VIPsight - July 2010

COMPANIES

BASF takes over Cognis

Chemicals giant BASF in mid-June agreed with financial investor Permira and the private-equity division of Goldman Sachs to buy the special-chemicals producer Cognis, which BASF will in future incorporate into a separate division of Performance Products. €3.1 billion is what the Ludwigshafen group is paying for Cognis; €700 million in a pure purchase price, and the remaining €2.4 billion in debts and pension obligations. Cognis had been hived off in 2001 by consumer-chemicals maker Henkel, and produces products for the food and health market on the basis of sustainable raw materials, as well as for the cosmetics, laundry and cleansing products industries. Henkel is today still an important customer for Cognis products. Last business year Cognis had a turnover of €2.6 billion. BASF is counting on synergy effects amounting to 5% of the Cognis turnover and integration costs of €200 to 250 million. The takeover should be completed by November.

Chemicals giant BASF in mid-June agreed with financial investor Permira and the private-equity division of Goldman Sachs to buy the special-chemicals producer Cognis, which BASF will in future incorporate into a separate division of Performance Products. €3.1 billion is what the Ludwigshafen group is paying for Cognis; €700 million in a pure purchase price, and the remaining €2.4 billion in debts and pension obligations. Cognis had been hived off in 2001 by consumer-chemicals maker Henkel, and produces products for the food and health market on the basis of sustainable raw materials, as well as for the cosmetics, laundry and cleansing products industries. Henkel is today still an important customer for Cognis products. Last business year Cognis had a turnover of €2.6 billion. BASF is counting on synergy effects amounting to 5% of the Cognis turnover and integration costs of €200 to 250 million. The takeover should be completed by November.

BayWa will not disclose salaries in future either

The Munich group BayWa will in coming years too not individually disclose the salaries of its board members, as recommended in the Corporate Governance Code. By 96.81%, shareholders voted at the group’s AGM against this transparency rule. BayWa was thus clearly ahead of the 75% needed for such a position to be adopted. Last year the group, operating in the areas of construction, farming and energy, had a turnover of €7.3 billion and paid its five-member board total pay of €5.4 million. Disclosure would interfere too strongly with the private sphere of the board member concerned, was the argument of BayWa management. Shareholder associations criticized the decision.

Gildemeister in the sights of Mori Seiki?

Officially the two machine makers, Germany’s Gildemeister and Japan’s Mori Seiki, have agreed criss-cross holdings of 5% and cooperation in procurement, sales and sales financing. Financial Times Deutschland (FTD) reports that rumours were circulating in the industry that the Japanese could be aiming at a far larger holding. Japanese banks had initially collected options on 20% of the capital of the German lathe and grinding-machine maker. Mori Seiki CEO Masahiko Mori denied this intention.

Is Sistema moving into Infineon?

Russian conglomerate Sistema wanted to come into German chipmaker Infineon at 29%, reported Financial Times Deutschland (FTD). To emphasize this intention, Russia’s president Dmitri Medvedev and ex-president Vladimir Putin asked German Chancellor Angela Merkel (CDU) in late June to exercise her influence on the Dax group, whereupon the chancellery allegedly, according to the FTD, said she was willing to act as a mediator. Infineon has since denied talks with Sistema. In 2006 the firm of Russian billionaire Vladimir Yevtushenkov already unsuccessfully tried to come into Deutsche Telekom. At the time Merkel rejected the deal, since the Bonn group is the most important supplier for government data networks and bug-proof communication.

Siemens in a clinch with Areva

In early 2009 the German conglomerate Siemens unilaterally terminated its joint venture in nuclear power stations with French partner Areva set up in 2001. Since then Siemens CEO Peter Löscher has been negotiating with Russian nuclear group Rosatom on cooperation. Areva, however, sees this as a clear breach of contract, since the contract stated that the Germans could not leave the joint venture before 2012, and additionally could not compete with ex-partner Areva for a year. Now Löscher has called in the European Commission. Brussels is looking into whether this exclusion clause infringes EU antitrust law. The Commission’s decision may certainly take some time, but merely taking on the investigation is evaluated by Löscher as a positive signal. The Munich group originally wanted to seal the partnership with Russians in May 2009.

In early 2009 the German conglomerate Siemens unilaterally terminated its joint venture in nuclear power stations with French partner Areva set up in 2001. Since then Siemens CEO Peter Löscher has been negotiating with Russian nuclear group Rosatom on cooperation. Areva, however, sees this as a clear breach of contract, since the contract stated that the Germans could not leave the joint venture before 2012, and additionally could not compete with ex-partner Areva for a year. Now Löscher has called in the European Commission. Brussels is looking into whether this exclusion clause infringes EU antitrust law. The Commission’s decision may certainly take some time, but merely taking on the investigation is evaluated by Löscher as a positive signal. The Munich group originally wanted to seal the partnership with Russians in May 2009.

New remuneration systems non-transparent

Deutsche Bank and Deutsche Börse have had new pay systems approved at their shareholder meetings on 27 May. The bank, however, got only 58% agreement, while even fewer shareholders voted for the stock exchange’s model (53%). This meant that the complex remuneration systems for management had heavy dampers put on them. With the new remuneration model the bank is reacting to criticisms of its success bonuses, said to be too short-term, paid in addition to fixed salary and regarded as one of the causes of the financial crisis, since they tempted financial tricksters into too-high risks. BaFin too therefore called for stricter bonus rules. The more performance- and long-term-oriented financial giants want to make their remuneration, the more complicated the models seem to become. Risk Metrics has already warned of the lack of transparency. The actual remuneration of the Deutsche Bank board members cannot be calculated, despite presentation of the model.

Drugstore company builds up its DOUGLAS holding

Erwin Müller has built up his holding in DOUGLAS HOLDING. The head of the Müller drugstore markets is according to his own statements building up his holding to 5.2%. The billionaire, who with 500 branches has the fourth-largest drugstore market chain in Germany behind Schlecker, Rossmann and DM, came into the perfumery group only last November, at 3%. In an interview with the magazine Focus the businessman additionally thought aloud about stocking up his holding to 18%. Oetker currently has 25.81% in Douglas, and Jörn Kreke has 12.16%.

HeidelCement in the DAX

On 21 June Salzgitter fell out of the DAX because of its too-low market capitalization, and was replaced by HeidelbergCement. The acceptance of the construction-materials producer came on the basis of the fast-entry rule, since by the set date of the end of May the company already took 22nd place in the index ranking for both market capitalization and stock-exchange turnover, Deutsche Börse stated in Frankfurt am Main. The steel group was thus able to keep itself in the leading index for only one and a half years, and will in future be listed, together with Kabel Deutschland and Brenntag, in the MDAX. These bring in sufficient weight and thus replace Pfleiderer and MLP, who will from now on be listed in the SDAX.

On 21 June Salzgitter fell out of the DAX because of its too-low market capitalization, and was replaced by HeidelbergCement. The acceptance of the construction-materials producer came on the basis of the fast-entry rule, since by the set date of the end of May the company already took 22nd place in the index ranking for both market capitalization and stock-exchange turnover, Deutsche Börse stated in Frankfurt am Main. The steel group was thus able to keep itself in the leading index for only one and a half years, and will in future be listed, together with Kabel Deutschland and Brenntag, in the MDAX. These bring in sufficient weight and thus replace Pfleiderer and MLP, who will from now on be listed in the SDAX.

Insider trading suspicions against Software employees

Saarbrücken public prosecutors suspect employees of IDS Scheer and Software of insider trading. “We are investigating a total of twelve people,” stated a spokesman for the authority. They are accused of “unprofessional treatment of insider information” in relation to the takeover plans for the Saarbrücken IT company. As early as 26 May, offices of both firms and the homes of those accused were searched, and documents seized. The investigations are not being carried out against the companies themselves.

BGH confirms ban on Springer/ProSiebenSat.1 merger

The Federal Court of Justice (BGH) on 8 June confirmed the ban on the takeover of ProSiebenSat.1 by Axel Springer. Antitrust agency Bundeskartellamt had been right in 2006 to assume that the merger would adversely affect the television competition market. Additionally, ProSiebenSat.1 and Bertelsmann could have become too powerful together, said the antitrust chamber of the BGH in justifying the decision. The two companies at the time of the planned takeover constituted a “market-controlling oligopoly” on the market for television ads, with a market share of over 80%. After the takeover ban, shares were sold in 2007 to KKR and Permira. The publishing house had submitted an appeal on points of law against the 2006 decision and brought the case in front of BGH.

Buhlmann's Corner

The wolf has cleaned up its sheep’s clothing

The first attempt by German CG czar Klaus-Peter Müller, the newly appointed chair of the Corporate Governance Code Commission, to adapt the code has started. Obediently, he applied the policy instructions from the ministerial squad, and the Commission did not stop him. The German code no longer clearly represents investor interests, but indirectly also those of all others – so that everyone can be happy, best at the same time. The stakeholder principle is only polemically in conflict with the shareholder principle – since a dividend is possible as long as employees and customers, or rather, customers and employees, lastingly stay on board. Or are there other worlds? Political greenhouse worlds, for instance?

The first attempt by German CG czar Klaus-Peter Müller, the newly appointed chair of the Corporate Governance Code Commission, to adapt the code has started. Obediently, he applied the policy instructions from the ministerial squad, and the Commission did not stop him. The German code no longer clearly represents investor interests, but indirectly also those of all others – so that everyone can be happy, best at the same time. The stakeholder principle is only polemically in conflict with the shareholder principle – since a dividend is possible as long as employees and customers, or rather, customers and employees, lastingly stay on board. Or are there other worlds? Political greenhouse worlds, for instance?

The head of the Commission, who was able to resign from the Commerzbank board just in time to escape personal nationalization and the capping of his director’s fees, has sent quite striking signals. For instance, at long last he introduced a female quota. But how do things look for the female quota in the Commission’s own case? Not exactly exemplary, is it? But anyway, one lady is in on the game as an exemplary token – all the others are “self-confessed” men. They include Christian Strenger, the uncrowned Pope of governance – whose flaw of not being a woman is irreparable.

One other thing has been cleared up at the head of German governance: supervisory-board members will now become more professional and (at long last?) themselves responsible for their continuing training. Previously things were different – nobody was responsible for it. So it’s clear, then, the Code is improving the world. And after all that’s what it’s supposed to be there for, isn’t it? If Code Commission members on the Arcandor supervisory board looked on attentively at how directors, with a fuss you couldn’t fail to mishear, drove an old DAX group into ruin, only then to conclude another consultancy contract with the supervisory board chair as a parting gesture, then there are no cooling-off rules that could be thought up for such weird situations. For such a case even the monopoly consultant ISS/RiskMetrics, who still manage to reject their own findings, would be under too much strain.

ACTIONS CORNER

The actions for damages brought by several investors against Conergy have been joined by Hamburg Higher Regional Court into a model case with binding effect in accordance with the Capital Investors Model Case Act. The Act, introduced in 2005, enables similar cases for false, misleading or absent capital-market information to be joined. The court will be deciding a total of seven disputed points. The model case goes back to an initiative by the plaintiff company. Some 20 shareholders in Hamburg are calling for damages of around of 3 million euros.

The prolonged conflict between Deutsche Bank and Leo Kirch is landing before the Federal Court of Justice (BGH) once more. The highest German court is now to deal with the bank’s 2008 AGM: Frankfurt Higher Regional Court declared the AGM decisions null and void because of formal errors in the invitation, as both parties to the dispute confirmed on 15 June. The chamber accordingly rejected the Deutsche Bank’s appeal against an earlier judgment by a lower court. A bank spokesman immediately announced that it would be challenging the decision at the BGH. Several actions by Kirch against resolutions of previous AGMs are already pending there.

After a reconciliation hearing before the Civil Chamber of Nürnberg-Fürth Regional Court on 9 June failed, from 1 September onward demands for compensation for damages by Siemens will now be heard as from 1 September. In connection with concealed payments of millions to the AUB trade union, the electrical conglomerate is demanding €3.2 million in damages from Wilhelm Schelsky. The former head of the company union is allegedly guilty of deceit and abetting breach of trust, and additionally unjustifiably enriched himself, says Siemens in justifying the demand. He allegedly used money intended for AUB inter alia for private purposes.

AGM Dates

| Company | Event | Date | Time | Place | Address | Published on |

| MDAX | ||||||

| Heidelberger Druck | ord.AGM | 29.07.2010 | 10:00 | 68161 Mannheim | Rosengartenplatz 2, Congress Center Rosengarten | 15.06.2010 |

| The Agenda for the ordinary AGM of Heidelberger Druckmaschinen AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. A resolution approving the remuneration system for board members is to be taken. A resolution on assent to amendment of the control and profit-transfer agreement with Heidelberg Consumables Holding GmbH is to be taken. Additionally, a resolution increasing the registered capital by issuing new shares against cash contributions of up to €399.58m is to be taken. | ||||||

| Südzucker | ord.AGM | 20.07.2010 | 10:00 | 68161 Mannheim | Rosengartenplatz 2, CongressCenter Rosengarten | 31.05.2010 |

| The Agenda for the ordinary AGM of Südzucker AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Südzucker AG earned balance-sheet profits of €85.22m last business year. Of the profits, €85.21m is to be paid out as dividend and €6,735 carried forward to a new account. Additionally, several charter amendments are to be decided. The company is again to be authorized to purchase its own shares and use them, possibly excluding shareholders’ subscription and tendering rights. Conditional Capital I and the authorization to issue non-voting equity securities, option and convertible bonds are to be cancelled. A resolution approving the remuneration system for board members is to be taken. A resolution on non-disclosure of board members' pay is to be taken. | ||||||

| Fielmann | ord.AGM | 08.07.2010 | 10:00 | 20457 Hamburg | Adolphsplatz 1, Handelskammer Hamburg | 28.05.2010 |

| The Agenda for the ordinary AGM of Fielmann AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. The balance-sheet profits of €84.0m are to be fully paid out as dividend. The Supervisory Board is in future to consist of 16 members. Elections to the Supervisory Board are to be held. Supervisory Board pay is to be adjusted. Additionally, several charter amendments are to be decided. | ||||||

Politics

Short-selling banned

On 2 July the Bundestag decided on a ban on naked short-selling of shares and government bonds of Euro countries. Financial actors are accordingly in future to trade only with shares, government bonds and credit insurances that they themselves own or have borrowed.

More rights for investors

Shareholder association Deutsche Schutzvereinigung für Wertpapierbesitz (DSW) has taken a stance in a position paper on the Act to strengthen investor protection and improve the functionality of the capital market. In it the DSW welcomes the fact that banks and financial-services providers will in future have to register their consultancy with the Federal Institution for Financial Services Oversight (BaFin), though the distinction between consultants and providers of investment products is vague. The consultancy ought accordingly to be arranged according to a private-investor model and not the sales model chosen. Creeping up on firms, as in the Conti/Schaeffler and VW/Porsche cases, is not regulated clearly in the Act. All that is mentioned is financial instruments and other instruments that would become subject to disclosure if positions in shares were built up. The ban on naked short-selling is seen by the shareholder protection association as sensible; all the same, the DSW has reservations since in practice the determination of such naked short-selling is hard, and BaFin possibly does not possess adequate powers of intervention. The introduction of a product information sheet (PIB) for financial consultancy to private customers was sensible; however, there should also be rules on the content of it. Otherwise, there would be a threat that investment consultancy would become too costly and that credit institutions would continue to withdraw from consultancy, as they already did after the duty to keep a record. There can in future be no consultancy on any form of investment for which there is no such PIB. That meant that there was already a selection beforehand as to which products consultancy could still be offered on. The removal of the short statutory limitation periods in prospectus liability met a long-standing demand of the DSW. By setting the period of liability at six months, or the 100 days proposed by the DSW for ad hoc disclosures and quarterly reports, the legislator was on the right path. The possibility allowed of withdrawing shares in open real-estate funds and the notice periods introduced of 6 to 24 months were also welcome. Private investors should, however, be able without termination to call back an amount of €100,000, the DSW advises. The shareholder protectors are also calling for direct liability of members of company bodies, the setting-up of a register of complaints and thus a possibility for model cases and the extension of the Freedom of Information Act to BaFin.

BaFin publishes MaComp

On 7 June in a circular BaFin summarized its considerations to date on the good-conduct obligations under the Securities Trading Act (WpHG) and supplemented them with new regulations. The circular, entitled “Minimal requirements and further obligations on conduct, organization and transparency duties pursuant to §§31 ff. (MaComp)” fleshes out the conduct, organization and transparency duties under the WpHG where there are credit or securities transactions with customers. BaFin had previously found in numerous talks with the compliance officials of various institutions that the compliance function was often not equipped in accordance with its importance and that compliance employees could not ensure that the company was complying with the provisions of the WpHG. In the circular, inter alia the duties of the compliance function, the processes in which the compliance function is to be incorporated and the organizational setup, design and technical requirements on employees are explained. Additionally, the circular also contains explanations on best execution and on the monitoring of employee transactions and publicity.

Is a national financial-market transaction tax coming?

Neither the G8 nor the G20 summit in Canada brought the necessary breakthrough in financial market regulation. The Heads of State postponed agreement on broad outline conditions to the summit in November in Seoul, South Korea. That meant an end to the hopes of German Chancellor Angela Merkel to be able to introduce a bank levy and a financial-market transaction-cost tax at G20 level. As well as Canada, Australia and Brazil, other G20 States also came out against a bank levy at international level. The 27 EU Heads of State have already come out in principle in favour of a European regulation. In the case of the financial-market transaction tax Germany might be going it alone: in the recent savings package, receipts from the taxation of financial transactions are already pencilled in as from 2012 at 2 billion euros a year.

Neither the G8 nor the G20 summit in Canada brought the necessary breakthrough in financial market regulation. The Heads of State postponed agreement on broad outline conditions to the summit in November in Seoul, South Korea. That meant an end to the hopes of German Chancellor Angela Merkel to be able to introduce a bank levy and a financial-market transaction-cost tax at G20 level. As well as Canada, Australia and Brazil, other G20 States also came out against a bank levy at international level. The 27 EU Heads of State have already come out in principle in favour of a European regulation. In the case of the financial-market transaction tax Germany might be going it alone: in the recent savings package, receipts from the taxation of financial transactions are already pencilled in as from 2012 at 2 billion euros a year.

The German government wants to get rid of bank shares

On 23 June the German cabinet set about setting up a seven-member advisory committee to work out a strategy for the government to get rid of its holdings in crisis banks like Commerzbank, Hypo Real Estate, Aareal Bank and WestLB. Federal Finance Minister Wolfgang Schäuble (CDU) then appointed (alongside the chairman, Bonn law professor Daniel Zimmer) Werner Brandt, professor Claudia-Maria Buch, Hans Georg Fabritius, professor Martin Hellwig, Hans-Hermann Lotter and professor Hanno Merkt to the body. One representative each of the Federal Finance Ministry, the Federal Institute for Financial Market Stabilization, the Federal Ministry for the Economy and the Federal Ministry of Justice can take part in the meetings, but without vote. The body is to present recommendations by the end of the year on how to get out of the holdings.

On 23 June the German cabinet set about setting up a seven-member advisory committee to work out a strategy for the government to get rid of its holdings in crisis banks like Commerzbank, Hypo Real Estate, Aareal Bank and WestLB. Federal Finance Minister Wolfgang Schäuble (CDU) then appointed (alongside the chairman, Bonn law professor Daniel Zimmer) Werner Brandt, professor Claudia-Maria Buch, Hans Georg Fabritius, professor Martin Hellwig, Hans-Hermann Lotter and professor Hanno Merkt to the body. One representative each of the Federal Finance Ministry, the Federal Institute for Financial Market Stabilization, the Federal Ministry for the Economy and the Federal Ministry of Justice can take part in the meetings, but without vote. The body is to present recommendations by the end of the year on how to get out of the holdings.

Panic brake usual in Germany

In connection with the “panic brake” introduced by US securities regulator SEC, the Munich stock exchange points out that such systems have long been in use in Germany. Thus, in the Max-One trading system operated by the Bavarians since 2003, for all securities traded there is a dynamic and a static price corridor, monitored at each price setting. Additionally, the size of the spread on the reference market is also verified. “If the difference between the money and paper rate on the reference market for the share is too big,” says Manfred Schmid, head of market control, “the transaction is automatically interrupted.” As an additional monitoring body, an account taker checks the figures for plausibility.

EU wants to regulate bankers’ bonuses

EU parliamentarians in the Economic and Finance Committee have produced a list according to which at least 40% of a bonus payment to a bank employee is to be payable at earliest after five years. In order to create incentives to long-term, sustainable business practice, cash payments are to be limited to six percent of the total amount. The variable parts are according to the list not to exceed the whole of the fixed salary. At the end of June parliament, in negotiations with the Commission and the Member States, nonetheless yielded a bit. The compromise secured provides for no statutory upper limit to bonuses. Each bank is now to ensure a healthy relationship between fixed salary and bonuses. However, a maximum of 30% of the bonuses are to be distributed in cash, and payments are to be spread over several years. Parts may also be withheld. If as expected the European Parliament agrees to the proposal in early June, the rules could enter into force in 2011.

EU parliamentarians in the Economic and Finance Committee have produced a list according to which at least 40% of a bonus payment to a bank employee is to be payable at earliest after five years. In order to create incentives to long-term, sustainable business practice, cash payments are to be limited to six percent of the total amount. The variable parts are according to the list not to exceed the whole of the fixed salary. At the end of June parliament, in negotiations with the Commission and the Member States, nonetheless yielded a bit. The compromise secured provides for no statutory upper limit to bonuses. Each bank is now to ensure a healthy relationship between fixed salary and bonuses. However, a maximum of 30% of the bonuses are to be distributed in cash, and payments are to be spread over several years. Parts may also be withheld. If as expected the European Parliament agrees to the proposal in early June, the rules could enter into force in 2011.

Reform of financial supervision postponed

At the meeting of G20 finance ministers in Busan, South Korea, in early June, finance minister Wolfgang Schäuble (CDU) and Bundesbank head Axel Weber postponed their financial oversight reform project for later consideration, with no date set. There were more important problems, said the statement by the two of them. Priority went to international negotiations on regulating finance markets and bringing forward the Basel-III reform; financial-market supervision in Germany was more of a medium-term project. Originally, a ministerial draft of it was supposed to be presented before the summer pause in early July. Financial Times Deutschland writes that Schäuble now wants first to await the introduction of European monitoring structures and then tackle the national regulation. It is controversial how powers will in future be distributed between the Federal Institution for Financial Services Oversight (BaFin) and the Bundesbank. The Bundesbank fears for its independence in this connection.

Female quota ought to rise

In order to increase the proportion of women in leadership positions, the Corporate Governance Commission at the end of May incorporated a passage into the voluntary Code to the effect that companies ought regularly to report on progress with a self-set female quota in the company. That meant that initially a statutory regulation has been skilfully avoided; the pressure to include women more is, however, being built up still further. While Federal Minister of Justice Sabine Leutheusser-Schnarrenberger welcomed this voluntary aspect of equal rights and rejected a statutory regulation at this time, Federal Minister for the Family Kristina Schröder raised a sword of Damocles: an Act with clear quotas would come, unless the proportion of women in management ranks rose to 20% in an overall average of branches, the lady minister threatened.

Stress test to be locked away?

The heads of the 16 big German banks were surprised by a change in opinion by Bundesbank president Axel Weber. At the end of June, together with the head of the Federal Institute for Financial Services Oversight (BaFin), Jochen Sanio, he had invited the CEOs of the biggest German banks to Frankfurt for a meeting to get them to agree to new EU stress tests. After the meeting they indicated that they were in principle ready to take part in the tests on a basis of Europe-wide uniform rules. While the European association of financial overseers CEBS wants to make the total findings of the latest stress tests on European banks completely open, Weber has now retreated from this position at the meeting, and come out in favour of only partial disclosure. This is a turn on his part, since in mid-June he was still backing the plans of the EU and the federal government. The CEBS wants to restore transparency and thus trust to banks through full disclosure. The banks are however afraid that information that has so far been kept hidden could attract speculators. The timetable has today provided for disclosure of the findings in July; however, many details are still unclear. The tighter tests are supposed to check scenarios in which write-downs are made from investments hitherto regarded as safe. If core capital then falls below 6%, banks could be obliged to accept state aid. The EU already presented a first stress test on 22 banks in early October 2009, though only as a summary.

People

Kurt Bock is to succeed Jürgen Hambrecht at the head of BASF. The chemical group’s CFO is taking on the post after the end of the AGM on 6 May 2011. This was decided by the supervisory board. He will be flanked by his opponent and supervisory-board member Martin Brudermüller as deputy board chairman. The succession on the board will be decided in early 2011.

Kurt Bock is to succeed Jürgen Hambrecht at the head of BASF. The chemical group’s CFO is taking on the post after the end of the AGM on 6 May 2011. This was decided by the supervisory board. He will be flanked by his opponent and supervisory-board member Martin Brudermüller as deputy board chairman. The succession on the board will be decided in early 2011.

The board reshuffle at Beiersdorf is almost completed, with the appointment of Peter Feld as director for “Region Europe”. The 44-year-old qualified engineer is taking over the post on 1 September from CEO Quaas, who has been handling it provisionally to date. Pieter Nota, to date responsible for marketing and innovation, left the cosmetics giant on 30 June. Nota’s post is not being filled.

The supervisory board of centrotherm photovoltaics appointed Thomas Riegler as Chief Financial Officer (CFO) with effect from 1 August. He thus replaces Oliver M. Albrecht, who will be taking up new professional challenges, and resigned on 30 June. Riegler has been working for over 12 years in various management positions for the Daimler group in Germany and abroad.

At the end of September Michael Cohrs will leave the board at his own request, stated Deutsche Bank on 15 June. The manager talked of as a successor to Josef Ackermann, Anshu Jain, will in future take on sole responsibility for the core area of investment banking.

Karlheinz Hornung is the new supervisory board chair at Q-Cells. The former CFO of lorrymaker MAN was elected to the supervisory board at the AGM on 24 June, after Andrew Lee had resigned his supervisory board post. As the struggling solar-cell producer further stated, the 59-year-old will replace the current supervisory-board chair Marcel Brenninkmeijer, who will, however, remain a supervisory-board member.

The number of supervisory-board members at Software is to double, following the takeover of IDS Scheer, from the current six to twelve, stated the Darmstadt company on 28 May. The expanded supervisory board is to continue to have equal numbers of employer and employee representatives. The existing four shareholder representatives were confirmed in their office by the AGM on 21 May; two further members were newly elected to the supervisory board: Siemens director Hermann Requardt and Anke Schäferkordt, business manager of RTL Television. On the employees’ side, the election will be held in August directly by the staff. In order to ensure the functionality of the supervisory board until then, the competent court has for the moment made a judicial appointment of six employee representatives for the transitional period, on application by the board.

Christian Wulff has announced that he is to resign his VW secondment post. The Minister-President of Lower Saxony, who managed to win election as president of Germany, is to be replaced by David McAllister, the CDU’s Land-President for Lower Saxony and Wolf’s successor as Minister-President.

Professor Marcus Labbé

Quality beats diversity

“The term ‘Corporate Governance’ is a notably fortunate one. What makes the expression, which does not mean much to many people, particularly attractive in German linguistic usage is the fact that it is ennobled by its English form and pronunciation,” says Sebastian Hakelmacher in his legendary best-seller “Corporate Governance, or the corpulent governess,” in which he reveals some insights into life on supervisory boards.

The fact that recently the Government Commission on the German Corporate Governance Code included qualifications for a supervisory board member on its agenda is welcome and sensible, as well as being necessary in the interests of both firms and supervisory board members. But the topic has already been occupied for several years in connotative terms, and also de facto, by an initiative that is unique in Europe to have supervisory board members qualified and certified.

The desire to exploit all the tricks in the Accounting Law Modernization Act as well as the sloganization of the appropriateness of executive salaries, to date interpreted unfortunately in purely abstract terms, follows most recently from the buzzword of the hour: diversity. There is hardly a theme that seems to move hearts at the moment as much as this one, says a study published in March, for which 445 active supervisory board members, both men and women, were surveyed. One interesting finding is as follows: women who have made it reject the quota.

I have been dealing with this subject for a long time, since it brings women into the focus of debate, particularly as a factor for success and not just as a subject of quota regulations. This seems to be a pragmatic way. For diversity on supervisory boards certainly can pay. With equal certainty, however, the problem is by no means solely to do with faults in appointments by supervisory board bodies.

The sovereign personnel competence of the supervisory board works in two directions: appointment of board members and nomination to supervisory-board positions. And the quota is supposed to put that right? Well, anyone wanting to settle in Spain would be well advised to start by tackling the Spanish language and culture. To that extent, qualification might be an obvious way onto the supervisory board. After all, I don’t know anyone who would prefer to have incompetent supervisory board members.

If not a quota, then at least qualification measures exclusively for women, runs the current creed. Specific know-how for supervisory board members is, however, not gender-specific. Qualification measures exclusively for (would-be) female supervisory board members is something I would regard as extremely counterproductive. Considerations of this nature also irritate established supervisory-board women. Just ask the ones certified by the Rhineland authority.

Men and women act together on supervisory-board committees, not separately. What shareholder meeting would like to elect to supervisory-board committees women who have focused on giving gender-specific aspects preference over specific supervisory-board ones? That is the way to get kept out. But the rules of the game can be changed only if they are controlled, and that means from the inside out.

Women may possibly be able to make the breakthrough if they appear with a neutral qualification certificate, which is the only way to make it really valuable, being independent of persons because it is related exclusively to qualification. Candidates, men and women, who take a three-hour written examination are credible. The necessary continuing sensitization to specific supervisory-board knowledge is an overdue step that the Government Commission is now also calling for.

Internal independence and competence are conditions for each other, all the more so since supervisory board and administrative board appointments have to be exercised very personally. Responsibility and liability can not be delegated away. Every appointee is responsible for his or her actions and omissions. Qualified exercise of the mandate and qualification for a post are thus needed in the interests of both firms and the appointees.

Professor Dr Marcus Labbé, President of the German Supervisory Board Institute (D.A.I.)

Campus

Caution, double agents

Among investor protection agencies there are black sheep too, as a study by the VERS insurance consultancy company has shown. Through Internet searches, author Werner Siepe has investigated a number of alleged investor protection agencies, and in his paper revealed a few providers who use the cover of protection of investors and consumers to pursue primarily their own interests. Such pseudo investor protection associations as for instance the Consumer Association (BDV) or the Savers Association (BDS) recommend doubtful financial products and providers, says Siepe. Financial news service GoMoPa offers information on the Internet about questionable firms, including wrong information about companies. The consultancy contracts concluded with financial service providers are said nothing about here, the study continues. No less bad are shareholder protection associations that cooperate with lawyers, where many associations act to draw in clients: in the cases of the Verein Mensch und Kapital or the Deutsche Anleger Stiftung, it is clearly the lawyers’ interest in fees that takes primacy over investor interests.

High interest in on-line business reports

In May the business-report portal Anwender asked in what form business reports should be accessible, whether on-line or as a print version. By a large majority of 74%, respondents voted for having the business report accessible both on-line and as a PDF (hard copy). 21% stated that it would be enough for the report to be available only as an on-line version. Alongside the traditional Internet, availability on new media is also becoming increasingly important. Thus, 41% wanted a version for the iPhone, 29% for the iPad and 12% for the eBook Reader. A main reason for publishing an on-line version of the business report is stated by 53% as the use of multimedia content like video and audio. The points of rapidity and topicality were mentioned by 29%. 80% of them stated that the number of clicks on business reports on their internet page had increased in recent years. In answer to the question whether the print version would become superfluous in future, minds are divided: half take the opinion that it will, the other that it will not.

AGM attendance constant

This season attendance by investors at the annual general meetings of the 38 DAX groups was almost at the same level as the previous year, said an analysis by investor association Deutsche Schutzvereinigung für Wertpapierbesitz (DSW). On average the attendance figure was 57.8%, 0.4 percentage points lower than the previous year. The highest attendance figure was at the Metro AGM (81.5%).

German IR prize goes to Bayer

The best IR in the DAX this year, according to DIRK, came from Bayer, BASF and Allianz. On an individual rating for the best IR manager, in the DAX the winner was Oliver Luckenbach (Henkel), followed by Henning Gieseke (Metro) and Oliver Schmidt (Allianz). In the MDAX, Deutsche EuroShop, Lanxess and Douglas were on top, and among the best IR managers chosen were Martin Praum (IVG Immobilien), Patrick Kiss (Deutsche EuroShop) and Ralf Gierig (ProSiebenSat.1). In the TECDAX Software, Aixtron and United Internet won, as did Marcus Bauer (United Internet), Guido Pickert (Aixtron) and Otmar Winzig (Software). The German Investor Relations Prize is awarded by the German Investor Relations Association (DIRK) in collaboration with Thomson Reuters Extel Surveys and Wirtschaftswoche. This year 815 experts were surveyed, from 300 companies in 19 countries.

KPMG analysis: Groups have adjusted their EBIT by over 13 billion euros because of the financial crisis

Companies listed in the DAX and MDAX adjusted their earnings before interest and taxes (EBIT) by on balance a total of around €13.2 billion in the business year 2009. This was found by KPMG’s "EBIT/EBITDA-Monitor", for which 137 final reports of groups quoted on the German stock exchange were assessed at the cut-off date of 31 December 2009. Altogether, in the DAX, the MDAX and the TECDAX a slightly positive trend could be noted to providing an EBITDA index figure. The reason for the adjustment was, according to KPG, primarily the special-effects expenses on things like restructurings and unplanned write-offs caused by the financial crisis. At one in three of the firms (33%) these amounted on balance to over 200 million Euros.

Companies listed in the DAX and MDAX adjusted their earnings before interest and taxes (EBIT) by on balance a total of around €13.2 billion in the business year 2009. This was found by KPMG’s "EBIT/EBITDA-Monitor", for which 137 final reports of groups quoted on the German stock exchange were assessed at the cut-off date of 31 December 2009. Altogether, in the DAX, the MDAX and the TECDAX a slightly positive trend could be noted to providing an EBITDA index figure. The reason for the adjustment was, according to KPG, primarily the special-effects expenses on things like restructurings and unplanned write-offs caused by the financial crisis. At one in three of the firms (33%) these amounted on balance to over 200 million Euros.

The DAX companies adjusted their EBIT in the business year 2009 by around 9.1 billion Euros on balance, and their EBITDA by around €2.2 billion. The MDAX companies on balance adjusted their EBIT by €4.1 billion Euros, and their EBITDA by €349 million. In the TECDAX the corresponding figures were €71 million and less than €20 million respectively.

Some catching-up called for in compliance

70% of companies in Germany are calling on their workers to get to know their own company’s compliance guidelines and processes. At the same time, however, nearly 60% of the companies are doing without any training in the desired rules of conduct. This was found by Steria Mummert Consulting’s Managementkompass Compliance, in collaboration with the F.A.Z. Institute. Yet training measures are key to companies’ compliance-management systems, said Bernd Michael Lindner, compliance expert at Steria Mummert Consulting. “Only if the relevant legal and internal company rules are known can management and employees recognize critical situations and deal with them with the requisite sensitivity. Merely putting provisions into writing is not by itself a sufficient guarantee of a functioning compliance culture.”

In practice, according to Steria Mummert, training using real-life situations has proved itself. About half those involved were from the company itself. To prevent criminal acts, it was important to know the motives and the security gaps of employees in danger. “Among these,” said Lindner, “is in the first place anonymity, lack of identification with company goals and unclear communication of the code of conduct.”

The flat tax too has to be regarded as provisional

Since the end of 2009, the revenue offices have been fixing the solidarity levy in tax decisions for assessment periods as from 2005 only provisionally, given the questions as to the constitutionality of the Act on the solidarity levy. Since however as from 2009 capital gains are in principle no longer to be indicated in the tax declaration, it was still questionable how the solidarity levy applying to the flat tax was to be handled. A current circular from the revenue administration answers the question in favour of capital investors. If the Federal Constitutional Court decides that the solidarity levy is to be repealed and replaced, on application the solidarity levy charged on the capital gains tax with the effect of a flat tax will also be reimbursed. An application to assess income tax is not, however, to be presumed. Where no income tax declaration is made, the reimbursement entitlement exists only within the statute of limitations for the assessment (BMF Circular of 23.4.2010, Az. IV C 1 - S 2283-c/09/10005).

PR costs soon to be deductible?

Since the introduction of the flat tax, PR costs arising in connection with capital investments can no longer be claimed separately. Instead, the PR costs are reckoned at the flat-rate amount of €801 per year per person (€1,602 for married couples submitting a joint assessment). This is the case even where in fact more than €801 were incurred in PR costs. This means that fees on accounts and deposits, administrative fees or even interest on debt can no longer be deducted. The elimination of deduction of an actual PR cost particularly affects capital investors who have taken up a loan in order to finance their capital investment. It means that PR costs arising in connection with a capital investment and PR costs arising in connection with some other type of income are treated differently. Whether this unequal treatment infringes the equality principle and the requirement of consistency is now to be tested in a test case. A jumping action in this connection has been brought in Münster Financial Court (Bund der Steuerzahler, communication of 1.6.2010; pending action at FG Münster, Az. 6 K 1847/10 E).

Capital News

Drägerwerk has started its capital increase for buying back the Siemens shares in Dräger Medical. In the course of it, the family’s share in the registered capital at the Lübeck medical and safety-technology company is to fall from 100% to 71%. The voting shares are also in future to be traded; to date it was only the preference shares that were listed. Up to 30 June 3,810,000 new ordinary shares were issued, the 120-year-old firm stated on 16 June. With its IPO, the registered capital against cash contributions rises from €9,753,600 to €42,265,600.

Heidelberger Druckmaschinen wants to collect some €420 million in fresh funds in a capital increase. The number of shares will triple. Saved from collapse only last year with €850 million in state aid, Heidelberger is seeking to use the money to reduce its pressing debt burden and increase its equity-capital ratio, which in the crisis had fallen to 20%. The machine builder is accordingly abandoning its months-long search for an anchor investor. Allianz, the biggest shareholder at 12%, is according to indications fully joining in the capital increase and will exercise its subscription rights in full. RWE, which still holds 8%, will not be joining in.

By 25 June LANXESS had bought back 155,000 of its own shares, or 0.2% of the registered capital, to issue employee shares. The purchase of the shares took place exclusively in XETRA trading on the Frankfurt securities exchange.

Rhön-Klinikum has failed on its authorization to buy back shares. The agenda item did not secure the necessary majority, stated the private-clinic operator, following the shareholder meeting on 9 June in Frankfurt. According to the statutes, for this decision a 90% majority was necessary, but this was not reached. Only 84% of the capital present voted in favour of the reserve decision. Voting representative Riskmetrics had opposed the resolution.

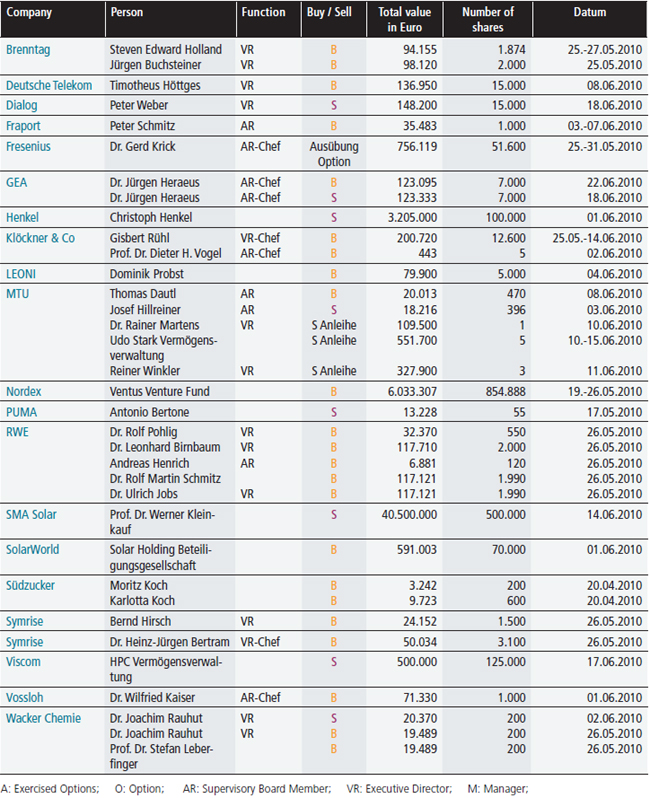

Director's Dealings

in June

VIPsight Shareholder

VIPsight Shareholder ID <click here>

Events Diary

23 July Basis-Seminar Aktienanalyse

Organizer: DVFA; place:DVFA-Center, Mainzer Landstraße 37-39, Frankfurt am Main; cost:€725; info: Christiane Bauer 069 2648 121

Reading suggestions

Henkel, Knut: Rechnungslegung von Treasury-Instrumenten nach IAS/IFRS und HGB

Gabler Verlag, 454 pp, €49.95, ISBN 978-3-8349-1612-9

In this age of international accountancy, the system of accounting in general and with regard to financial instruments in particular has taken on a level of detail unknown before under the HGB. The objective of this book is, therefore, to offer a guide with which practitioners in banks and non-banks can orient themselves in the complex world of accounting, so as to understood how financial instruments and transactions affect the balance sheet, income statement and annual report. Readers can use the book in different ways: in addition to a comprehensive study of the material, its glossary allows a quick overview, while its detailed structure offers specific access to certain aspects. Practical examples from annual reports, a presentation of the essential legal texts and a variety of useful links ensure comprehensive and clear information.

Peterreins, Hannes, Märtin, Doris, and Beetz, Maud: Fairness und Vertrauen in der Finanzberatung

Gabler Verlag, 229 pp, €32.95, ISBN 978-3-8349-2274-8

This book aims to give financial and asset-management advisers and insurance consultants information and suggestions for an ethical, partnership-based and stylish relationship with clients.