take more than three appointments. Supervisory Boards are to set up specialized risk committees which may also, at the bank’s expense, call in external advice. For investments decisions, a veto right should be reserved for the Chief Risk Officer. According to Barnier’s ideas, institutional investors are in future to disclose their voting behaviour. Auditors are additionally to check important indicators such as a bank’s or insurance company’s capital ratio. Interested parties are to be able to state positions on Barnier’s proposals through mid-August. Then decisions will be taken on possible legislative initiatives.

Tighter rules for real-estate funds

Finance Minister Wolfgang Schäuble wants to radically change the business model of open real-estate funds in future. With a minimum holding period of two years and a notice period of six to 24 months, investments in open real-estate funds would in future no longer be available daily. Additionally, the funds are to take back shares only twice a year in future, and to evaluate their properties every six months, not every twelve as hitherto. Furthermore, the Federal Institution for Financial Services Oversight (BaFin) is to audit prospectuses henceforth economically and not merely formally as hitherto, putting the funds on the same basis as shares and bringing them under the Securities Trading Act. With this bill, Schäuble is reacting to closed real-estate funds’ liquidity problems during the financial crisis. The Bundestag will discuss the bill in September.

People

The appointment of Edward Kozel as Chief Technology and Innovation Officer has closed the vacancy in the technology spot there has been on the Deutsche Telekom board since the departure of Hamid Akhavan. Kozel took the board post with effect from 3 May. The American electrical engineer spent most of his career at Cisco Systems. The board is thus now back up to complement.

Toni Schrofner was appointed production and logistics director at Drägerwerk with effect from 1 September. Herbert Fehrecke, hitherto in charge of this sector, will in future take on the research and development sector along with those of procurement, IT and quality. The deputy CEO is taking over his new responsibility from Ulrich Thibaut, leaving the firm on 30 June.

The E.ON supervisory board agreed on 12 May to an organizational and staffing board reshuffle, appointing three new board members with immediate effect. The new labour director will be Regine Stachelhaus. Electricity and gas production, worldwide trading and energy-saving optimization of the group across all regions and products will be run centrally by the 47- year old Norwegian Jørgen Kildahl, in a new board spot. Also newly appointed to the group board is current E.ON Energie CEO Klaus-Dieter Maubach. As well as running all research and development areas, he will also take charge of E.ON New Build and Technology. A further board post is to be created for running companies in the Länder; until a new appointment is made, CEO Johannes Teyssen will handle this. The background is that the board is to take closer control and responsibility for the operational businesses. Two members of the old board are leaving: current personnel director Christoph Dänzer-Vanotti is leaving the group, as is Lutz Feldmann, in charge of “new markets”.

The E.ON supervisory board agreed on 12 May to an organizational and staffing board reshuffle, appointing three new board members with immediate effect. The new labour director will be Regine Stachelhaus. Electricity and gas production, worldwide trading and energy-saving optimization of the group across all regions and products will be run centrally by the 47- year old Norwegian Jørgen Kildahl, in a new board spot. Also newly appointed to the group board is current E.ON Energie CEO Klaus-Dieter Maubach. As well as running all research and development areas, he will also take charge of E.ON New Build and Technology. A further board post is to be created for running companies in the Länder; until a new appointment is made, CEO Johannes Teyssen will handle this. The background is that the board is to take closer control and responsibility for the operational businesses. Two members of the old board are leaving: current personnel director Christoph Dänzer-Vanotti is leaving the group, as is Lutz Feldmann, in charge of “new markets”.

GILDEMEISTER, in a surprise move, has changed its CFO. 49-year-old MBA Kathrin Dahnke was appointed with immediate effect as new financial head at the machine-tool maker. On the way out is Michael Welt, on the board since January 2003, who has worked a total of 14 years for Gildemeister. No further details were given on the reason for the current CFO’s departure.

Christopher von Hugo is to be the new supervisory board chair at Pfleiderer. The Germany head of One Equity Partners is to be elected at the end of the AGM on 23 June. He will be replacing Ernst-Herbert Pfleiderer, long-term Supervisory Board chair, who is leaving it on age grounds. He will be succeeded by Hans Theodor Pfleiderer as a Supervisory Board member, assuming the AGM agrees.

Rüdiger Merz has been proposed for election to the Supervisory Board of Rhön-Klinikum. He succeeds Heinz Korte. The other nine representatives of the capital side are up for re-election at the AGM on 9 June. Eugen Münch is to remain Supervisory Board chair.

SMARTRAC announced on 3 May that Dato Tan Soo Hee will be joining the firm on 1 June as Chief Operating Officer and member of the Group Executive Team. In this role he will be taking responsibility for production sites worldwide. The new COO succeeds Franz Vollmann, leaving the firm on 31 March to pursue his professional career in Europe.

The Supervisory Board of STADA Arzneimittel decided at its meeting on 10 May not to renew the contract of Christof Schumann. Schumann’s contract was by agreement to run till the end of this year. The production and development director, in the post since 2008, will until further notice be completing the contract. The pharmaceuticals maker is seeking to make a new appointment to the post.

Heinrich Hiesinger’s successor at Siemens is to be Siegfried Russwurm. The chairman’s committee of the Supervisory Board is also proposing that Ms Brigitte Ederer be appointed to the managing board, effective 1 July. Currently CEO of Siemens Österreich, she will take the post of the current personnel and labour director. This ups the female proportion on the board to 25%. The Supervisory Board will take this decision on 9 June.

At ThyssenKrupp, on 21 January 2011 Heinrich Hiesinger is to replace Ekkehard Schulz, departing after the next AGM. The Siemens director is joining the Ruhr firm on 1 October, initially as deputy CEO. Schulz himself is to be elected to the Supervisory Board immediately on leaving. The Ethikverband der deutschen Wirtschaft, a business ethics association, criticized the decision by Gerhard Cromme, and his double appointment. The Supervisory Board chair of Siemens and ThyssenKrupp stated that the procedure infringed neither principles of company law, nor good corporate governance. Beitz liaison officer Jürgen Claassen is also joining the board in January 2011, and will then be in charge of group development and compliance.

Karl Martin im Brahm

Private investors buying against the trend

The behaviour of private investors on the stock exchange is something there is no lack of theories about. However, there are no genuine large-scale guaranteed data for Germany on it. This gap has been filled by dwpbank, with an analysis of a total of over 3.5 million transactions carried out at a decisive stage of the financial and economic crisis. Between August 2008 and April 2010 purchases and sales of shares on the DAX, MDAX, TecDAX and SDAX were evaluated. This means the study covers a universe of some 70% of the total market capitalization of German shares.

This finding is likely to surprise quite a few capital-market experts. In the clear correction phase on the exchange between August 2008 and spring 2009, private investors appeared significantly as net purchasers of shares. The value of purchases in various months – with a total volume well above average on the whole – ranged from 130 to 160% above that of sales. The picture changed considerably in the ensuing upswing on the market. As from May 2009 private investors shifted slowly to the selling side – with particularly high intensity when in December 2009 and in March 2010 the DAX reached the 6,000 point mark.

Correspondingly, it should be noted that German private investors have shown contrarian behaviour in relation to developments on the markets in the financial crisis, with notable consistency. For when there were brief corrections within the upward movement, the private investors gave up their selling activities and moved back to the buying side again for a few weeks. From this it can also be deduced that private investors actively follow short-term developments on the exchange and include this information in decisions about their assets.

This means that German private investors do not act in accordance with the motto “The trend is your friend”. It also shows, though, that the trend on the market is not determined by them; for instance, their massive purchases in the upswing on the exchange ought, for instance, to have supported prices, an effect that was not to be observed. The direction on the stock market is instead – but here the findings of the analysis are instead not surprising – determined by the counterparts of private investors, namely institutional investors. Dwpbank’s object in the analysis was to contribute, as the leading German transaction bank, to a more realistic picture of the behaviour of various groups of investors on the basis of highly aggregated data. This is a project we continue to feel committed to in the future.

Karl Martin im Brahm, sales director of dwpbank

Campus

DAX groups forecasting again

Last year, because of the uncertain economic developments, eight of the 30 DAX groups published new forecasts for the current business year. This year, finds Cortent Kommunikation, all DAX firms again gave a forecast for 2010, with indications of expected turnover or result. In principle, listed companies are, according to a judgment of Frankfurt Higher Regional Court given in late 2009, obliged to publish a forecast.

Last year, because of the uncertain economic developments, eight of the 30 DAX groups published new forecasts for the current business year. This year, finds Cortent Kommunikation, all DAX firms again gave a forecast for 2010, with indications of expected turnover or result. In principle, listed companies are, according to a judgment of Frankfurt Higher Regional Court given in late 2009, obliged to publish a forecast.

Dividends fall

Shareholder association Deutsche Schutzvereinigung für Wertpapierbesitz (DSW) has published a study on dividends paid by German firms. According to it, in the Prime Standard one in two companies paid dividends for 2009, as for the previous year. However, the amount of dividend paid out fell from €31.61 billion in 2008 to €27.26 billion in 2009. The biggest dividend payers were RWE, Deutsche Telekom, E.On, Allianz and BASF, which alone totalled a distribution volume of €13.6 billion. The likelihood of a distribution and the size of dividend are apparently correlated with index membership. Whereas in the DAX 86.7% of firms pay dividends, in the MDAX it is 74.0%, in the SDAX 66.7% and in the TECDAX 48.3%. In Prime, only one company in three shared out profits.

High assent to compliance

According to a study by steria mummert, 84% of executives regard compliance as an important factor in a company’s success. The consultancy found the most important objectives given to be compliance with legal requirements (60%), avoiding financial risks (47%), protecting employees (46%) and upholding reputation (41%).

More research on Supervisory Board members

Professor Marcus Labbé, along with Susanne Rückert (Arqis), has set up the Deutsche Aufsichtsrats-Insitut, D.A.I. The object of the D.A.I. is to promote research and development in the area of responsible and sustainable company development. Among the institute’s supporters are A.T. Kearney, the Deutsche Bank, Euler Hermes and PwC.

Environmental funds work

A study by consultancy firm Adelphi looked at how investors are pushing climate protection forward. As Adelphi found, environment and sustainability funds are having a measurable influence, particularly on smaller firms. The proportion of environment-friendly and sustainable investments on the capital market as a whole is still small. However, such capital investments had a clear influence on company managements. Environment-friendly capital investments also strengthened CSR divisions, and helped to get tight environment-protection strategies incorporated into business policy.

A study by consultancy firm Adelphi looked at how investors are pushing climate protection forward. As Adelphi found, environment and sustainability funds are having a measurable influence, particularly on smaller firms. The proportion of environment-friendly and sustainable investments on the capital market as a whole is still small. However, such capital investments had a clear influence on company managements. Environment-friendly capital investments also strengthened CSR divisions, and helped to get tight environment-protection strategies incorporated into business policy.

Bulky business reports

The average business report has around 450,000 characters, finds geschäftsberichte-portal. To save pages, in more than a third of cases font sizes were reduced. 55% of firms placed value on readability, 45% more on graphics and illustrations. A total of 87% stated that balanced typography was very important.

Heavy footprints

Consultancy firm Adelphi has done a study commissioned by the Environment Ministry looking at the so-called carbon footprint, i.e. CO2 emissions, of individual installations. With conventional capital investments there are currently around five tons of greenhouse gases for every ten thousand euros invested, said one finding. This was half the carbon footprint of the average German citizen. Choosing environment-friendly and sustainable investments could reduce this emission quantity by an average of 42%, said the study.

Capital News

The shareholders of Aareal Bank consented at the AGM on 19 May to creation of a new authorized capital and on authorization for the board to issue convertible and/or option bonds. Both of these are reserve decisions; at the moment there are no specific plans for making use of the authorizations.

Shareholders in Commerzbank almost unanimously authorized the board to increase the registered capital, possibly excluding subscription rights. By a 98.3% vote, they allowed the board the possibility of at least partly exchanging the SoFFin silent contribution for its own shares in order thereafter to place them on the market. Shareholder association Schutzgemeinschaft das Kapitalanleger had opposed the management proposal, which it saw as depriving shareholders of their voice. CEO Martin Blessing will start repaying the €16.4 billion by 2012 at latest.

The Fresenius AGM on 12 May agreed to a change in legal form into a KGaA and a conversion of the preference shares to ordinary ones. Ordinary shareholders agreed by a 98% majority, and preference shareholders by a 94% majority, to a proposal to this effect by the board and Supervisory Board. Accordingly, all the non-voting preference shares in the health group were obligatorily converted in a 1:1 ratio into ordinarily voting shares. Some shareholders had their objections minuted. They complained of the influence of the Else Kröner-Fresenius Foundation, which would still remain in being even at a 10% holding.

K+S shareholders again rejected a management-proposed capital framework at the AGM on 11 May. The proposals would have authorized the company to sell bonds to a nominal amount of up to €1.5 billion and to create a new authorized capital. Only 43.75% of the 56.23% of registered capital in attendance voted in favour. Current major shareholders in the Kassel salt and fertilizer producer are Russian investor Andrei Melnichenko’s company Eurochem at round 15%, and BASF with 10%.

On 12 May SolarWorld began a buyback of its own shares. The board had decided on that date to make use of the authorization from the 20 May 2009 AGM to buy up to 10% of its own registered capital. The repurchase is time-limited till 20 November.

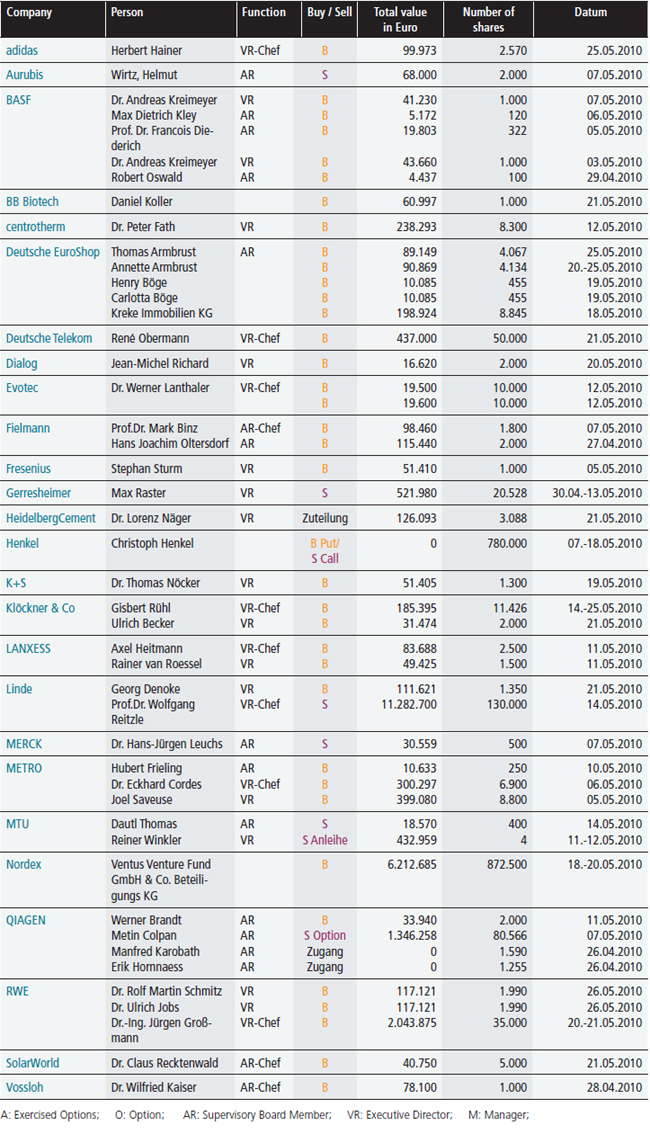

Director's Dealings

in May

VIPsight Shareholder

VIPsight Shareholder ID <click here>

Events Diary

15 June 2010 Aktuelle Fragen des Konzernrechts

Organizer: Deutsches Aktien-Institut; place: DVFA-Center im Signaris, Frankfurt am Main; cost: €900 (non-members); info: 069 929 15-0

17 June 2010 Eigenkapital auf Abruf und Debt-to-Equity-Swaps: Maßgeschneiderte Instrumente zur Finanzierung von Wachstum und Restrukturierung

Organizer: Deutsches Aktien-Institut; place: IHK, Frankfurt am Main; cost: €900 (non-members); info: 069 929 15-0

23 June 2010 Elinor Ostrom: Future Directions in Social-Ecological Systems Research

Organizer: Frankfurt School; place: Frankfurt School, Sonnemannstraße 9-11, Frankfurt am Main; cost: none; registration: www.frankfurt-school.de

29 June 2010 Einflussnahme des US-Rechts auf europäische Unternehmen – neueste Entwicklungen und Perspektiven

Organizer: Deutsches Aktien-Institut; place: House of Finance der Goethe-Universität, Raum Paris, Frankfurt am Main; cost: none; info: 069 929 15-0

29 June 2010 DVFA-Symposium Wealth Management

Organizer: DVFA; place: DVFA-Center im Signaris, Frankfurt am Main; cost: €295 (non-members); info: This email address is being protected from spambots. You need JavaScript enabled to view it.

30 June 2010 CFS-Colloquium Wiederaufbau der Finanzmärkte

Organizer: CFS; place: Frankfurter Innenstadt; cost: none; info: Isabelle Penther 069 798 30050

Reading suggestions

Korndoerffer, Sven H., Scheinert, Liane, Bucksteeg, Mathias: Ihre Werte, bitte!

Gabler Verlag, 192 pp, €39.95, ISBN 978-3-8349-2157-4

In times of change the relevance of values as a means of generating orientation increases. Decision makers are expected to take responsibility for restoring trust in politics and business. There should be a certainty that internalized values are the basis for action. This book from the Values Commission provides insight into the individual value conceptions of outstanding figures from companies, institutions, politics and culture. The basis of the discussion is the Values Commission’s six core values: integrity, courage, sustainability, respect, responsibility and trust.